Overview

Mediation in insurance is a vital process that can truly make a difference. Imagine a situation where you’re facing a dispute over a claim or policy. It can be overwhelming, right? An impartial mediator steps in to assist both parties, fostering collaboration and understanding.

Why consider mediation? Here are some key benefits:

- Cost-effectiveness: Save money compared to traditional litigation.

- Time efficiency: Resolve disputes more quickly.

- Confidentiality: Keep your matters private.

- Preservation of relationships: Maintain connections that matter.

These advantages make mediation a preferable alternative for those navigating complex insurance issues. It’s not just about resolving disputes; it’s about doing so in a way that respects everyone involved.

If you’re feeling uncertain about your situation, remember that mediation offers a compassionate path forward. We encourage you to explore this option, as it may lead to a resolution that feels right for you.

Introduction

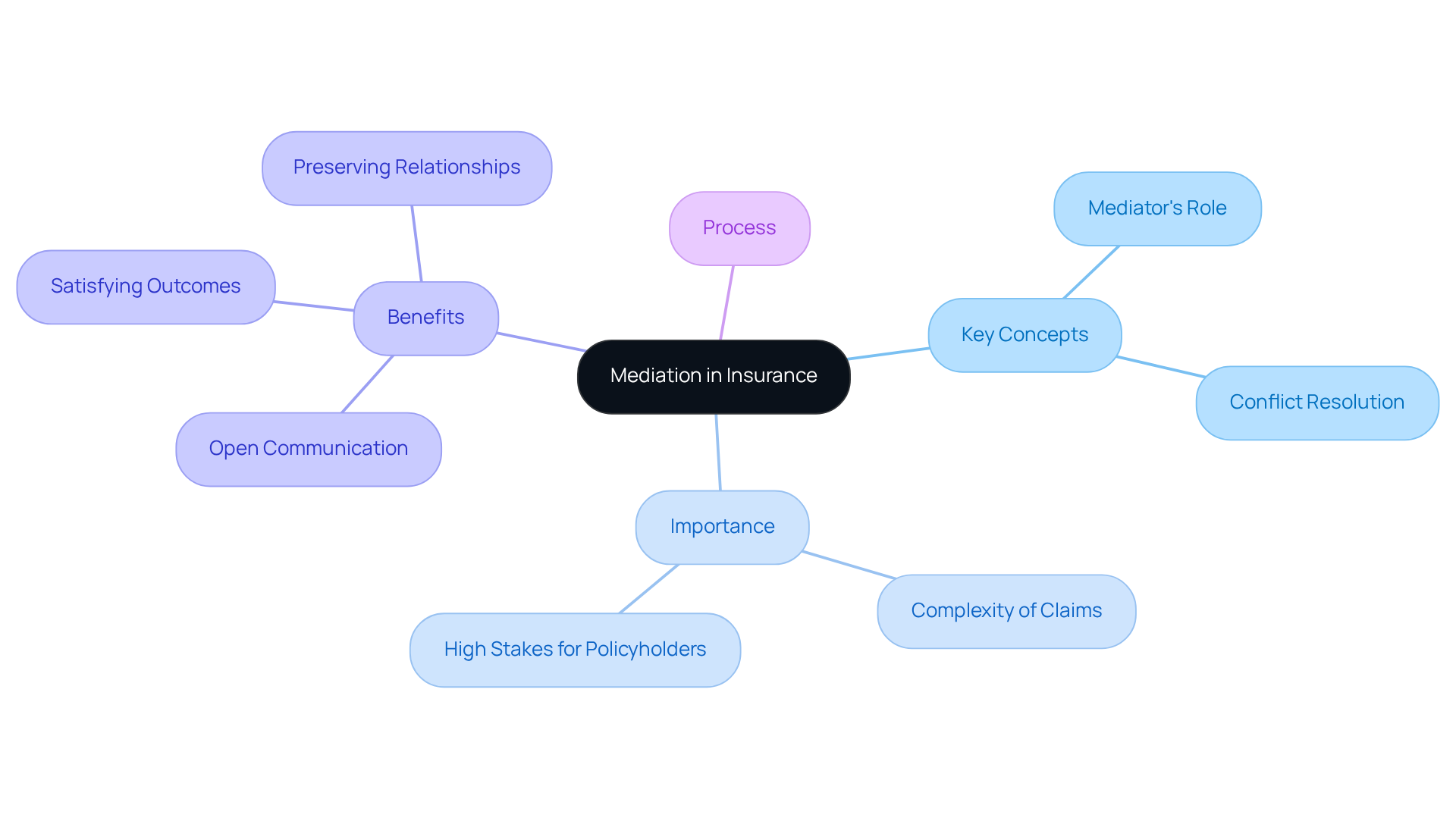

Mediation in insurance acts as a vital lifeline for those of us navigating the often murky waters of claims and disputes. By engaging a neutral third party, the mediation process fosters open dialogue and collaboration. This approach can lead to resolutions that satisfy everyone involved. But we must ask ourselves: can this compassionate method truly replace the traditional, adversarial ways of litigation? Or does it merely serve as a temporary fix in a complex industry?

Exploring the key concepts, benefits, and structured process of mediation reveals not only its significance but also its potential to transform how conflicts are resolved in the insurance sector. Imagine a world where disputes are resolved through understanding rather than confrontation. With mediation, we can move toward that reality together.

Define Mediation in Insurance: Key Concepts and Importance

The process of mediation in insurance involves a compassionate approach where an impartial third party, called a mediator, assists those in conflict in finding common ground on issues related to insurance claims or policy disputes. This approach is especially crucial in the insurance world, where mediation in insurance is needed due to the complexity of claims and the high stakes for policyholders. Have you ever felt overwhelmed by a claim? Mediation encourages open communication, allowing everyone to voice their concerns and interests. This often leads to more satisfying outcomes than traditional litigation.

By creating a collaborative environment, mediation not only resolves conflicts but also helps preserve relationships. Imagine resolving a dispute quickly, saving both time and money that would otherwise be spent on prolonged arguments. In this nurturing space, you can find solutions that work for you, fostering a sense of partnership and understanding. Let's explore how mediation in insurance can serve as a supportive option for you in navigating these challenges.

Explore the Mediation Process: Stages and Key Roles

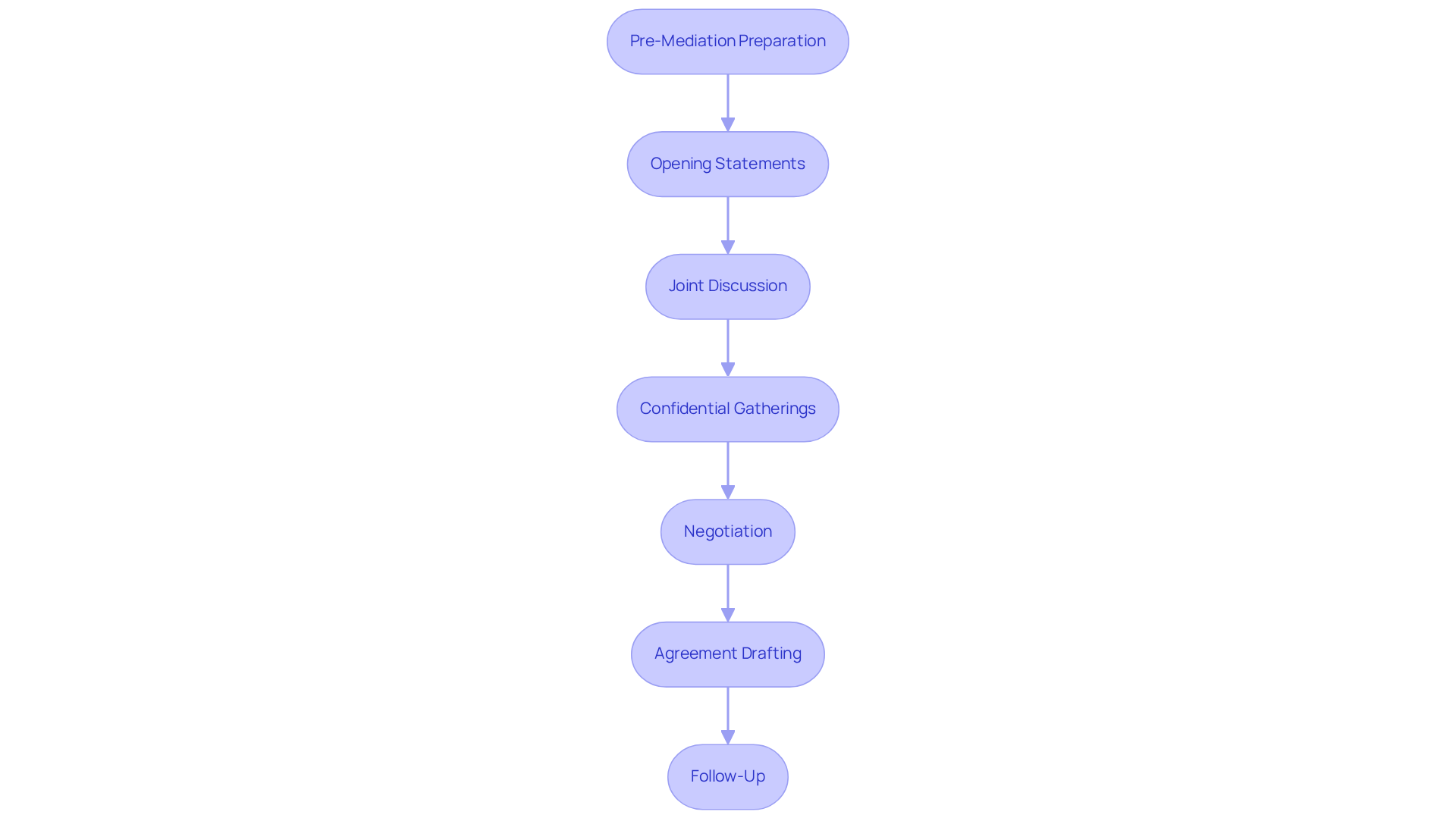

The mediation process typically unfolds through several key stages, each designed to facilitate effective communication and resolution:

-

Pre-Mediation Preparation: In this initial stage, we gather relevant information and identify the issues at stake. It's essential to choose a third party who can guide us. Here, parties discuss their goals and expectations, laying the groundwork for a productive session.

-

Opening Statements: Each side has the opportunity to share their perspective on the dispute, outlining their concerns and desired outcomes. This initial sharing is crucial for establishing context and understanding, creating a safe space for dialogue.

-

Joint Discussion: The facilitator encourages open communication, promoting dialogue among all parties. This stage is vital for identifying common ground and understanding differing viewpoints, fostering a collaborative atmosphere where everyone feels heard.

-

Confidential Gatherings: The facilitator may conduct private sessions with each side to address sensitive matters and explore possible resolutions without the other side present. This allows for candid discussions that can lead to breakthroughs, nurturing trust and openness.

-

Negotiation: Guided by the facilitator, individuals discuss terms that could lead to resolution. This may involve brainstorming innovative solutions that satisfy both parties, highlighting the facilitator's role in promoting collaboration and understanding.

-

Agreement Drafting: If a consensus is reached, the facilitator helps create a written document detailing the terms, which both sides will sign. This formalizes the decision and ensures clarity, reinforcing the commitment to the agreed-upon resolution.

-

Follow-Up: After mediation, the facilitator may check in with participants to ensure adherence to the agreement and address any lingering issues. This step is crucial in reinforcing our commitment to a lasting resolution.

In insurance conflicts, the roles of the intermediary and mediation in insurance are essential for the involved individuals. In mediation in insurance, the mediator acts as a neutral facilitator, guiding the process and helping to navigate complex emotions and interests. Meanwhile, we encourage everyone to engage actively, express their viewpoints, and collaborate towards a solution. This structured approach not only enhances the likelihood of a successful outcome but also minimizes stress, aligning with our resolution-focused philosophy at Conclude ADR.

Highlight Benefits of Mediation: Why Choose This Approach?

Mediation in insurance provides several significant benefits, especially when it comes to navigating disputes.

-

Cost-Effectiveness: Have you ever felt overwhelmed by the expenses of litigation? Mediation in insurance is generally less costly, as it helps you avoid court fees and lengthy legal processes. Plus, people often adhere to mediated agreements more than court orders because they work together to achieve outcomes that suit everyone involved.

-

Time Efficiency: Imagine resolving your dispute in a matter of hours or days instead of the months or years that litigation might take. Mediation can often be scheduled quickly, free from the constraints of overloaded court schedules or strict timelines, providing a faster route to settlement.

-

Confidentiality: In a world where privacy matters, mediation stands out. Unlike court proceedings, this process is private, allowing you to discuss sensitive matters without public scrutiny. This confidentiality creates a safe space for open communication.

-

Control Over Outcomes: Wouldn't it be empowering to have more control over the outcome of your situation? In mediation in insurance, parties can create solutions that are tailored to their specific needs, rather than having a decision imposed by a judge. As Chad Tamaroff, Esq. notes, "One of the main advantages of choosing negotiation is the chance it offers for participants to retain control over the matters involved and the result of the case."

-

Preservation of Relationships: Think about the relationships that matter most to you. Mediation fosters collaboration and communication, helping to maintain professional relationships that might otherwise suffer through adversarial litigation. This process encourages understanding and mutual respect, which can preserve and even strengthen your connections.

-

Increased Satisfaction Levels: Have you ever felt more satisfied when you played an active role in a decision? Research shows that groups involved in negotiation often express greater contentment with the results because they have shaped the agreement themselves. Engaging in conflict resolution can lead to greater satisfaction, as you are actively involved in crafting the resolution.

In considering these benefits, we hope you feel encouraged to explore mediation as a compassionate alternative to traditional litigation.

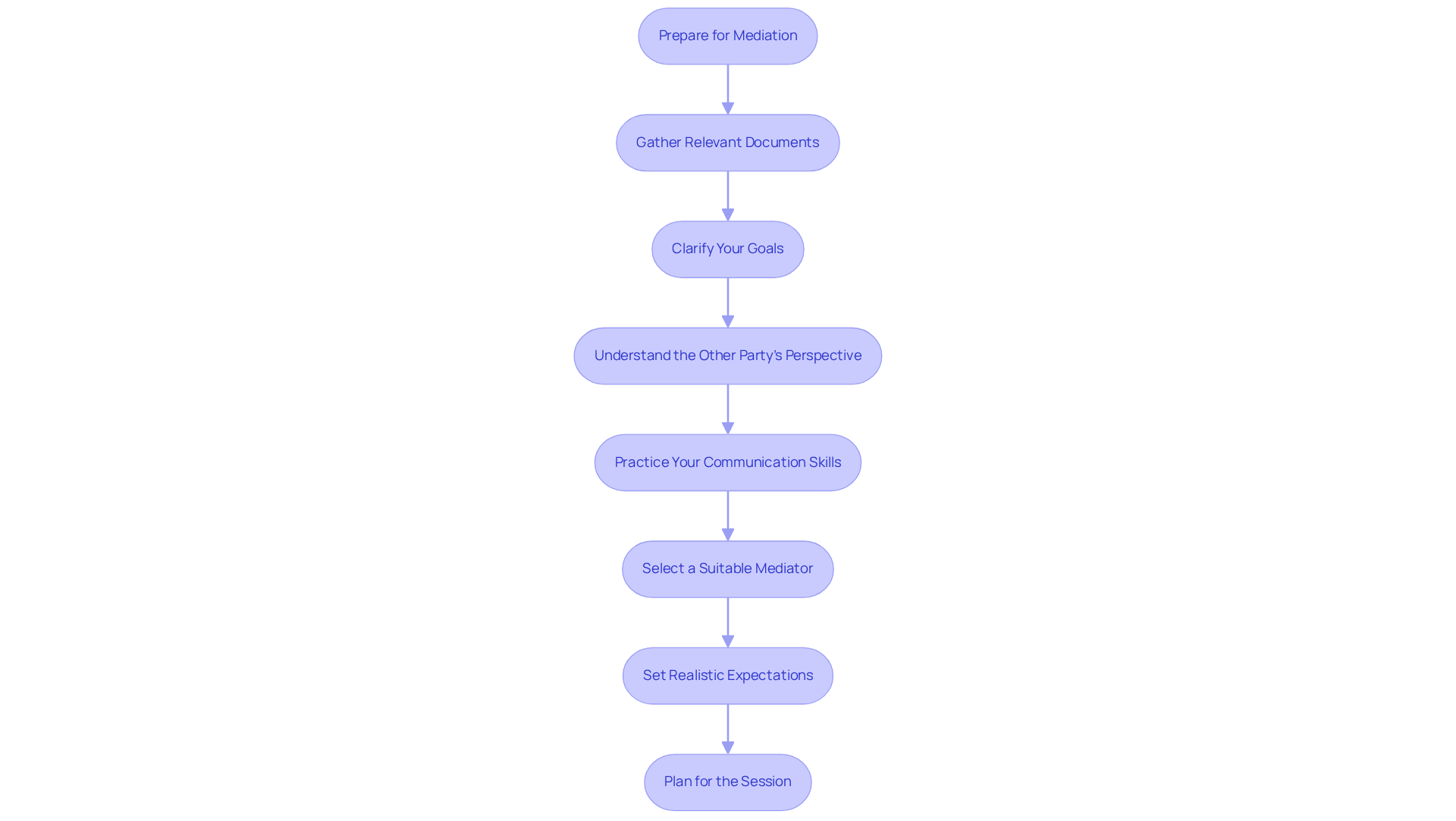

Prepare for Mediation: Essential Steps and Expectations

Preparing for mediation in insurance can feel daunting, but with the right steps, you can navigate this process more effectively. Here are some essential steps to consider:

-

Gather Relevant Documents: Start by compiling all the necessary information. This includes your insurance policies, claim forms, correspondence, and any supporting evidence that can strengthen your position. Having everything organized can help you feel more confident.

-

Clarify Your Goals: Take a moment to think about what you truly want to achieve through mediation. Clearly defining your desired outcomes and any concessions you might be willing to consider can guide your discussions.

-

Understand the Other Party's Perspective: It’s important to anticipate the concerns and interests of the opposing party. By gaining insight into their viewpoint, you can enhance your negotiation strategy and foster a more collaborative atmosphere.

-

Practice Your Communication Skills: Prepare to express your thoughts clearly and respectfully. Engaging in active listening will also be beneficial during the negotiation session, as it shows that you value the other party's input.

-

Select a Suitable Mediator: Choosing a mediator who is experienced in insurance disputes can significantly facilitate the process. Their expertise can help create a more balanced and productive environment.

-

Set Realistic Expectations: Remember, negotiation is a discussion process. While it can lead to a resolution, it may not fulfill all your desires. Being open to compromise can pave the way for a more amicable outcome.

-

Plan for the Session: Familiarize yourself with the logistics of the mediation session, such as the time, location, and format (in-person or virtual). Arriving prepared and on time not only sets a positive tone but also shows your commitment to the process.

By following these steps, you can approach mediation with a sense of preparedness and confidence. Remember, you are not alone in this process, and taking these actions can lead to a more favorable resolution.

Conclusion

Mediation in insurance is not just a process; it’s a vital tool for resolving conflicts with compassion and understanding. By prioritizing collaboration over adversarial tactics, mediation helps navigate the complexities of insurance claims while nurturing relationships and fostering a sense of partnership among all parties involved. When individuals choose mediation, they often find themselves on a path toward greater ease and satisfaction, leading to outcomes that are not only favorable but also fulfilling.

As we reflect on the various stages of mediation—from pre-mediation preparation to the final follow-up—we see how each step is designed to enhance communication and facilitate resolution. The mediator plays a crucial role as a neutral facilitator, guiding the process with care. The benefits of mediation, such as cost-effectiveness, time efficiency, confidentiality, and the empowerment it offers participants in crafting their own solutions, truly showcase its appeal as an alternative to traditional litigation.

Ultimately, embracing mediation in insurance disputes is a proactive choice that can save time, reduce costs, and preserve important relationships. As the complexities of insurance claims continue to evolve, the importance of mediation will only grow. Engaging in this process not only leads to resolution but also fosters a healthier dialogue among all parties. So, why not consider mediation as a pathway to more amicable and satisfying outcomes? Together, we can navigate these challenges with empathy and understanding.

Frequently Asked Questions

What is mediation in insurance?

Mediation in insurance is a process where an impartial third party, known as a mediator, helps individuals in conflict find common ground on issues related to insurance claims or policy disputes.

Why is mediation important in the insurance industry?

Mediation is important in the insurance industry due to the complexity of claims and the high stakes for policyholders. It encourages open communication and often leads to more satisfactory outcomes compared to traditional litigation.

How does mediation benefit those involved in insurance disputes?

Mediation benefits those involved by creating a collaborative environment that resolves conflicts, preserves relationships, and allows for quick resolutions, saving time and money that would otherwise be spent on prolonged arguments.

What atmosphere does mediation create for resolving disputes?

Mediation creates a nurturing space that fosters partnership and understanding, allowing everyone to voice their concerns and interests.

Can mediation lead to better outcomes than litigation?

Yes, mediation often leads to more satisfying outcomes than traditional litigation by promoting open dialogue and collaborative problem-solving.