Introduction

Navigating the maze of financial obligations can feel overwhelming, leaving many of us feeling trapped and anxious. But there’s hope. Enter the debt mediation specialist - your essential ally in the journey toward financial clarity and resolution. These compassionate professionals not only bridge the gap between borrowers and lenders but also create personalized solutions that foster understanding and cooperation.

But what happens when traditional methods just don’t cut it, and the stakes are high? It’s crucial to explore the vital role of debt mediation specialists. They not only aid in financial recovery but also bring unique skills that make them indispensable in today’s complex economic landscape.

Imagine having someone by your side, guiding you through this challenging process. With their support, you can regain control and find a path forward. So, if you’re feeling lost in the financial labyrinth, consider reaching out to a debt mediation specialist. Together, you can navigate these challenges and work toward a brighter financial future.

Defining a Debt Mediation Specialist

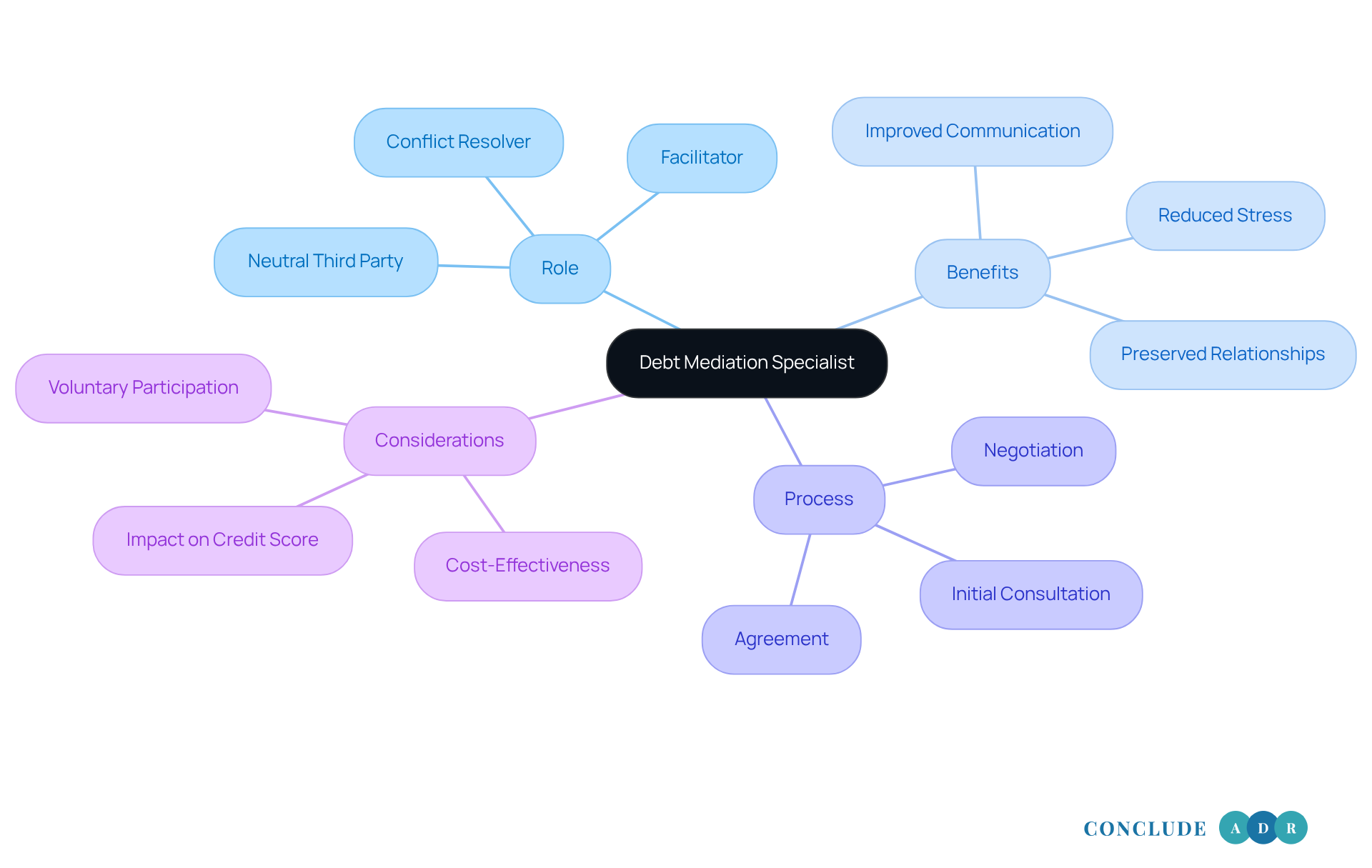

Have you ever felt overwhelmed by financial obligations? A debt mediation specialist can serve as your guiding light in these challenging times. These skilled individuals act as debt mediation specialists, facilitating discussions between borrowers and lenders to help both sides reach resolutions that feel fair and acceptable. Acting as neutral third parties, they foster understanding and cooperation, ensuring that everyone’s voice is heard.

Unlike settlement firms, financial negotiation experts focus solely on promoting communication. They don’t take sides; instead, they work to bridge gaps and find common ground. Their expertise in conflict resolution allows them to navigate the emotional and financial complexities of disputes effectively, making the process less daunting.

The role of these experts is crucial in maintaining professional relationships between creditors and borrowers. Did you know that around 70% of financial disagreements are resolved through negotiation rather than litigation? This approach not only alleviates the stress associated with payment collection but also reduces the risk of default, benefiting everyone involved.

Consider the success stories that highlight the power of financial negotiation. Companies that engage mediators often recover a significant portion of their outstanding amounts while preserving valuable customer relationships. This is vital for long-term goodwill. By tailoring solutions to the unique circumstances of each case, debt mediation specialists can create agreements that are both practical and sustainable, leading to better outcomes than traditional litigation.

As noted by Mediator Debt Solutions, "Mediation is a structured negotiation process where a neutral third party works directly with your creditors to reduce balances, interest, and stress." This statement underscores the organized nature of mediation and its focus on achieving fair resolutions. However, it’s important to remember that while negotiation can be beneficial, it may also impact a debtor's credit score. This balanced perspective helps you understand the process more fully.

If you find yourself in a financial bind, consider reaching out to a financial negotiation expert. They can help you navigate these waters with compassion and understanding, ensuring you feel supported every step of the way.

The Role of Debt Mediation Specialists in Debt Resolution

Debt mediation specialists are essential in assisting borrowers and lenders to find common ground. They understand the emotional weight of debt and work to uncover the root issues that lead to financial struggles. By evaluating the circumstances of both parties, they can suggest solutions that feel fair and achievable.

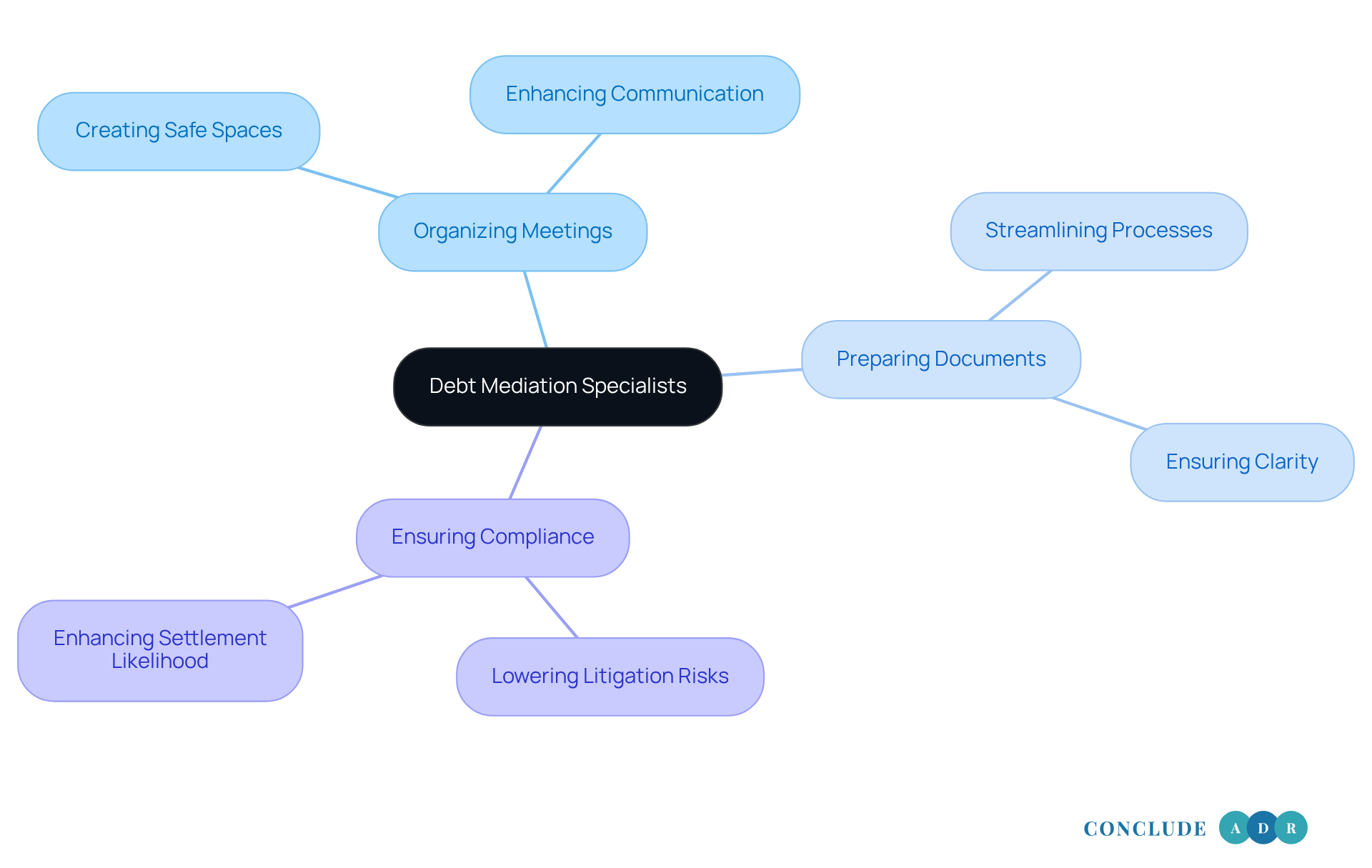

Their role includes:

- Organizing meetings to resolve conflicts

- Preparing necessary documents

- Ensuring everyone sticks to the agreed terms

By remaining neutral, they create a safe space for open conversations, which is crucial for reaching a resolution that satisfies everyone involved. This support can significantly lower the chances of litigation, saving both time and money for all parties.

Have you ever felt overwhelmed by financial obligations? The cooperative nature of these negotiations allows both sides to craft settlement terms together, which increases the likelihood that everyone will honor the agreement. This collaborative approach not only fosters a sense of ownership but also enhances the chances of a successful outcome.

While negotiation is often more efficient and cost-effective than going to court, it’s important to be aware that it might impact a borrower’s credit rating due to signs of unpaid debts.

In summary, debt mediation specialists simplify the repayment process, ultimately benefiting both borrowers and lenders. If you find yourself in a challenging financial situation, consider reaching out for support. Together, we can navigate these waters and find a path forward.

Key Characteristics of Effective Debt Mediation Specialists

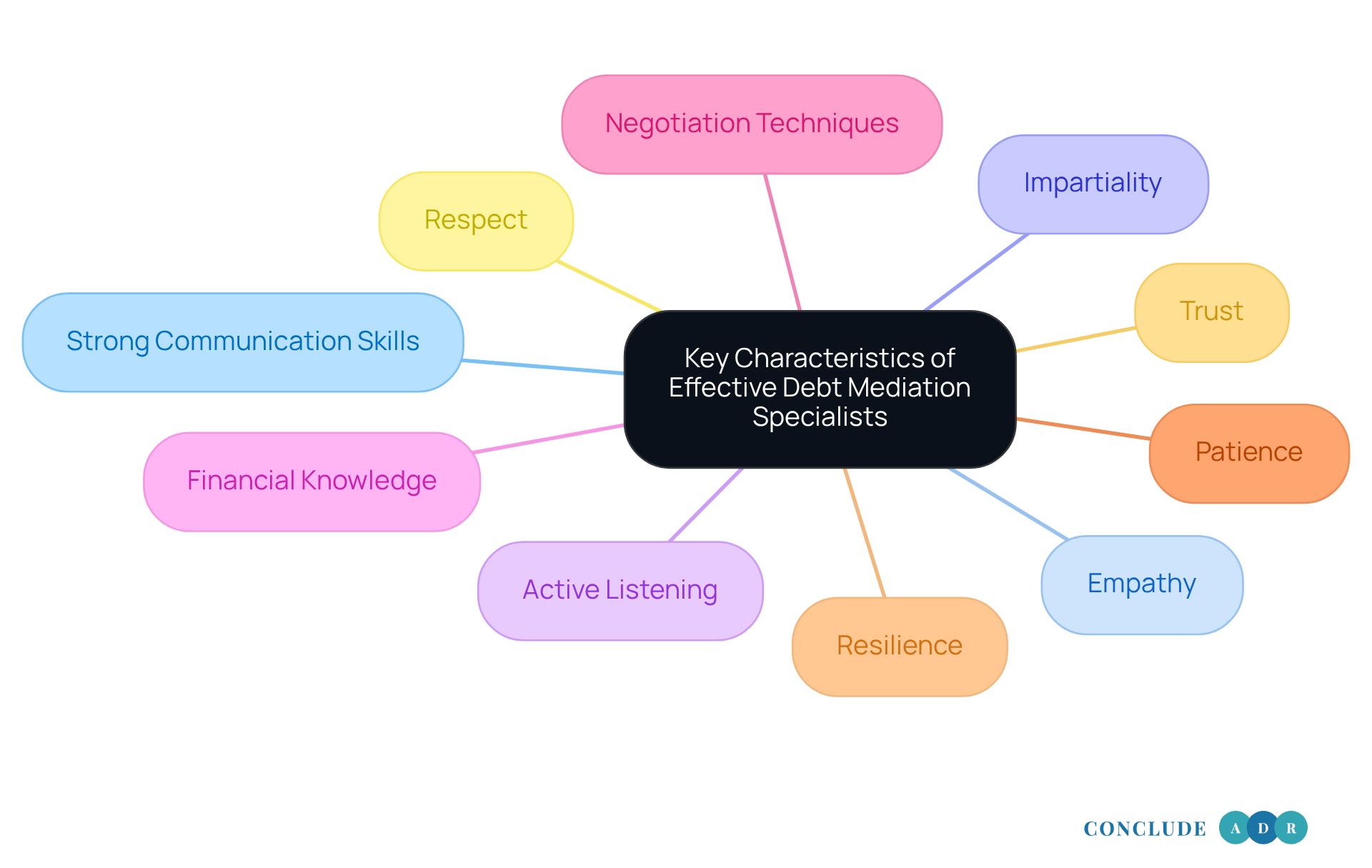

When it comes to financial negotiations, having the right traits can make all the difference. Think about it: strong communication skills, empathy, and impartiality are essential. These qualities not only help negotiators understand the emotional landscape but also create a space where everyone feels heard.

Imagine a debt mediation specialist who truly listens-someone who takes the time to understand the concerns of both debtors and creditors. This active listening is crucial. It allows for a deeper understanding of the issues at hand, paving the way for viable solutions.

Moreover, a solid grasp of financial concepts and negotiation techniques is vital. It’s not just about knowing the numbers; it’s about proposing solutions that resonate with everyone involved. Patience and resilience are equally important, as financial negotiations can often be lengthy and complex.

Ultimately, the best debt mediation specialists create an environment of trust and respect. They promote cooperation among all parties, ensuring that everyone feels valued. So, as you navigate your financial discussions, remember: cultivating these traits can lead to more fruitful outcomes. How can you incorporate these qualities into your own negotiations?

Benefits of Working with a Debt Mediation Specialist

Are you or your company feeling overwhelmed by financial challenges? Collaborating with a financial negotiation expert can be a game-changer.

Here are some key benefits:

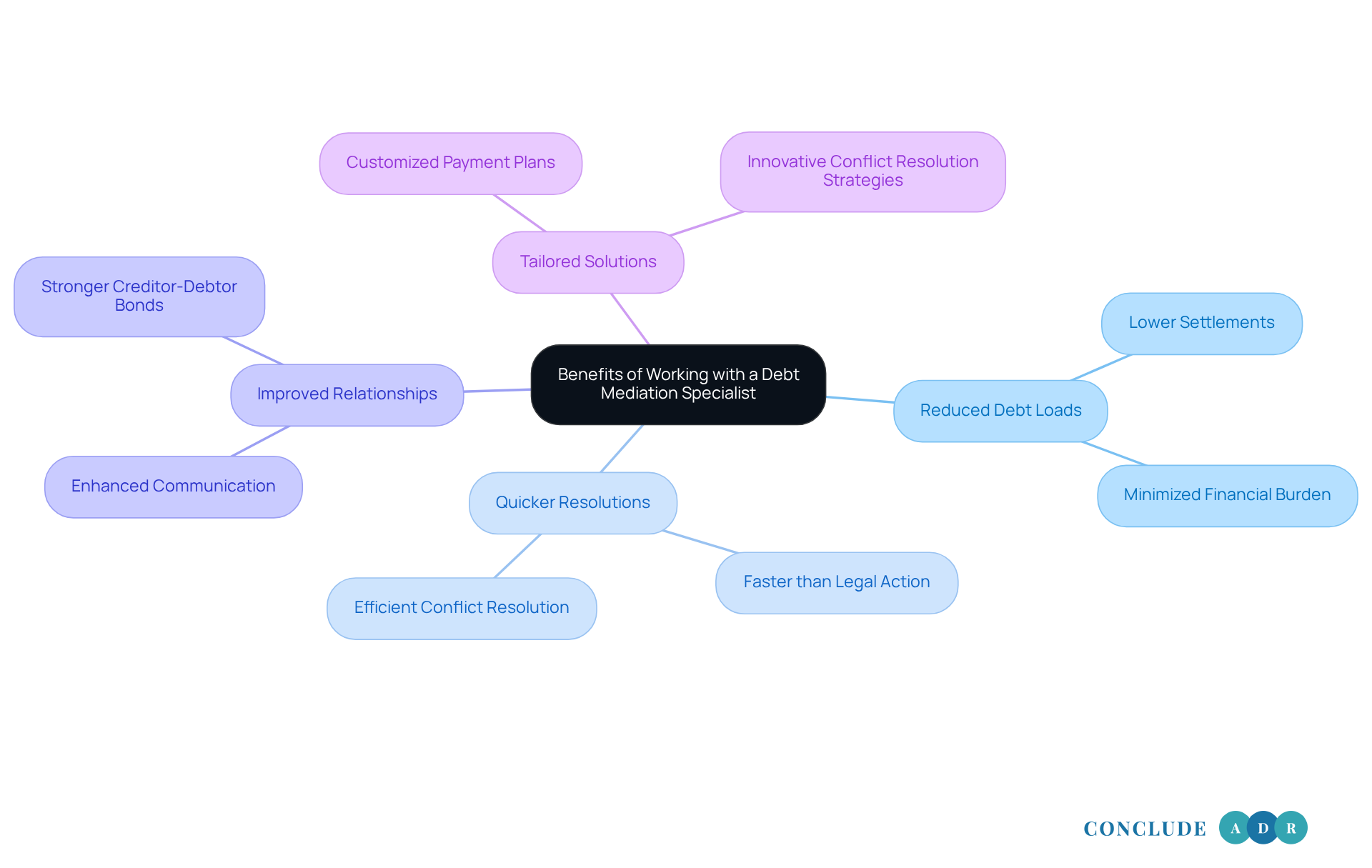

- Reduced Debt Loads: Experts can often negotiate lower settlements than what you initially owe.

- Quicker Resolutions: Negotiation is typically faster and more affordable than legal action, allowing you to resolve conflicts effectively.

- Improved Relationships: The process encourages open communication, which can enhance relationships between debtors and creditors.

- Tailored Solutions: Conflict resolution experts provide a structured environment that helps you discover innovative solutions tailored to your unique situation.

Engaging a debt mediation specialist can result in more favorable outcomes and a smoother resolution process. Imagine feeling the weight of your financial burdens lift as you work towards a brighter future. You don’t have to navigate this journey alone; support is available. Why not take the first step today?

Conclusion

Debt mediation specialists truly make a difference in the often overwhelming world of financial disputes. They step in as neutral facilitators, guiding borrowers and lenders toward constructive conversations. This process not only leads to fair resolutions but also helps ease the stress that comes with debt. In tough financial times, having these professionals by your side can feel like having a trusted ally.

As we reflect on the role of debt mediation specialists, it’s clear they offer invaluable support. They don’t just organize meetings and prepare documents; they create a safe space for open dialogue. This collaborative approach increases the chances of honoring agreements and reduces the risk of expensive litigation. Plus, their emotional intelligence and negotiation skills are key to crafting solutions that fit each unique situation.

The importance of debt mediation specialists is immense. They provide a pathway to financial recovery that emphasizes communication and understanding, making it a more appealing option than traditional litigation. If you’re facing financial challenges, reaching out to a debt mediation specialist could be a crucial step toward reclaiming control over your financial future. By embracing this supportive approach, you not only empower yourself but also nurture healthier relationships with creditors, fostering a more cooperative financial environment.

Have you considered how a debt mediation specialist could help you? Taking that step might just be the support you need to navigate these challenging times.

Frequently Asked Questions

What is a debt mediation specialist?

A debt mediation specialist is a skilled individual who facilitates discussions between borrowers and lenders to help both sides reach fair and acceptable resolutions. They act as neutral third parties, promoting understanding and cooperation.

How do debt mediation specialists differ from settlement firms?

Unlike settlement firms, debt mediation specialists focus solely on promoting communication and do not take sides. They work to bridge gaps and find common ground between creditors and borrowers.

What is the main role of a debt mediation specialist?

The main role of a debt mediation specialist is to navigate the emotional and financial complexities of disputes, ensuring that everyone’s voice is heard while maintaining professional relationships between creditors and borrowers.

How effective is negotiation in resolving financial disagreements?

Approximately 70% of financial disagreements are resolved through negotiation rather than litigation, alleviating stress associated with payment collection and reducing the risk of default.

What are the benefits of engaging a debt mediation specialist?

Companies that engage mediators often recover a significant portion of their outstanding amounts while preserving valuable customer relationships. Debt mediation specialists tailor solutions to unique circumstances, leading to practical and sustainable agreements.

What does mediation involve?

Mediation is a structured negotiation process where a neutral third party works directly with creditors to reduce balances, interest, and stress, focusing on achieving fair resolutions.

Can debt mediation impact a debtor's credit score?

Yes, while negotiation can be beneficial, it may also impact a debtor's credit score, which is an important factor to consider in the process.

How can someone find help if they are in a financial bind?

If you find yourself in a financial bind, consider reaching out to a financial negotiation expert who can help you navigate the situation with compassion and understanding.