Introduction

Navigating the turbulent waters of divorce can feel overwhelming, can’t it? The emotional strain is often compounded by the complex financial implications that come with it. This is where a Certified Divorce Financial Analyst (CDFA) in San Diego can step in as a vital ally. They offer specialized insights that can truly make a difference in the outcome of your separation proceedings.

But how do you know if engaging a CDFA is the right choice for you amidst all this chaos? Understanding their role can shed light on the significant benefits they bring to the table. It’s not just about numbers; it’s about ensuring you have the support you need during this challenging time. Ignoring this crucial resource could lead to potential pitfalls that might affect your future.

Define the Role of a Certified Divorce Financial Analyst (CDFA)

Navigating the emotional and financial complexities of divorce can be overwhelming. A certified divorce financial analyst San Diego is here to help you through this challenging time. They specialize in the economic aspects of separation, focusing on your unique situation and needs.

CDFAs play a crucial role in helping you and your lawyer understand the financial implications of divorce agreements. They examine your assets, liabilities, and income, providing a clear picture of your financial landscape. This comprehensive analysis empowers you to make informed decisions about your future.

Imagine being able to foresee how different settlement options could impact your financial well-being. CDFAs forecast future monetary scenarios, bridging the gap between legal and economic considerations. This ensures you grasp how your choices today will affect your long-term financial health.

Additionally, CDFAs offer valuable insights into tax implications and help you create realistic budgets for life after divorce. They understand that this is not just about numbers; it’s about your peace of mind and security.

If you’re feeling uncertain about your financial future, consider reaching out to a certified divorce financial analyst San Diego for guidance. They can provide the support and guidance you need to navigate this transition with confidence.

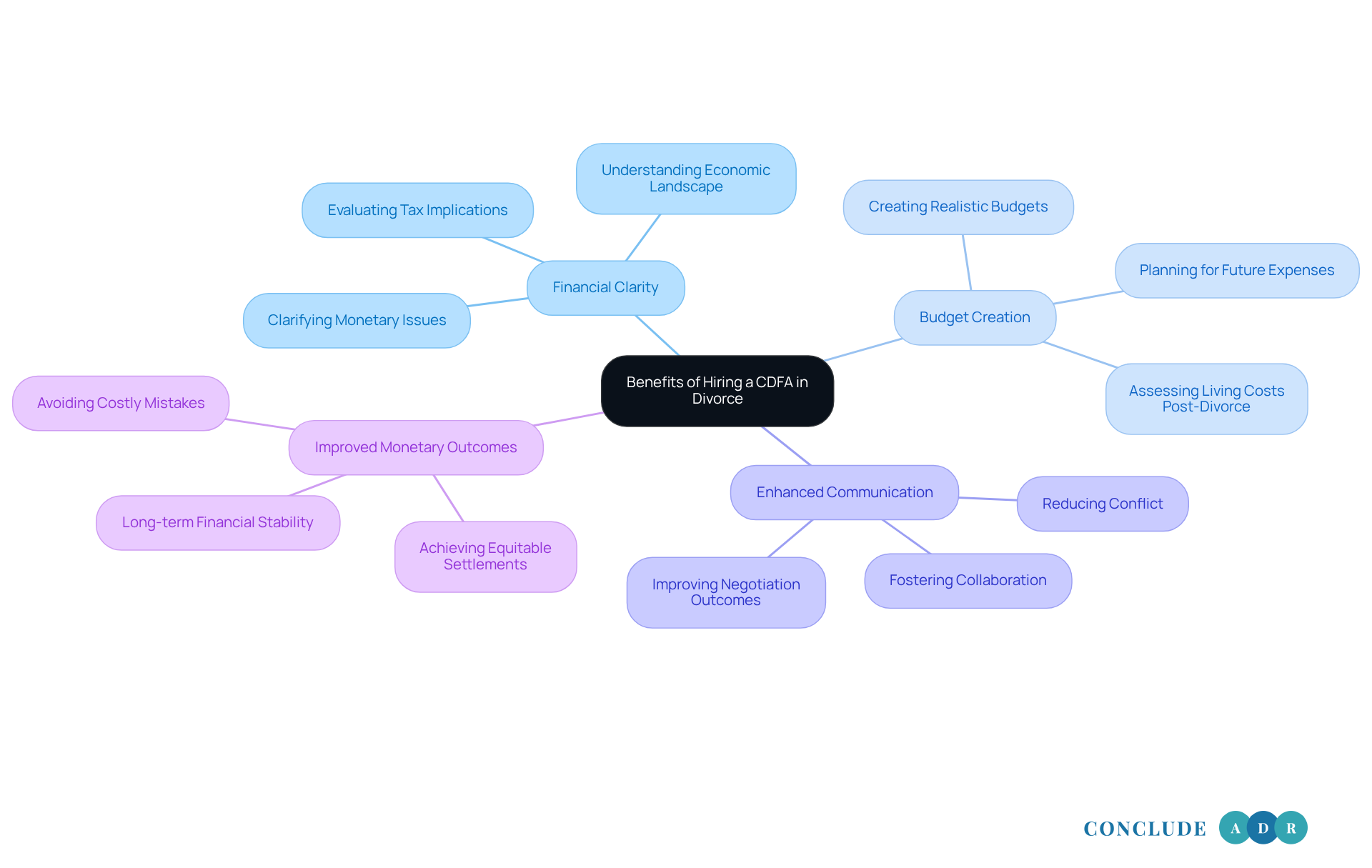

Explore the Benefits of Hiring a CDFA in Divorce Proceedings

Engaging a certified divorce financial analyst San Diego during divorce proceedings can truly make a difference. Have you ever felt overwhelmed by the financial complexities of divorce? CDFAs excel at clarifying intricate monetary issues, helping you understand your entire economic landscape. This comprehensive understanding is essential for making informed decisions that can profoundly impact your future.

Moreover, CDFAs can identify potential pitfalls in monetary settlements, ensuring you don’t overlook critical elements that could lead to unfavorable outcomes. They play a pivotal role in creating realistic budgets that encompass both immediate and long-term monetary needs, which is crucial for maintaining stability after divorce.

But it doesn’t stop there. CDFAs also enhance communication between parties, reducing conflict and fostering a collaborative atmosphere. Their expertise not only results in more equitable settlements but also guarantees that all monetary aspects are meticulously considered and addressed. Did you know that individuals who utilize the services of a certified divorce financial analyst in San Diego often achieve improved monetary results? These experts provide thorough evaluations and forecasts that help avert costly mistakes.

For instance, the typical duration of a U.S. separation process is about a year. This highlights the importance of hiring a certified divorce financial analyst San Diego for prompt fiscal evaluation. By focusing on the monetary consequences of divorce, CDFAs empower you to negotiate agreements that align with your best interests, ultimately securing a more stable economic future.

As Bryan Driscoll, a Divorce Content Specialist, wisely notes, 'Such a thorough economic analysis can assist you in making informed choices and negotiating an equitable distribution of marital assets.' The role of a certified divorce financial analyst is further illustrated in case studies, showing how they assist clients in making informed choices about the allocation of marital assets, thus minimizing the chances of future disagreements over economic issues.

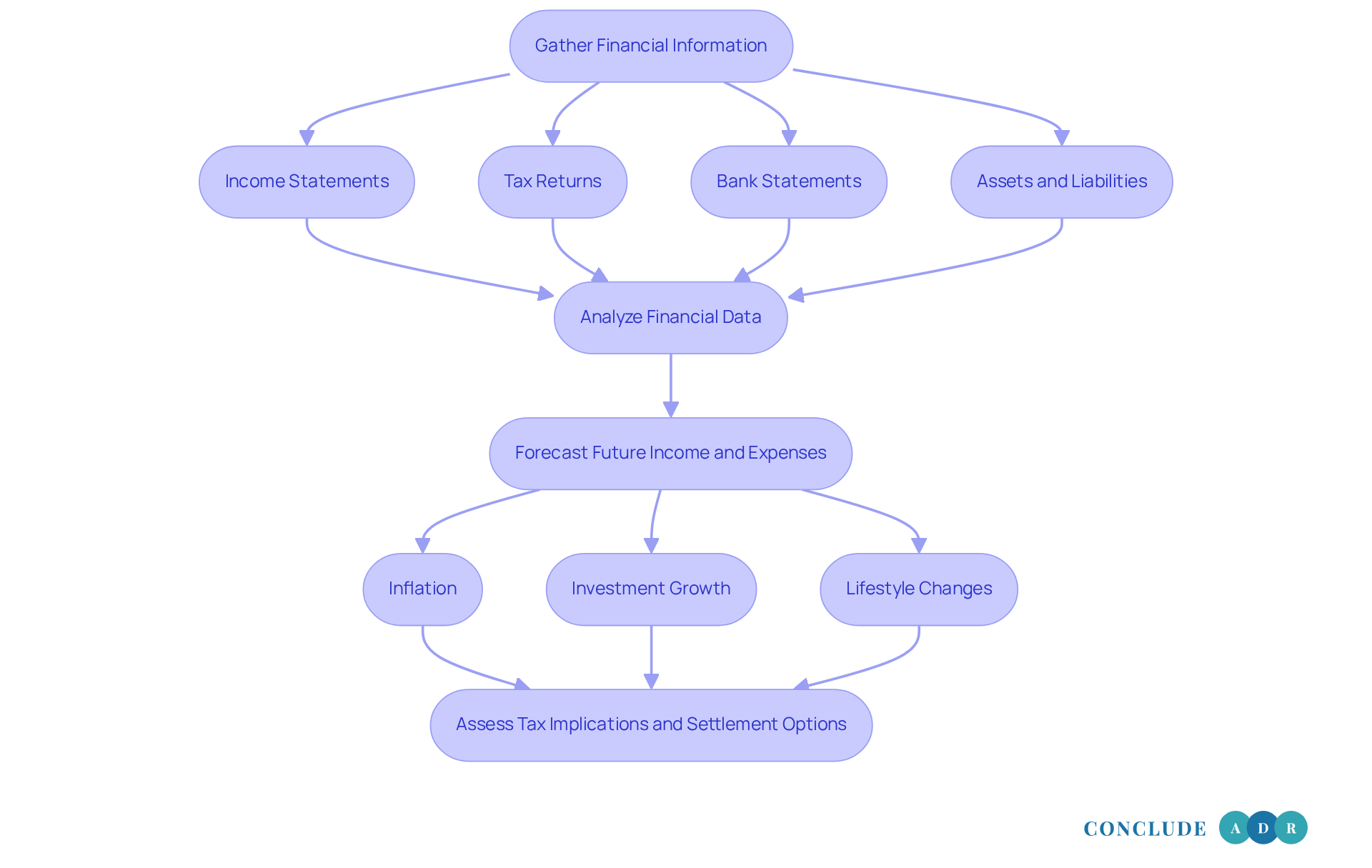

Understand the Financial Analysis Process Conducted by a CDFA

Navigating the financial aspects of divorce can feel overwhelming, but a Certified Divorce Financial Specialist (CDFA) is here to help. The monetary assessment process involves several important steps that can make a significant difference in your future. First, the CDFA gathers detailed financial information from both parties, including:

- Income statements

- Tax returns

- Bank statements

- A comprehensive overview of assets and liabilities

This information is carefully analyzed to create a clear picture of your economic landscape.

Certified divorce financial analysts in San Diego work collaboratively within separation teams, partnering with legal counsel and clients to ensure fair settlements. They use various financial modeling techniques to forecast future income and expenses, considering factors like:

- Inflation

- Investment growth

- Potential lifestyle changes after separation

Have you thought about how different settlement options might impact your financial future? CDFAs also assess the tax implications of these options, which can greatly affect the net value of your assets. For instance, a family law attorney might overlook up to $8,000 in potential financial consequences, underscoring the value of having a wealth advisor on your side.

By presenting this analysis in a clear and understandable way, CDFAs empower individuals to make informed choices that align with their long-term financial goals. This support is crucial for ensuring a more secure economic future after divorce. As Jamie Lima wisely notes, "A CDFA focuses on the financial complexities of separation," highlighting their essential role in guiding clients through this intricate process. Remember, you don’t have to face this alone; support is available to help you navigate these challenges.

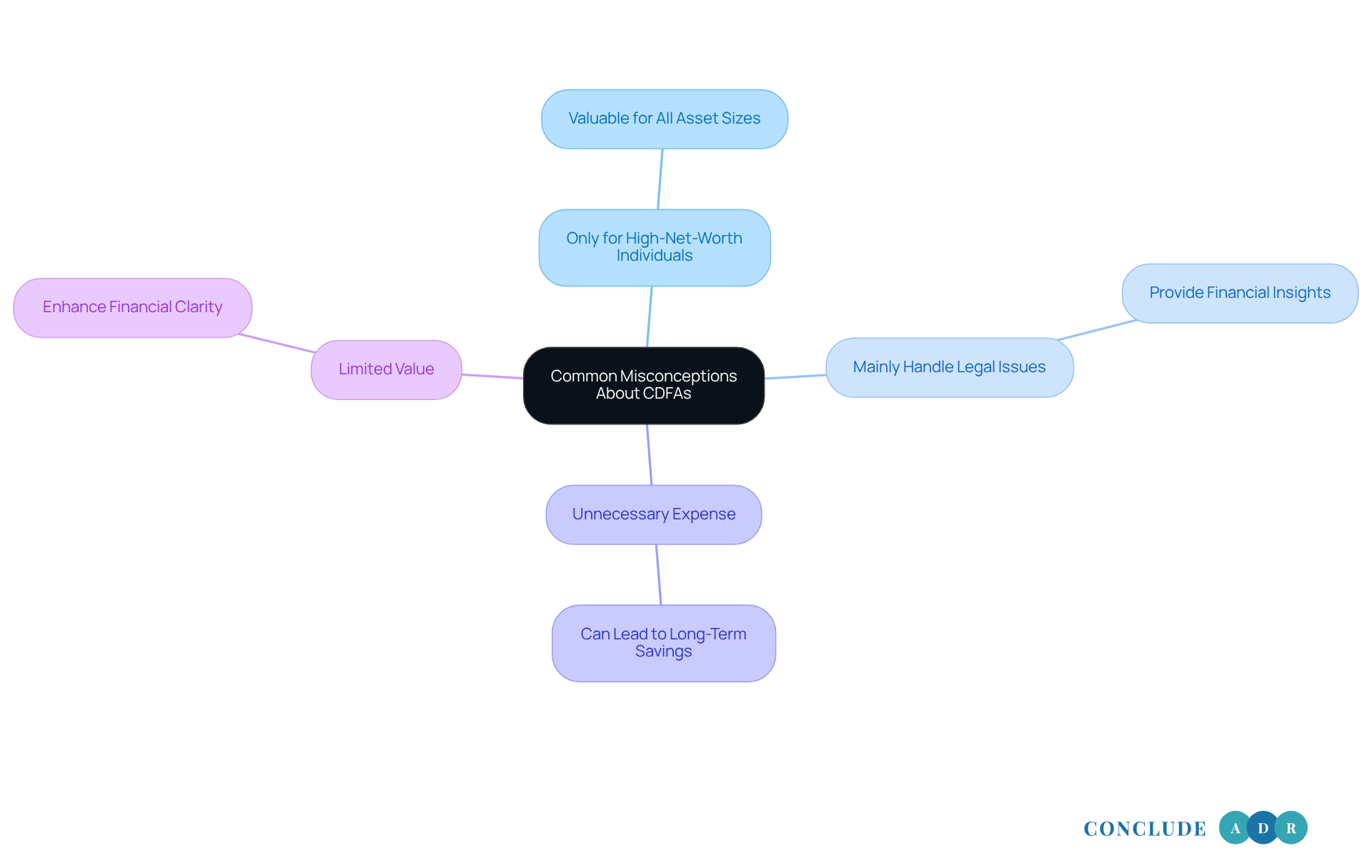

Identify Common Misconceptions About CDFAs

Misunderstandings about certified divorce financial analysts San Diego can create barriers for those considering their services. Many believe that a certified divorce financial analyst San Diego is only necessary for high-net-worth individuals. But in reality, the expertise of a certified divorce financial analyst San Diego is invaluable for anyone navigating a separation, regardless of the size of their assets.

Did you know that a divorce is often the largest financial event in a person's life? This makes specialized financial guidance essential for everyone involved. Another common misconception is that certified divorce financial analysts San Diego mainly handle legal issues. However, the certified divorce financial analyst San Diego plays a primary role in providing crucial financial insights and projections that inform legal decisions.

As one Certified Divorce Financial Advisor shared, 'A detailed budget created by a certified divorce financial analyst San Diego can help both parties understand where potential concessions need to be made to reach an agreement that meets everyone’s needs.' This highlights how a CDFA can facilitate understanding and cooperation.

Some might view hiring a certified divorce financial analyst in San Diego as an unnecessary expense. Yet, guidance from a certified divorce financial analyst San Diego often leads to significant long-term savings by helping individuals avoid costly mistakes and ensuring fair settlements. Many clients find that the cost of hiring a certified divorce financial analyst San Diego is significantly outweighed by the benefits they receive.

By dispelling these myths, we can appreciate the substantial value certified divorce financial analysts San Diego bring to the divorce process. They enhance financial clarity and stability, making a challenging time a bit easier to navigate.

Conclusion

Navigating the complexities of divorce can feel overwhelming, and having a Certified Divorce Financial Analyst (CDFA) in San Diego by your side can make a world of difference. During this challenging time, it’s crucial to make informed financial decisions, and CDFAs play a pivotal role in guiding individuals through the financial implications of separation. Their support can significantly impact your long-term economic well-being.

Have you ever felt lost in the maze of financial matters during a divorce? CDFAs are here to clarify those intricate details and foster communication between both parties. They provide comprehensive analyses of assets, liabilities, and potential future scenarios, empowering you to grasp the full scope of your financial landscape. It’s important to address common misconceptions about CDFAs; their expertise isn’t just for the wealthy. In fact, their guidance is invaluable for anyone facing divorce, regardless of financial status.

Ultimately, hiring a certified divorce financial analyst in San Diego can lead to more favorable outcomes, both financially and emotionally. Their guidance can help prevent costly mistakes and promote equitable settlements. Imagine navigating your transition with confidence, knowing you have a knowledgeable partner by your side. Considering the expertise of a CDFA isn’t just a wise investment; it’s a necessary step toward securing a stable financial future post-divorce.

So, why wait? Take that step today and empower yourself with the support you deserve.

Frequently Asked Questions

What is the role of a Certified Divorce Financial Analyst (CDFA)?

A CDFA specializes in the financial aspects of divorce, helping individuals navigate the economic complexities of separation by analyzing their unique financial situations.

How do CDFAs assist during the divorce process?

CDFAs help individuals and their lawyers understand the financial implications of divorce agreements by examining assets, liabilities, and income to provide a clear financial picture.

What kind of financial analysis do CDFAs provide?

CDFAs conduct a comprehensive analysis of an individual's financial landscape, forecasting how different settlement options could impact their financial well-being.

What additional insights do CDFAs offer?

CDFAs provide valuable insights into tax implications and assist in creating realistic budgets for life after divorce.

Why is it important to consult a CDFA during a divorce?

Consulting a CDFA is important for understanding the long-term financial effects of divorce decisions, ensuring peace of mind and financial security during a challenging transition.