Overview

Navigating the financial aspects of a divorce can be overwhelming. That's where the role of a financial mediator becomes crucial. They facilitate discussions between separating couples about their financial rights and obligations, guiding them toward mutually agreeable solutions without imposing decisions.

Financial mediators bring specialized knowledge and skills to the table. This not only streamlines complex financial negotiations but also fosters a cooperative environment. Imagine a space where both parties feel heard and understood—this is what mediation strives to create.

Ultimately, this approach leads to more satisfying and sustainable outcomes for both individuals involved. By choosing to work with a financial mediator, you are taking a positive step toward a healthier resolution. Together, you can navigate this challenging time with compassion and support.

Introduction

Navigating the financial complexities of divorce can feel overwhelming for many couples. It’s common for heightened emotions and disputes to arise during this challenging time. This is where financial mediators come in. These skilled professionals facilitate discussions, helping partners clarify their rights and responsibilities while promoting amicable resolutions.

But what happens when the stakes are high, and emotions run even higher? Understanding the pivotal role of a financial mediator can be enlightening. Their expertise not only sheds light on their responsibilities but also reveals how they can transform a potentially adversarial process into a collaborative journey towards financial stability and mutual agreement.

Imagine feeling supported through this process, knowing that you have someone by your side who understands your concerns. Financial mediators can provide that support, guiding you toward a resolution that respects both partners' needs. Together, you can navigate this path with confidence and care.

Define Financial Mediator: Role and Responsibilities

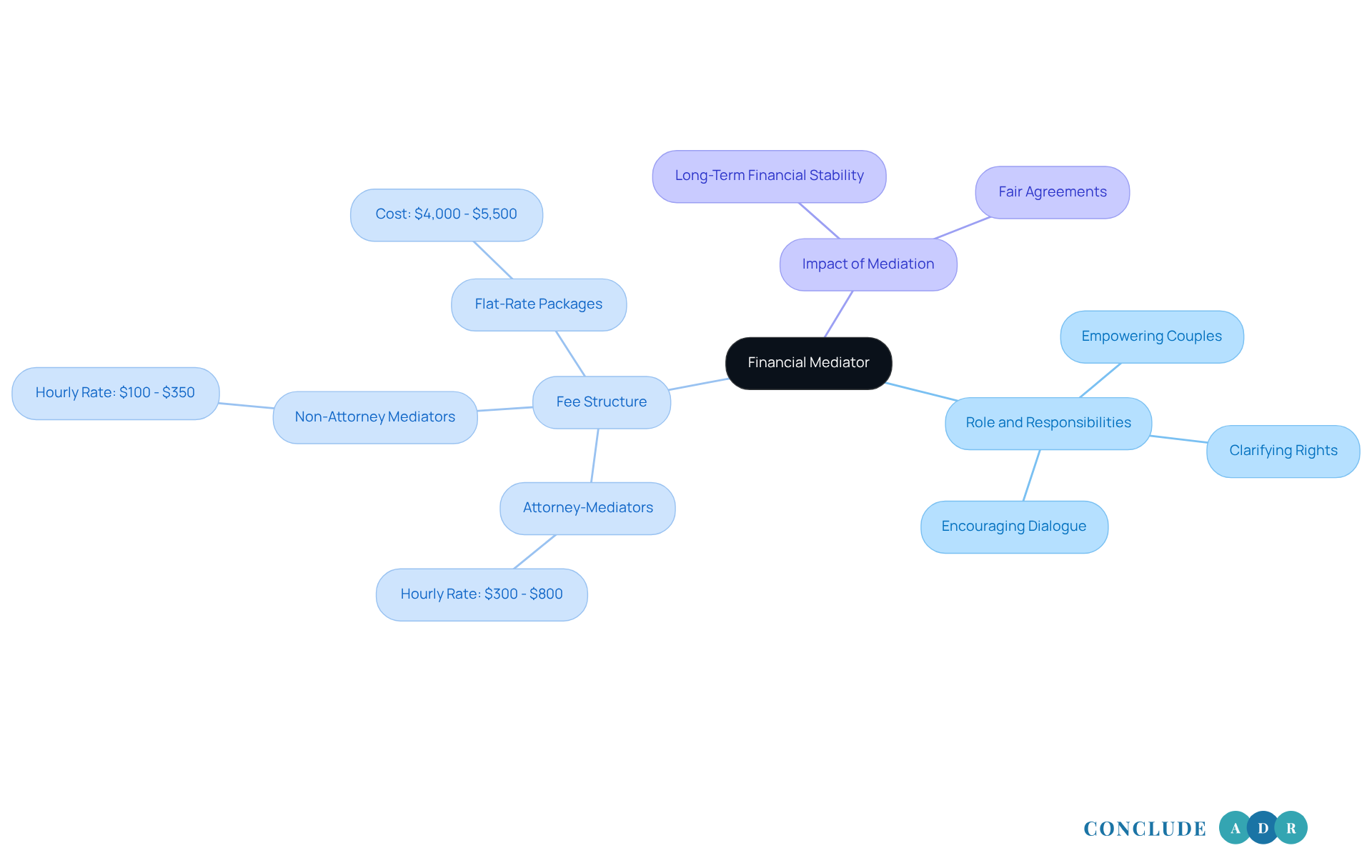

A serves as a compassionate intermediary, dedicated to helping separating couples . Their primary role as a financial mediator is to empower both parties by clarifying their financial rights and obligations, enabling informed decisions about asset division, alimony, and child support. Unlike traditional facilitators, financial mediators bring , allowing them to handle complex conversations with care and efficiency. They do not dictate decisions; rather, they encourage couples to reach through structured dialogue and negotiation.

Have you ever wondered about the during a divorce? Typically, their , depending on their qualifications and experience. For example:

- Attorney-mediators often charge between $300 and $800 per hour.

- Non-attorney mediators may charge between $100 and $350 per hour.

- Additionally, , generally costing between $4,000 and $5,500, which can help couples set clearer cost expectations.

Successful examples of economic mediation highlight the effectiveness of a financial mediator in this approach. In cases involving high-value assets or intricate financial situations, facilitators have helped create agreements that not only address immediate monetary concerns but also lay the groundwork for for both parties. By fostering open dialogue and understanding, a financial mediator plays a vital role in ensuring that are fair and sustainable.

If you find yourself in a similar situation, consider reaching out for support. You don’t have to navigate this challenging time alone; there are professionals ready to help guide you through the process with empathy and expertise.

Contextualize Financial Mediation in Divorce Proceedings

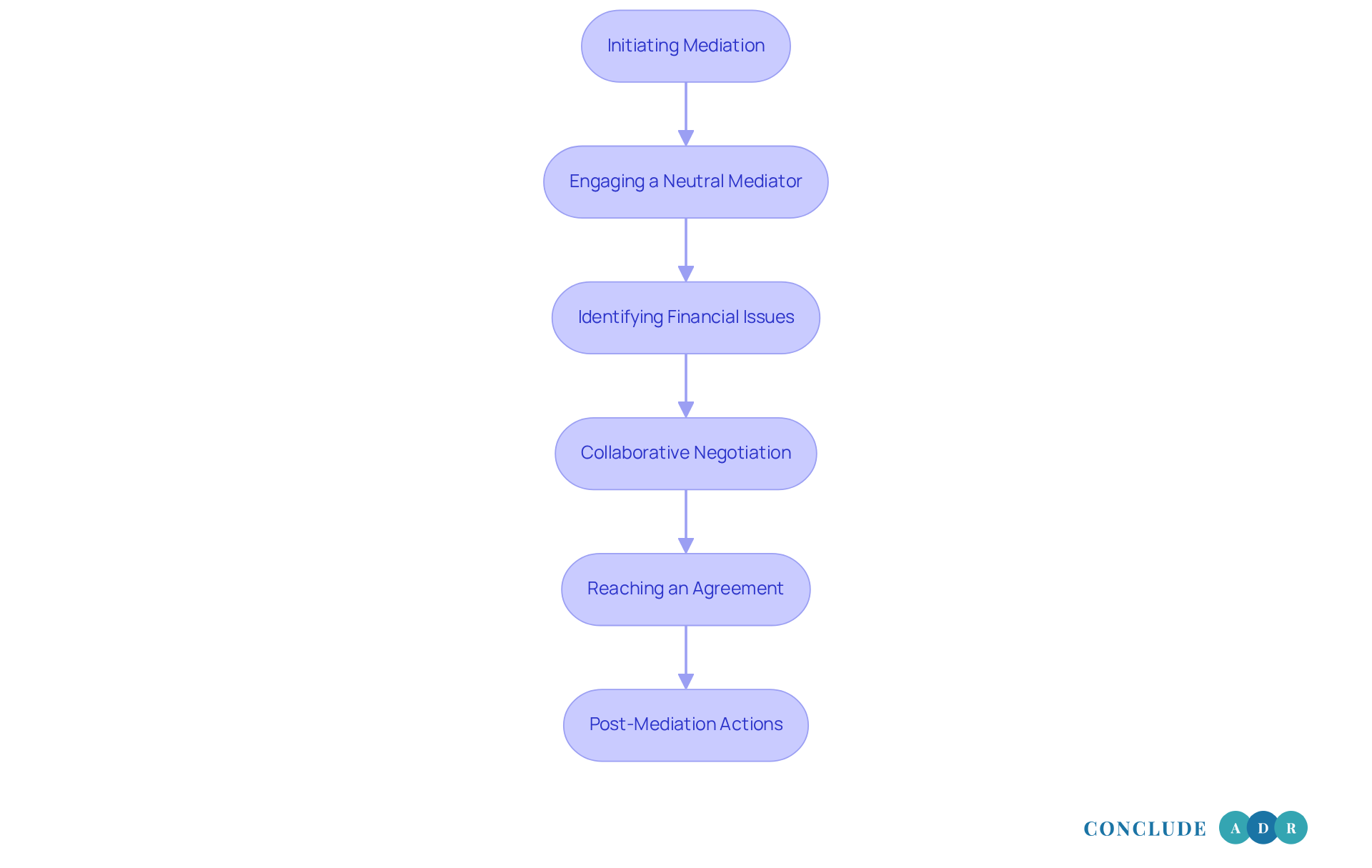

Financial negotiation has emerged as a crucial aspect of marital dissolution, offering partners a more harmonious and affordable alternative to traditional courtroom battles. Unlike the often contentious and emotionally draining nature of litigation, . Here, couples can work alongside a neutral financial mediator to resolve their disputes privately. This approach not only alleviates the stress commonly associated with separation but also enhances communication and understanding between the parties, leading to more satisfying and tailored outcomes.

The can be significant. Conventional litigation often results in high legal fees and prolonged courtroom disputes. In contrast, , allowing couples to save both time and money. Did you know that research shows negotiation can cut divorce costs by up to 50% compared to litigation? This makes it an appealing option for many. Mediation typically incurs lower financial and emotional costs, further underscoring its advantages.

More and more couples are finding success through economic negotiation, reporting higher satisfaction levels when they engage in this process. For instance, a case study highlighted a couple who, through negotiation, reached a mutually beneficial agreement on asset distribution and child support. This not only helped them maintain their relationship for their children's sake but also fostered a collaborative spirit. Mediation can assist parents in designing parenting plans that prioritize their children's needs, laying the groundwork for healthier interactions and effective communication post-divorce.

Family law experts emphasize , noting that it empowers partners to take control of their financial futures. By encouraging open dialogue and creative problem-solving, couples can rely on in navigating complex financial landscapes, ensuring that everyone's interests are taken into account. This shift towards negotiation reflects a broader trend in divorce resolution, emphasizing cooperation over conflict and nurturing healthier post-divorce relationships. Importantly, ; even those who are not on speaking terms can participate, making it a versatile option for various situations. The confidentiality of the process encourages open communication, further enhancing the likelihood of successful outcomes.

Trace the Origins and Evolution of Financial Mediation

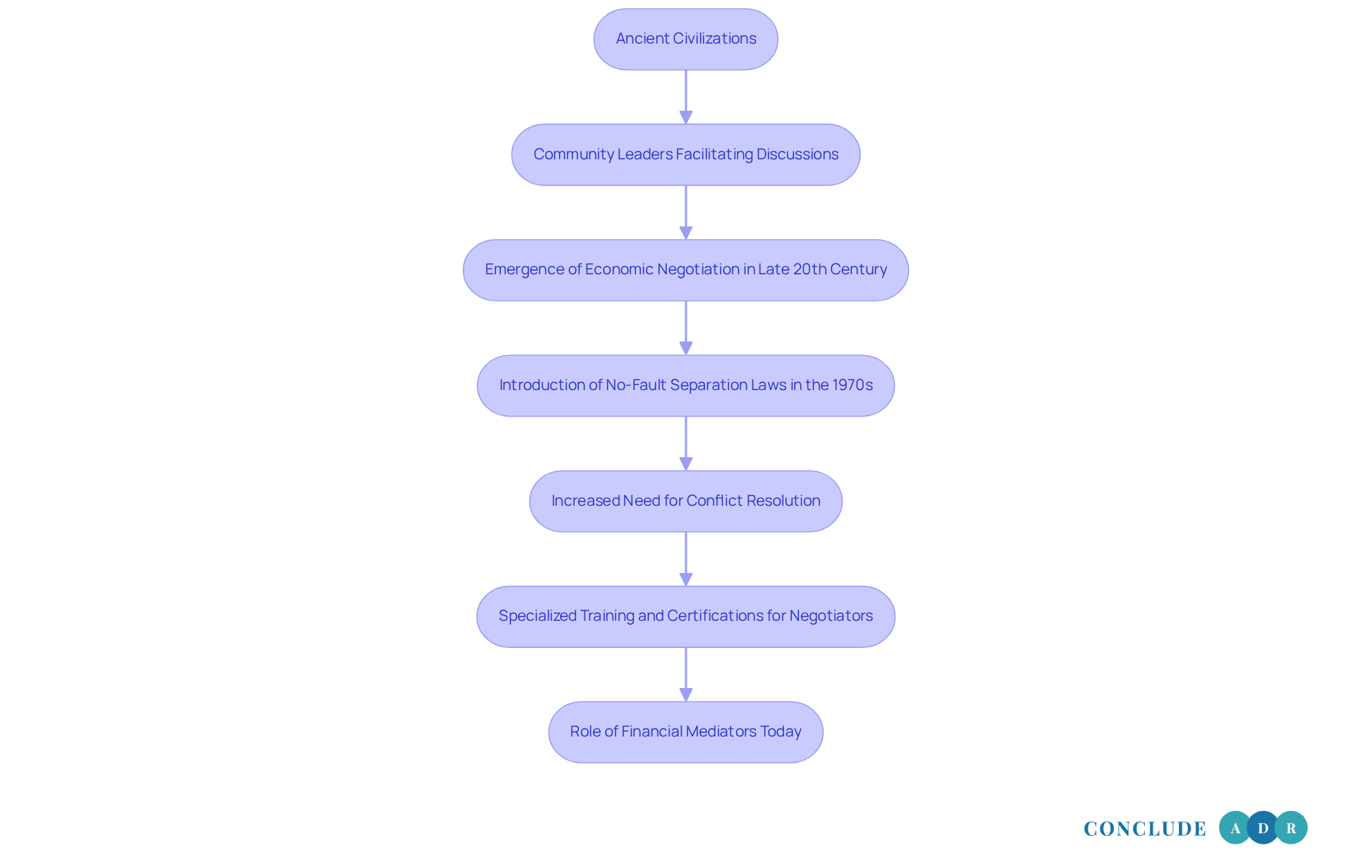

Negotiation has roots in ancient civilizations, where community leaders facilitated discussions to resolve disputes. Today, we recognize that economic negotiation emerged as a distinct practice in the late 20th century, particularly with the introduction of no-fault separation laws in the 1970s. As marriages dissolved more frequently, the need for effective techniques became increasingly apparent.

Economic negotiation evolved to address the complexities of financial agreements during marital separations, drawing from both traditional negotiation and economic planning. This growth has led to , resulting in certifications and professional groups dedicated to the role of a .

Today, play a vital role in helping couples navigate the . They ensure that both parties feel informed and empowered throughout the process. As James A. Cuddy, a legal professional, notes, 'The financial mediator assists the spouses in discussing and settling issues related to .' This highlights the importance of skilled experts in conflict resolution, who can adeptly manage the legal complexities involved.

Moreover, negotiation often serves as a to litigation, frequently leading to quicker resolutions and lower legal expenses. For instance, that go to trial may take months or even years to resolve, while negotiation can expedite this process, allowing couples to reach agreements more swiftly.

Negotiation also fosters creative financial solutions, such as structured settlements and flexible alimony arrangements tailored to the unique needs of both parties. As the demand for negotiation continues to rise, the role of experienced financial mediators in separation processes becomes increasingly crucial. They help reduce conflict and promote fair outcomes, ensuring that couples can move forward with confidence and clarity.

Identify Key Characteristics and Skills of Effective Financial Mediators

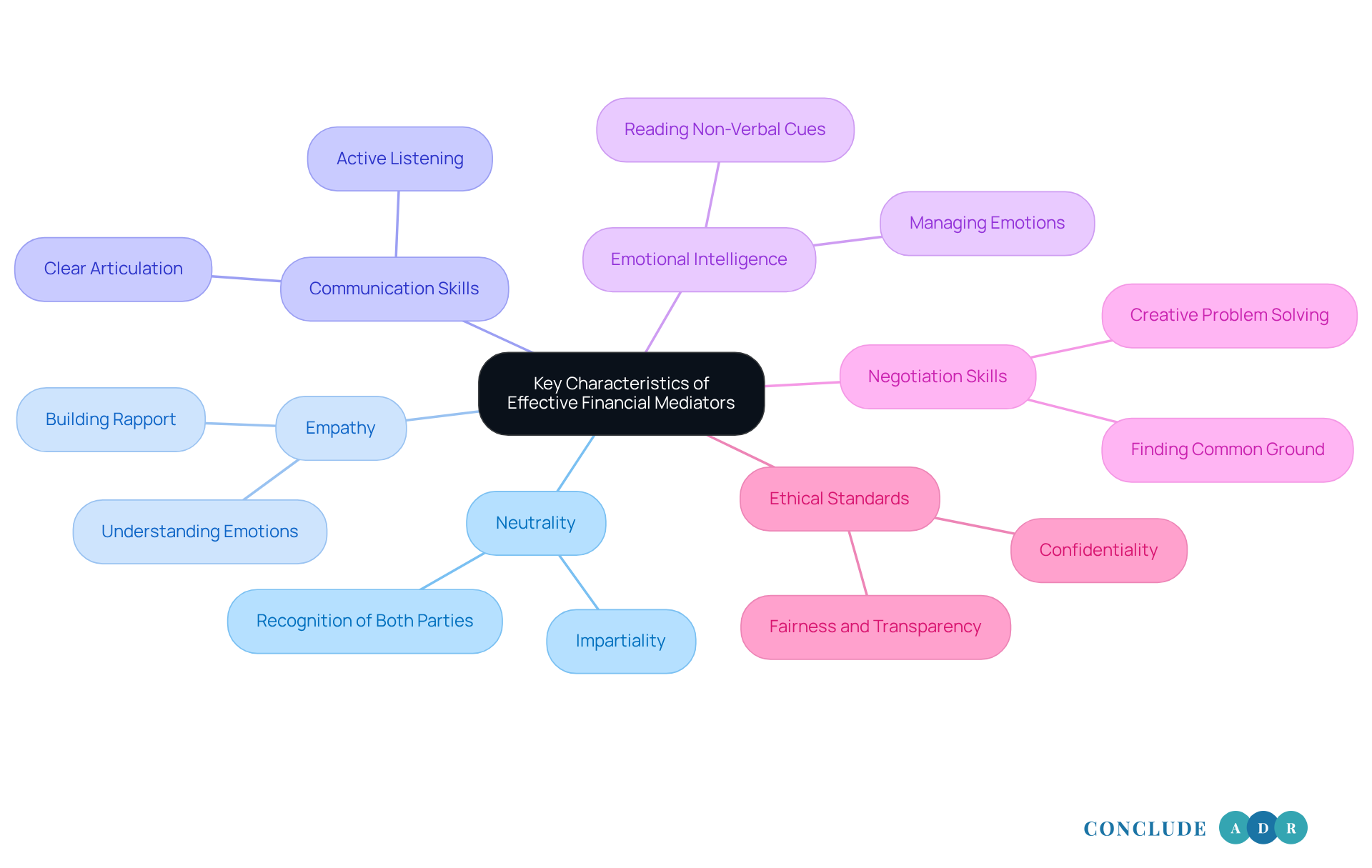

of abilities and traits that foster productive conversations during divorce cases. Key traits include neutrality, empathy, and . A successful negotiator must uphold neutrality, ensuring that both parties feel recognized and valued throughout the process. Additionally, having a —such as asset valuation, tax implications, and retirement planning—is essential for guiding discussions effectively.

Emotional intelligence is crucial as facilitators navigate the heightened emotions often present in divorce situations. Have you ever felt overwhelmed during a tough conversation? Research indicates that individuals who receive communication coaching prior to mediation are significantly more likely to achieve amicable agreements. By establishing a secure space for conversation, efficient to find fair solutions that address their monetary issues while reducing conflict.

Insights from experienced negotiators reveal that the ability to stay neutral and unbiased is one of the most essential qualities for success. The best financial mediators also exhibit , allowing them to help disputing parties find common ground and reach mutually beneficial settlements. This blend of skills not only enhances the mediation process but also increases the likelihood of achieving satisfactory outcomes for all involved.

Ethical standards are fundamental as they ensure confidentiality and fairness, fostering trust among the parties. Moreover, building rapport is essential for creating a resolution-conducive atmosphere, encouraging open communication and emotional release. Together, let’s navigate this journey towards resolution with understanding and support.

Conclusion

A financial mediator plays a crucial role in divorce proceedings, serving as a supportive guide to help couples navigate the complexities of their financial discussions. By facilitating open communication and providing specialized knowledge, these professionals empower both parties to make informed decisions regarding asset division, alimony, and child support. Their approach emphasizes collaboration over conflict, ensuring that the mediation process is both efficient and effective.

Have you considered the benefits of financial mediation? Throughout this article, we've highlighted its cost-effectiveness compared to traditional litigation, the promotion of healthier post-divorce relationships, and the ability to reach tailored agreements that meet the unique needs of both parties. The evolution of financial mediation reflects a growing recognition of its importance in fostering amicable separations. The characteristics and skills of effective mediators—such as neutrality, empathy, and strong communication—are essential for facilitating successful negotiations.

Ultimately, embracing financial mediation not only streamlines the divorce process but also lays the groundwork for a more positive future for both individuals involved. Couples facing separation should consider the advantages of engaging a financial mediator to navigate their financial landscape. This ensures that their rights and interests are protected while fostering a cooperative environment for resolution. Taking this step can lead to more satisfactory outcomes and pave the way for healthier interactions moving forward.

Why not take the first step towards a more harmonious resolution today?

Frequently Asked Questions

What is the role of a financial mediator?

A financial mediator serves as an intermediary to help separating couples navigate economic discussions, clarifying their financial rights and obligations to enable informed decisions about asset division, alimony, and child support.

How do financial mediators differ from traditional facilitators?

Financial mediators possess specialized knowledge in financial matters, allowing them to handle complex conversations with care and efficiency, whereas traditional facilitators may not have this specific expertise.

Do financial mediators make decisions for the couples?

No, financial mediators do not dictate decisions. Instead, they encourage couples to reach mutually agreeable solutions through structured dialogue and negotiation.

What are the typical costs associated with hiring a financial mediator?

The fees for hiring financial mediators typically range from $200 to $500 per hour, depending on their qualifications and experience. Attorney-mediators usually charge between $300 and $800 per hour, while non-attorney mediators may charge between $100 and $350 per hour. Flat-rate resolution packages may also be available, costing between $4,000 and $5,500.

Can financial mediators help with complex financial situations?

Yes, financial mediators are particularly effective in cases involving high-value assets or intricate financial situations, helping to create agreements that address immediate monetary concerns and promote long-term financial stability.

What is the benefit of having a financial mediator during separation?

A financial mediator fosters open dialogue and understanding, playing a vital role in ensuring that separation agreements are fair and sustainable for both parties.