Overview

Finding a financial mediator nearby can feel overwhelming, but understanding your specific needs is the first step toward resolution. Take a moment to reflect on what you hope to achieve through mediation. Exploring various resources can provide you with options that resonate with your situation.

As you evaluate potential candidates, consider reaching out for interviews and consultations. It’s important to understand the type of dispute you’re facing and the experience of the mediator. Ask yourself: Do you feel comfortable and compatible with them? These are crucial factors that can significantly impact the effectiveness of the mediation process.

Remember, you deserve a mediator who can nurture a supportive environment for your financial negotiations. By taking these steps, you’re not just selecting a mediator; you’re choosing a partner in your journey toward resolution. Don’t hesitate to seek out the help you need—you’re not alone in this process.

Introduction

Navigating financial disputes can feel overwhelming, especially during emotionally charged times like divorce or separation. The process of financial mediation offers a beacon of hope. It provides a structured environment where individuals can collaboratively address their monetary concerns with the guidance of a neutral third party. This approach fosters understanding and can lead to significant cost savings and more amicable resolutions.

However, finding the right financial mediator who aligns with your specific needs and circumstances can be challenging. How can you effectively find someone who understands the intricacies of financial disputes and facilitates a constructive dialogue toward resolution? Consider the importance of a mediator who not only has the expertise but also approaches the situation with empathy and care.

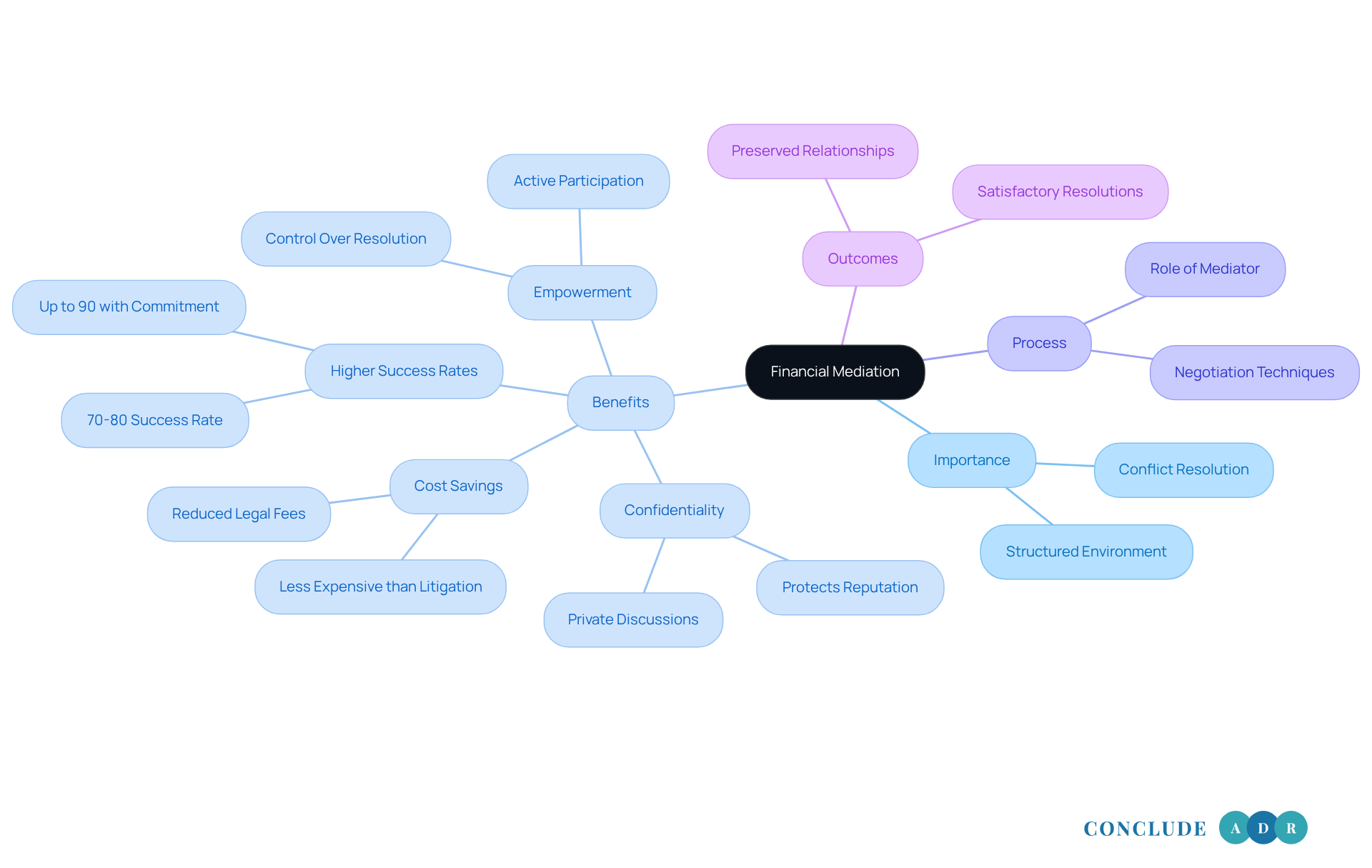

Understand Financial Mediation and Its Importance

Monetary negotiation is a unique form of intervention that focuses on resolving economic conflicts, often arising during divorce or separation. Imagine having a financial mediator near me who serves as a neutral third-party to facilitate discussions between you and your partner, helping you find a mutually acceptable solution for your monetary issues, such as asset division, spousal support, and child support. This process is significant because it provides a structured environment where both sides can openly discuss their financial concerns without the stress of court confrontations. Not only does this save time and money, but it also encourages collaboration and understanding, leading to more satisfactory outcomes for everyone involved.

One of the most heartening aspects of financial negotiation is its potential for significant cost savings compared to litigation. Mediation has demonstrated efficiency in resolving disputes, with success rates ranging from 70% to 80%, and even soaring to 90% when both parties are committed to finding a resolution. A study highlighted that negotiation resolved 78% of the cases analyzed, showcasing its effectiveness. Moreover, monetary negotiation empowers you to take control of the resolution process, allowing you to actively participate in creating the agreement rather than having a judge impose a decision. This sense of empowerment can greatly alleviate stress and foster a more amicable relationship post-dispute, which is especially important when children are involved.

Additionally, confidentiality in negotiation plays a crucial role in handling sensitive monetary matters, allowing you to express your concerns without the fear of public exposure. Understanding monetary negotiation is the first step toward and may lead you to seek a financial mediator near me for achieving fair solutions. Recent trends show a growing acceptance of conflict resolution as a viable alternative to litigation, with many seeking early resolution through this compassionate method. Real-life examples illustrate how monetary mediation has successfully addressed asset division conflicts, enabling parties to reach agreements that reflect their unique situations.

Have you considered how this approach might benefit you? Embracing monetary negotiation could be the key to a more peaceful resolution and a brighter future.

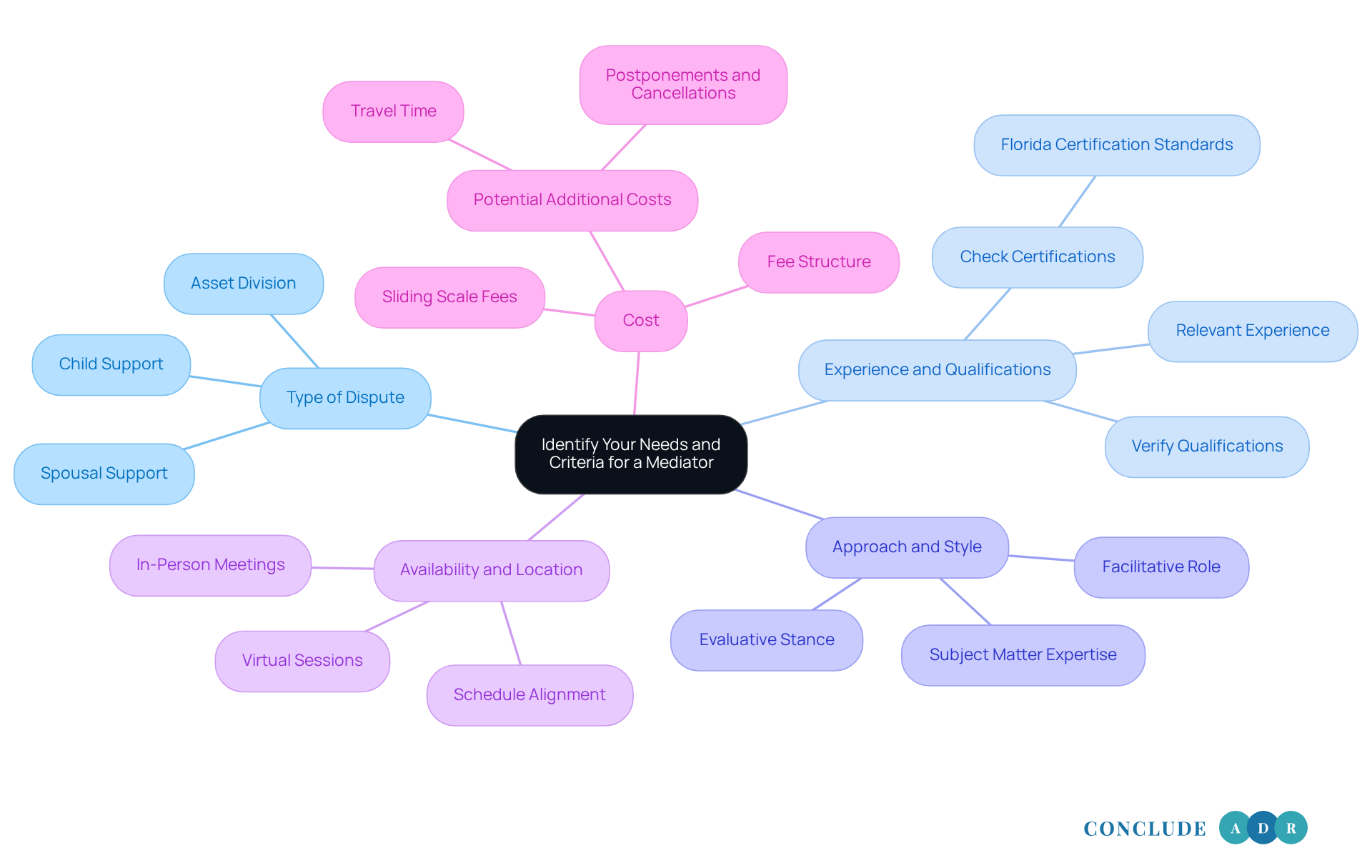

Identify Your Needs and Criteria for a Mediator

Before you embark on your search for a monetary negotiator, it’s important to take a moment to clearly define your unique requirements and standards. This step is crucial as it sets the foundation for a successful resolution. Consider the following factors:

- Type of Dispute: What kind of monetary dispute are you facing? Whether it’s , spousal support, or child support, understanding these specifics will guide you in finding a facilitator with the right expertise.

- Experience and Qualifications: Look for individuals who possess substantial experience in financial negotiation, particularly in situations similar to yours. It’s wise to verify their qualifications, certifications, and any specialized training they may have. As of March 2024, facilitators in Florida are required to meet specific certification standards, which can serve as a helpful benchmark in your assessment.

- Approach and Style: Different mediators employ various styles and approaches. Some may take on a facilitative role, encouraging open dialogue, while others might adopt a more evaluative stance, offering insights into potential outcomes. Reflect on which style resonates with you and would be most effective in your situation. Additionally, consider the intermediary’s subject matter expertise, as this can greatly influence the mediation process.

- Availability and Location: It’s essential to confirm that the mediator you choose is available when you need assistance and is conveniently located for face-to-face meetings, if necessary. Many facilitators also offer virtual sessions, which can enhance accessibility and flexibility. Ensuring that the facilitator's schedule aligns with your needs is vital for a smooth process.

- Cost: Familiarize yourself with the facilitator’s fee structure to ensure it fits within your budget. Some facilitators offer sliding scale fees based on income, which can be particularly beneficial. Additionally, keep in mind that the fees for mediation may vary depending on the combined or joint income of the parties involved.

By clearly outlining your needs and standards, you will be better positioned to find a negotiator who can effectively assist you in resolving your monetary disagreement. Remember, you are not alone in this process; taking these steps can lead you toward a more peaceful resolution.

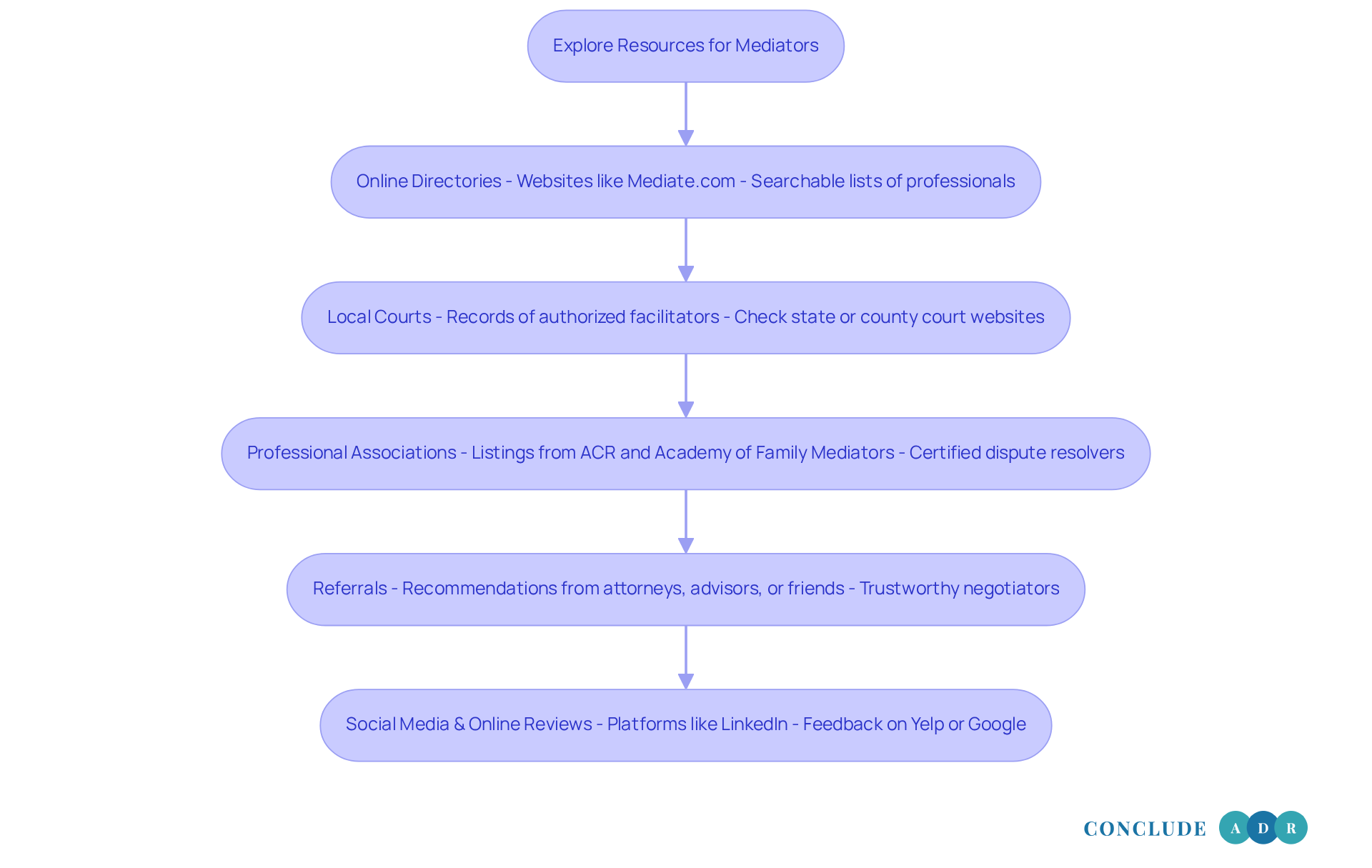

Explore Resources and Platforms to Find Mediators

After recognizing your needs and criteria, the next step is to explore various resources and platforms to discover a financial mediator near me. This journey can feel overwhelming, but there are effective avenues to consider that can ease your path:

- Online Directories: Websites like Mediate.com and the American Arbitration Association (AAA) offer searchable lists of dispute resolution professionals. You can refine results according to location, specialization, and other pertinent criteria, ensuring you find a who truly meets your specific needs.

- Local Courts: Many local courts maintain records of authorized facilitators. It’s wise to check your state or county court's website for resources related to mediation services. These lists often include qualified professionals who understand local laws and practices, providing you with peace of mind.

- Professional Associations: Organizations such as the Association for Conflict Resolution (ACR) and the Academy of Family Mediators provide listings of certified dispute resolvers. Membership in these associations typically requires adherence to rigorous professional standards, offering an extra layer of confidence regarding the facilitator's qualifications and expertise.

- Referrals: Personal recommendations can be invaluable. Consider seeking referrals from trusted sources like attorneys, financial advisors, or friends who have navigated similar disputes. These referrals can direct you to trustworthy negotiators with a proven track record of successful outcomes.

- Social Media and Online Reviews: Platforms like LinkedIn can assist you in finding arbitrators and examining their professional profiles. Additionally, reading feedback on sites like Yelp or Google can provide insights into others' experiences with particular facilitators, helping you make an informed decision.

By utilizing these resources, you can create a list of potential facilitators, such as a financial mediator near me, who align with your criteria and are well-equipped to assist you in your financial negotiation process. Remember, alternative dispute resolution (ADR) emphasizes resolution-focused services, providing expert guidance from qualified facilitators and a streamlined booking process to ensure your mediation experience is efficient and tailored to your needs. Choosing the right facilitator is crucial for fostering constructive dialogue and achieving the outcomes you desire.

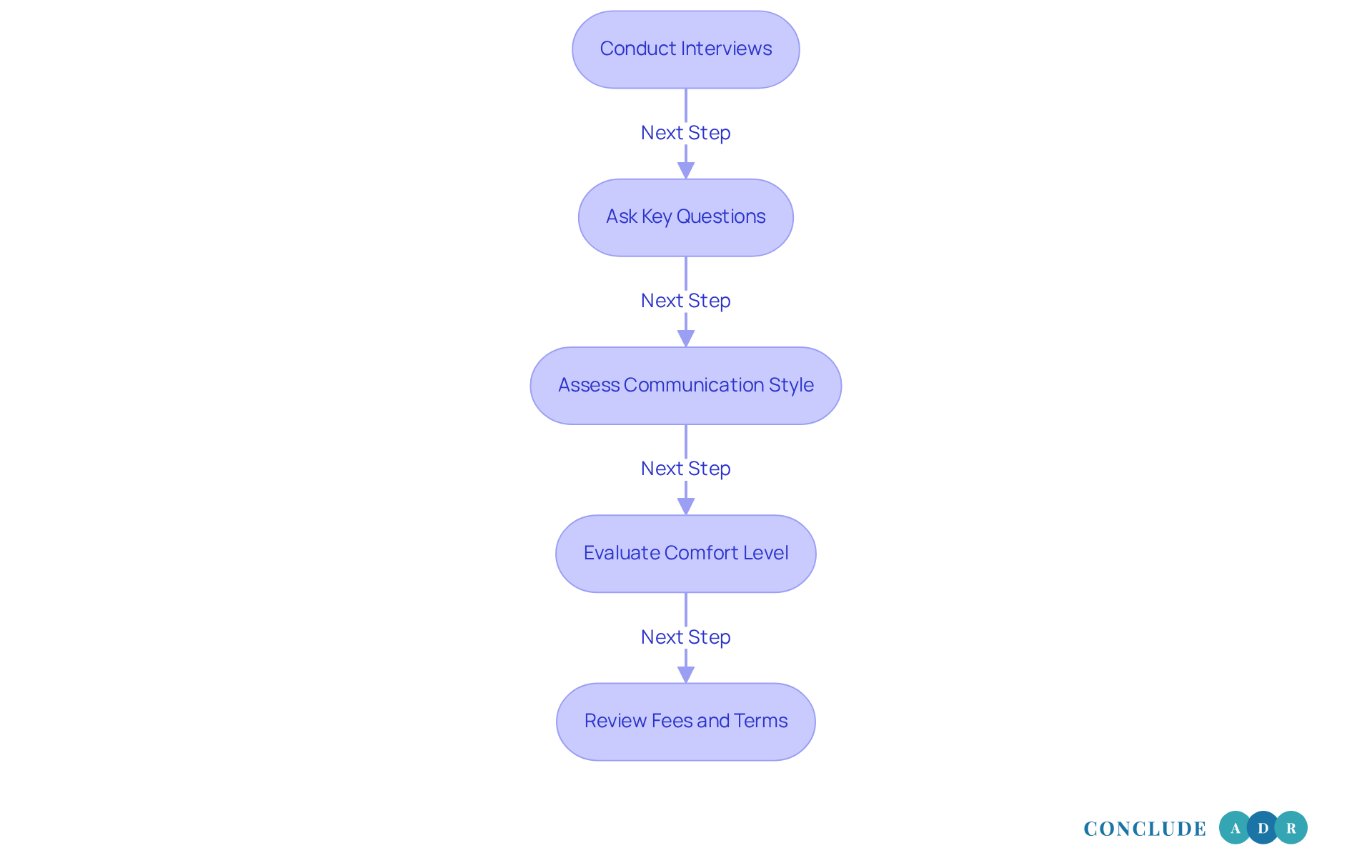

Evaluate and Choose the Right Financial Mediator

After creating a list of possible financial facilitators, the next step is to thoughtfully assess and select the right one for your needs. This process can feel overwhelming, but we're here to guide you through it.

Conduct Interviews: Reach out to your shortlisted facilitators and schedule initial consultations. Many mediators offer free consultations, which can help you gauge their approach and compatibility. This is an important step in ensuring you find someone who resonates with your needs.

Ask Key Questions: During the consultation, inquire about their experience with monetary negotiation, their approach to conflict resolution, and how they handle challenging discussions. Specific questions to consider include:

- What is your experience in handling financial disputes similar to mine?

- How do you facilitate communication between parties?

- Can you provide examples of successful outcomes from past mediations?

These questions can help you feel more secure in your choice.

Assess Communication Style: Pay attention to how the facilitator communicates. An effective negotiator should clarify intricate economic ideas distinctly and encourage open communication between involved parties. Consider asking:

- How do you ensure that all parties understand the financial implications of the discussions?

- What strategies do you use to keep the conversation constructive?

This will help ensure that you feel understood and supported.

Evaluate Comfort Level: It’s essential to feel at ease with your facilitator, as this will influence your willingness to engage in the process. Trust your instincts about whether you during your interactions. Ask yourself:

- Do I feel safe expressing my concerns?

- Is the facilitator attentive to my needs and perspectives?

Your comfort is paramount in this journey.

Review Fees and Terms: Before reaching a final conclusion, ensure you comprehend the facilitator's fee structure and any conditions linked to their services. Transparency in costs is crucial to avoid surprises later on. Key questions include:

- What are your fees, and how are they structured?

- Are there any additional costs I should be aware of?

By thoughtfully assessing possible intermediaries according to these standards, you can choose a fiscal facilitator who is well-prepared to help you manage your monetary conflict efficiently. Remember, the monetary costs of workplace conflict can accumulate to £28.5 billion each year, emphasizing the significance of selecting an effective mediator. As noted by the Ohio State Bar Association, mediation can address various divorce issues, including financial disputes, making it crucial to find the right professional for your needs.

Conclusion

Finding a financial mediator is a crucial step in navigating the complexities of financial disputes, especially during emotionally charged situations like divorce or separation. By utilizing mediation, you can engage in a constructive dialogue facilitated by a neutral party. This leads to resolutions that are not only fair but also tailored to your unique circumstances. This approach fosters understanding and significantly reduces the stress and costs associated with traditional litigation.

This article outlines a clear four-step process to help you identify your needs, explore available resources, and select the right mediator. Consider key factors such as:

- The type of dispute

- The mediator's experience

- Communication style

- Fee structure

These essential considerations can greatly influence the success of the mediation process. By carefully evaluating these criteria, you can ensure that you choose a mediator who is not only qualified but also a good fit for your specific situation.

Ultimately, embracing financial mediation can pave the way for more amicable resolutions and empower you to take control of your financial future. The potential for significant cost savings, coupled with the opportunity to maintain a respectful relationship post-dispute, highlights the importance of this process. Taking the time to find the right financial mediator can lead to a smoother, more positive resolution, making it a worthy investment for anyone facing financial conflict. Remember, you are not alone in this journey, and the right support can make all the difference.

Frequently Asked Questions

What is financial mediation?

Financial mediation is a form of intervention that helps resolve economic conflicts, often during divorce or separation, by facilitating discussions between parties with the help of a neutral third-party mediator.

Why is financial mediation important?

Financial mediation provides a structured environment for open discussions about financial concerns, saving time and money while encouraging collaboration and understanding, leading to satisfactory outcomes without the stress of court confrontations.

What are the success rates of financial mediation?

Financial mediation has success rates ranging from 70% to 80%, and can reach up to 90% when both parties are committed to finding a resolution.

How does financial mediation empower individuals?

It allows individuals to actively participate in creating their own agreements rather than having a judge impose a decision, which can alleviate stress and foster a more amicable relationship post-dispute.

What role does confidentiality play in financial mediation?

Confidentiality is crucial in financial mediation as it allows parties to discuss sensitive monetary matters without the fear of public exposure.

How has the acceptance of financial mediation changed recently?

There is a growing acceptance of conflict resolution through financial mediation as a viable alternative to litigation, with more individuals seeking early resolution through this compassionate method.

Can you provide examples of conflicts resolved through financial mediation?

Real-life examples demonstrate how financial mediation has successfully addressed asset division conflicts, enabling parties to reach agreements tailored to their unique situations.