Introduction

Mediation in debt collection has emerged as a caring approach, fostering collaboration between borrowers and lenders in a landscape often filled with tension. This process not only aims to ease financial stress but also empowers individuals to negotiate terms that feel fair and manageable.

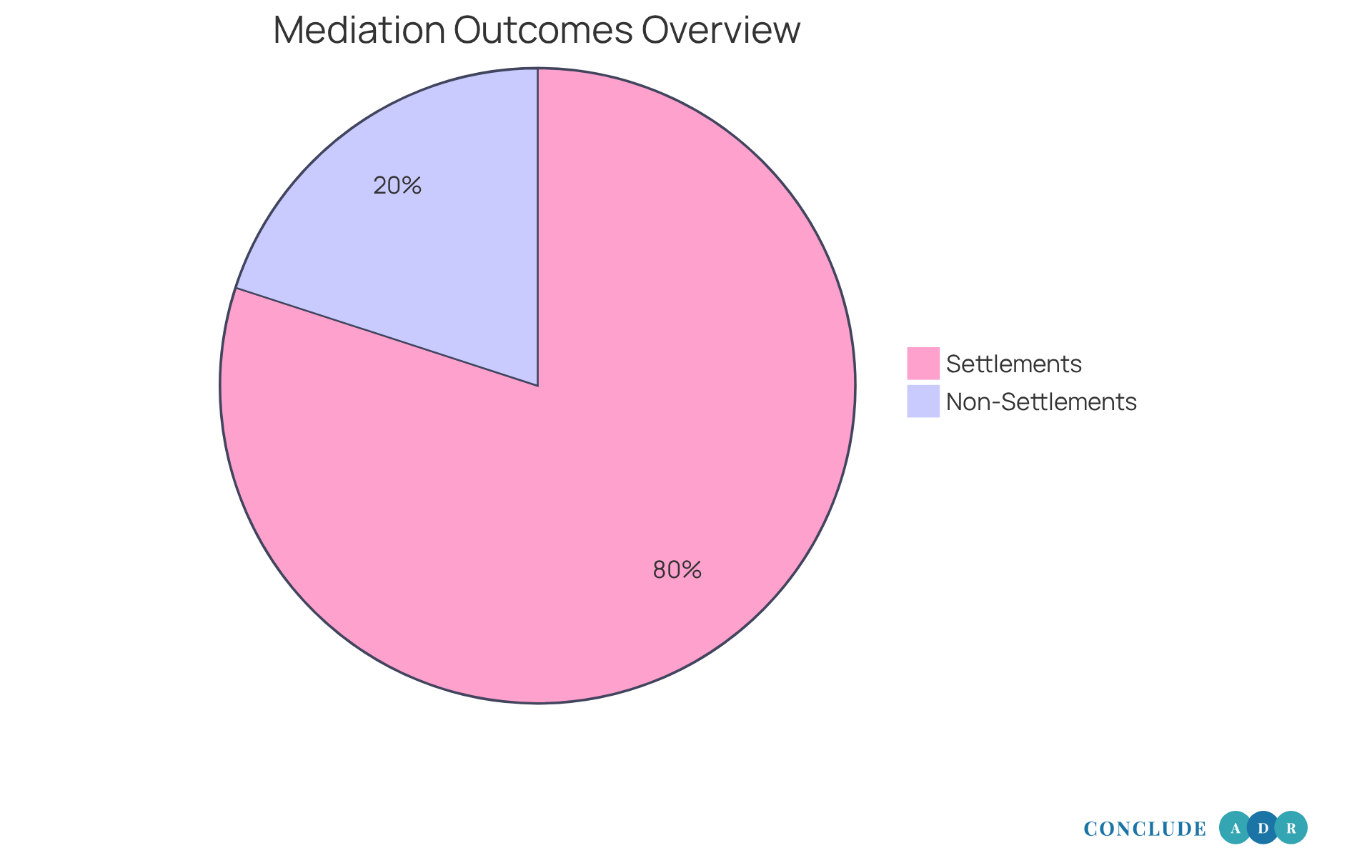

But with success rates now reaching up to 80%, you might wonder: what makes mediation a more effective alternative to traditional litigation? How can it truly benefit those grappling with debt?

Exploring the nuances of mediation reveals not just its mechanics but also the profound impact it can have on financial recovery and preserving relationships.

Imagine being able to sit down with your lender, discussing your situation openly, and finding a solution together. This is the essence of mediation - creating a space where both parties can express their concerns and work towards a resolution that honors their needs.

Key Benefits of Mediation:

- Empowerment: You take an active role in the negotiation process.

- Cost-Effective: Mediation often costs less than litigation.

- Faster Resolutions: Reach agreements more quickly than through court.

- Relationship Preservation: Maintain a working relationship with your lender.

In this journey, remember that you’re not alone. Mediation offers a supportive path forward, allowing you to regain control over your financial situation. Let’s explore how this compassionate approach can lead to a brighter financial future together.

Define Mediation in Debt Collection

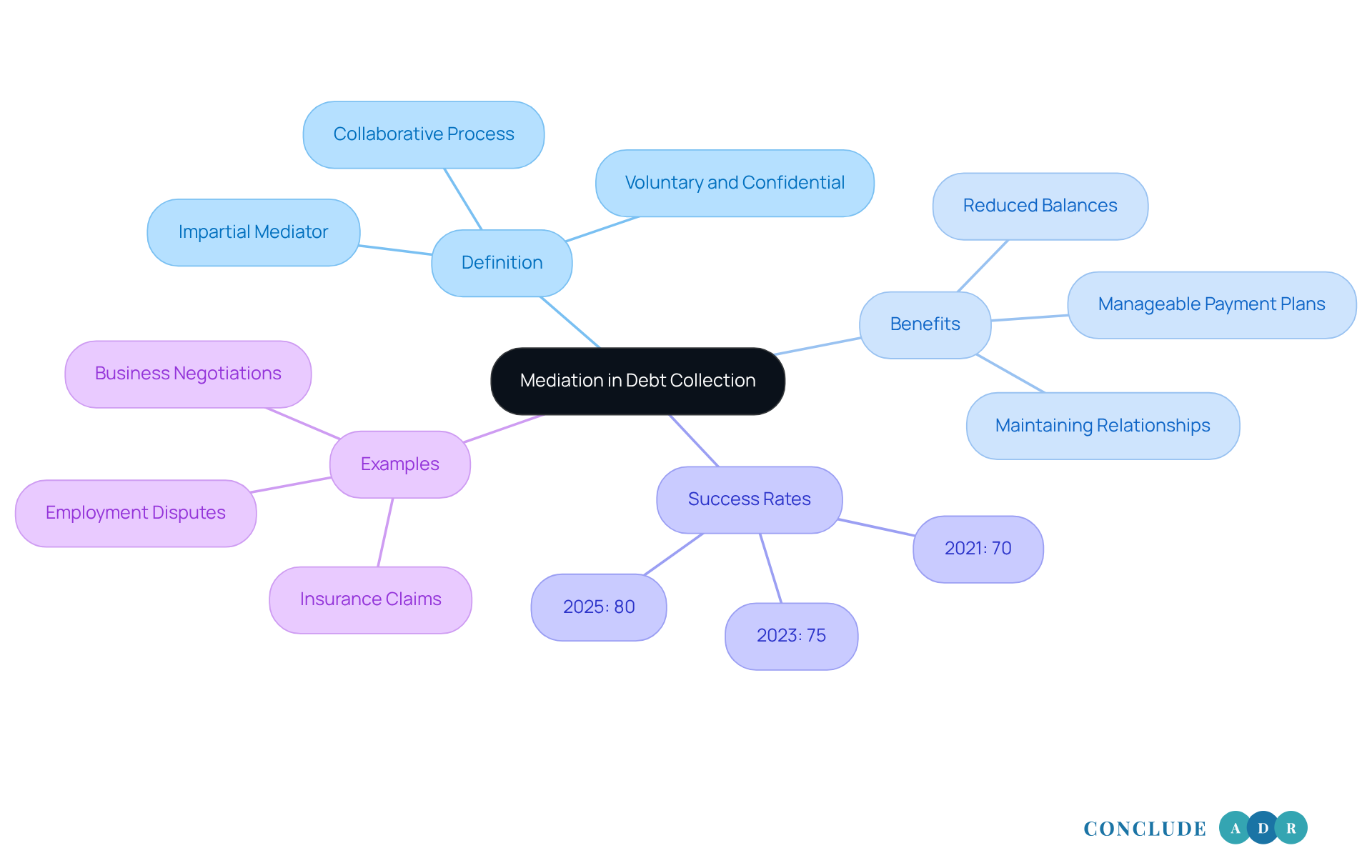

Mediation in financial recovery is a compassionate process where an impartial mediator helps facilitate discussions between borrowers and lenders. The primary goal is to find a resolution that works for everyone involved. Unlike the often adversarial nature of litigation, mediation encourages collaboration and open communication. This allows both parties to voice their concerns and negotiate terms that feel fair and satisfactory. It’s a voluntary and confidential process that nurtures honest dialogue, enabling participants to explore creative solutions tailored to their unique situations.

Have you ever felt overwhelmed by financial disputes? Mediation debt collection is proving to be a highly effective approach for resolving these issues. In Florida, success rates have risen from 70% in 2021 to around 75% in 2023, with reports now indicating rates as high as 80% in 2025. This impressive success rate reflects the mediators' ability to guide discussions toward amicable agreements, often resulting in reduced balances, manageable payment plans, or extended deadlines. Many borrowers who engage in this process find relief through reduced balances and organized monthly payments, easing the stress associated with financial collection.

Consider the successful negotiation examples in debt disputes. In business negotiations, for instance, success rates typically range from 65% to 75%, focusing on contract disputes and partnership disagreements. These negotiations often lead to settlement payments and preserved relationships, showcasing the practical benefits of resolving issues outside of court.

Mediation debt collection professionals highlight the many advantages of this approach. They note that conflict resolution not only helps avoid the confrontational nature of litigation but also empowers individuals to maintain control over the outcome. As one specialist pointed out, negotiation creates a win-win scenario where both borrowers and lenders can reach agreements that feel fair and satisfying, even if one side benefits slightly more than the other. This spirit of collaboration is vital for fostering long-term goodwill and maintaining professional relationships.

Ultimately, negotiation stands out as a cost-effective, time-saving alternative to litigation, especially in financial recovery. Its focus on open communication and joint decision-making significantly reduces conflict, making it a preferred choice for resolving disputes efficiently and amicably.

So, if you find yourself facing financial challenges, consider mediation as a supportive path forward. Together, we can navigate these waters and find a resolution that works for you.

Explain How Debt Collection Mediation Works

The mediation debt collection resolution process begins with a preliminary meeting where the facilitator warmly introduces all participants and outlines the structure of the mediation. This initial stage is crucial, as it gathers relevant information, including documentation related to the debt. The facilitator encourages open conversation, inviting each side to share their viewpoints and concerns candidly. This collaborative environment fosters the exploration of potential solutions, with the facilitator suggesting mediation debt collection options or settlement strategies that align with the financial realities of both parties.

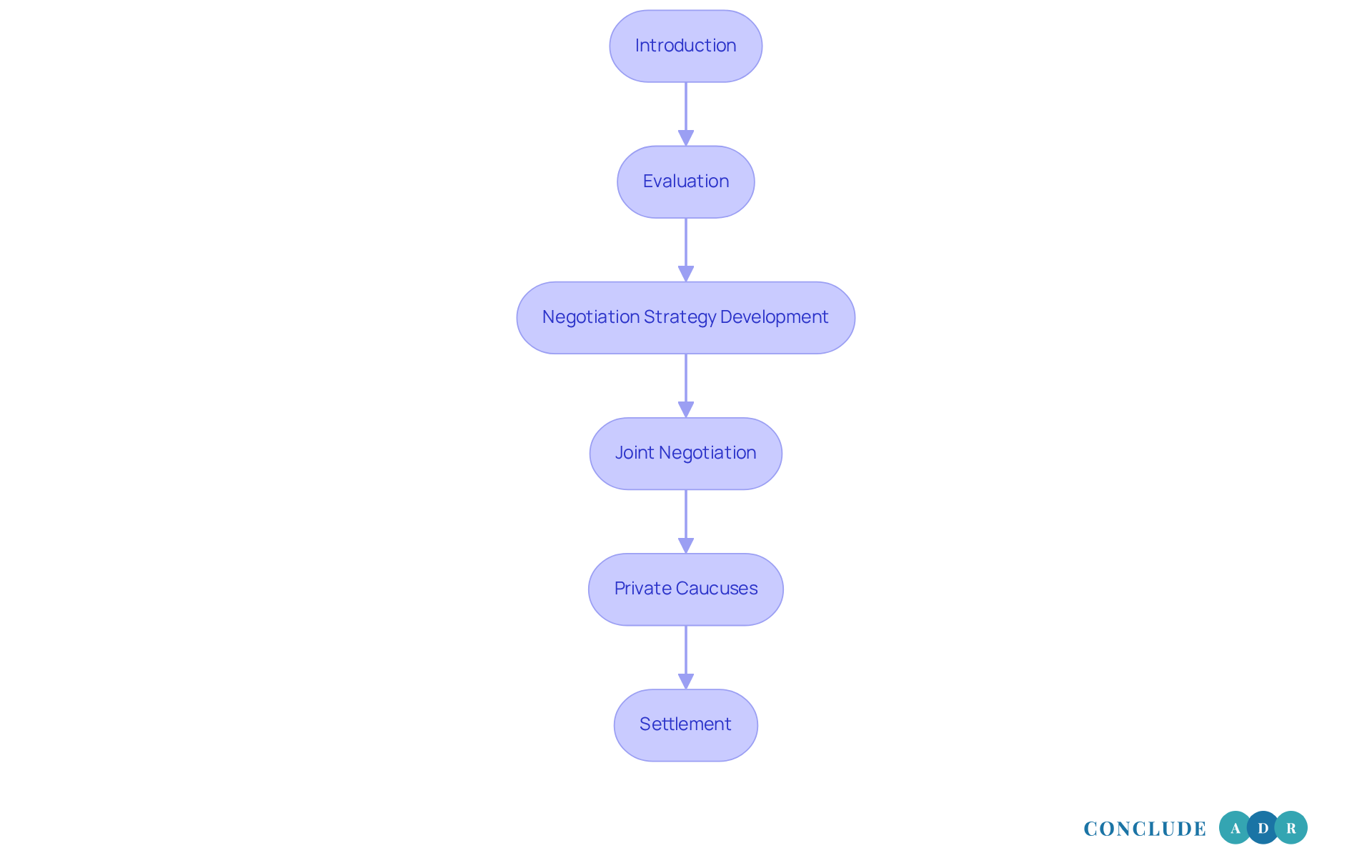

The mediation typically follows a structured process, which includes several key steps:

- Introduction: The facilitator sets the stage, explaining the process and establishing ground rules to ensure everyone feels comfortable.

- Evaluation: The intermediary assesses the financial health of the debtor and the expectations of the creditor, creating a clear understanding of the situation.

- Negotiation Strategy Development: A strategy is crafted to align with the debtor's financial capabilities, focusing on realistic repayment options that feel achievable.

- Joint Negotiation: Parties engage in discussions, often with a neutral party facilitating mediation debt collection to ensure clarity and understanding.

- Private Caucuses: The mediator may meet individually with each group to discuss sensitive issues and refine negotiation strategies, ensuring everyone’s voice is heard.

- Settlement: If an agreement is reached, it is documented and signed, making it legally binding, which brings peace of mind to all involved.

The length of negotiation sessions in debt collection can vary significantly. Straightforward cases often conclude in just half a day, while more complex issues may require an entire day. This efficiency is one of the key benefits of mediation debt collection, as it allows participants to reach agreements more swiftly than conventional court processes.

Mediators emphasize the importance of maintaining a neutral stance throughout the process, guiding discussions without taking sides. This impartiality fosters trust and encourages open communication, which is crucial for successful outcomes. As seasoned mediators highlight, the process is not solely focused on settling conflicts; it aims to empower participants to discover mutual understanding and create solutions that benefit everyone involved.

It's also important to recognize that participating in financial negotiation may affect a borrower's credit rating, as it signifies previous difficulties in meeting financial responsibilities. However, mediation debt collection is often perceived as less formal than court proceedings, promoting a collaborative atmosphere aimed at finding mutually beneficial solutions.

Are you ready to explore how mediation can help you navigate your financial challenges? Together, we can work towards a resolution that feels right for you.

Outline the Advantages of Mediation for All Parties

Mediation offers a wealth of significant advantages for both debtors and creditors, making it a compassionate choice for resolving disputes in debt collection. Let’s explore some key benefits:

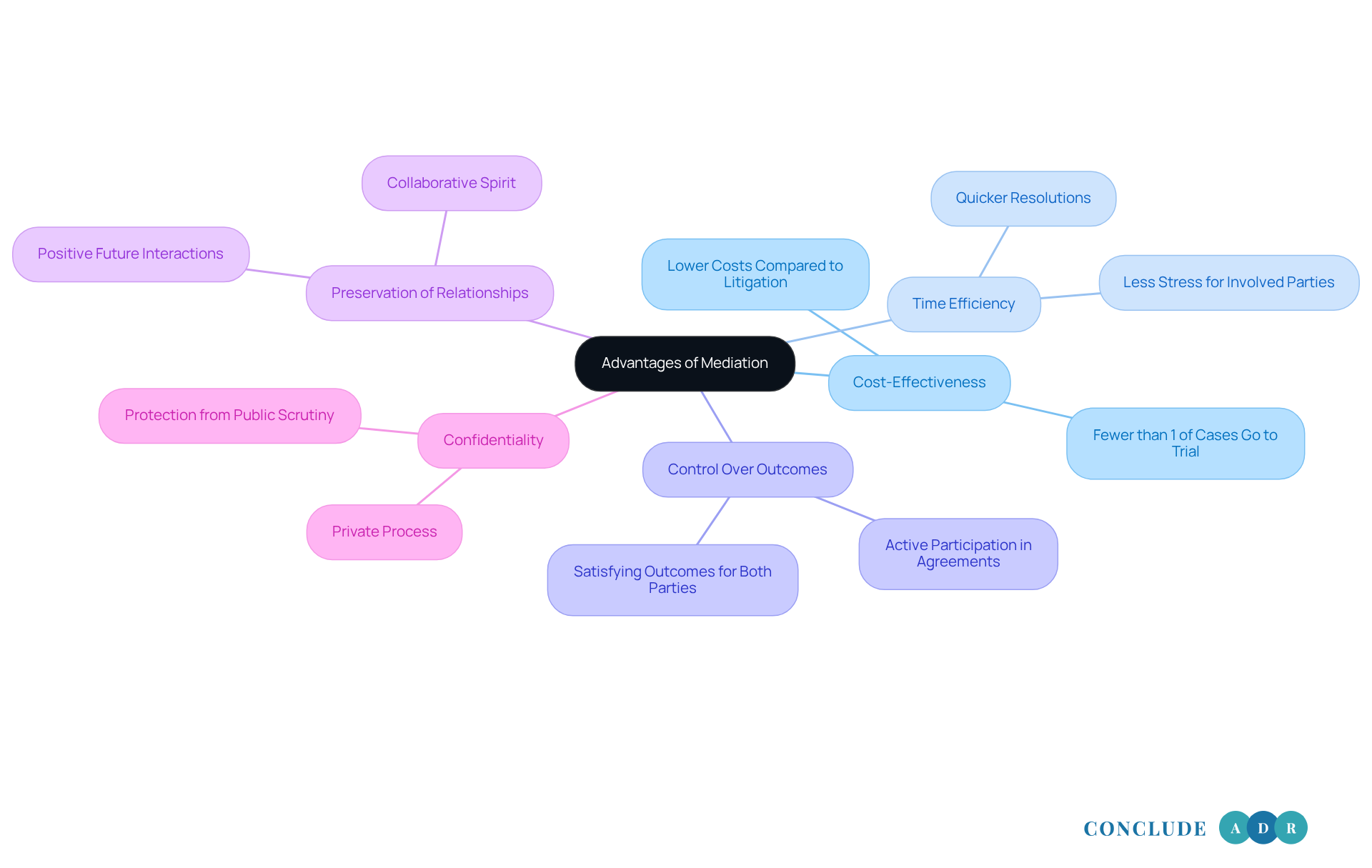

- Cost-Effectiveness: Mediation usually comes with lower costs compared to litigation, allowing both parties to save money while reaching a resolution. Did you know that fewer than 1% of commercial cases submitted in federal court actually go to trial? This highlights how effective negotiation can be as an alternative.

- Time Efficiency: The mediation process can often be wrapped up in a fraction of the time it takes for court proceedings. Quicker resolutions mean less stress for everyone involved.

- Control Over Outcomes: Unlike litigation, where a judge makes the final call, mediation allows both sides to actively shape their agreements. This often leads to more satisfying outcomes. As Bruce A. Edwards, a respected mediator, puts it, "The mediator’s role is to assist disputants in understanding the other side’s perspective and effectively convey settlement proposals."

- Preservation of Relationships: The collaborative spirit of mediation helps maintain professional relationships between creditors and debtors. This nurturing environment can pave the way for positive future interactions.

- Confidentiality: Mediation is a private process, ensuring that both parties' interests are shielded from public scrutiny. This is especially important in sensitive financial matters.

These benefits not only enhance the overall experience of conflict resolution but also promote a friendlier and more efficient method of collecting payments. Ultimately, this leads to higher recovery rates and fewer disagreements. Imagine the positive outcomes from negotiation: reduced balances, manageable payment plans, and relief from harassment. Mediation truly is a beneficial option for everyone involved.

Present Real-Life Results of Mediation in Debt Collection

Many case studies show how effective negotiation is in the context of mediation debt collection for collecting payments. For example, a recent meeting between a small business and a creditor resulted in a remarkable 40% reduction in the outstanding amount. This allowed the business to keep running without the burden of overwhelming financial pressure. Have you ever felt the weight of debt? In another case, a debtor managed to negotiate a payment plan through mediation debt collection that fit their financial situation, avoiding the stress of litigation and protecting their credit rating.

These stories not only highlight the potential for significant financial relief but also demonstrate how mediation debt collection can lead to win-win outcomes for everyone involved. Did you know that nearly 80% of cases resolved through mediation debt collection end in some form of settlement? This statistic underscores the effectiveness of mediation debt collection as an approach in resolving disputes.

In fiscal year 2008, the Minnesota FLM Program opened 2,002 conflict resolution cases, addressing over $156.3 million in financial obligations. This further illustrates the positive impact of resolution in these situations. As Mary Nell Preisler, Director of the Minnesota FLM Program, wisely notes, "Solid business practices and planning, and common sense about debt and lending, will go a long way toward preventing the next crisis."

So, if you find yourself in a tough financial spot, remember that negotiation can be a powerful tool. You’re not alone in this journey, and there are ways to find relief.

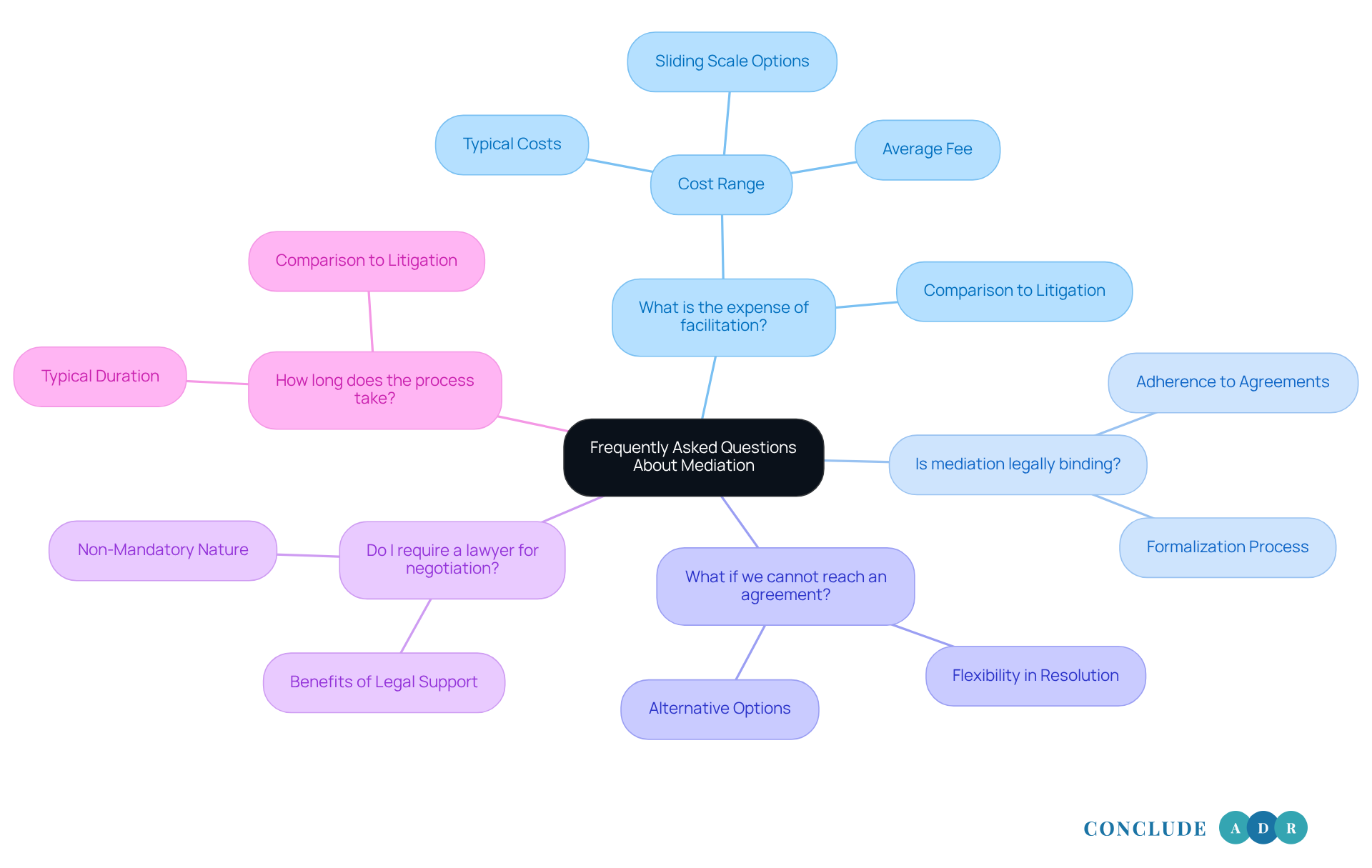

Answer Frequently Asked Questions About Mediation

-

What is the expense of facilitation?

Mediation costs can be quite manageable, typically ranging from $358 to $1,167, with an average fee around $647. This makes mediation debt collection a more affordable option compared to litigation, which can escalate to $15,000 or more. For those considering divorce, the national average cost for mediation is reported to be $643, with a low-end average of $356 and a high-end average of $1,161. Many facilitators offer flexible pricing models, including sliding scales based on income, ensuring that mediation is accessible to a wide range of clients. For example, some mediators charge tiered rates, starting at $250 for the first hour, $200 for the second hour, and $100 for each additional hour. This approach can significantly reduce overall costs, making mediation debt collection a viable option for many. -

Is mediation legally binding?

Yes, mediation agreements can become legally binding if both parties agree to formalize the terms in a written contract. This process ensures that the resolutions you reach together are enforceable in a court of law, providing a sense of security for everyone involved. When clients contribute to the agreements, they are often more inclined to adhere to them, which enhances the efficiency of the resolution process. -

What if we cannot reach an agreement?

If mediation doesn’t lead to a resolution, don’t worry-you still have options. You can pursue litigation or explore other dispute resolution methods. This flexibility allows you to seek alternative avenues for resolving conflicts without feeling trapped in one approach. -

Do I require a lawyer for negotiation?

While having a lawyer isn’t mandatory for mediation, it can be beneficial. A legal specialist can help clarify your rights and choices, ensuring you feel well-informed during the negotiation process. This support can make a significant difference in your experience. -

How long does the process take?

The duration of mediation sessions can vary, but many disputes are resolved within a few hours to a few days. Typically, most disputes can be resolved in 2 to 6 months, which is significantly faster than litigation, often taking over a year. In fact, mediation debt collection is typically 60% faster than traditional court proceedings, making it an efficient choice for conflict resolution. This efficiency is one of the key benefits of choosing mediation, allowing you to move forward more quickly.

Conclusion

Mediation in debt collection stands out as a caring and constructive alternative to traditional litigation. It opens a door for borrowers and lenders to work together in resolving their financial disputes. This process encourages open communication and empowers both parties to negotiate terms that feel satisfactory and beneficial. Ultimately, it leads to amicable resolutions that can ease financial stress.

Throughout this article, we’ve explored key insights into the mediation process. We’ve defined it, outlined the structured steps involved, and highlighted its significant advantages. With success rates climbing and real-life examples showcasing its effectiveness, it’s clear that mediation can lead to positive outcomes - like reduced debt and manageable payment plans. Plus, the cost-effectiveness and time efficiency of mediation make it an appealing option for anyone facing financial challenges.

As financial disputes become more common, embracing mediation can be a pivotal step toward regaining control over your financial situation. By choosing this compassionate approach, you can navigate your challenges with the support of a neutral mediator. This not only helps you achieve resolutions that benefit your immediate circumstances but also lays the groundwork for a healthier financial future.

So, why not consider mediation as a viable solution? It could pave the way for a brighter financial outlook, allowing you to move forward with confidence and peace of mind.

Frequently Asked Questions

What is mediation in debt collection?

Mediation in debt collection is a compassionate process where an impartial mediator facilitates discussions between borrowers and lenders to find a resolution that works for everyone involved. It encourages collaboration and open communication, allowing both parties to voice their concerns and negotiate fair terms.

How effective is mediation in resolving debt disputes?

Mediation has proven to be highly effective, with success rates in Florida increasing from 70% in 2021 to around 75% in 2023, and reports suggesting rates as high as 80% in 2025. This effectiveness often results in reduced balances, manageable payment plans, or extended deadlines for borrowers.

What are the key steps in the mediation debt collection process?

The mediation process typically includes the following steps: 1. Introduction: The facilitator explains the process and establishes ground rules. 2. Evaluation: The mediator assesses the financial situation of both parties. 3. Negotiation Strategy Development: A repayment strategy is crafted based on the debtor's capabilities. 4. Joint Negotiation: Parties engage in discussions facilitated by the mediator. 5. Private Caucuses: The mediator meets individually with each party to address sensitive issues. 6. Settlement: If an agreement is reached, it is documented and signed, making it legally binding.

How long do mediation sessions usually take?

The length of mediation sessions can vary; straightforward cases may conclude in half a day, while more complex issues might take an entire day. This efficiency is one of the key benefits of mediation compared to conventional court processes.

What impact does mediation have on a borrower's credit rating?

Participating in mediation may affect a borrower's credit rating, as it indicates previous difficulties in meeting financial responsibilities. However, mediation is often seen as less formal than court proceedings, promoting a collaborative atmosphere.

What are the advantages of mediation over litigation in debt collection?

Mediation helps avoid the confrontational nature of litigation, empowers individuals to maintain control over outcomes, and fosters collaboration. It is also a cost-effective and time-saving alternative, significantly reducing conflict and allowing for efficient dispute resolution.