Introduction

Professional debt mediation offers a compassionate way to resolve financial disputes, connecting borrowers and lenders through understanding rather than conflict. This approach not only seeks fair settlements but also nurtures communication that can help maintain important relationships in the business world.

As we face growing economic uncertainties, you might wonder: how can individuals and companies tackle their financial challenges without the stress and costs of traditional methods? By exploring the nuances of professional debt mediation, we can uncover a path that is not only more efficient but also more empathetic and effective.

Imagine a process where your concerns are heard, and solutions are crafted collaboratively. This is the essence of debt mediation - a supportive environment where both parties can work together towards a resolution that respects their needs.

Key Benefits of Professional Debt Mediation:

- Empathy: Understand each party's perspective.

- Efficiency: Resolve disputes faster than in court.

- Relationship Preservation: Maintain vital business connections.

In this journey, we can find a way forward that alleviates stress and fosters understanding. Let's explore how professional debt mediation can be the solution you’ve been looking for.

Defining Professional Debt Mediation

Professional financial negotiation is more than just a structured process; it’s a compassionate approach that brings together borrowers and lenders with the help of a neutral third-party facilitator. This facilitator guides both sides toward a resolution that feels fair and acceptable, prioritizing open communication to minimize misunderstandings. Imagine a space where collaboration thrives, where problem-solving takes center stage, unlike the often adversarial and costly nature of litigation. Here, we focus on crafting adaptable solutions that truly consider the unique circumstances of everyone involved.

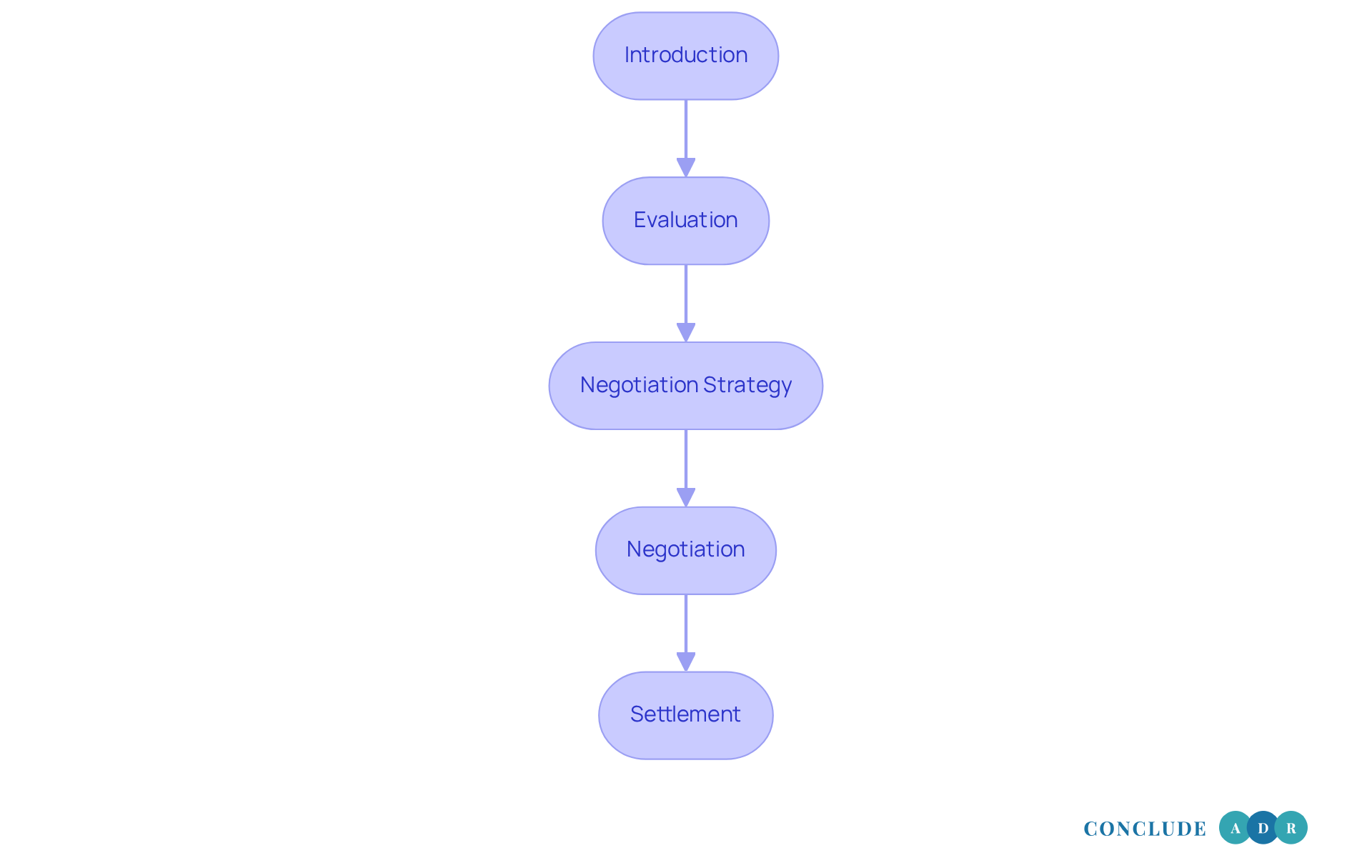

One of the key traits of professional financial negotiation is its voluntary nature. Both parties willingly engage in discussions, supported by a facilitator who acts as an unbiased intermediary. This process typically unfolds in five essential steps:

- Introduction

- Evaluation

- Negotiation strategy

- Negotiation

- Settlement

By steering the conversation, facilitators ensure that everyone feels heard and understood, which is crucial for developing effective repayment strategies.

The benefits of involving a mediator in financial resolution are significant. Mediation can lead to:

- Decreased balances

- Lower interest rates

- Manageable payment plans

These outcomes can alleviate the economic stress that often accompanies debt. Plus, negotiation tends to be less expensive than litigation, which can come with hefty legal fees and court costs. For instance, in 2020, companies with at least $1 billion in revenue spent a staggering $22.8 billion on external litigation expenses. This highlights the financial advantages of seeking alternative dispute resolution.

Experts agree on the effectiveness of negotiation in achieving positive results. As noted by Mediator Debt Solutions, 'Ultimately, what is professional debt mediation offers something that most debt relief options lack: an opportunity to progress with reduced risk, less stress, and greater confidence.' Research shows that conflict resolution often leads to higher satisfaction levels among participants, as both sides play a role in shaping the outcome rather than having a judge impose a decision. Successful case studies reveal how negotiation has preserved relationships between lenders and debtors, fostering collaborative discussions that yield better long-term results.

In summary, expert obligation negotiation serves as a practical and effective alternative to traditional resolution methods. It offers a pathway for individuals and businesses to manage their responsibilities with less risk and stress. If you find yourself facing financial challenges, consider reaching out for support. Together, we can navigate these waters and find a resolution that works for you.

Context and Importance of Debt Mediation

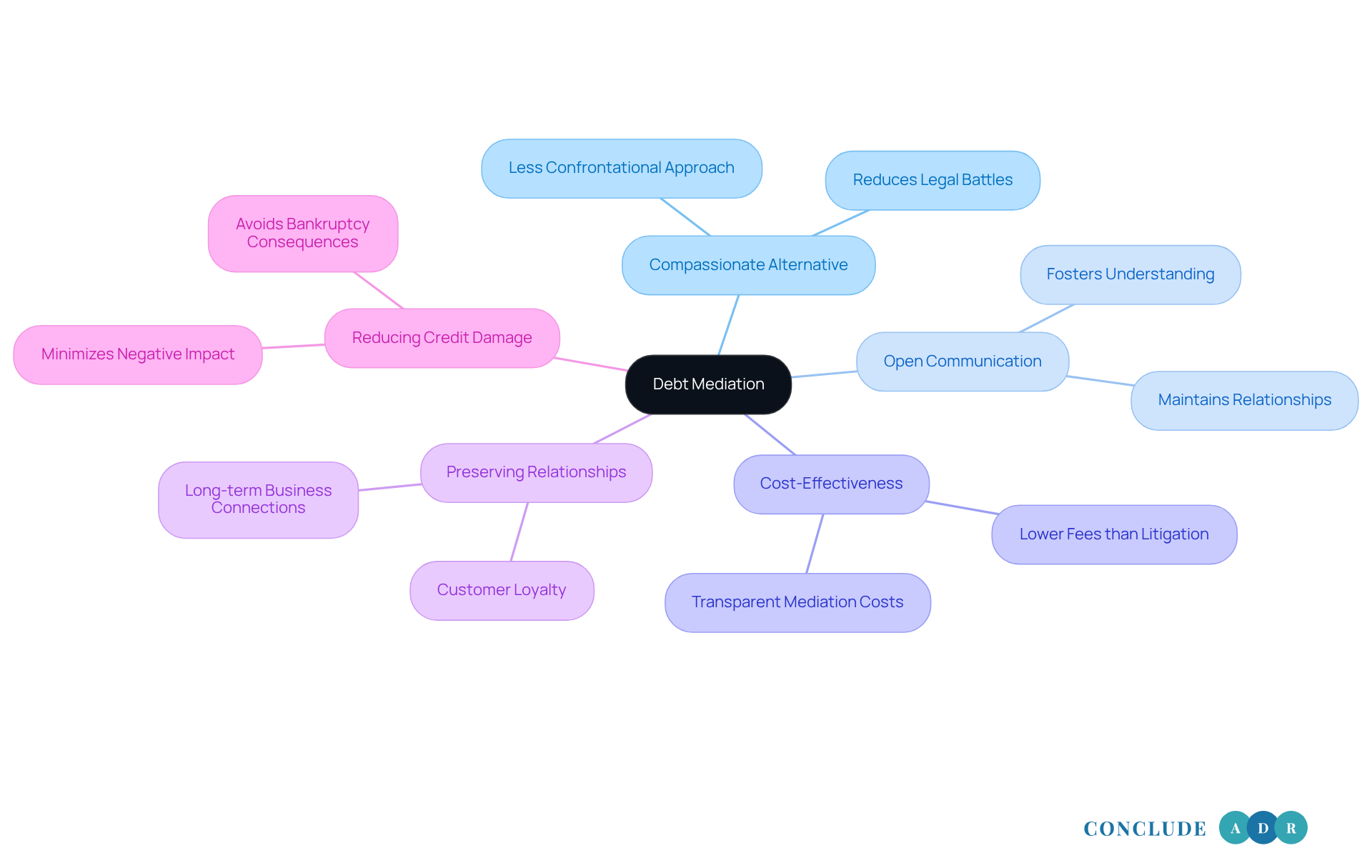

Debt negotiation has become a vital tool for many facing financial challenges, especially in these uncertain economic times. It offers a compassionate alternative to traditional collection methods, which often lead to legal battles and added stress. By fostering open communication between debtors and creditors, this process not only helps in reaching settlements but also preserves important relationships - something that’s crucial for businesses.

Have you ever felt overwhelmed by financial disputes? The beauty of financial negotiation lies in its ability to provide a less confrontational and more constructive approach to resolving money issues. This ultimately leads to better outcomes for everyone involved.

Mediation stands out as a quicker and more cost-effective solution compared to litigation, which can drag on and create tension. Imagine resolving a conflict in just one session, allowing your business to maintain customer loyalty while effectively managing debts. As economic conditions shift, the need for such conflict resolution methods is likely to grow, reflecting a more empathetic approach to handling disputes.

Experts agree that negotiation not only eases the burden for both debtors and creditors but also reduces the risk of credit damage. This makes it a preferred choice for those seeking to navigate financial difficulties without resorting to litigation.

In summary, financial negotiation is not just a practical solution; it’s a pathway to cooperation and understanding. By embracing this approach, we can foster more favorable outcomes for everyone involved. So, why not consider this compassionate route to resolving your financial challenges?

Historical Background of Debt Mediation

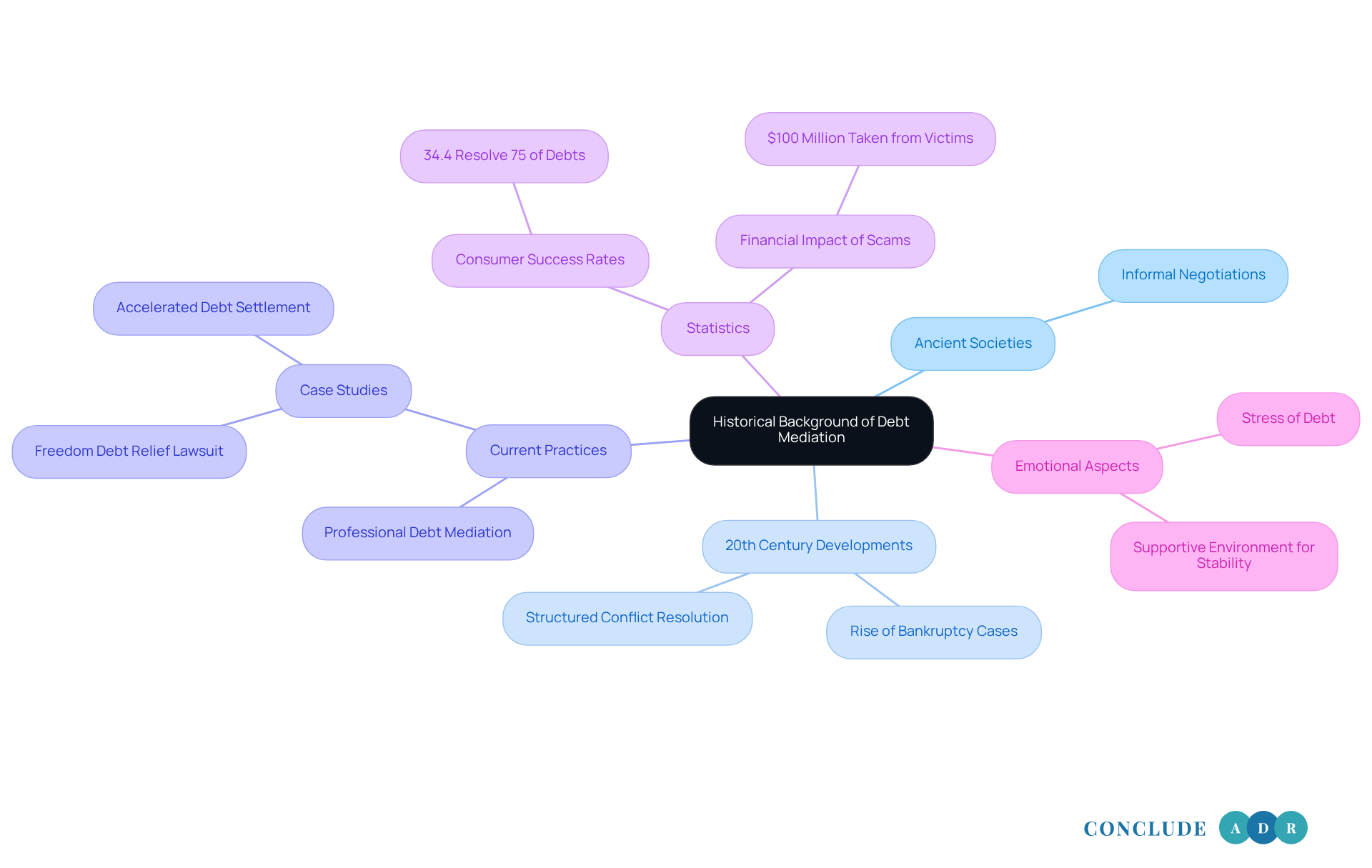

The journey of debt resolution has deep roots, reaching back to ancient societies where creditors and debtors often engaged in informal negotiations. As our economic systems have grown more complex, so have the ways we resolve disputes related to debt. By the late 20th century, the rise in bankruptcy cases and intricate monetary dealings led to the development of structured conflict resolution procedures. This shift marked a significant change in financial negotiations, evolving from casual agreements to organized methods supported by legal frameworks and professional guidance.

Today, what is professional debt mediation is recognized as a valid and effective method for settling financial conflicts. Established practices enhance its reliability and effectiveness. For instance, case studies, such as the lawsuit against Freedom Debt Relief, reveal the challenges and implications of financial negotiation practices. They underscore how these methods can help individuals regain economic stability while alleviating the stress often associated with traditional collection approaches.

Did you know that 34.4 percent of consumers in settlement programs successfully resolve at least 75 percent of their enrolled debts? This statistic highlights the power of negotiation in achieving positive outcomes. Voices like Richard Cordray remind us of the importance of understanding financial resolution practices, especially in the context of what is professional debt mediation and consumer protection. He noted that 'Freedom exploited susceptible consumers seeking assistance to escape financial obligations.'

As we reflect on these developments, it’s crucial to recognize the emotional weight that debt can carry. We can navigate these challenges together, fostering a supportive environment where financial stability is within reach.

Key Features and Processes of Debt Mediation

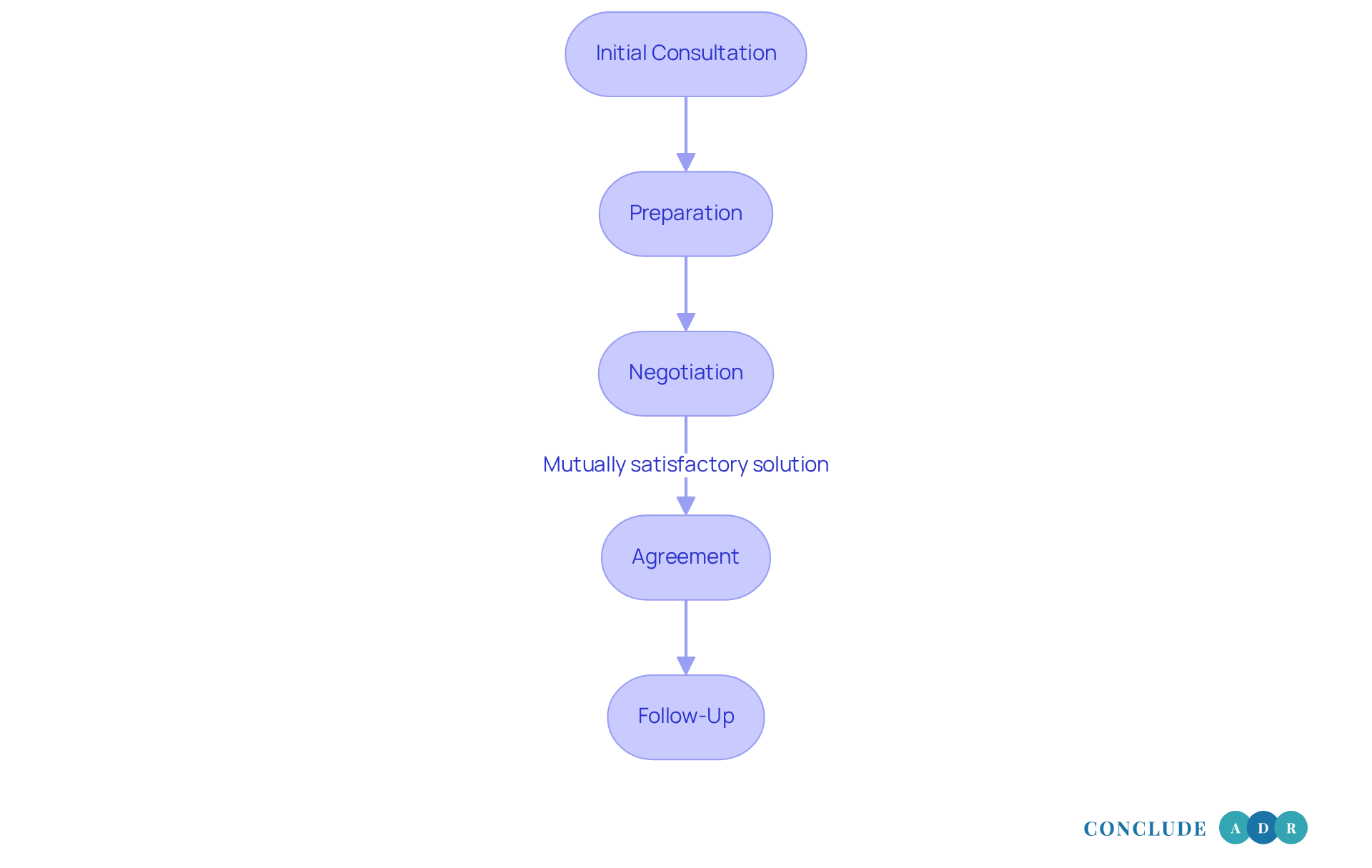

The debt mediation process unfolds through several essential stages, each designed to foster effective negotiation and resolution:

-

Initial Consultation: Here, the facilitator meets with the debtor to understand their financial situation and the specifics of the debt. This step is crucial, as it sets the tone for a supportive dialogue.

-

Preparation: Both parties are encouraged to gather important documents. This preparation is vital for informed negotiations. Research shows that being well-prepared can significantly enhance the outcome. As Giambrone & Partners wisely state, "Preparation is just as crucial as attitude in achieving a successful resolution."

-

During this phase, the facilitator plays a key role in guiding discussions between the debtor and creditor. They help explore various settlement options. Many companies find they can reach agreements in just a day, showcasing the efficiency of this process.

-

Agreement: If a mutually satisfactory solution is reached, the facilitator assists in drafting a formal agreement that clearly outlines the settlement terms. This ensures everyone understands their commitments. Debt negotiation can lead to substantial reductions in balances and interest rates, providing much-needed financial relief.

-

Follow-Up: The facilitator may arrange follow-up sessions to monitor adherence to the agreement and address any issues that arise. This highlights the importance of ongoing communication.

These stages illustrate what is professional debt mediation and its collaborative nature. Understanding what is professional debt mediation, the mediator's expertise creates a safe space for open dialogue, allowing individuals to express their concerns and negotiate terms without the stress of confrontation. Engaging in this process not only alleviates immediate financial pressures but also empowers individuals to rebuild their financial health.

Key Benefits of Debt Mediation:

- Empathy and Understanding: The process is designed to support you emotionally.

- Efficient Resolutions: Many agreements can be reached quickly.

- Financial Relief: Substantial reductions in debt can be achieved.

- Ongoing Support: Follow-up sessions ensure you stay on track.

Are you ready to take the first step towards financial freedom? Let’s work together to find a resolution that works for you.

Conclusion

Professional debt mediation stands out as a compassionate way to tackle financial disputes, focusing on collaboration rather than conflict. This approach not only opens up lines of communication between borrowers and lenders but also nurtures a resolution process that feels more humane. By bringing in a neutral third-party mediator, both individuals and businesses can face their financial hurdles with greater confidence, leading to outcomes that truly benefit everyone involved.

As we reflect on this topic, it’s clear that professional debt mediation offers a structured, voluntary process with significant advantages. Imagine reducing your debt balances and lowering interest rates - these are just a few of the benefits that come with this approach. The journey of debt mediation has evolved, becoming a trusted solution for navigating today’s intricate financial landscape. With effective negotiation strategies and ongoing support, this method not only improves relationships between creditors and debtors but also lays the groundwork for lasting financial recovery.

Choosing professional debt mediation doesn’t just relieve immediate financial stress; it empowers you to take charge of your economic future. As more people seek empathetic ways to resolve conflicts, considering mediation can lead to outcomes that are not only favorable but also bring lasting peace of mind. Whether you’re dealing with personal or business-related financial issues, exploring this compassionate path might just be the key to achieving the stability and success you deserve.

Frequently Asked Questions

What is professional debt mediation?

Professional debt mediation is a compassionate financial negotiation process that brings together borrowers and lenders with the help of a neutral third-party facilitator, focusing on open communication and collaboration to reach a fair resolution.

What are the key steps involved in professional debt mediation?

The process typically unfolds in five essential steps: Introduction, Evaluation, Negotiation strategy, Negotiation, and Settlement.

How does a mediator facilitate the negotiation process?

A mediator acts as an unbiased intermediary, steering the conversation to ensure that everyone feels heard and understood, which is crucial for developing effective repayment strategies.

What are the benefits of involving a mediator in financial resolution?

Mediation can lead to decreased balances, lower interest rates, and manageable payment plans, alleviating the economic stress often associated with debt.

How does mediation compare to litigation in terms of costs?

Mediation tends to be less expensive than litigation, which can incur hefty legal fees and court costs. For example, companies with at least $1 billion in revenue spent $22.8 billion on external litigation expenses in 2020.

What is the overall effectiveness of professional debt mediation?

Experts agree that negotiation in debt mediation often leads to positive results, higher satisfaction levels among participants, and better long-term outcomes, as both sides play a role in shaping the resolution.

Can mediation help preserve relationships between lenders and debtors?

Yes, successful case studies show that negotiation can preserve relationships by fostering collaborative discussions that yield better long-term results.

Who should consider professional debt mediation?

Individuals and businesses facing financial challenges may benefit from professional debt mediation as a practical and effective alternative to traditional resolution methods.