Overview

Navigating the modification of spousal support can feel daunting. This article serves as a comprehensive guide, offering essential steps, criteria for changes, and negotiation strategies to help you through this process. It’s important to recognize that changes in circumstances can happen to anyone, and documenting these changes is crucial.

Have you considered consulting with legal professionals? Their guidance can provide clarity and assurance as you prepare for potential outcomes. Remember, you are not alone in this journey; many have faced similar challenges and found resolution through proper support.

As you explore the modification process, think about the benefits of mediation and arbitration. These avenues can foster understanding and lead to mutually beneficial agreements. By taking proactive steps and preparing for what lies ahead, you can navigate this transition with confidence.

Ultimately, our goal is to empower you. We encourage you to take action, seek support, and embrace the possibilities that lie ahead. You deserve a resolution that reflects your current circumstances and needs.

Introduction

Navigating the complexities of spousal support modification can feel overwhelming, especially when unexpected financial changes arise. We understand that this journey can be filled with uncertainty and concern. This guide aims to provide a clear roadmap for those looking to adjust their alimony obligations, highlighting the essential steps and considerations that can lead to a successful modification process.

But what happens when the financial landscape shifts dramatically? How can you effectively advocate for your needs while ensuring compliance with varying state laws? It's important to recognize that understanding the nuances of this process is crucial for achieving a fair outcome in your spousal support negotiations. Remember, you are not alone in this; we are here to support you every step of the way.

Understand the Basics of Spousal Support Modification

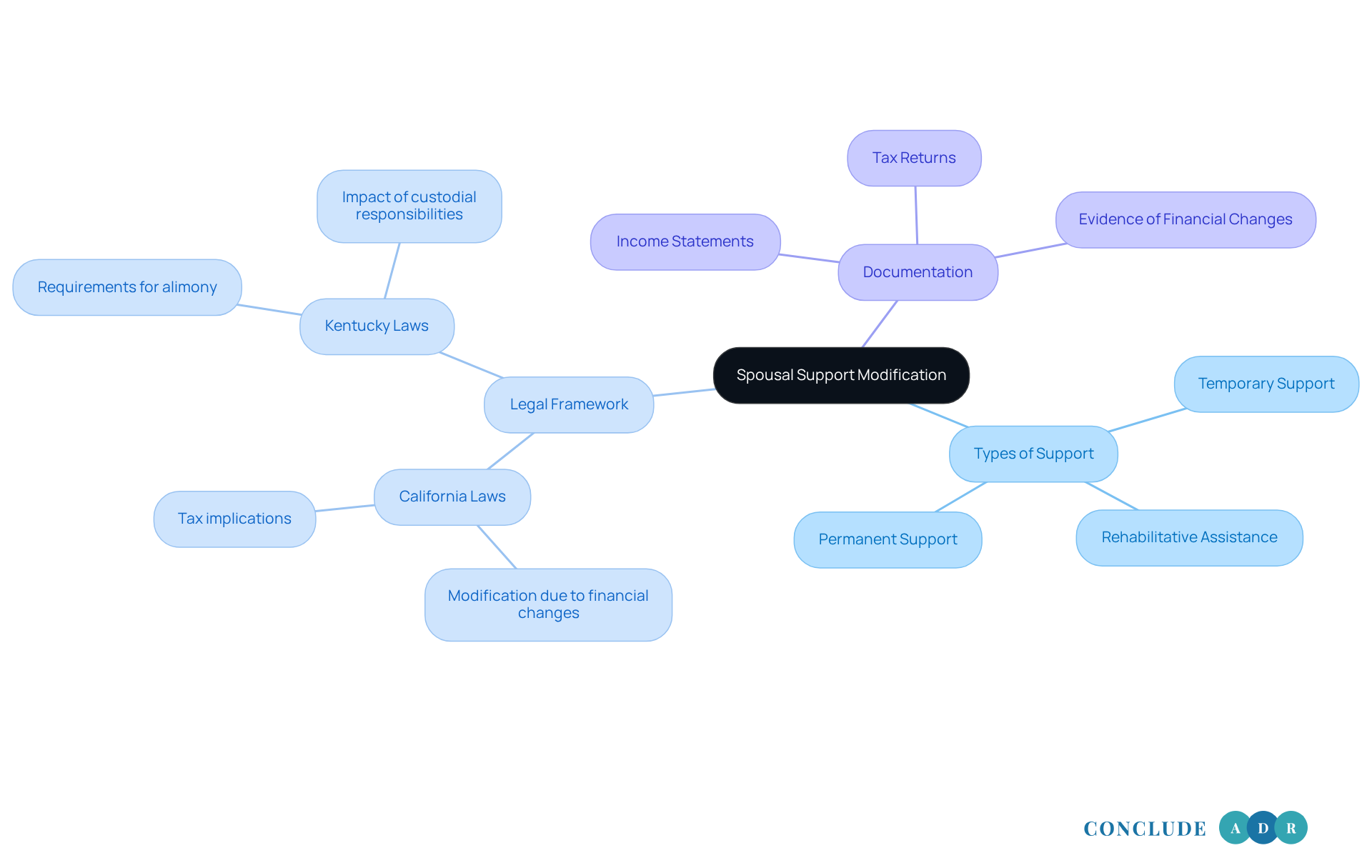

Spousal assistance, often referred to as alimony, is a financial obligation one spouse may have to provide support to the other following separation or divorce. Adjusting marital assistance involves the [modification of spousal support](https://disso.com/modification/spousal-support), which entails legally changing the amount or duration of these payments. This process can be influenced by various factors, including changes in income, job status, or the evolving needs of the recipient partner. Understanding these essential aspects is vital for effectively process.

-

Types of Spousal Support: There are three primary types of spousal support:

- Temporary Support: This short-term assistance is designed to ensure financial stability until the divorce is finalized.

- Rehabilitative Assistance: This aid helps the receiving spouse acquire skills or education to achieve self-sufficiency, typically within a set timeframe.

- Permanent Support: This type continues indefinitely, often relevant in longer marriages, and can be subject to a modification of spousal support based on changing circumstances.

-

Legal Framework: It’s important to understand state laws related to marital assistance, as regulations can vary significantly. For instance, in California, there can be a modification of spousal support due to substantial changes in either party's economic situation or living conditions. In Kentucky, the requesting spouse must demonstrate a lack of sufficient property to qualify for alimony, highlighting the differing requirements across states.

-

Documentation: Gathering relevant financial documents is crucial to strengthen your case. This includes income statements, tax returns, and evidence of any changes in financial circumstances. Additionally, understanding the tax implications of partner assistance payments is important, as these payments are considered taxable income for the recipient and deductible for the payer on state tax filings.

By grasping these fundamental aspects, you will feel more prepared to evaluate your situation and identify the appropriate steps in the partner assistance adjustment process. Moreover, consulting with experienced family law attorneys can offer valuable insights and guidance tailored to your unique circumstances.

Identify Criteria for Material Change in Circumstances

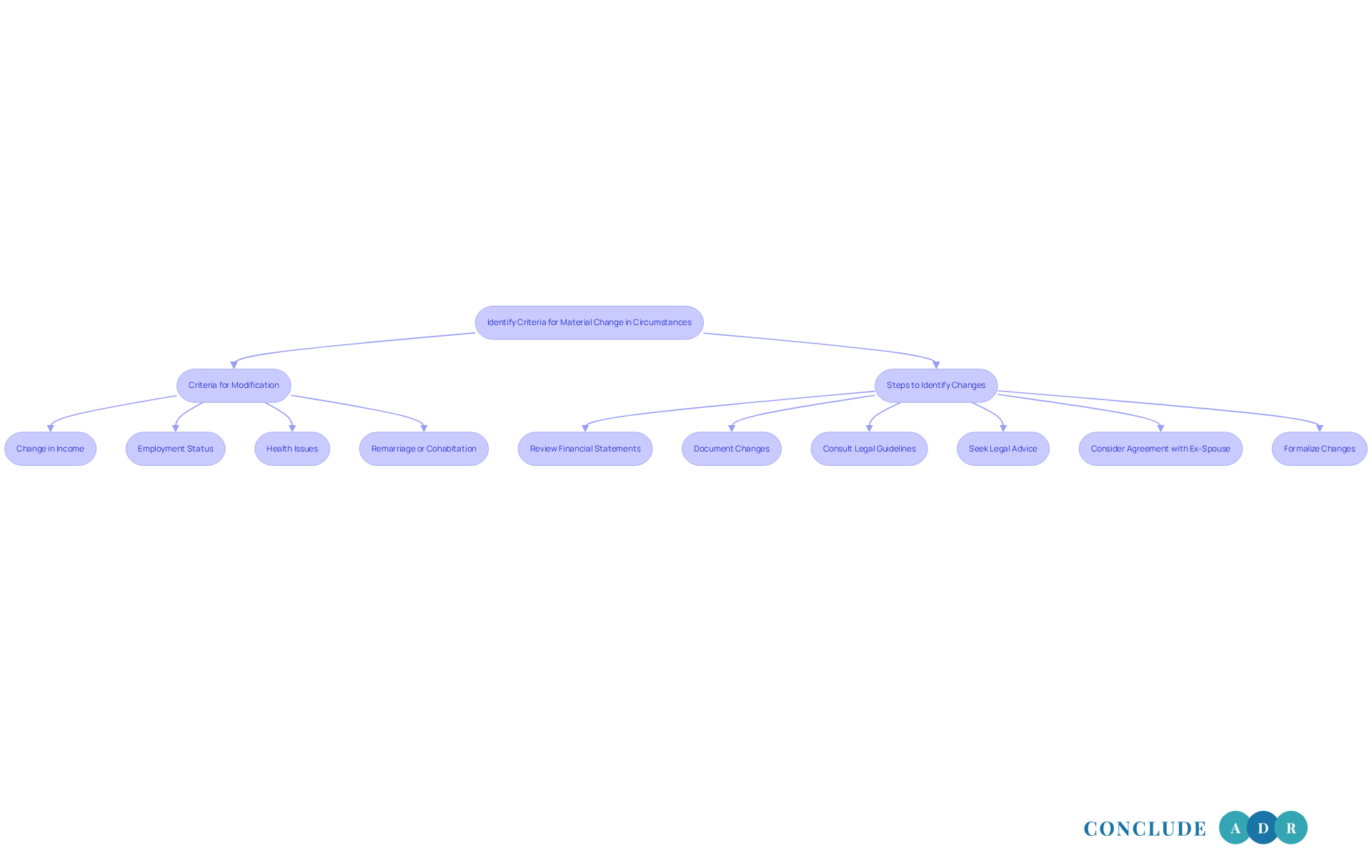

To successfully implement a modification of spousal support, it is essential to demonstrate a material change in circumstances. Understanding your situation can be overwhelming, but recognizing common criteria that can justify a modification may bring some clarity:

- Change in Income: A significant increase or decrease in either party's income can warrant a reassessment of support obligations. For instance, if the contributing partner faces a job loss or a significant reduction in salary, this economic difficulty may act as a legitimate reason for adjustment.

- Employment Status: Changes in employment, such as job loss, promotions, or career shifts, can significantly affect economic stability and may require a modification of spousal support. Have you experienced any shifts in your job situation?

- Health Issues: Medical conditions impacting either spouse's earning potential or economic needs can warrant a modification of spousal support. For example, if the paying partner becomes severely ill or incapacitated, it might diminish their capacity to fulfill financial responsibilities. How might health changes affect your financial landscape?

- Remarriage or Cohabitation: The monetary requirements of the receiving spouse may change if they enter a new relationship. While remarriage usually ends financial assistance, it is important to note that a modification of spousal support is not always the case; living together may lead to a decrease in payments instead of an automatic termination.

Steps to Identify Changes:

- Review Financial Statements: Comparing current income and expenses with previous statements can highlight any significant shifts. Have you taken the time to look over your financial documents recently?

- Document Changes: Maintain thorough records of any life changes that impact financial circumstances, such as job loss or health issues. Keeping track can empower you in this process.

- Consult Legal Guidelines: Researching state-specific laws regarding material changes can ensure compliance and strengthen your case. Knowledge is a powerful tool.

- Seek Legal Advice: Consulting a lawyer can safeguard your rights and responsibilities as situations evolve, ensuring that you navigate the complexities of spousal support adjustments effectively. You don’t have to face this alone.

- Consider Agreement with Ex-Spouse: If possible, reaching an agreement on changes with your ex-spouse can simplify the process. Open communication can often lead to mutual understanding.

- Formalize Changes: Remember that failing to formalize the alteration with the court can lead to legal vulnerabilities. Taking this step is crucial for your protection.

By clearly identifying these criteria and gathering supporting documents, you can build a compelling argument for the modification of spousal support from your partner. You are not alone in this journey; can help you navigate the path ahead.

Initiate the Modification Process: Steps to Follow

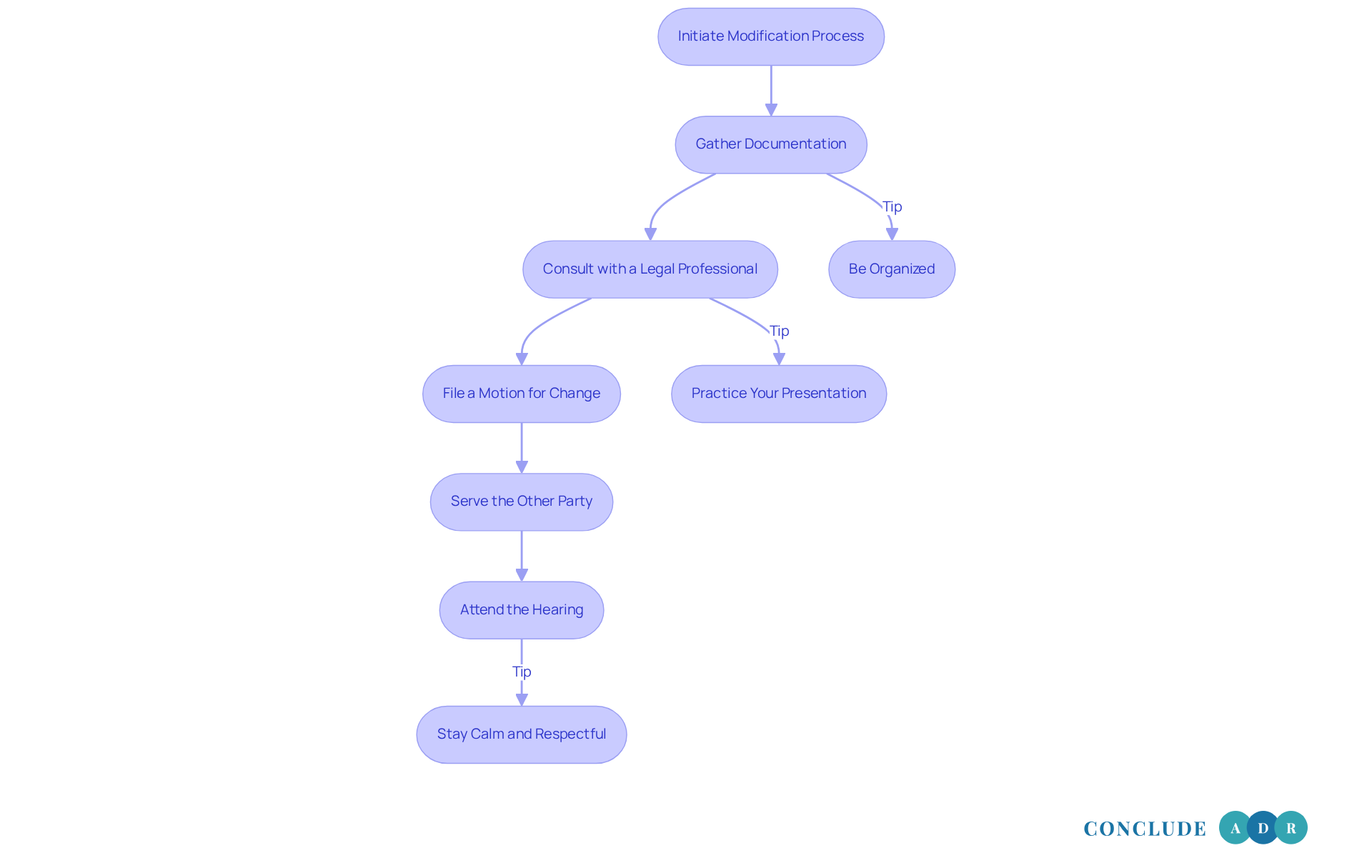

To begin the process of modifying spousal support, it’s important to follow these essential steps with care:

- Gather Documentation: Start by collecting all relevant financial documents, such as income statements, tax returns, pay stubs, bank statements, and expense reports. Thorough documentation is crucial, as courts expect clear evidence of any significant changes in circumstances.

- Consult with a Legal Professional: It’s wise to seek advice from a lawyer who specializes in family law. Understanding your can make a difference. Legal representation can significantly impact the outcome; studies indicate that only 42% of individuals filing for divorce had legal representation, and 61.9% of uncontested divorces lacked legal representation for either party. As family law attorney Cynthia Hernandez wisely states, "With the right guidance, you can approach this process with confidence, clarity, and the best chance of a favorable outcome."

- File a Motion for Change: Prepare and submit the necessary legal documents to the court, clearly outlining your request for modification. A well-organized motion can facilitate understanding during the hearing.

- Serve the Other Party: Ensure that your spouse is formally notified of the motion. Proper service of process is essential to prevent delays and complications.

- Attend the Hearing: Be ready to present your case in court, providing evidence of the material change in circumstances. Practicing your presentation can help you express your situation effectively.

Tips for Success:

- Be Organized: Keeping all documents and correspondence in order can help streamline the process.

- Practice Your Presentation: Rehearse what you plan to say during the hearing to build confidence.

- Stay Calm and Respectful: Maintaining professionalism throughout the process can positively influence the court's perception.

Important Considerations:

- Timing Matters: Delays in filing for alimony modification can lead to financial strain that cannot be recouped later, so acting promptly is crucial.

- Non-Modification Clauses: Take a moment to review your divorce agreement for any non-modification clauses that may limit your ability to seek changes to alimony.

By following these steps and considerations, you can effectively initiate the change process and advocate for your needs, ensuring that your case is presented clearly and compellingly.

Anticipate Outcomes and Prepare for Negotiation

As you prepare for negotiations regarding spousal support modification, consider the following:

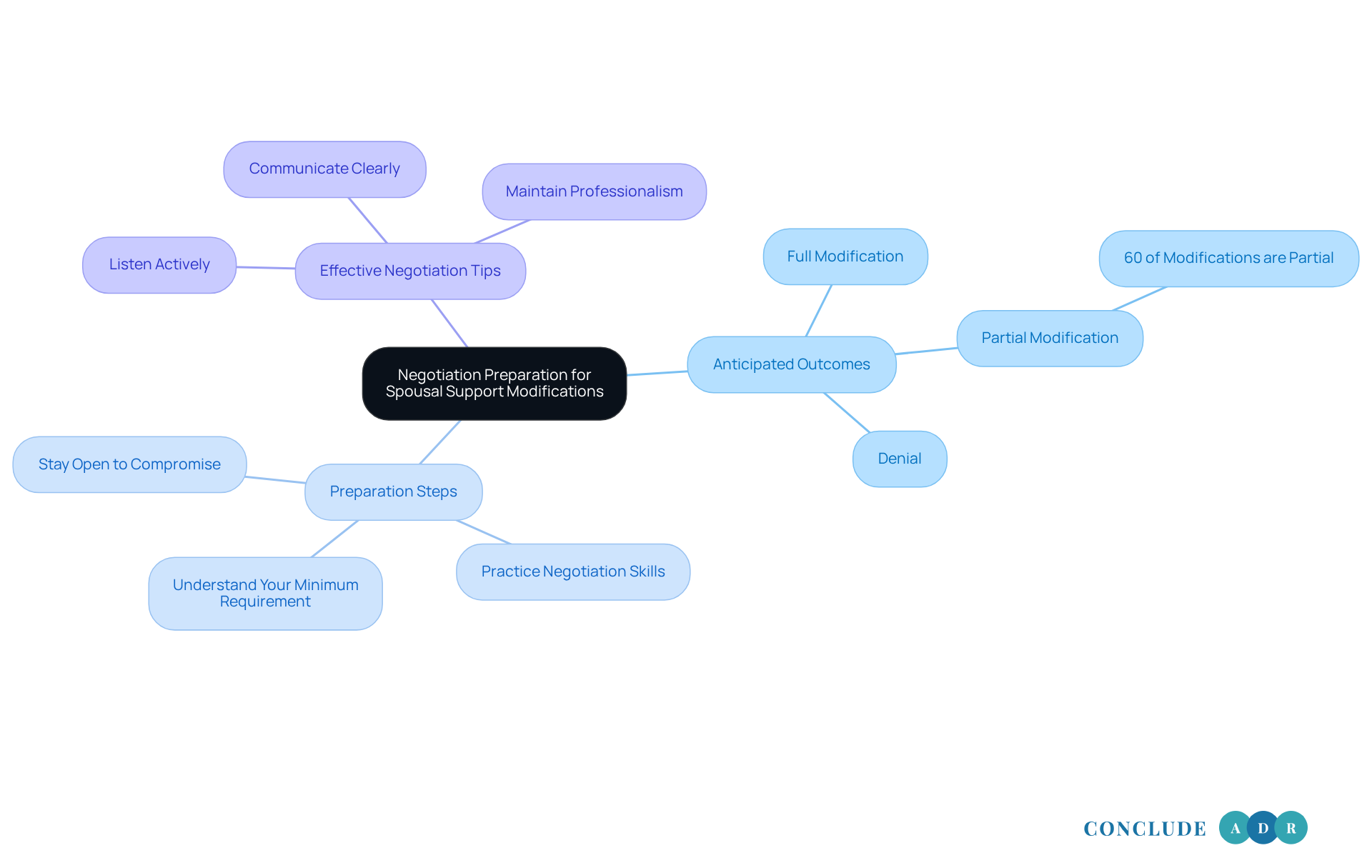

Anticipate Possible Outcomes:

- Full Modification: The court may grant your request for a complete change in support, reflecting a significant shift in circumstances.

- Partial Modification: The court may adjust the assistance amount but not remove it completely, often based on shown economic changes. Did you know that approximately 60% of modifications are partial? This highlights the importance of .

- Denial: The court may deny the request if insufficient evidence is presented, which emphasizes the importance of thorough documentation.

Preparation Steps:

- Understand Your Minimum Requirement: Identify the least amount you can accept, ensuring you have a clear monetary baseline.

- Practice Negotiation Skills: Role-play potential negotiation scenarios with a trusted friend or advisor to build confidence and refine your approach.

- Stay Open to Compromise: Be willing to consider alternative solutions that may satisfy both parties. Flexibility can lead to more amicable outcomes.

Effective Negotiation Tips:

- Listen Actively: Pay attention to the other party's concerns and needs. This fosters a collaborative atmosphere.

- Communicate Clearly: Articulate your position and rationale effectively, ensuring your points are understood.

- Maintain Professionalism: Keeping emotions in check can foster a constructive dialogue. Emotional control can significantly impact negotiation success.

Incorporating insights from family law mediators can be incredibly beneficial. For instance, a mediator from Conclude ADR might suggest, "Understanding the full financial picture is essential when negotiating spousal support." By anticipating outcomes and preparing strategically, you can approach the modification of spousal support with confidence. This enhances your chances of achieving a favorable resolution. Recent court rulings indicate that modifications are often granted partially, underscoring the importance of presenting a well-supported case. Successful negotiation strategies include leveraging mediation services from Conclude ADR to clarify legal points and maintain respectful discussions. This approach can lead to mutually beneficial agreements without court intervention. Additionally, Conclude ADR offers flexible scheduling options, accommodating your needs and ensuring timely access to mediation services.

Conclusion

Navigating the modification of spousal support can feel overwhelming, especially during significant financial changes. It’s crucial to understand the types of spousal support, the legal framework for modifications, and the documentation needed to advocate for a fair adjustment. This guide has outlined the criteria for material changes, the steps to initiate the modification process, and effective negotiation strategies, empowering you to approach your situation with clarity and confidence.

Key insights include the importance of demonstrating a material change in circumstances, such as shifts in income, employment status, or health issues. Have you considered how thorough documentation and legal consultation can impact your modification request? Preparing for potential court outcomes and honing your negotiation skills will further equip you to navigate this often challenging terrain successfully.

Ultimately, understanding the spousal support modification process is not just about financial adjustments; it’s about ensuring fair treatment and stability in the aftermath of personal change. Engaging with legal professionals and proactively documenting changes can pave the way for a smoother modification journey. As your circumstances evolve, remaining informed and prepared will lead to better outcomes, helping you secure the support you need to thrive post-separation or divorce.

Frequently Asked Questions

What is spousal support modification?

Spousal support modification involves legally changing the amount or duration of spousal support payments, which may be influenced by factors such as changes in income, job status, or the evolving needs of the recipient spouse.

What are the types of spousal support?

There are three primary types of spousal support: - Temporary Support: Short-term assistance until the divorce is finalized. - Rehabilitative Assistance: Support to help the receiving spouse acquire skills or education for self-sufficiency, typically within a set timeframe. - Permanent Support: Ongoing support that can continue indefinitely, often relevant in longer marriages, and may be modified based on changing circumstances.

How do state laws affect spousal support modification?

State laws regarding spousal support can vary significantly. For example, in California, spousal support can be modified due to substantial changes in either party's economic situation or living conditions. In Kentucky, the requesting spouse must demonstrate a lack of sufficient property to qualify for alimony.

What documentation is needed for spousal support modification?

Relevant financial documents are crucial for strengthening your case, including income statements, tax returns, and evidence of changes in financial circumstances.

Are spousal support payments taxable?

Yes, spousal support payments are considered taxable income for the recipient and are deductible for the payer on state tax filings.

How can I prepare for the spousal support modification process?

Understanding the fundamental aspects of spousal support and consulting with experienced family law attorneys can provide valuable insights and guidance tailored to your unique circumstances.