Introduction

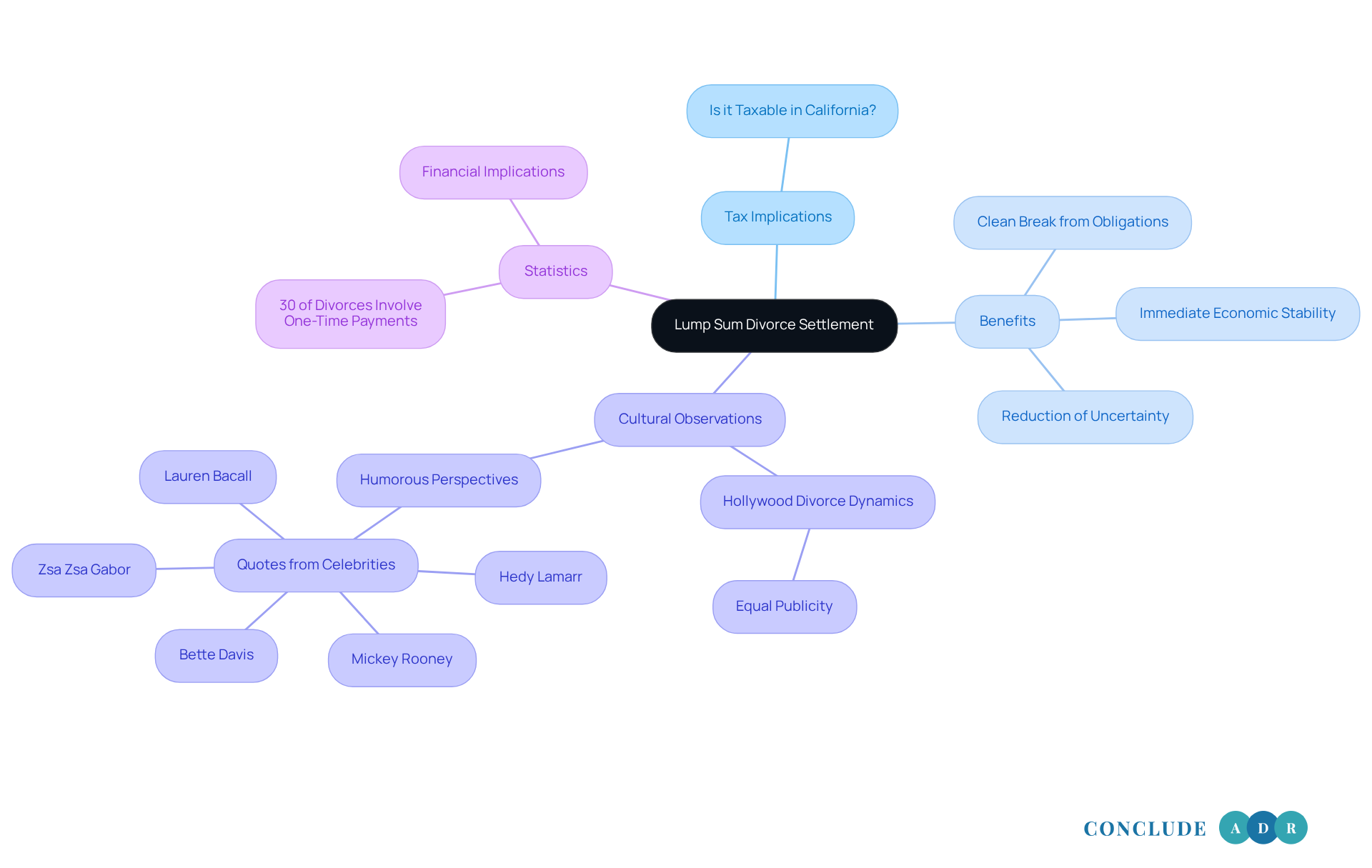

Navigating the complexities of divorce can feel overwhelming, especially when it comes to financial arrangements. A lump sum divorce settlement might just be the solution you’re looking for. It offers a one-time payment that can simplify the process and help avoid ongoing alimony disputes. But here’s the critical question: is a lump sum divorce settlement taxable in California?

Understanding the tax implications of such settlements is essential for both parties. It can help you avoid unexpected financial burdens and ensure a smoother transition into your new life. As you weigh your options, it’s important to consider what factors matter most to you before committing to this approach. What are your priorities? What do you hope to achieve?

Taking the time to reflect on these questions can make a significant difference in your decision-making process. Remember, you’re not alone in this journey, and clarity in your financial decisions is paramount.

Define Lump Sum Divorce Settlement

A single payment divorce arrangement brings up the important consideration of whether a lump sum divorce settlement is taxable in California, providing a comforting option for many couples. The agreement involves a one-time disbursement made by one partner to the other, prompting the question of whether this is a lump sum divorce settlement taxable in California, designed to fulfill all future alimony responsibilities. This arrangement offers a clean break from ongoing monetary obligations, setting it apart from traditional alimony, which is typically paid in installments over time.

By choosing a one-time payment, both parties can benefit from the removal of uncertainty and potential disagreements about continuous payments. Have you ever felt anxious about what the future holds? As family law attorney Jane Doe wisely notes, "A one-time payment can offer both parties reassurance, knowing that monetary responsibilities are resolved in advance."

In California, around 30% of divorces include one-time payments, which raises the question: is a lump sum divorce settlement taxable in California, highlighting their growing popularity. It is important to understand whether a lump sum divorce settlement is taxable in California, as this amount can address various financial needs, such as living expenses, child support, or other obligations stemming from the marriage. It provides immediate economic stability to the recipient, allowing them to breathe a little easier during a challenging time.

Consider this: Lauren Bacall once humorously pointed out that in Hollywood, a fair divorce agreement often means both parties receive equal publicity. This observation underscores the unique dynamics of divorce arrangements in the entertainment sector. Ultimately, this approach not only simplifies financial arrangements but also empowers individuals to move forward with their lives more confidently.

Explore Tax Implications of Lump Sum Settlements in California

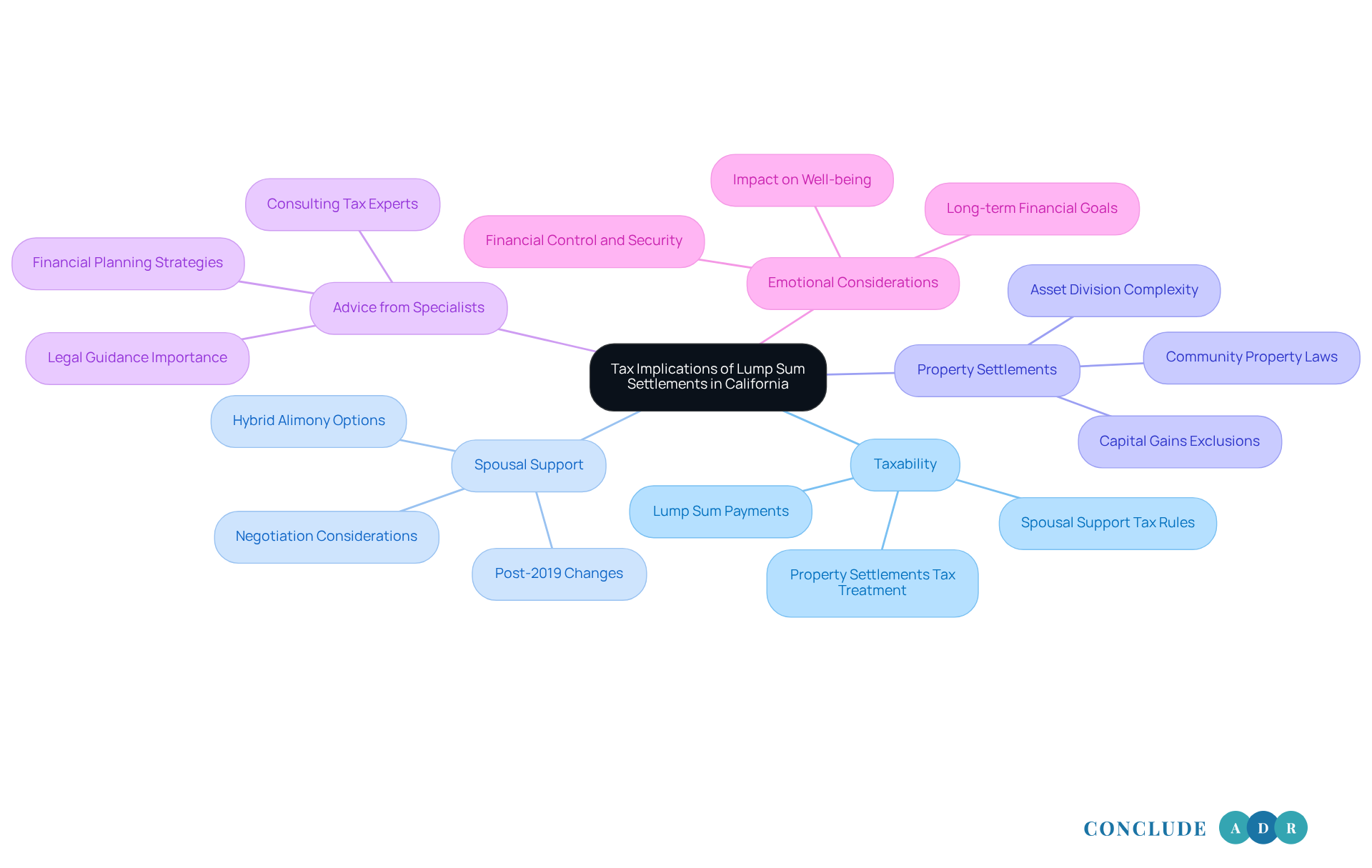

In California, navigating the tax consequences of a single payment divorce agreement raises the question of whether it is a lump sum divorce settlement taxable in California. It's important to understand that typically, one-time payments made as part of a divorce agreement raise the question of whether a lump sum divorce settlement is taxable in California, and these payments aren't considered taxable income for the recipient. This means you won’t have to report that lump sum as income on your tax return.

However, it’s crucial to differentiate between spousal support and property settlements, particularly in understanding if a lump sum divorce settlement is taxable in California, as they can be treated differently when it comes to taxes. For example, spousal support payments made under agreements finalized after January 1, 2019, are not deductible by the payer and are not taxable to the recipient. This aligns with federal tax laws, which also treat alimony payments established after this date as tax-neutral.

It is vital for both parties to understand if a lump sum divorce settlement is taxable in California. It can help you avoid unexpected financial burdens and plan your post-divorce financial strategies effectively. Have you considered seeking advice from a tax specialist before finalizing a one-time payment agreement? This step can significantly assist in reducing your tax obligations.

Exploring options like hybrid alimony might also be beneficial, as it can lessen tax burdens compared to a full one-time divorce payment. Remember, the emotional aspects of monetary decisions in divorce are just as important. They can greatly impact your overall experience and outcomes.

Take a moment to reflect on how these financial decisions affect your emotional well-being. You deserve to navigate this process with clarity and support.

Analyze Context and Considerations for Choosing Lump Sum Settlements

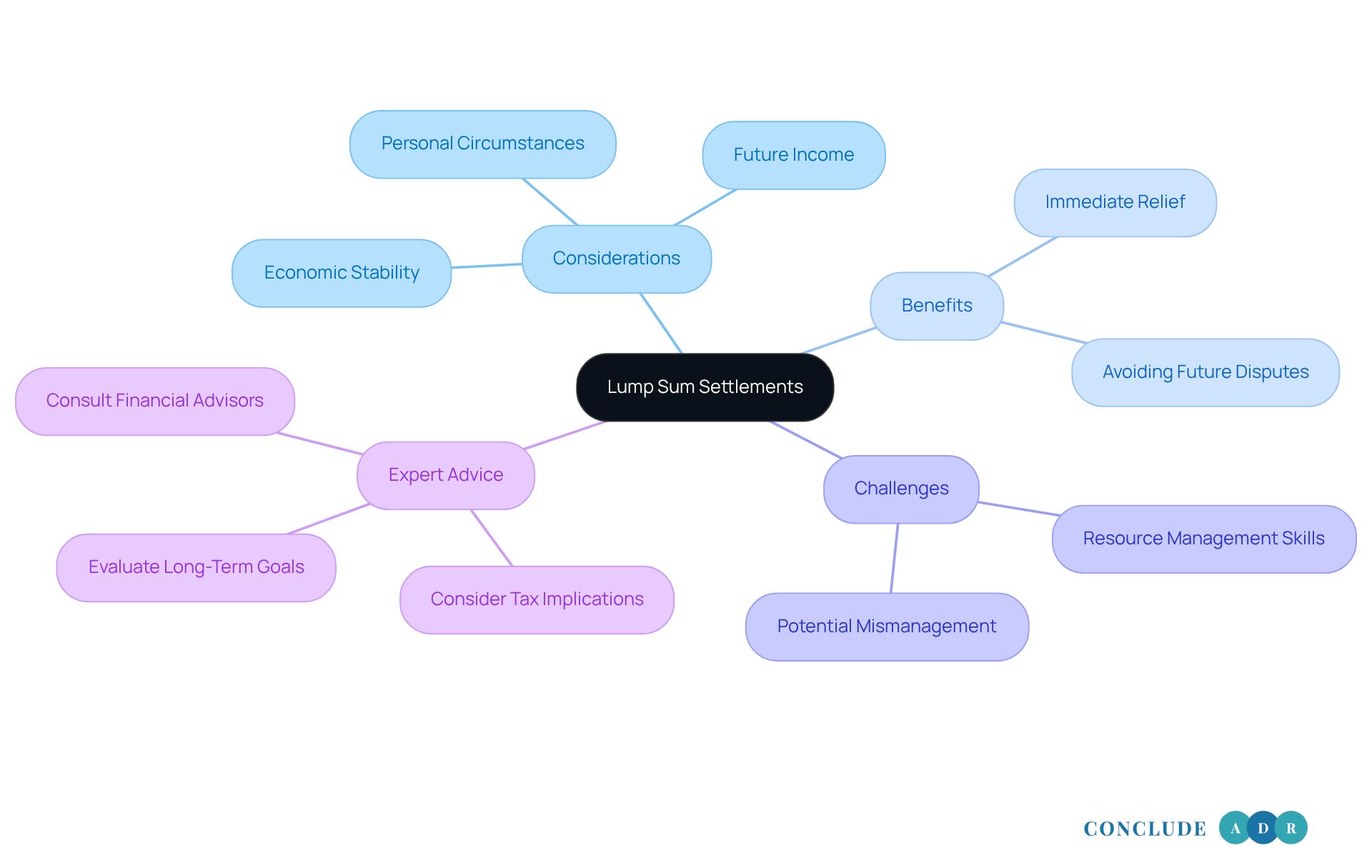

Choosing a one-time divorce agreement can feel overwhelming, and it’s important to consider several factors, like your economic stability, future income possibilities, and personal circumstances. One of the main benefits of a lump sum settlement is that it raises the question of whether it is a lump sum divorce settlement taxable in California, providing immediate relief. Imagine being able to address urgent financial needs right away, without the stress of waiting for monthly payments. This approach can also help avoid future disputes over unpaid alimony, giving both parties a sense of closure.

However, it’s crucial for recipients to have strong resource management skills. A sudden influx of money can be both a blessing and a challenge. Without a solid budget plan, it’s easy to mismanage those funds, which could lead to financial difficulties down the road. Key factors to consider include:

- The duration of the marriage

- The standard of living during that time

- The financial needs of both individuals

All of these elements play a significant role in determining whether a one-time settlement is the right choice for you.

Open communication is vital during this process. Have you considered seeking mediation from experts like Conclude ADR? Their experienced mediators and arbitrators have decades of expertise in alternative dispute resolution, ensuring that you receive fair and effective outcomes tailored to your unique needs. With flexible scheduling and a streamlined booking process, accessing their services is easier than ever.

Expert opinions suggest that a one-time payment can provide you with economic independence and control over your investments. This allows you to align your financial decisions with your personal goals and risk tolerance. Plus, with thorough planning, the benefits of a one-time payment can be maximized, potentially leading to greater economic growth compared to smaller monthly disbursements.

Ultimately, your decision should reflect your personal financial needs and emotional well-being, especially considering if a lump sum divorce settlement is taxable in California. Collaborating with financial advisors and resolution experts can help you navigate these complexities effectively. Remember, you’re not alone in this journey; support is available to help you make the best choice for your future.

Review Real-World Examples of Lump Sum Divorce Settlements

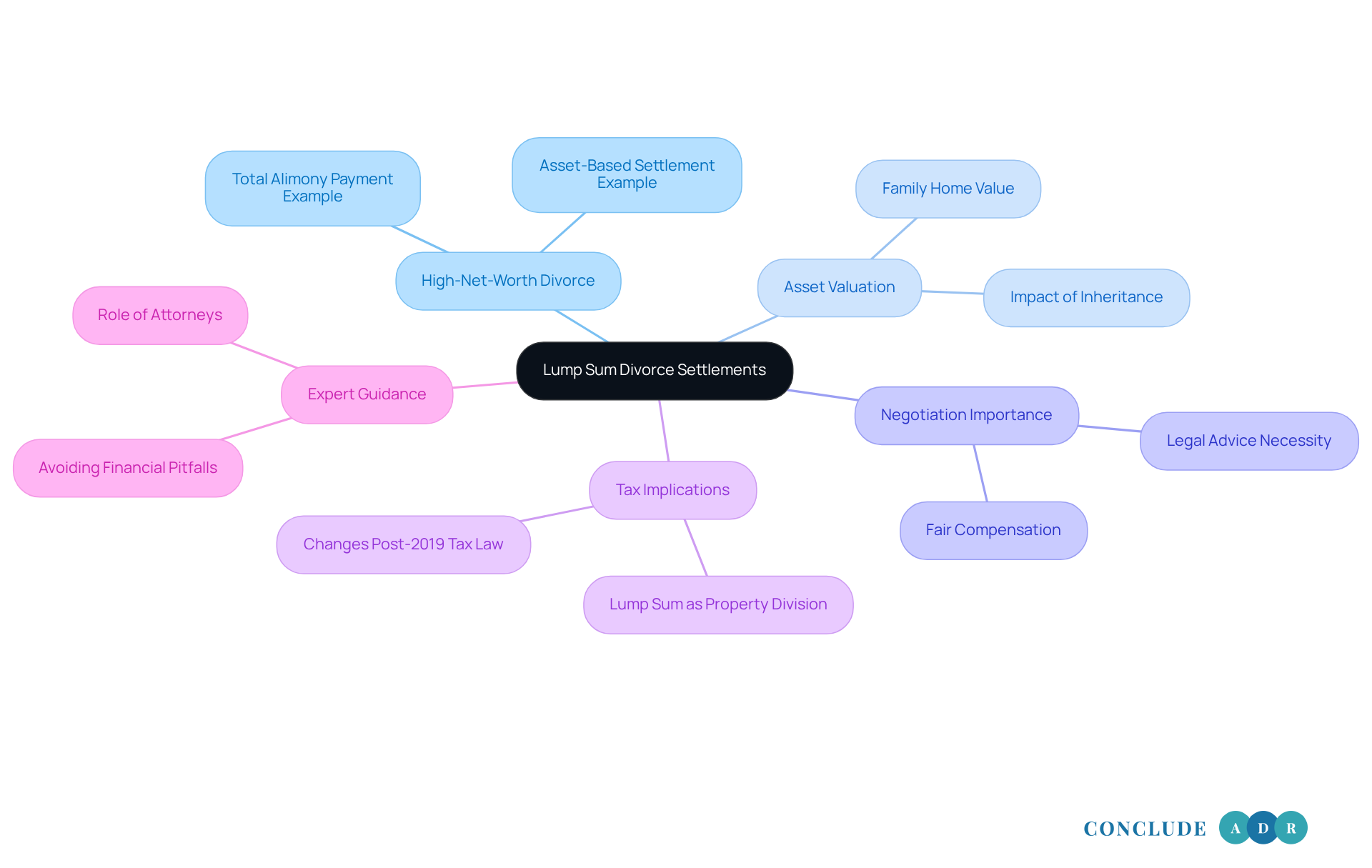

Real-world examples of total divorce settlements show just how varied the outcomes can be and the many factors at play. Have you ever thought about how a high-net-worth divorce might unfold? In such cases, one partner might agree to pay a total of $1 million to the other, settling all alimony responsibilities. This allows the recipient to invest those funds for future financial stability.

In another scenario, a couple might decide on a one-time payment that reflects the value of shared assets, like their family home. This way, both parties can receive fair compensation without the hassle of ongoing financial interactions. Doesn’t that sound like a more straightforward approach?

These examples highlight how one-time payments can bring clarity and resolution to divorce processes, allowing both individuals to move forward without lingering financial obligations. However, it’s essential to recognize the importance of thorough negotiation and legal advice to ensure that the agreement is fair and beneficial for everyone involved.

As Michael Geller, an attorney licensed by the State Bar of California, wisely points out, "One of the primary advantages of a spousal support buyout is the certainty it provides." It’s also crucial to consider the tax implications of these one-time payments. Typically viewed as a division of property rather than income, they can create a clearer tax situation for the recipient.

Ultimately, navigating the complexities of divorce settlements involves understanding if a lump sum divorce settlement is taxable in California, which requires careful thought and expert advice. By seeking guidance, you can avoid potential pitfalls and work towards a satisfactory outcome for both parties. Remember, you’re not alone in this journey.

Conclusion

Navigating the complexities of divorce can be overwhelming, but a lump sum divorce settlement offers a unique financial solution that can bring clarity and peace of mind. By choosing a one-time payment, you can alleviate ongoing financial uncertainties and focus on your future. It’s crucial to understand the tax implications of these settlements, especially in California, where they’re typically not considered taxable income for the recipient. This knowledge empowers you to make informed decisions that truly align with your financial and emotional needs.

As we explore the nature of lump sum settlements, it’s clear they can simplify financial arrangements and provide immediate economic stability. Understanding the difference between spousal support and property settlements is essential, especially with recent changes in tax law that can influence your obligations. Real-world examples show how these settlements can effectively resolve financial matters, allowing both parties to shift their focus toward a brighter future.

Ultimately, choosing a lump sum divorce settlement requires thoughtful consideration of your personal circumstances and financial strategies. Engaging with financial advisors and legal experts can offer valuable guidance, ensuring you navigate this process with confidence. By prioritizing informed decision-making, you can harness the benefits of a lump sum settlement, paving the way for a more secure and fulfilling post-divorce life. Remember, you’re not alone in this journey; support is available to help you every step of the way.

Frequently Asked Questions

What is a lump sum divorce settlement?

A lump sum divorce settlement is a one-time payment made by one partner to the other to fulfill all future alimony responsibilities, providing a clean break from ongoing monetary obligations.

Is a lump sum divorce settlement taxable in California?

The article raises the question of whether a lump sum divorce settlement is taxable in California, but it does not provide a definitive answer. It's important to consult a tax professional for specific tax implications.

What are the benefits of a lump sum divorce settlement?

The benefits include the removal of uncertainty and potential disagreements about ongoing payments, immediate economic stability for the recipient, and the reassurance that monetary responsibilities are resolved in advance.

How common are lump sum divorce settlements in California?

Around 30% of divorces in California include one-time payments, indicating their growing popularity among couples.

What financial needs can a lump sum divorce settlement address?

A lump sum divorce settlement can address various financial needs, such as living expenses, child support, or other obligations stemming from the marriage.

How does a lump sum settlement empower individuals post-divorce?

This approach simplifies financial arrangements, allowing individuals to move forward with their lives more confidently and with less financial uncertainty.