Overview

Debt mediation is a structured process that can help resolve conflicts related to debt, offering a compassionate alternative to litigation. Have you ever felt overwhelmed by debt-related issues? You're not alone. Many people find themselves in similar situations, and mediation can be a ray of hope.

This approach brings in a neutral mediator who facilitates the conversation, making it easier for everyone involved to express their concerns. The benefits of mediation are numerous:

- It's cost-effective

- Saves time

- Ensures confidentiality

- Helps preserve relationships

Imagine being able to discuss your challenges openly, leading to solutions that work for everyone.

Mediation fosters cooperative dialogue, allowing for mutually agreeable solutions that can ease the burden of debt. It’s about creating a space where you feel heard and understood. If you’re facing debt challenges, consider exploring this supportive option. Together, we can find a path forward that respects your needs and emotions.

Introduction

Navigating the complexities of debt can feel overwhelming, leaving many individuals and businesses trapped in a cycle of stress and uncertainty. Debt mediation presents a compassionate and effective alternative to traditional litigation. This structured process encourages open dialogue and collaboration, allowing for a more supportive environment. By exploring the step-by-step journey of debt mediation, you will discover how this approach not only alleviates financial burdens but also preserves relationships. It empowers participants, enabling you to take control of your resolutions.

Yet, what truly makes mediation a superior choice compared to the adversarial nature of court disputes? How can you master these techniques to achieve the best outcomes? By embracing mediation, you open the door to a more harmonious resolution process.

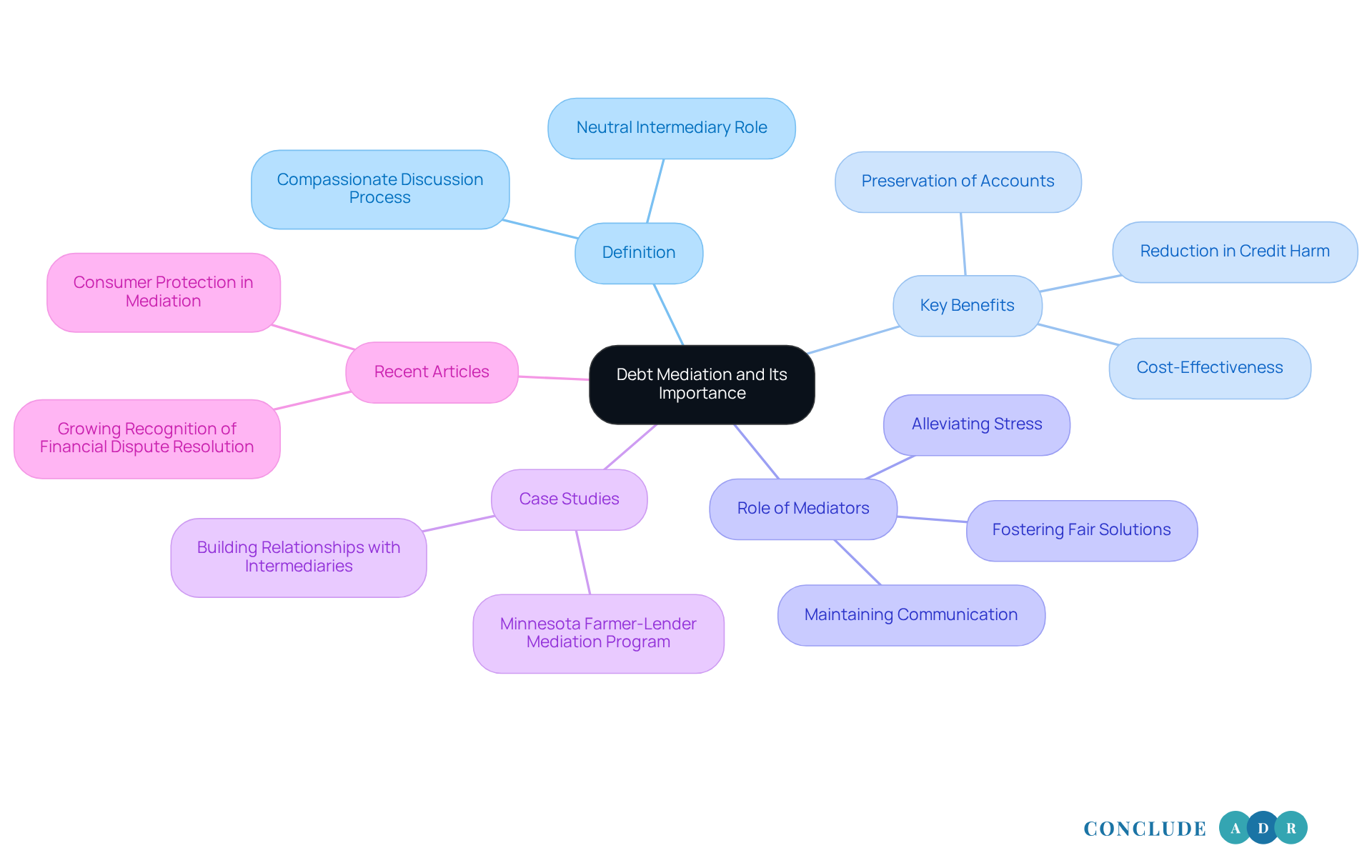

Define Debt Mediation and Its Importance

Debt mediation is a compassionate discussion process where a neutral intermediary, known as a mediator, supports individuals and organizations in resolving debt-related conflicts. This approach is vital because it creates a safe space for open dialogue, enabling individuals to voice their concerns and negotiate terms without the confrontational stress often found in court cases. The significance of financial negotiation lies in its ability to foster understanding and cooperation, leading to outcomes that benefit everyone involved.

Key benefits of debt negotiation include the preservation of accounts and a reduction in credit harm—especially important for those facing significant debt. Did you know that negotiation can significantly lower balances and interest rates? This alleviates the financial burden on consumers. For instance, conflict resolution has been shown to help maintain accounts and minimize credit damage compared to default or settlement, making it a more secure option for those in financial distress. Moreover, alternative dispute resolution is often less costly than traditional legal routes, allowing individuals to avoid exhausting their savings on attorney fees or facing expensive lawsuits.

Experts consistently highlight the effectiveness of debt mediation in resolving disputes related to debt. Mediators engage in debt mediation as intermediaries, alleviating stress by keeping lines of communication open with creditors and concentrating on fair, sustainable solutions. This process not only tackles immediate financial issues but also empowers consumers to rebuild their financial health. Consider case studies from the Minnesota Farmer-Lender Dispute Resolution Program; they show that effective negotiation relies on individuals' willingness to engage and find common ground. For example, the program illustrates that well-trained mediators can facilitate discussions that lead to resolutions, ensuring that all parties feel heard and understood.

Recent articles, particularly those published between June 2, 2025, and July 7, 2025, underscore the growing recognition of financial dispute resolution as a viable alternative to default or settlement. They showcase its ability to provide clear agreement structures and consumer protection. By prioritizing openness and feasible arrangements, financial negotiation offers a pathway for individuals to move forward with confidence, significantly reducing the risks associated with unresolved financial conflicts. Furthermore, maintaining neutrality in facilitation processes is essential, as it helps build trust among participants—crucial for achieving balanced and fair outcomes.

Explore the Debt Mediation Process

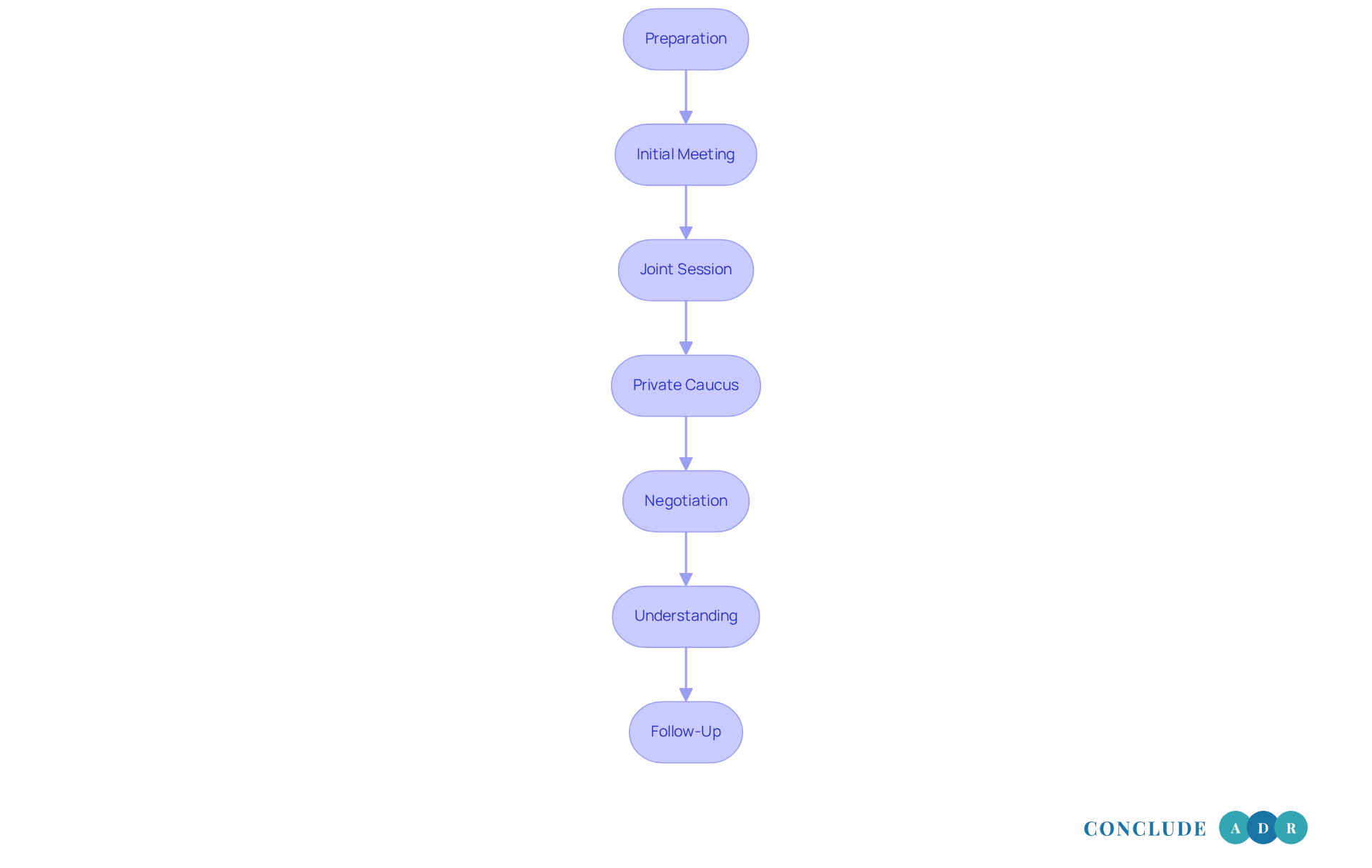

The debt mediation process typically unfolds through several essential steps that facilitate effective resolution:

-

Preparation: Before the discussion, both sides should gather pertinent documents and clearly define their positions. This groundwork is crucial for clarifying the issues at hand and setting the stage for productive discussions.

-

Initial Meeting: The facilitator gathers with both sides to clarify the mediation process, set ground rules, and ensure that everyone understands their roles. This initial meeting is vital for fostering a cooperative atmosphere.

-

Joint Session: During this session, both sides present their perspectives on the dispute. The facilitator plays a crucial role in enabling the discussion, encouraging respectful dialogue and comprehension between the groups.

-

Private Caucus: The facilitator may conduct individual meetings with each group to address sensitive matters and examine possible solutions without the influence of the other group's presence. This step allows for candid conversations that can lead to creative resolutions.

-

Negotiation: Directed by the facilitator, the involved individuals participate in discussions to arrive at terms that are agreeable to both sides. The focus here is on finding common ground and addressing the interests of all involved.

-

Understanding: If a consensus is achieved, the facilitator helps in creating a written document that specifies the terms, which both sides endorse to formalize the resolution. This step is crucial for ensuring clarity and commitment to the agreed-upon terms.

-

Follow-Up: After the negotiation, the mediator may check in with both sides to confirm that the agreement is being honored and to address any lingering issues. This follow-up can help maintain the relationship and ensure compliance with the terms.

In contrast to litigation, which can be lengthy and expensive, debt mediation often results in quicker resolutions, enabling parties to conserve both time and money. For instance, conflict resolution can settle disputes in a matter of weeks, while litigation may take months or even years. Effective negotiation not only settles disagreements but also promotes a cooperative atmosphere that can avert future conflicts.

As highlighted by seasoned negotiators, preparation and clear communication are essential in attaining a favorable result. Clients who express their viewpoints effectively can greatly improve their chances of success. One mediator stated, "Preparation is just as crucial as attitude in achieving a successful resolution.

Identify the Benefits of Debt Mediation

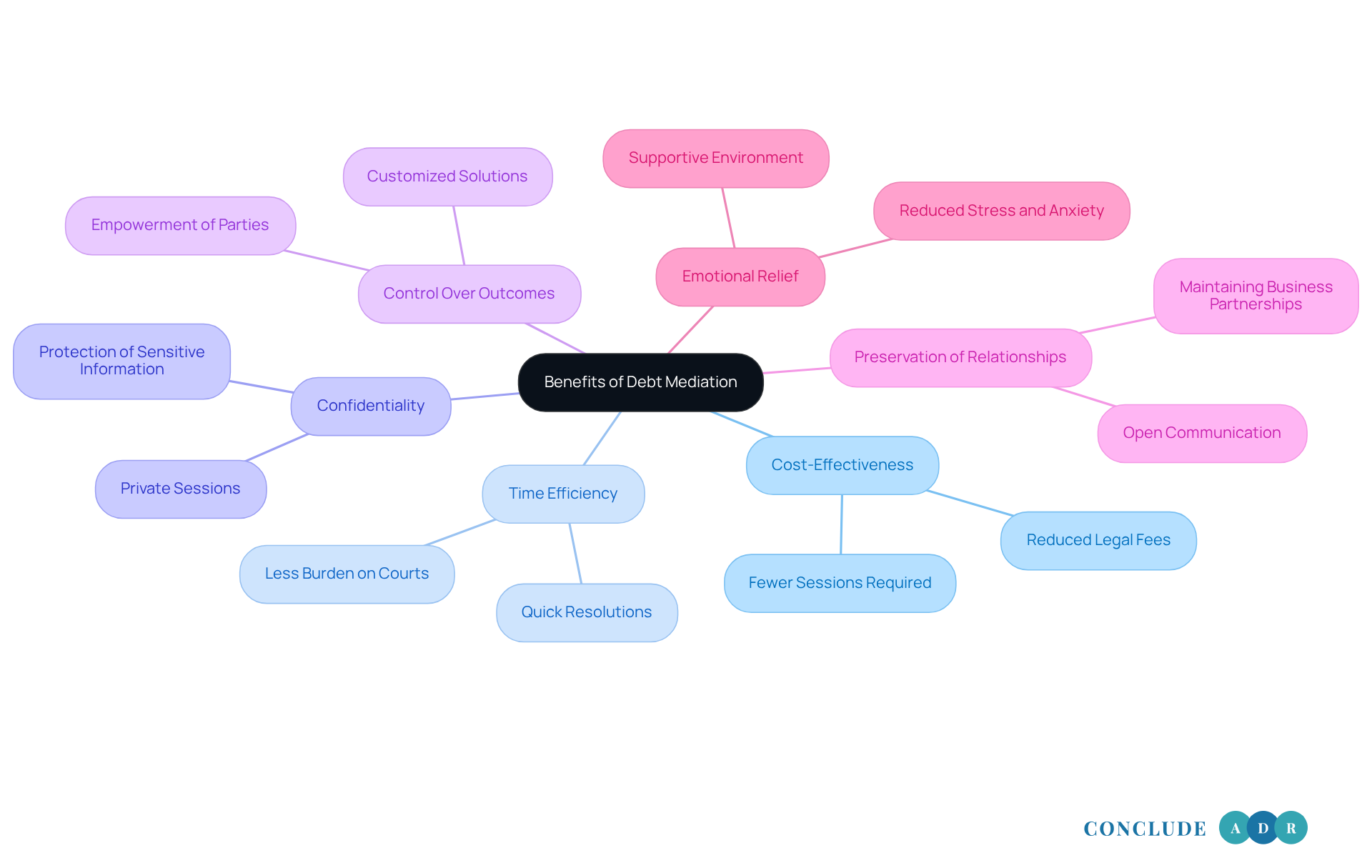

Debt mediation presents numerous advantages that can make it a reassuring choice for those navigating disputes. Have you ever felt overwhelmed by the thought of litigation? Here’s how mediation can help.

-

Cost-Effectiveness: Mediation can significantly reduce expenses compared to traditional court proceedings. Imagine eliminating court fees and minimizing the need for extensive legal representation. This financial relief is especially beneficial for both businesses and individuals, allowing for quicker recovery of debts without the burden of overwhelming costs. Studies show that negotiation tends to be much more cost-efficient than court due to fewer sessions and lower fees.

-

Time Efficiency: Mediation can often be arranged swiftly, leading to resolutions within weeks rather than the lengthy months or years typical of court. This rapid turnaround not only eases the burden on the court system but also allows you to move forward without prolonged uncertainty. Many companies find they can reach agreements in just a day, restoring communication and relationships that may have been strained.

-

Confidentiality: Unlike public court hearings, mediation sessions are private, protecting sensitive information from public scrutiny. This confidentiality is vital for businesses wanting to safeguard their reputations while resolving disputes.

-

Control Over Outcomes: Mediation empowers you to take charge of the resolution process, allowing for customized solutions that address your unique circumstances. This collaborative approach often leads to more satisfying outcomes than those imposed by a judge.

-

Preservation of Relationships: The collaborative nature of mediation encourages open communication, which can help maintain or even enhance relationships between disputing parties. This is particularly important in business contexts where ongoing partnerships may be at stake. For instance, the 'Can't Pay' situation illustrates how negotiation can preserve relationships while addressing financial concerns.

-

Emotional Relief: The supportive environment created by mediators can significantly lessen the stress and anxiety often tied to debt disputes. By fostering a more amicable atmosphere, mediation can lead to a positive resolution experience for everyone involved. Ultimately, debt mediation offers several advantages, including reduced costs, faster resolution times, confidentiality, flexibility, and a less adversarial approach.

In conclusion, debt mediation is a practical and beneficial alternative to traditional litigation, providing a streamlined path to resolution that prioritizes your needs and emotions.

Conclusion

Debt mediation stands as a crucial resource for resolving financial disputes, offering individuals and organizations a way to address their debt challenges in a nurturing and constructive environment. By involving a neutral mediator, parties can engage in open dialogue, fostering understanding and leading to mutually beneficial agreements without the stress and adversarial nature of traditional court proceedings.

Throughout this article, we’ve highlighted the significance of the debt mediation process, showcasing its structured approach that encompasses:

- Preparation

- Joint sessions

- Private caucuses

- Follow-ups

Consider the key benefits:

- Cost-effectiveness

- Time efficiency

- Confidentiality

- Preservation of relationships

These advantages underscore why mediation is often the preferred choice over litigation. Imagine having the ability to maintain control over outcomes, empowering you to seek personalized resolutions that resonate with your unique circumstances.

Recognizing the importance of debt mediation can truly transform how we approach disputes. It encourages a shift toward more collaborative and less confrontational methods. For anyone facing financial conflicts, embracing mediation not only provides a pathway to resolution but also contributes to long-term financial health and stability. Engaging in this process can lead to a more secure financial future. Isn’t that something worth striving for? Mediation is an essential strategy for both individuals and businesses alike, offering hope and support in challenging times.

Frequently Asked Questions

What is debt mediation?

Debt mediation is a discussion process facilitated by a neutral intermediary, known as a mediator, who helps individuals and organizations resolve debt-related conflicts.

Why is debt mediation important?

Debt mediation is important because it creates a safe environment for open dialogue, allowing individuals to express their concerns and negotiate terms without the stress of confrontational court cases. It fosters understanding and cooperation, leading to beneficial outcomes for all parties involved.

What are the key benefits of debt negotiation?

Key benefits of debt negotiation include the preservation of accounts, reduction in credit harm, significant lowering of balances and interest rates, and less financial burden on consumers. It is also generally less costly than traditional legal options, helping individuals avoid high attorney fees and lawsuits.

How does debt mediation help maintain financial health?

Debt mediation helps maintain financial health by alleviating immediate financial issues and empowering consumers to rebuild their financial status. It encourages open communication with creditors and focuses on fair, sustainable solutions.

What role do mediators play in debt mediation?

Mediators act as intermediaries who alleviate stress by keeping communication lines open with creditors and concentrating on achieving fair and sustainable solutions for all parties involved.

Can you provide an example of effective debt mediation?

The Minnesota Farmer-Lender Dispute Resolution Program illustrates effective debt mediation by showing that well-trained mediators can facilitate discussions that lead to resolutions, ensuring that all parties feel heard and understood.

How is financial dispute resolution viewed in recent articles?

Recent articles highlight the growing recognition of financial dispute resolution as a viable alternative to default or settlement, showcasing its ability to provide clear agreement structures and consumer protection.

What is essential for achieving balanced and fair outcomes in debt mediation?

Maintaining neutrality in the facilitation process is essential for building trust among participants, which is crucial for achieving balanced and fair outcomes in debt mediation.