Introduction

Alternative dispute resolution (ADR) is truly reshaping the landscape of debt collection. It offers a range of benefits that traditional litigation simply can’t match. By streamlining processes, reducing costs, and fostering a collaborative environment, ADR presents an appealing alternative for both creditors and debtors.

But amidst these advantages, many of us still grapple with a pressing question: how can ADR transform the often adversarial nature of debt disputes into a more constructive and efficient resolution?

This article delves into the multifaceted benefits of ADR in debt collection. It illuminates how this approach can lead to faster resolutions, significant cost savings, and a more humane way of managing conflicts.

Imagine a scenario where both parties feel heard and valued, rather than pitted against each other. With ADR, we can create a space for understanding and cooperation, paving the way for solutions that benefit everyone involved.

Achieve Faster Resolutions with ADR

One of the most compelling benefits of alternative dispute resolution debt collection is its remarkable speed in addressing conflicts. Have you ever felt overwhelmed by the lengthy court processes that can stretch on for months or even years? Techniques such as negotiation and arbitration within the framework of alternative dispute resolution debt collection can resolve issues in just a few weeks, providing much-needed relief for both creditors eager to recover debts promptly and debtors looking to settle their financial obligations without prolonged stress.

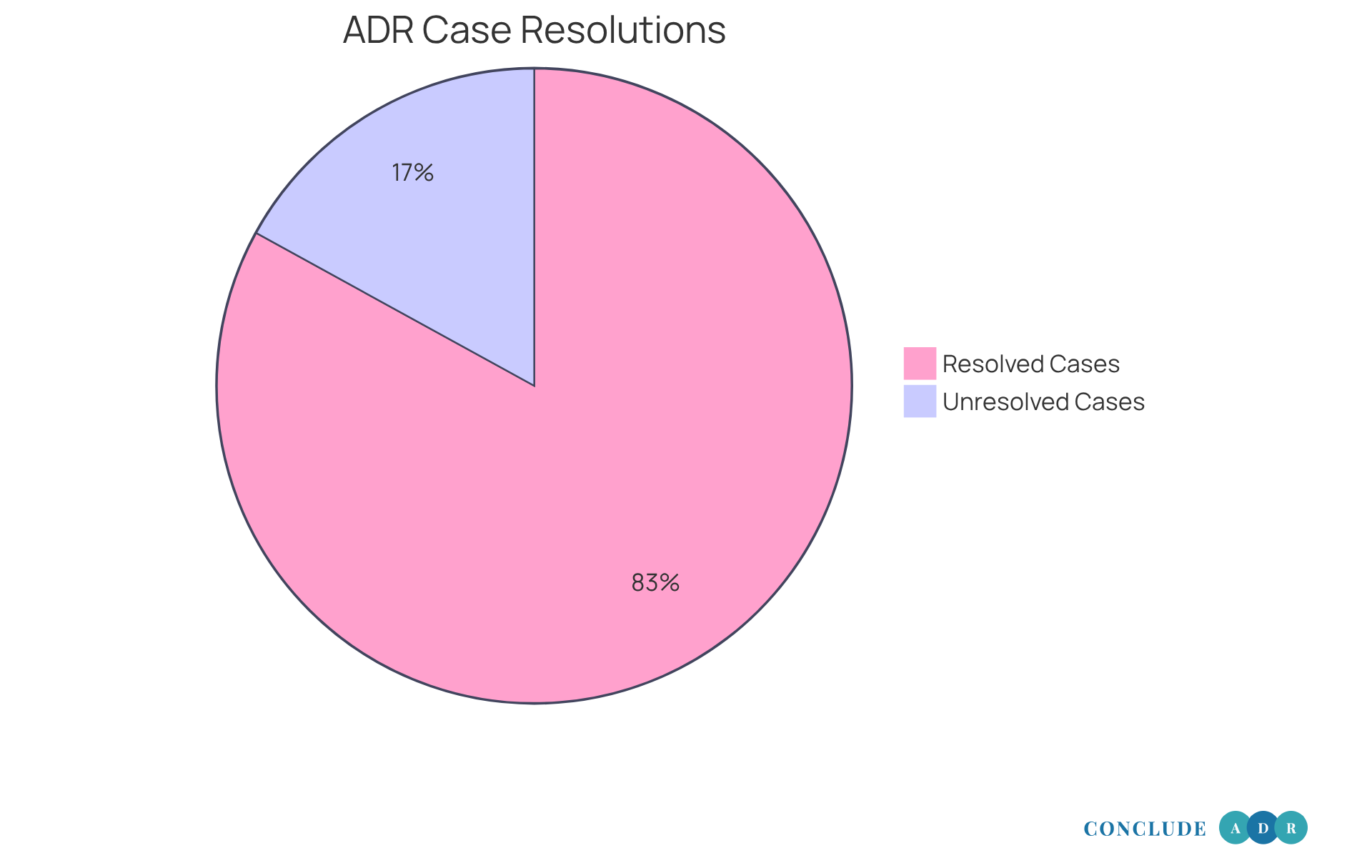

For instance, in 2025, conflict resolution sessions often led to agreements within an average of 125 days, with an impressive 83% of closed cases resolved efficiently. This swift turnaround is not just about numbers; it’s about easing the burden on everyone involved. In fact, 57% of customer claimant cases decided in 2025 resulted in damages awarded, showcasing how effective ADR can be in achieving favorable outcomes.

The flexibility of arranging negotiation sessions - often within days - allows parties to engage in discussions and reach agreements quickly. As conflict resolution specialists wisely point out, "Negotiation can break even the toughest challenges." This highlights that the ability to settle issues swiftly not only alleviates financial strain but also fosters a more amicable agreement process.

With mandatory negotiation anticipated to begin in May 2024, the use of alternative dispute resolution debt collection is becoming an increasingly favored option in debt collection situations. We understand that navigating these challenges can be daunting, but remember, you’re not alone. Together, we can explore these options and find a resolution that works for you.

Reduce Costs through Alternative Dispute Resolution

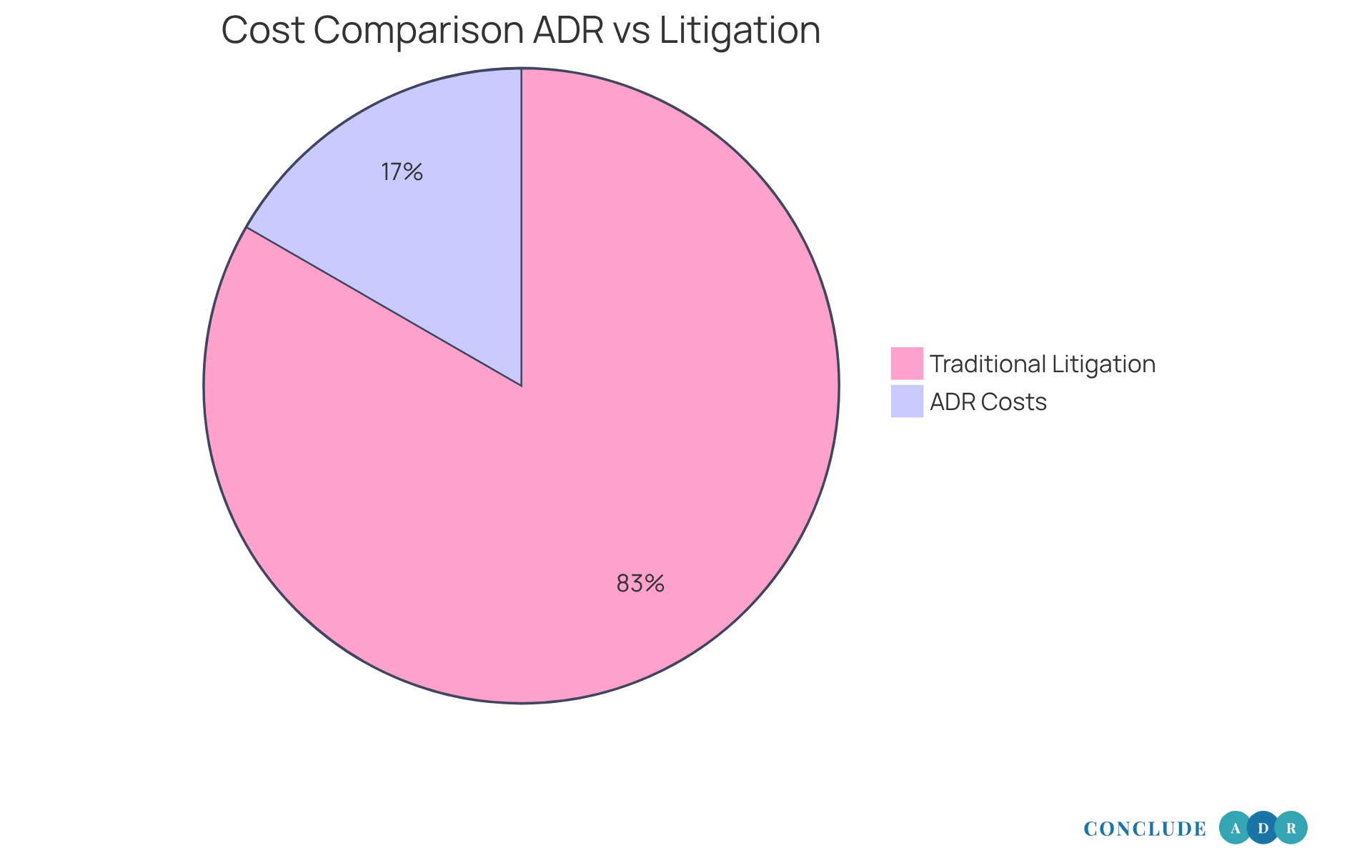

Alternative conflict resolution (ADR) methods can be a much more affordable choice than traditional litigation. Have you ever felt overwhelmed by the mounting costs of court fees, attorney fees, and other legal expenses? These costs can add up quickly, often reaching thousands of dollars. In contrast, ADR processes usually come with lower fees that can be adjusted to fit the financial situations of both parties.

For example, mediation sessions often involve a small fee for the mediator, which is typically shared between the disputing parties. This financial structure not only reduces immediate costs but also helps lower overall legal expenses. It’s a relief for individuals and businesses looking to resolve conflicts without facing significant financial strain.

Moreover, the upfront fees for ADR sessions are generally more predictable and lower than the cumulative costs associated with traditional litigation. Did you know that mediation can lead to a reduction in legal costs by 60% to 80% compared to court proceedings? This makes alternative dispute resolution debt collection particularly appealing in situations of debt recovery.

Additionally, ADR minimizes indirect costs by resolving conflicts within weeks to months. Imagine the peace of mind that comes with a quicker resolution! By choosing alternative dispute resolution debt collection, you’re not just saving money; you’re also selecting a more efficient way to handle disputes.

Maintain Confidentiality in Debt Collection Processes

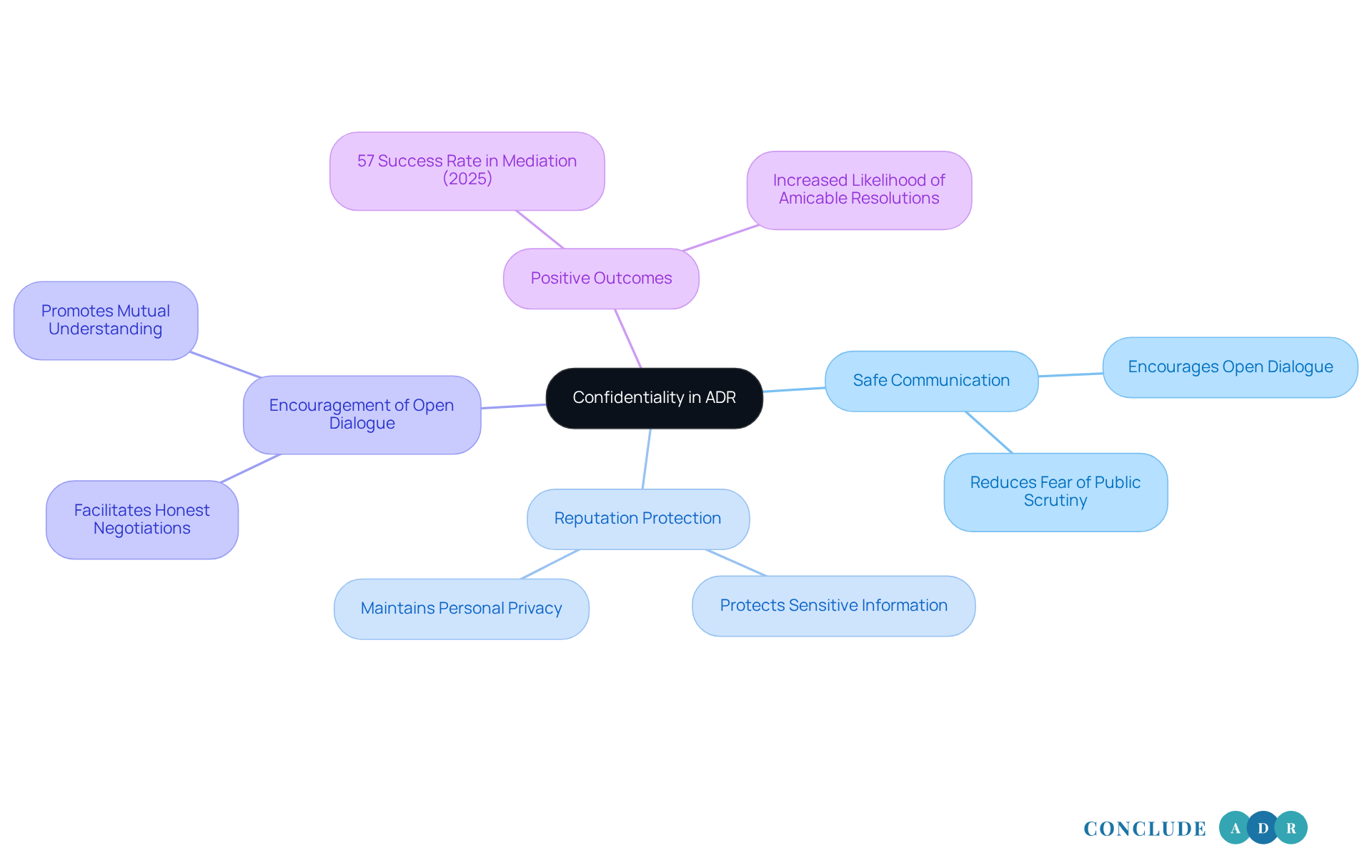

One of the most significant benefits of alternative conflict resolution (ADR) is the confidentiality it provides. Unlike court proceedings, which are public and can expose sensitive financial details, ADR processes take place in private. This confidentiality creates a safe space where parties can communicate openly and negotiate without the fear of public scrutiny or future repercussions.

Have you ever felt hesitant to speak freely because of what others might think? In negotiation, discussions remain confidential, allowing both creditors and debtors to explore potential solutions without the pressure of public opinion. This is especially crucial in the context of alternative dispute resolution debt collection, where maintaining reputations and relationships is paramount.

Legal experts emphasize that privacy during conflict resolution encourages open communication focused on finding mutual understanding. This is essential for settling disagreements peacefully. Statistics show the effectiveness of private mediation; in 2025, 57% of customer claimant cases resulted in damages awarded. This highlights the potential for positive outcomes when conflicts are managed confidentially.

By safeguarding sensitive information, alternative dispute resolution debt collection not only alleviates the stress associated with public litigation but also increases the likelihood of achieving mutually beneficial outcomes. So, if you’re facing a conflict, consider the compassionate approach of ADR - it might just be the solution you need.

Enjoy Flexible Scheduling Options with ADR

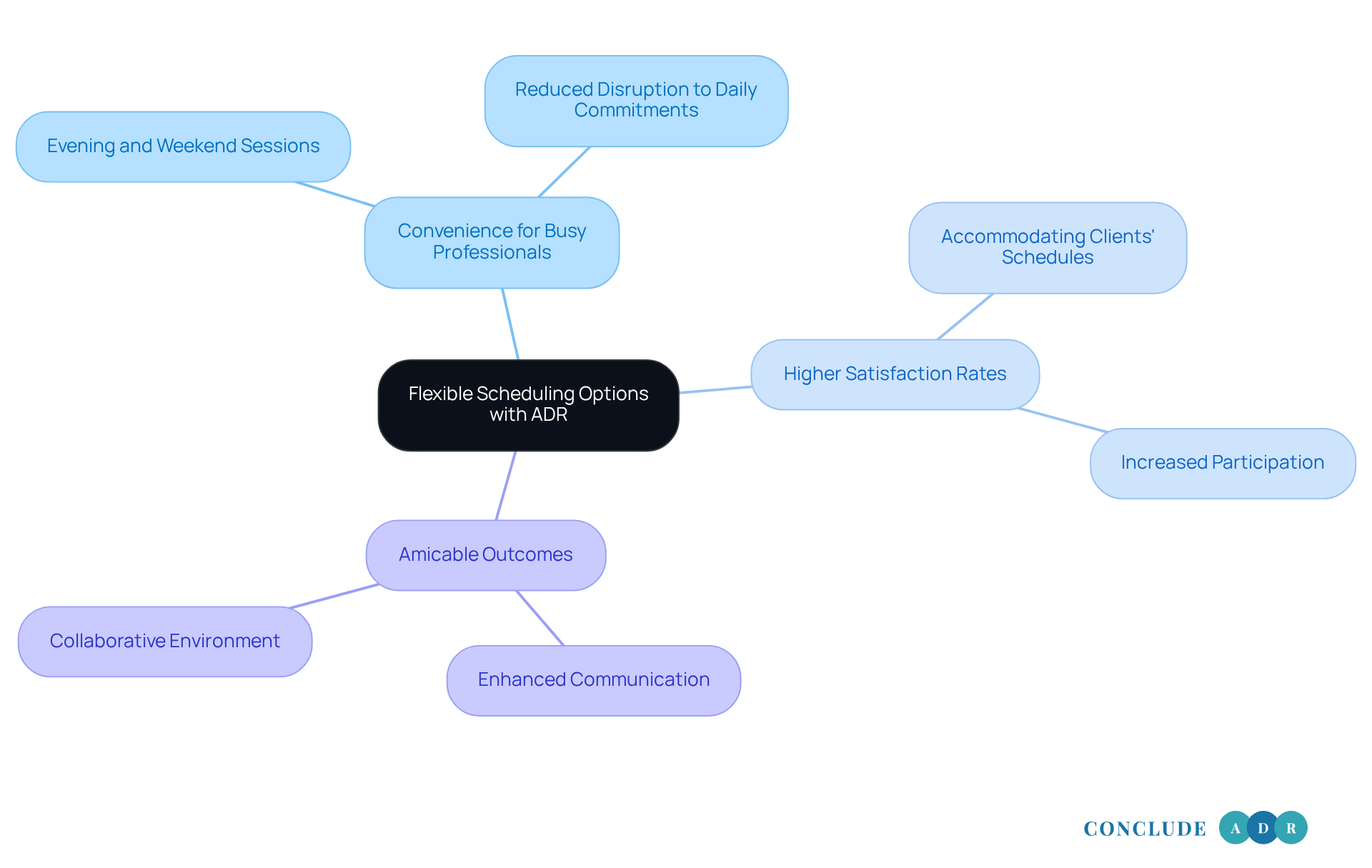

Alternative dispute resolution (ADR) offers remarkable flexibility in scheduling, which can be a breath of fresh air compared to traditional court proceedings. Have you ever felt overwhelmed by the rigid timelines of the court system? With ADR, you can organize negotiation or arbitration sessions at your convenience, even during evenings and weekends. This is especially beneficial for busy professionals like you.

Imagine creditors and debtors agreeing to meet for mediation after regular business hours. This arrangement allows both parties to engage fully without disrupting their daily commitments. It’s a win-win situation! This adaptability not only enhances participation but also fosters a more amicable outcome process.

Statistics show that many individuals prefer flexible scheduling options. ADR practitioners often note that accommodating clients' schedules leads to higher satisfaction rates. By prioritizing convenience, alternative dispute resolution debt collection effectively addresses the challenges faced by those involved in the debt collection process. It ensures that agreements are reached efficiently and amicably.

So, why not consider alternative dispute resolution debt collection for resolving your disputes? It’s designed with your busy life in mind, making it easier for you to find a resolution that works for everyone involved.

Benefit from Neutral Mediators in Dispute Resolution

Neutral mediators play a crucial role in the ADR process. They ensure that discussions remain balanced and focused on finding solutions that work for everyone involved. Have you ever felt unheard in a conversation? A skilled mediator can change that. Their impartiality creates a safe space where both parties feel respected and valued.

Imagine a mediator helping to reframe contentious issues. They guide parties to see each other's perspectives, fostering understanding and collaboration. This neutrality not only boosts the chances of reaching a satisfactory outcome but also helps maintain relationships. This is especially important in situations like alternative dispute resolution debt collection, where ongoing interactions may be necessary.

By choosing mediation, you’re not just seeking resolution; you’re investing in a healthier relationship moving forward. So, why not consider the benefits of having a neutral mediator by your side? Together, we can navigate these challenges with compassion and understanding.

Foster Collaboration and Communication through ADR

ADR offers a compassionate approach to resolving conflicts, allowing everyone involved to engage in open dialogue and work together towards a solution. Have you ever felt overwhelmed by the adversarial nature of litigation, where the focus is often on winning or losing? Unlike that, ADR encourages understanding and cooperation, creating a space where all voices can be heard.

During mediation, for instance, both parties have the opportunity to express their concerns and needs. This can lead to creative solutions that might not even be considered in a courtroom. Imagine the relief of finding common ground and working together to resolve issues! This collaborative spirit not only increases the chances of reaching an agreement through alternative dispute resolution debt collection but also aids in rebuilding trust and rapport between creditors and debtors.

So, why not consider alternative dispute resolution debt collection as a viable option? It’s a nurturing way to address conflicts, fostering a sense of partnership and support. Together, we can navigate these challenges with empathy and understanding.

Receive Tailored Solutions for Complex Debt Issues

One of the standout features of Alternative Dispute Resolution (ADR) is its ability to offer customized solutions that truly meet the specific needs and circumstances of each conflict. Have you ever felt overwhelmed by the rigid nature of court judgments? Unlike those one-size-fits-all approaches, ADR allows you and the other party to craft agreements that reflect your unique situations.

Imagine a scenario where a mediator helps a debtor propose a payment plan that aligns with their financial capabilities while also satisfying the creditor's need for timely repayment. This kind of customization not only enhances the likelihood of compliance with the agreement but also fosters a sense of ownership and commitment from both parties.

Isn't it comforting to know that there’s a way to resolve conflicts that respects your individual circumstances? By choosing alternative dispute resolution debt collection, you’re not just opting for a resolution; you’re embracing a process that values your voice and your needs. Together, let’s explore how ADR can be a nurturing path toward resolution.

Minimize Emotional Stress in Debt Collection

Debt collection conflicts can be emotionally exhausting for both creditors and debtors. Have you ever felt overwhelmed in such situations? It’s completely understandable. Alternative conflict management techniques, especially negotiation, can create a less confrontational atmosphere that significantly reduces stress levels.

The informal nature of negotiation allows everyone to engage in discussions without the pressures of a courtroom. This relaxed setting encourages participants to openly express their feelings and concerns, leading to a deeper understanding of each other's positions. Imagine how much easier it would be to resolve issues when both sides feel heard and valued.

This emotional relief is vital for reaching resolutions that satisfy both parties, enabling them to move forward. Research shows that conflict resolution can reduce stress levels by up to 60% compared to traditional litigation, where the adversarial nature often heightens tensions. Isn’t it comforting to know that there’s a better way?

Additionally, studies indicate that over 90% of participants in the process express high satisfaction. This emphasizes how effective negotiation can be in fostering a collaborative and supportive atmosphere. By prioritizing communication and understanding, conflict resolution not only addresses disagreements but also helps maintain relationships.

So, if you find yourself in a debt collection situation, consider exploring alternative dispute resolution debt collection methods. They can be invaluable tools for creating a more positive outcome for everyone involved.

Access ADR Services Anytime, Anywhere

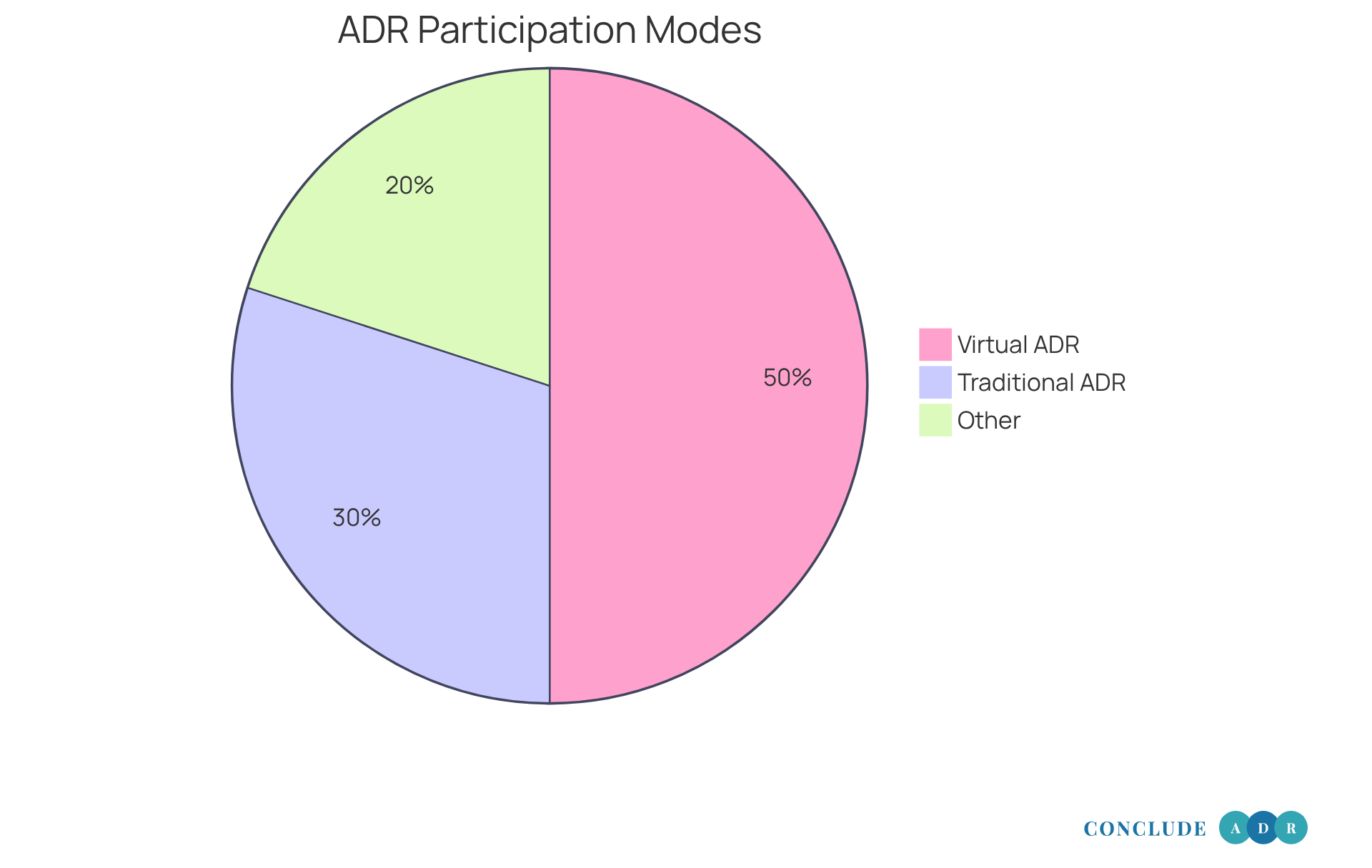

Have you ever felt overwhelmed by the challenges of resolving a conflict? The good news is that technology has truly transformed access to alternative conflict resolution (ADR) services, making them more convenient than ever before. Many ADR providers now offer online resolution and arbitration, allowing you to settle disputes from the comfort of your own home or office.

This accessibility is especially beneficial for those of us with demanding schedules or mobility challenges. Imagine being able to arrange virtual mediation sessions at times that work for everyone involved. This flexibility not only increases participation rates but also simplifies the problem-solving process, leading to quicker outcomes.

Recent statistics show a significant surge in participation in virtual ADR sessions, reflecting a growing preference for these accessible options. As technology continues to advance, it’s reshaping the landscape of alternative dispute resolution debt collection, making this approach a more viable solution for debt conflicts and beyond.

So, why not explore these options? You deserve a resolution that fits your life.

Choose Conclude ADR for Expert-Driven Dispute Resolution

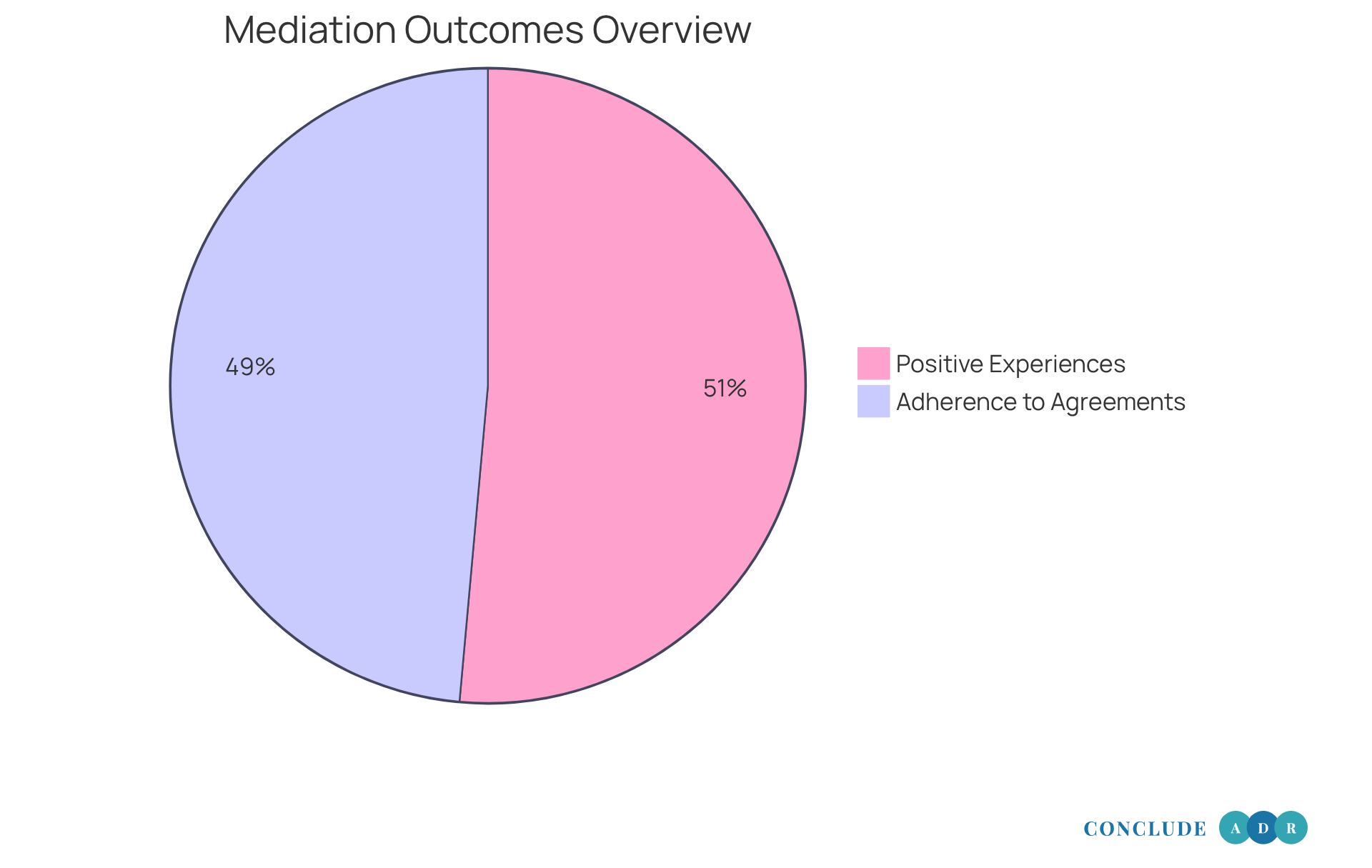

Choosing a trustworthy provider for alternative dispute resolution debt collection is crucial for achieving the best outcomes. Have you ever felt overwhelmed by conflict? Conclude ADR stands out as a leading provider of alternative dispute resolution debt collection and arbitration services, featuring a panel of experienced neutrals who truly understand the nuances of conflict management. This expertise is vital, as industry leaders emphasize that skilled professionals are essential for effectively navigating complex disputes.

At Conclude ADR, we believe in value-based pricing and low fees, ensuring you receive fair and efficient solutions tailored to your unique needs. Imagine having the flexibility to schedule your sessions during evenings or weekends-this accessibility can make all the difference when you're juggling life's demands.

With a focus on practical and lasting solutions, you can expect high satisfaction levels. In fact, over 90% of mediation participants report positive experiences, and voluntary adherence to mediated agreements ranges between 80% and 90%. By choosing Conclude ADR, you benefit from a streamlined process that prioritizes collaboration and effective communication.

So, why wait? If you're seeking expert-driven services for alternative dispute resolution debt collection, Conclude ADR is here to support you every step of the way. Together, we can navigate your challenges and find the resolution you deserve.

Conclusion

The advantages of alternative dispute resolution (ADR) in debt collection are truly profound. It offers a more efficient, cost-effective, and compassionate way to resolve conflicts. By embracing ADR, you can sidestep the lengthy and often stressful court processes, achieving resolutions in a fraction of the time. This method not only alleviates the financial burdens associated with litigation but also fosters a collaborative environment where both creditors and debtors can negotiate in good faith.

Throughout this discussion, we’ve highlighted key insights:

- The speed of resolutions

- Significant cost savings

- The importance of confidentiality

- The flexibility of scheduling that ADR provides

The role of neutral mediators is crucial; their impartiality enhances communication and leads to tailored solutions that meet the unique needs of each party. Furthermore, ADR minimizes emotional stress, creating a supportive atmosphere that encourages open dialogue and understanding.

In a time when conflict resolution can feel overwhelming, ADR stands out as a beacon of hope. Its focus on collaboration, efficiency, and personalized solutions not only benefits individuals facing debt disputes but also contributes to healthier relationships moving forward. As the landscape of debt collection evolves, exploring the options provided by ADR can lead to more positive outcomes for everyone involved.

So, why not embrace the potential of ADR today? Discover a path to resolution that respects your circumstances and promotes lasting agreements. Together, we can navigate these challenges and find a way forward.

Frequently Asked Questions

What is alternative dispute resolution (ADR) in debt collection?

Alternative dispute resolution (ADR) in debt collection refers to methods like negotiation and arbitration that facilitate resolving conflicts outside of traditional court processes, allowing for quicker and more efficient resolutions.

How quickly can conflicts be resolved using ADR?

Conflicts can often be resolved in just a few weeks using ADR techniques. For instance, in 2025, conflict resolution sessions led to agreements in an average of 125 days, with 83% of cases being resolved efficiently.

What are the cost benefits of using ADR compared to traditional litigation?

ADR methods are generally much more affordable than traditional litigation, with costs that can be adjusted to fit the financial situations of both parties. Mediation can lead to a reduction in legal costs by 60% to 80% compared to court proceedings.

How does ADR maintain confidentiality during the dispute resolution process?

ADR processes are private, unlike court proceedings, which are public. This confidentiality allows parties to communicate openly and negotiate without fear of public scrutiny, which is crucial for maintaining reputations and relationships.

What percentage of customer claimant cases resulted in damages awarded through ADR in 2025?

In 2025, 57% of customer claimant cases decided through ADR resulted in damages being awarded, showcasing the effectiveness of these methods in achieving favorable outcomes.

When is mandatory negotiation expected to begin?

Mandatory negotiation is anticipated to begin in May 2024, which is expected to increase the use of alternative dispute resolution in debt collection situations.

What is the main advantage of choosing ADR for debt collection?

The main advantage of choosing ADR for debt collection is that it provides a faster, more cost-effective, and confidential way to resolve disputes, reducing stress for both creditors and debtors.