Introduction

Navigating alimony in California can feel overwhelming, especially with the recent changes in the legal landscape for 2024. This financial support system aims to help a lower-earning spouse maintain a standard of living similar to what they enjoyed during the marriage. However, the various types, calculations, and duration of alimony can leave many feeling lost.

How can you make sense of these intricate laws and secure your financial future amidst the emotional upheaval of divorce? This article is here to guide you through California's alimony laws, offering clarity on what to expect and how to manage spousal support obligations effectively.

We understand that this is a challenging time, and it’s important to approach these issues with care and compassion. Together, we’ll explore the ins and outs of alimony, ensuring you feel informed and empowered to make the best decisions for your situation.

Define Alimony: Purpose and Legal Framework in California

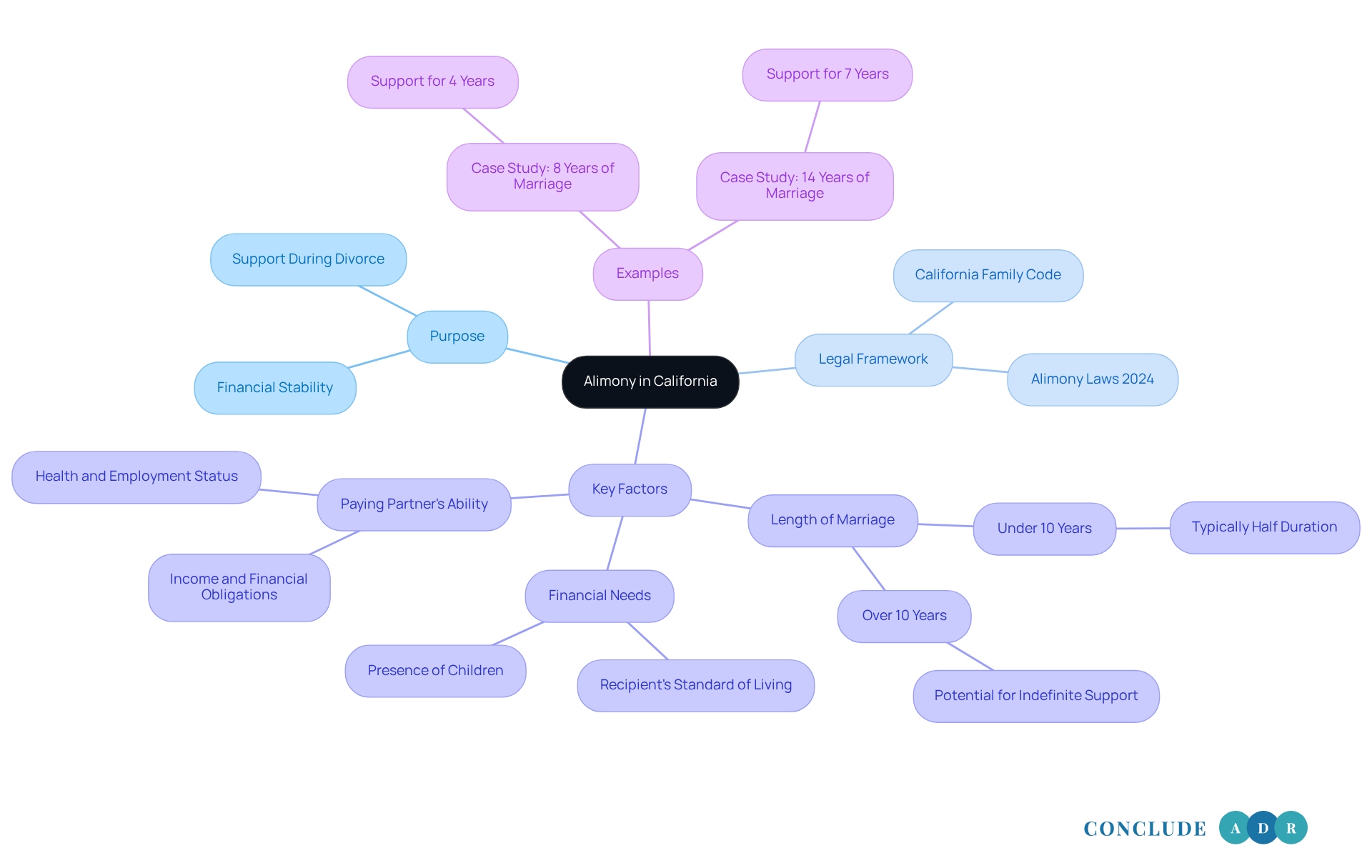

Alimony, often referred to as marital assistance, is a financial responsibility that one partner may be ordered to pay to another during or after a divorce. This support aims to help the lower-income partner maintain a standard of living similar to what they enjoyed during the marriage. In California, the Family Code outlines the legal framework for spousal maintenance, as stipulated by california alimony laws 2024, detailing how the amount and duration of support are determined.

Key factors include:

- The length of the marriage

- The financial needs of the recipient

- The paying partner's ability to provide support

California courts strive to achieve a fair outcome for both partners, ensuring that financial assistance serves its purpose of providing stability during the emotionally taxing process of divorce, rather than punishing the higher-earning partner.

For instance, if a couple was married for eight years, the court might order financial support for four years, reflecting a common guideline that assistance lasts for half the duration of shorter marriages. On the other hand, marriages lasting over ten years could lead to indefinite support, with adjustments based on changing circumstances. It's important to note that there isn't a strict '10 Years Rule' guaranteeing lifelong financial aid.

The recent changes in California alimony laws 2024 emphasize the importance of individual circumstances, such as health issues or the presence of children, which can significantly influence financial support decisions. Courts aim to achieve just outcomes, focusing on the financial needs of the supported partner while considering the obligations of the paying partner.

As legal experts point out, financial support is meant to provide stability during this challenging time, allowing the lower-earning partner to adjust to new circumstances and work towards financial independence. If you find yourself navigating this complex situation, remember that support is available to help you through.

Explore Types of Alimony: Temporary, Rehabilitative, and Permanent

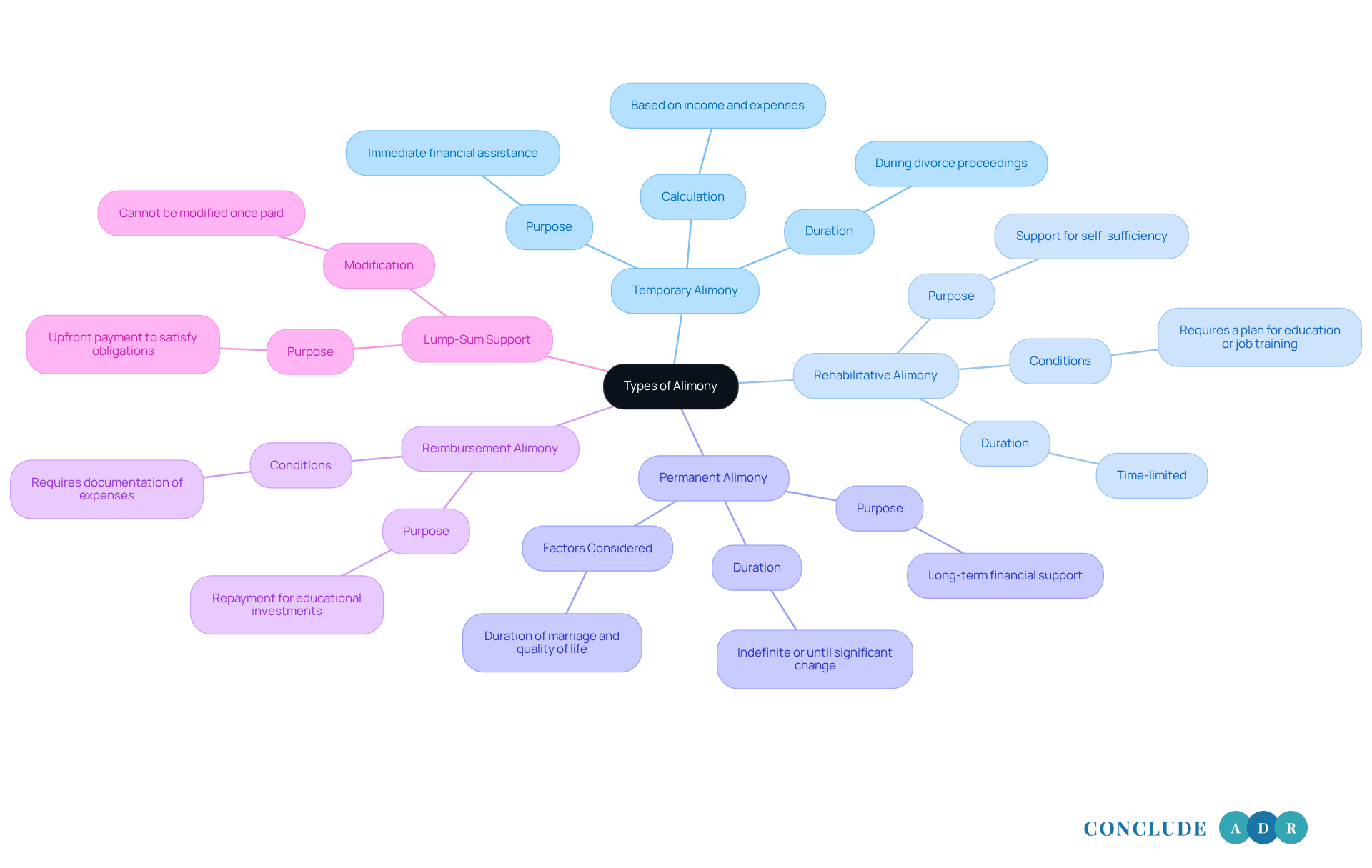

In California, understanding alimony can feel overwhelming, but it’s essential to know that there are several types, each designed to meet specific needs:

-

Temporary Alimony: This type is granted during divorce proceedings, providing immediate financial assistance to the lower-earning spouse until the divorce is finalized. It aims to prevent sudden financial hardship and is calculated based on the income and expenses of both parties. Have you ever worried about how to manage finances during such a challenging time?

-

Rehabilitative Alimony: This support helps the recipient acquire the skills or education necessary for self-sufficiency. Typically time-limited, rehabilitative support is designed to cover living expenses and educational costs during the transition to financial independence. Imagine having the opportunity to pursue your dreams while ensuring your basic needs are met.

-

Permanent Alimony: Often awarded in long-term unions, permanent alimony can last indefinitely or until a significant change occurs, like the recipient's remarriage or a substantial alteration in the payer's financial condition. Courts consider various factors, including the duration of the union and the quality of life during it. It’s important to know that your contributions to the marriage matter.

-

Reimbursement Alimony: This type repays a spouse for educational investments made during the marriage, such as tuition and fees, regardless of whether the education benefited the marriage. Clear documentation of expenses is required. Have you invested in your partner’s education? This type of support acknowledges that effort.

-

Lump-Sum Support: This refers to an upfront payment that satisfies spousal support obligations in full. Once paid, it cannot be modified, providing security for the recipient and freedom for the payor. It’s a straightforward solution that can bring peace of mind.

Comprehending these distinctions is vital, as each kind of financial support serves different purposes and has unique implications for both parties involved. For instance, the typical duration of a union that concludes in separation is about 8 years, which can influence the kind and length of spousal support granted. Under California alimony laws 2024, courts may consider factors like the earning capacity of each partner, the standard of living during the marriage, and the contributions each partner made.

Navigating these waters can be tough, but remember, you’re not alone in this journey.

Calculate Alimony Payments: Factors and Formulas

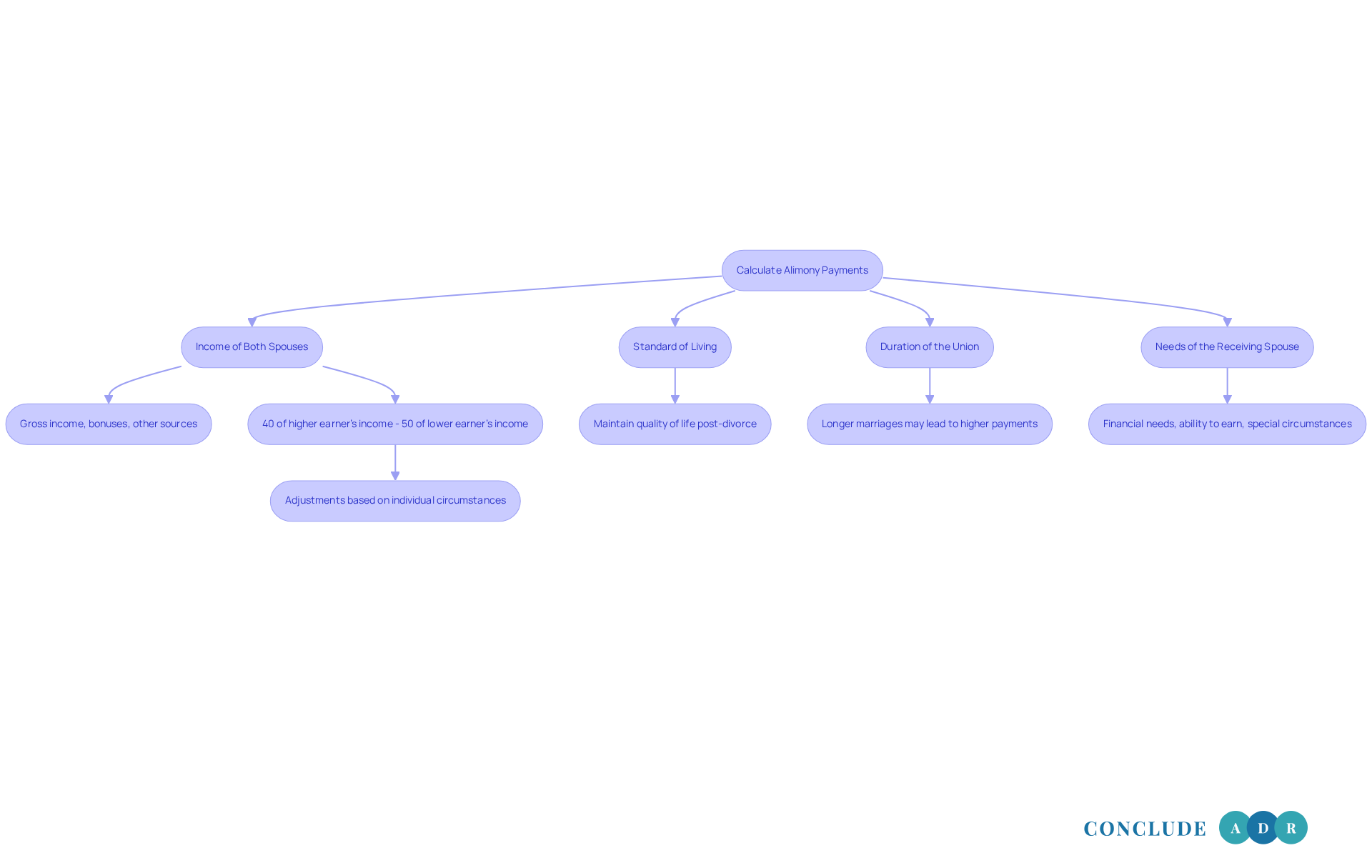

Calculating alimony payments in California according to California alimony laws 2024 can feel overwhelming, but understanding the key factors can help ease your concerns. Here are some critical elements the court considers to ensure fair support for the receiving spouse:

- Income of Both Spouses: The court looks at the gross income of both parties, including salaries, bonuses, and other income sources. This assessment is vital, as it directly impacts the alimony amount.

- Standard of Living: Courts strive to preserve the standard of living established during the marriage. This consideration is essential to ensure that both spouses can maintain a similar quality of life after the divorce.

- Duration of the Union: Generally, longer marriages lead to higher potential alimony payments. For instance, unions lasting over ten years may result in indefinite support, while shorter marriages often see payments lasting half the duration of the union.

- Needs of the Receiving Spouse: The financial needs of the spouse receiving support are carefully evaluated. This includes their ability to earn income and any special circumstances, such as health issues or caregiving responsibilities.

A common formula used by courts determines spousal support by taking 40% of the higher earner's net monthly income and subtracting 50% of the lower earner's net monthly income. This calculation serves as a baseline for determining spousal support payments, though judges have the discretion to adjust amounts based on individual circumstances.

As we look ahead to 2025, it’s important to remember that spousal support payments are not tax-deductible for the payer, and recipients do not report these payments as income under federal law. Additionally, spousal support can be adjusted or terminated if significant changes occur, such as the receiving partner cohabitating or changes in income.

Understanding these factors is crucial for navigating the complexities of spousal support according to California alimony laws 2024. If you’re feeling uncertain, know that you’re not alone. We’re here to help you through this process.

Determine Duration of Alimony: Key Considerations

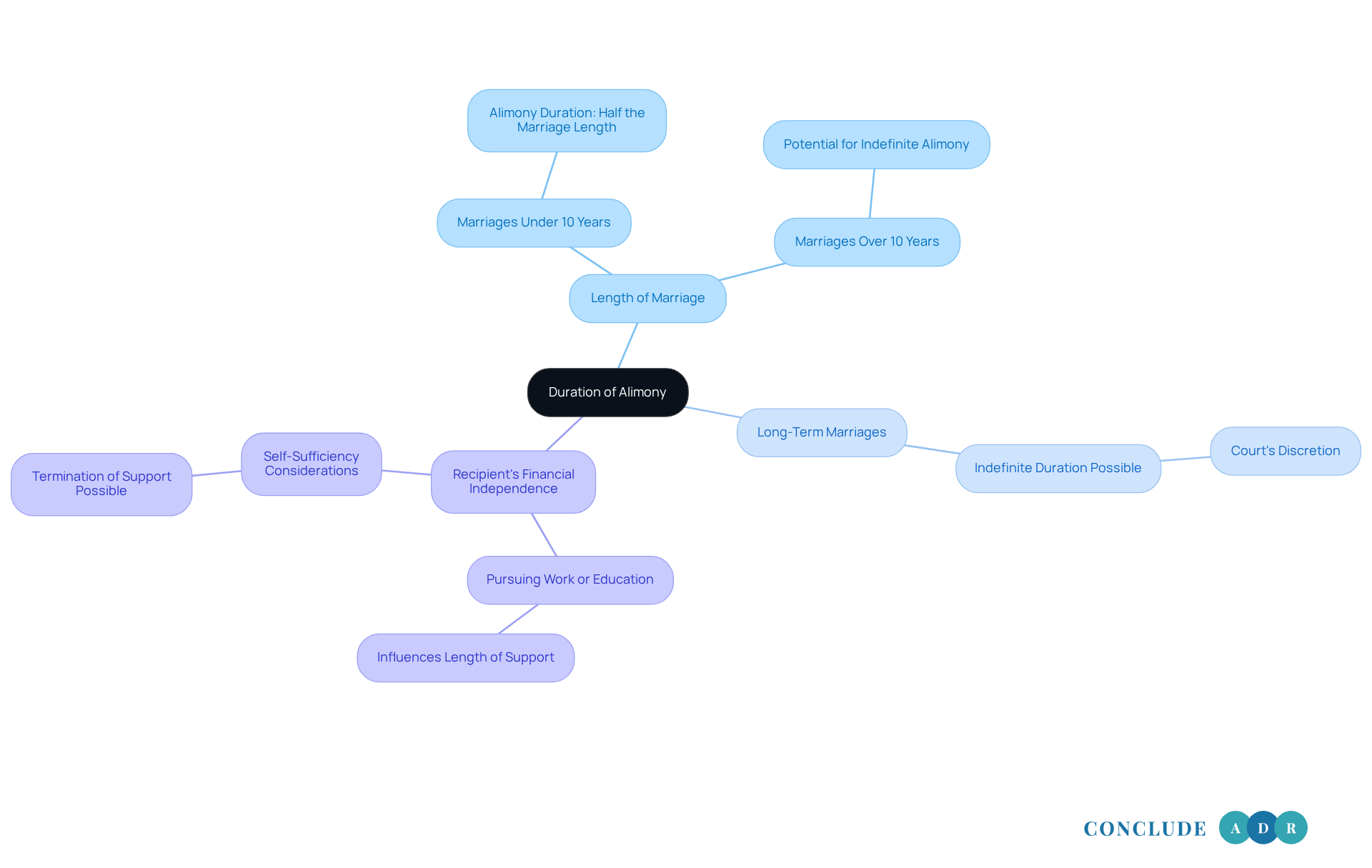

Understanding California alimony laws 2024 can feel overwhelming, but it’s important to know that several key factors influence the duration of alimony. Let’s explore these together, so you can feel more informed and supported.

-

Length of the Marriage: If your marriage lasted less than ten years, alimony is usually awarded for half that time. For example, if you were married for six years, you might expect three years of spousal support. This can provide a sense of stability during a challenging transition.

-

Long-Term Marriages: For those who have been married for ten years or more, the duration of alimony can be indefinite. This decision often depends on individual circumstances and the court's discretion as outlined in california alimony laws 2024, which can feel daunting, but it’s designed to ensure fairness.

-

Recipient's Financial Independence: The court will also consider whether the recipient can become self-sufficient. If you or your loved one is actively pursuing work or education, this can positively influence the length of support. It’s a reminder that taking steps toward independence is valued.

Navigating these factors can be complex, but you’re not alone. Understanding your rights and options is the first step toward finding resolution and peace.

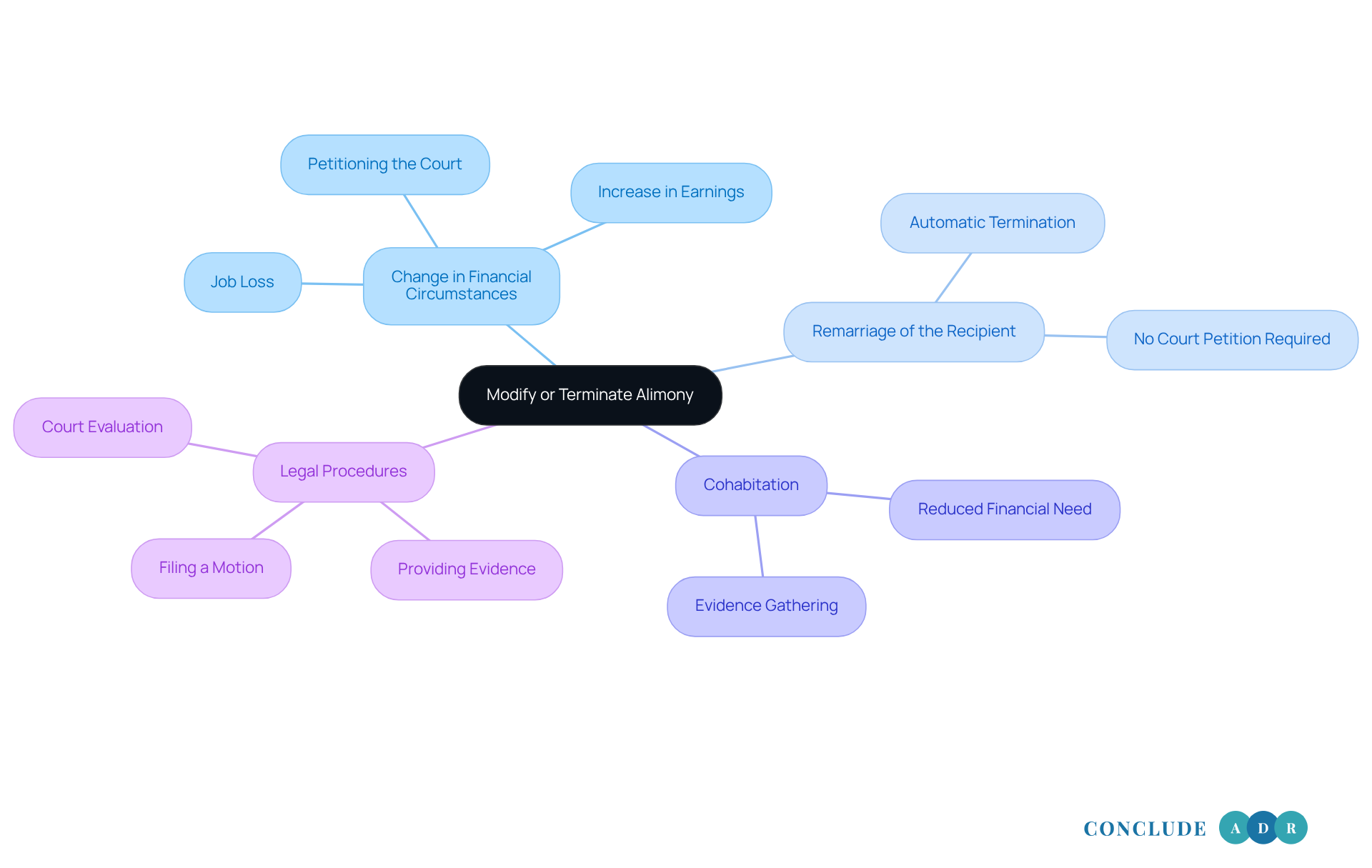

Modify or Terminate Alimony: Legal Grounds and Procedures

In California, navigating alimony can feel overwhelming, but understanding the California alimony laws 2024 regarding how it can be modified or terminated under specific circumstances can bring some peace of mind.

-

Change in Financial Circumstances: Life can throw unexpected challenges our way, like job loss or a sudden increase in earnings. If you find yourself in a situation where your income has significantly changed, either party can petition the court for a modification of alimony. For instance, if the payer experiences a drop in income, they might seek to lessen their financial obligations. Conversely, if the recipient's earnings increase, it could lead to a decrease in support. Consulting with an experienced attorney can help you navigate the changes brought by california alimony laws 2024 effectively, ensuring that any modifications reflect the current financial realities for both parties.

-

Remarriage of the Recipient: If the recipient remarries, alimony typically ends automatically. This is because the new partner is expected to provide financial support. Thankfully, this automatic termination doesn’t require a court petition, making it easier for the payer. However, having legal representation can help confirm that all necessary steps are taken to formalize this change.

-

Cohabitation: What if the recipient starts living with a new partner? This situation may also provide grounds for modifying or terminating alimony. Cohabitation can suggest a reduced financial need for the recipient, which might lead to a decrease in support payments. Legal counsel can assist in gathering evidence to support this claim, ensuring your voice is heard.

-

Legal Procedures: To initiate a modification or termination of spousal support according to california alimony laws 2024, the requesting party must file a motion with the court, backed by evidence that shows the change in circumstances. The court will carefully evaluate this evidence, making decisions based on the financial situations of both parties. This process highlights the importance of thorough documentation and legal representation to navigate the complexities of alimony modifications effectively. Remember, failing to disclose changes can lead to serious legal consequences, so maintaining transparency and seeking legal guidance is crucial throughout this journey.

Conclusion

Understanding California alimony laws in 2024 is essential for anyone navigating the often overwhelming landscape of spousal support during and after divorce. Alimony is designed to help the lower-earning partner maintain a standard of living similar to what they enjoyed during the marriage. This reflects the legal framework established by the Family Code, which aims to provide fairness and support.

There are various types of alimony - temporary, rehabilitative, permanent, and reimbursement - each tailored to meet specific needs. This variety underscores how crucial individual circumstances are in determining the right support. Have you considered how your unique situation might influence the type of alimony you may receive or pay?

Throughout this article, we’ve highlighted key factors that influence alimony payments and duration. These include:

- The length of the marriage

- The financial needs of both parties

- The recipient's potential for self-sufficiency

It’s important to remember that life changes, such as shifts in financial circumstances or remarriage, can lead to modifications or even termination of alimony. This dynamic nature of spousal support in California reflects the reality that circumstances can evolve.

Ultimately, understanding these laws empowers you to advocate for your rights and navigate the emotional and financial challenges that often accompany divorce. Whether you’re seeking support or looking to adjust existing agreements, staying informed about California alimony laws in 2024 is vital. It’s not just about achieving a fair resolution; it’s about moving toward financial independence and peace of mind.

So, as you move forward, remember that you’re not alone in this journey. We’re here to support you every step of the way.

Frequently Asked Questions

What is alimony and what is its purpose in California?

Alimony, also known as marital assistance, is a financial responsibility that one partner may be ordered to pay to another during or after a divorce. Its purpose is to help the lower-income partner maintain a standard of living similar to what they enjoyed during the marriage.

What legal framework governs alimony in California?

The legal framework for alimony in California is outlined in the Family Code, which specifies how the amount and duration of spousal maintenance are determined based on various factors.

What factors do California courts consider when determining alimony?

California courts consider the length of the marriage, the financial needs of the recipient, and the paying partner's ability to provide support when determining alimony.

How does the length of marriage affect the duration of alimony?

Generally, for shorter marriages, the court might order alimony for half the duration of the marriage. For marriages lasting over ten years, support may be indefinite, but there isn't a strict rule guaranteeing lifelong financial aid.

What recent changes have been made to California alimony laws in 2024?

The changes emphasize the importance of individual circumstances, such as health issues or the presence of children, which can significantly influence financial support decisions.

What are the different types of alimony available in California?

The types of alimony in California include: - Temporary Alimony: Granted during divorce proceedings for immediate financial assistance. - Rehabilitative Alimony: Helps the recipient acquire skills or education for self-sufficiency, typically time-limited. - Permanent Alimony: Awarded in long-term marriages, lasting indefinitely or until a significant change occurs. - Reimbursement Alimony: Repays a spouse for educational investments made during the marriage. - Lump-Sum Support: An upfront payment that satisfies spousal support obligations in full.

What is the purpose of temporary alimony?

Temporary alimony provides immediate financial assistance to the lower-earning spouse during divorce proceedings to prevent sudden financial hardship.

How does rehabilitative alimony support the recipient?

Rehabilitative alimony is designed to help the recipient cover living expenses and educational costs while they work towards financial independence.

What is permanent alimony and when is it awarded?

Permanent alimony can last indefinitely, awarded in long-term marriages, and continues until the recipient remarries or there is a significant change in the payer's financial condition.

What is reimbursement alimony and what does it require?

Reimbursement alimony repays a spouse for educational investments made during the marriage, and requires clear documentation of those expenses.

What is lump-sum support and what are its benefits?

Lump-sum support is an upfront payment that fulfills spousal support obligations in full, providing security for the recipient and freedom for the payer, as it cannot be modified once paid.