Introduction

Arbitration has become an essential tool in handling insurance disputes, offering a smoother alternative to traditional litigation. It can help reduce costs and speed up resolutions, which is something many policyholders and insurers truly appreciate. But as cases grow more complex, the costs can rise, leaving many of us wondering: how can we navigate this financial landscape while still achieving fair outcomes?

This article aims to shed light on the key factors that influence arbitration costs. We’ll explore practical strategies for managing these expenses, empowering you to make informed decisions on your journey toward dispute resolution. Together, we can tackle these challenges and find a path that works for everyone involved.

Define Arbitration and Its Role in Insurance Disputes

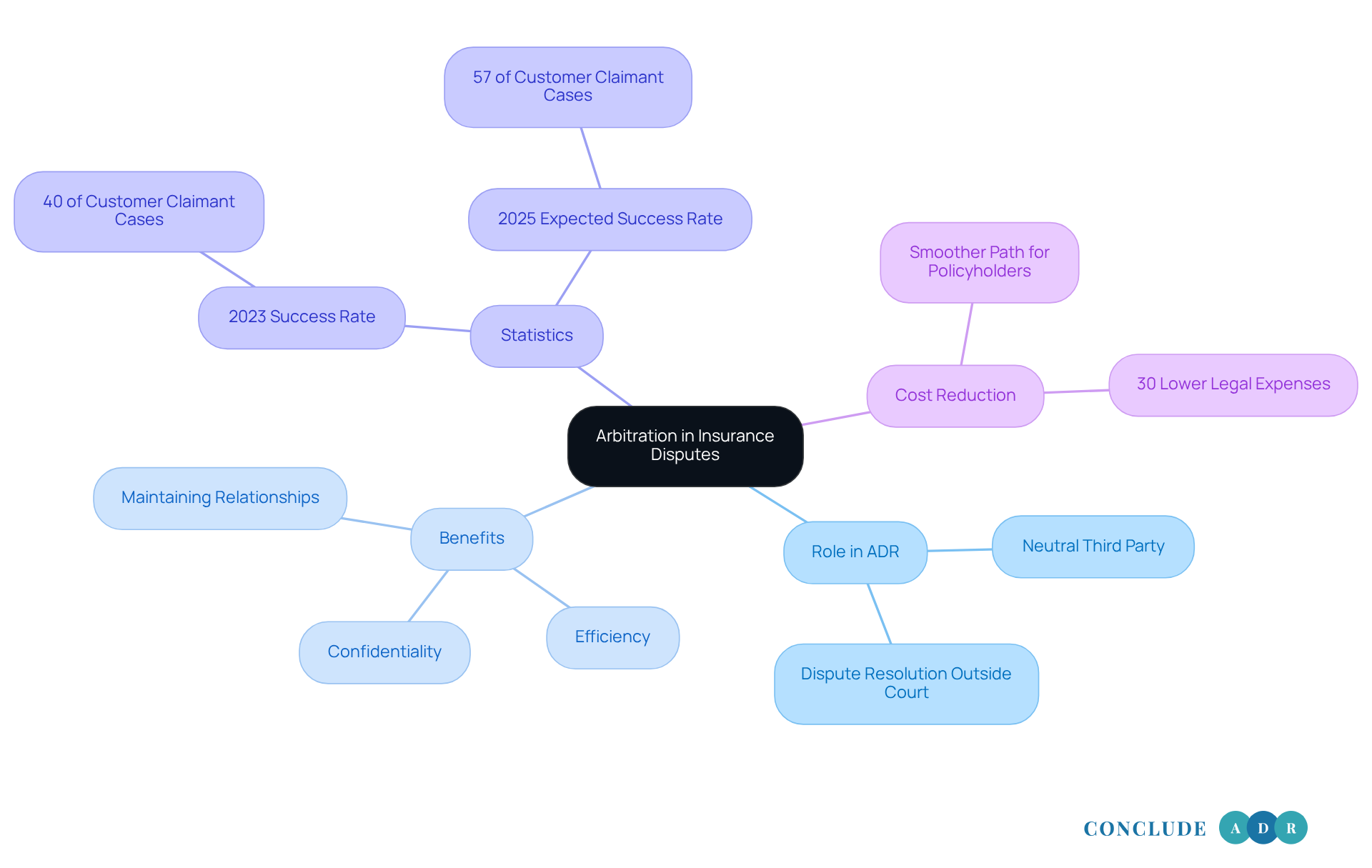

Arbitration plays a crucial role in alternative dispute resolution (ADR), where a neutral third party, known as an arbitrator, helps resolve disputes outside the traditional court system. For those navigating insurance disputes, ADR offers a smoother path for policyholders and insurers to settle disagreements about claims, coverage, and other important issues, while also reducing the insurance arbitration cost compared to lengthy and costly litigation. This approach is increasingly preferred for its efficiency, confidentiality, and the specialized knowledge of arbitrators in insurance matters.

Have you ever felt overwhelmed by the complexities of insurance claims? You're not alone. Recent statistics shed light on the effectiveness of mediation in resolving these issues. In 2023, 40% of customer claimant matters resulted in compensation, highlighting how dispute resolution can lead to positive outcomes for policyholders. Looking ahead, in 2025, 57% of customer claimant cases are expected to yield awards based on the merits, indicating a growing trend toward successful resolutions.

Experts emphasize the many advantages of mediation for insurance claims. The ability to resolve disputes quickly and confidentially allows parties to maintain their business relationships while achieving satisfactory outcomes. Additionally, the insurance arbitration cost is typically lower than traditional litigation, making it an appealing option for both policyholders and insurers. In fact, studies show that alternative dispute resolution can reduce overall legal expenses by as much as 30% compared to court proceedings.

As the landscape of insurance mediation evolves, understanding its role and the insurance arbitration cost becomes essential for those managing disputes. By embracing the benefits of dispute resolution, you can effectively navigate your claims, ensuring timely and fair outcomes. Remember, you don’t have to face this journey alone-support is available.

Explore the Costs of Arbitration: Fees and Expenses

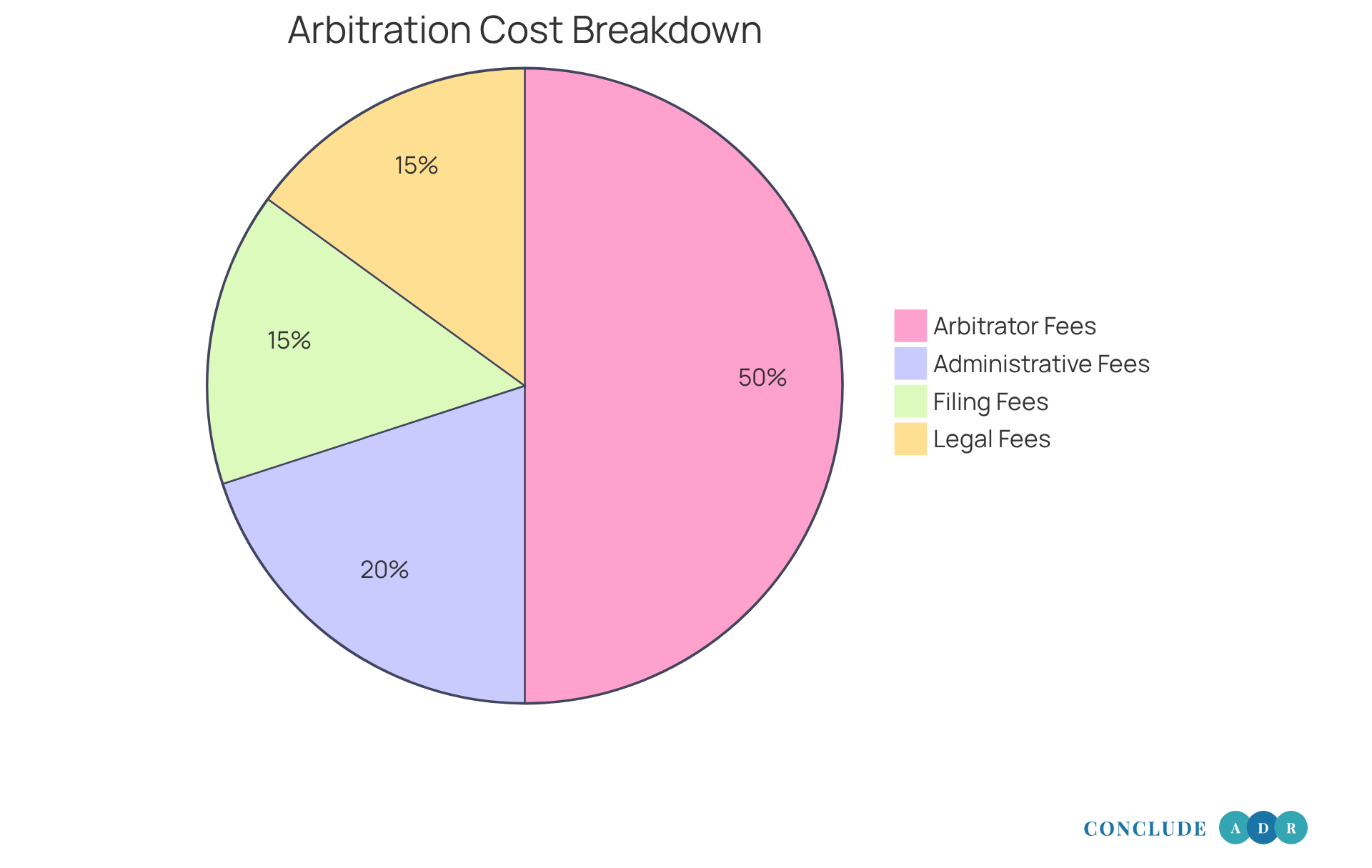

The insurance arbitration cost can be a source of worry for many when dealing with expenses in insurance disputes. They can vary greatly due to several factors, such as case complexity, the number of participants involved, and the insurance arbitration cost determined by the chosen dispute resolution institution. Let’s break down some common fees associated with arbitration:

- Filing Fees: These initial fees to start the arbitration process typically range from $750 to $3,500. The exact amount often depends on the institution and the number of parties involved.

- Arbitrator Fees: Experienced arbitrators charge hourly rates that can vary from $300 to over $1,000, depending on their qualifications and expertise.

- Administrative Fees: Additional fees may be imposed by dispute resolution organizations for processing, which can add to the overall expense.

- Legal Fees: If you choose to hire attorneys for representation during the dispute resolution process, legal fees will also be incurred.

As of 2026, the typical expense for holding a hearing stands at around $3,075, which includes various administrative and adjudicator fees. This figure reflects a shift in the financial obligations linked to dispute resolution, especially with new legislation (Act 25-131) requiring insurers to cover some of these expenses. For instance, if a claimant prevails, insurers may also be liable for a 15% annual interest on the disputed amount, retroactive to when the undisputed payment was made.

Consider this: in recent dispute resolutions, insurers have faced total outlays averaging approximately $46,125 under the updated reimbursement framework. Legislative analysts estimate that the new structure could lead to state reimbursements of about $35,000 in fiscal year 2026. Understanding the financial consequences, particularly the insurance arbitration cost, is crucial for stakeholders. It helps you prepare and evaluate whether mediation might offer a more economical option compared to traditional litigation.

Have you thought about how these changes might affect your situation? We’re here to help you navigate these complexities with care and support.

Identify Factors Affecting Arbitration Costs

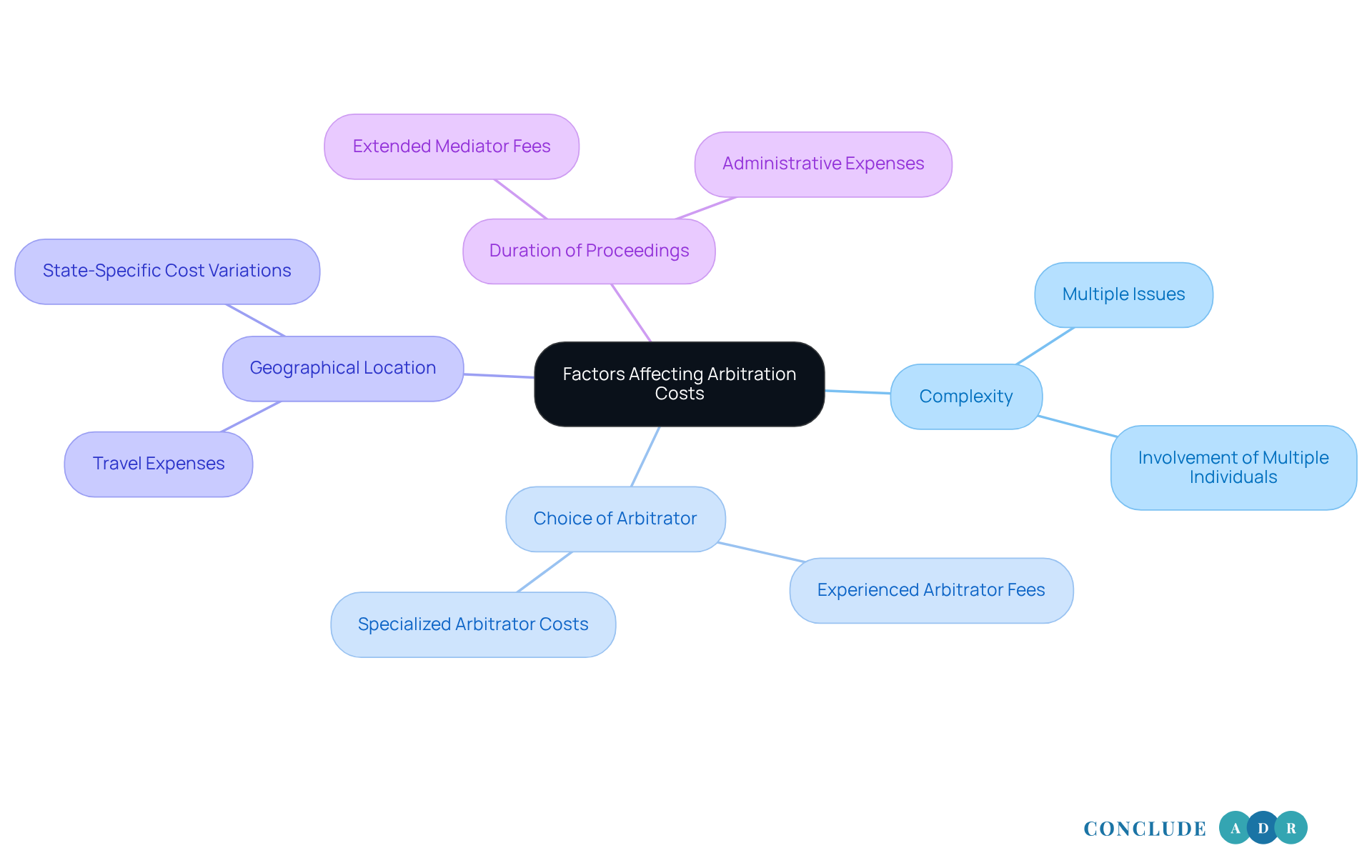

Several factors significantly influence the insurance arbitration cost, especially the complexity of the matter at hand. When situations become complicated - often involving multiple issues or individuals - the insurance arbitration cost tends to rise. This is due to the insurance arbitration cost that arises from the extra time and resources required to navigate these challenges. For instance, cases with several participants can lead to higher insurance arbitration costs, as these costs are typically shared among those involved.

The choice of arbitrator is another crucial element. Opting for a highly experienced or specialized arbitrator might come with increased fees, but their expertise can lead to more favorable outcomes. It’s essential to weigh these factors carefully.

Moreover, the geographical location of the mediation can also impact expenses, especially if travel is necessary for the arbitrator or any parties involved. For example, states like Texas and Florida have seen a notable rise in claims, which can affect the overall costs of dispute resolution.

The duration of the proceedings is directly tied to the insurance arbitration cost, as well. Lengthy resolution processes naturally incur higher insurance arbitration costs due to extended mediator fees and administrative expenses.

Understanding these elements empowers you to make informed decisions that can help manage your costs related to insurance arbitration. Did you know that the average cost to hold a hearing is around $3,075? This figure underscores the financial implications of the process. In insurance disputes, the complexity often stems from the nature of the conflicts, which may involve intricate policy interpretations, multiple claimants, and significant insurance arbitration costs. As experts in dispute resolution often say, "The complexities of a situation can significantly alter the financial environment of mediation, making it crucial for involved individuals to evaluate their circumstances thoughtfully."

By recognizing the impact of case complexity, you can strategize effectively to manage your insurance arbitration cost. Additionally, it’s worth noting that the Independent Dispute Resolution (IDR) system has added at least $5 billion to the overall health system expenses since its inception, highlighting the broader financial context surrounding dispute resolution.

In navigating these challenges together, we can find ways to alleviate the financial burden and work towards a resolution that feels right for everyone involved.

Implement Strategies to Reduce Arbitration Expenses

Managing insurance arbitration cost can feel overwhelming, but there are effective strategies that can help ease this burden.

-

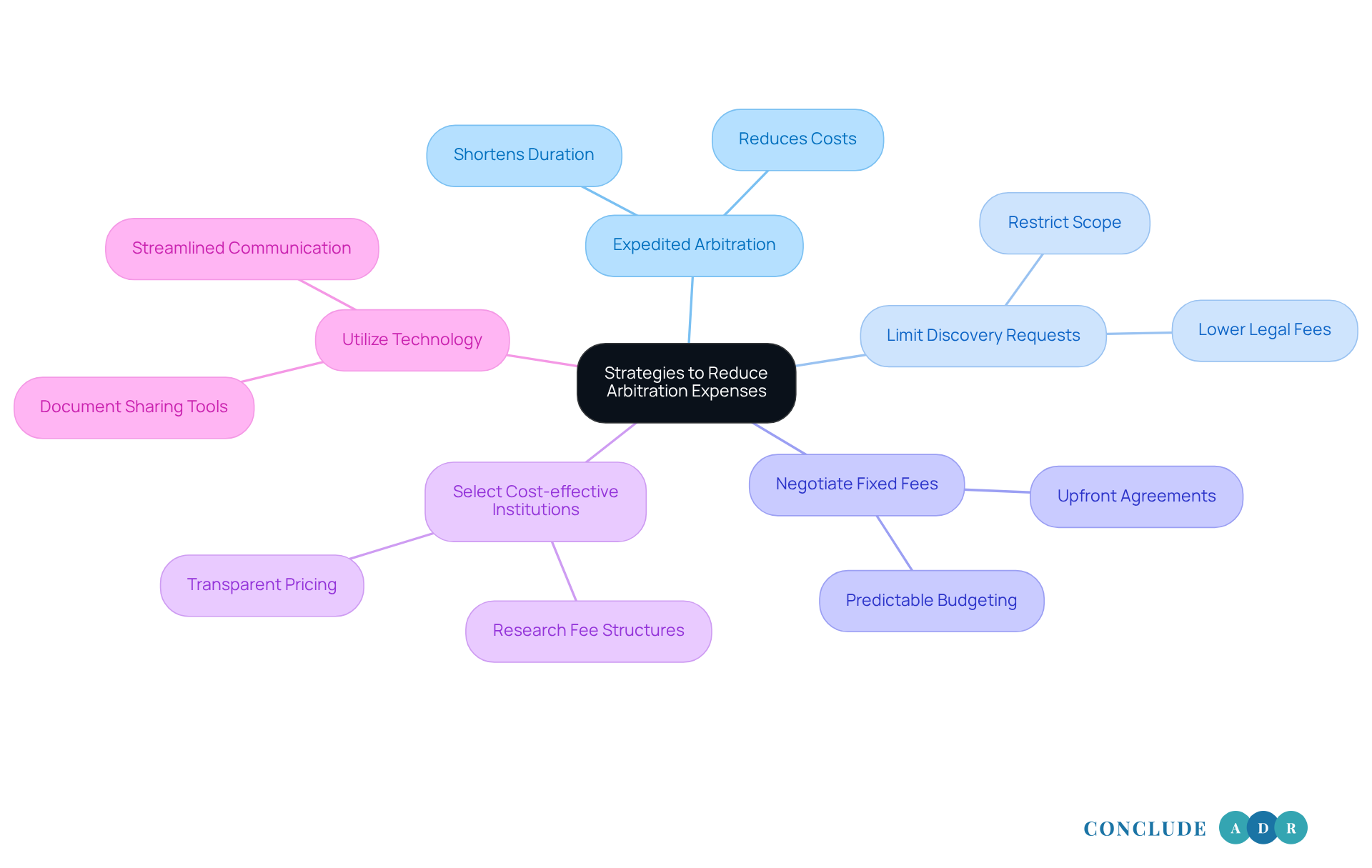

Have you considered expedited arbitration? Choosing expedited procedures can significantly shorten the duration of arbitration, which in turn reduces the insurance arbitration cost.

-

Another way to keep expenses in check is by limiting discovery requests. By agreeing to restrict the scope of discovery, you can lower legal fees and administrative expenses, thus reducing the insurance arbitration cost and making the process more manageable.

-

What if you could negotiate fixed fees? By discussing and agreeing on fixed fees for arbitrators and administrative expenses upfront, you can effectively manage your insurance arbitration cost, providing you with predictability in budgeting and allowing you to plan with confidence.

-

It's also wise to select a cost-effective dispute resolution institution. Take the time to research and choose institutions that offer competitive fee structures and transparent pricing. This can make a significant difference in your overall insurance arbitration cost.

-

Lastly, consider utilizing technology. Leveraging tools for document sharing and communication can streamline the process and reduce costs associated with physical meetings.

By implementing these strategies, you can navigate the arbitration process more efficiently and manage the insurance arbitration cost effectively. Remember, achieving fair resolutions doesn’t have to come with excessive expenses. Together, we can find a way to make this process smoother and more affordable.

Conclusion

Arbitration is a crucial tool for resolving insurance disputes, providing a smoother alternative to traditional litigation. If you’re feeling overwhelmed by the complexities of your claims, understanding the costs associated with insurance arbitration can help you navigate this process more effectively. It’s all about achieving fair and timely resolutions without breaking the bank.

Let’s take a moment to consider some key factors that influence arbitration costs. These include:

- The complexity of your case

- The choice of arbitrator

- Where you’re located

By implementing strategies like expedited arbitration, limiting discovery requests, and negotiating fixed fees, you can manage and even reduce these costs. Did you know that you could save up to 30% compared to litigation? That’s a significant benefit of choosing alternative dispute resolution methods.

The insights shared here not only clarify the financial aspects of insurance arbitration but also empower you to make informed decisions that can lead to better outcomes. By embracing these strategies and understanding the nuances of arbitration, you can transform the dispute resolution process into a more efficient and cost-effective experience.

If you’re facing an insurance dispute, consider leveraging these insights. They can pave the way for smoother resolutions and less financial strain. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Frequently Asked Questions

What is arbitration in the context of insurance disputes?

Arbitration is a form of alternative dispute resolution (ADR) where a neutral third party, known as an arbitrator, helps resolve disputes outside the traditional court system, particularly for issues related to insurance claims and coverage.

What are the benefits of using arbitration for insurance disputes?

The benefits of arbitration include efficiency, confidentiality, specialized knowledge of arbitrators in insurance matters, and a lower cost compared to lengthy litigation. It also allows parties to maintain business relationships while achieving satisfactory outcomes.

How effective is mediation in resolving insurance claims?

Recent statistics indicate that in 2023, 40% of customer claimant matters resulted in compensation through mediation. By 2025, it is expected that 57% of customer claimant cases will yield awards based on the merits, showing a growing trend toward successful resolutions.

How much can alternative dispute resolution reduce legal expenses compared to court proceedings?

Studies show that alternative dispute resolution can reduce overall legal expenses by as much as 30% compared to traditional court proceedings.

Why is it important to understand the role of arbitration and its costs in insurance disputes?

Understanding the role of arbitration and its costs is essential for effectively managing disputes, ensuring timely and fair outcomes for policyholders and insurers.