Introduction

Navigating billing disputes can feel overwhelming, can’t it? Especially when you’re faced with the complexities of the Fair Credit Billing Act (FCBA). This vital legislation is here to protect you from unfair billing practices, but it also lays out the steps to take when disagreements arise after a dispute has been resolved.

As you engage with your creditors, it’s common to feel uncertain about how to advocate for your rights and ensure your voice is heard. What should you do if you disagree with a creditor's resolution? This article will explore the intricacies of the FCBA, offering you valuable insights and actionable steps to help you take control of your billing disputes and work towards a fair outcome.

Together, we can navigate this journey, ensuring that you feel supported and informed every step of the way.

Clarify the Fair Credit Billing Act (FCBA) and Its Role in Consumer Disputes

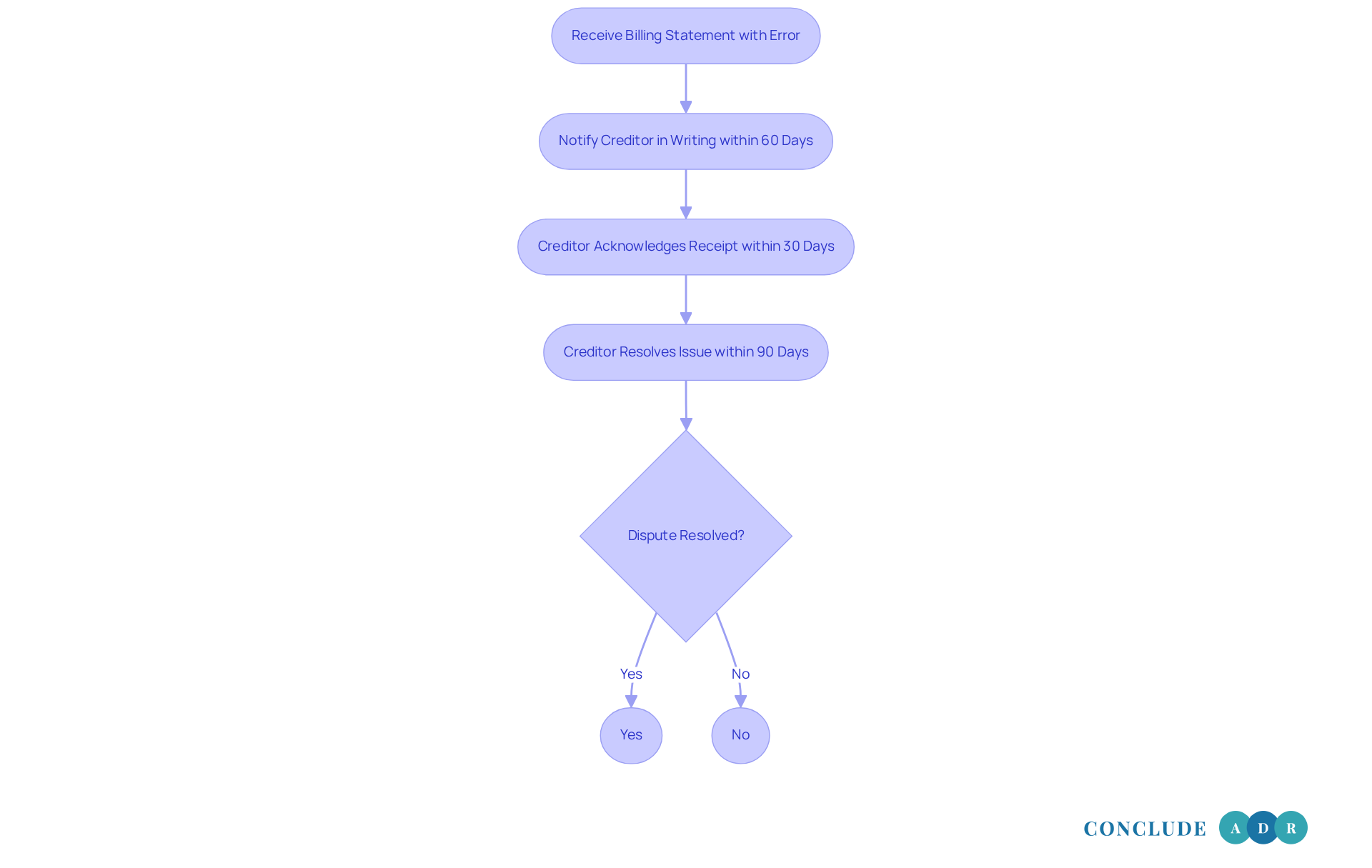

The Fair Credit Billing Act (FCBA) is a vital federal law that aims to protect you from unfair billing practices related to credit cards and revolving charge accounts. If you ever find yourself facing billing errors - like unauthorized charges or incorrect amounts - you have the right to challenge them. Just remember, you need to inform your creditors in writing within 60 days of receiving the billing statement that contains the error. As Marc Hopkins wisely points out, "You have 60 days from the date your credit card issuer mails or sends you the first billing statement containing the error to send a written letter under the Fair Credit Billing Act (FCBA)." Taking this prompt action is crucial; if you don’t contest within this timeframe, you might lose your right to a legally protected claim.

Once you file a dispute, lenders must acknowledge receipt within 30 days and resolve the issue within 90 days. This structured process not only protects you from liability for disputed charges during the investigation but also ensures that creditors fulfill their responsibilities. For instance, if you report unauthorized charges promptly, you’re only liable for a maximum of $50, which reinforces the protective measures of the act. If a violation occurs, you may even recover actual damages incurred, further enhancing your protections under the FCBA.

Did you know that E-Complish boasts over a 70% chargeback win rate? This statistic highlights how effective the FCBA can be in helping you contest billing errors successfully. Common disputes often involve shared billing errors, such as unauthorized fees or incorrect amounts, which a consumer disagrees with and can contest in writing under the FCBA dispute resolution process. Importantly, the act also prohibits lenders from negatively impacting your credit status while an inquiry is ongoing, providing you with even more security.

However, it’s essential to note that the FCBA doesn’t cover disputes regarding the quality of goods or services, which is a limitation you should keep in mind.

In summary, the FCBA establishes a clear framework for addressing billing errors, ensuring your rights are protected while holding lenders accountable. This legal framework not only empowers you but also encourages responsible practices among lenders, leading to fairer billing experiences for everyone.

Examine the Meaning of 'Dispute Resolved, Consumer Disagrees' and Its Consequences

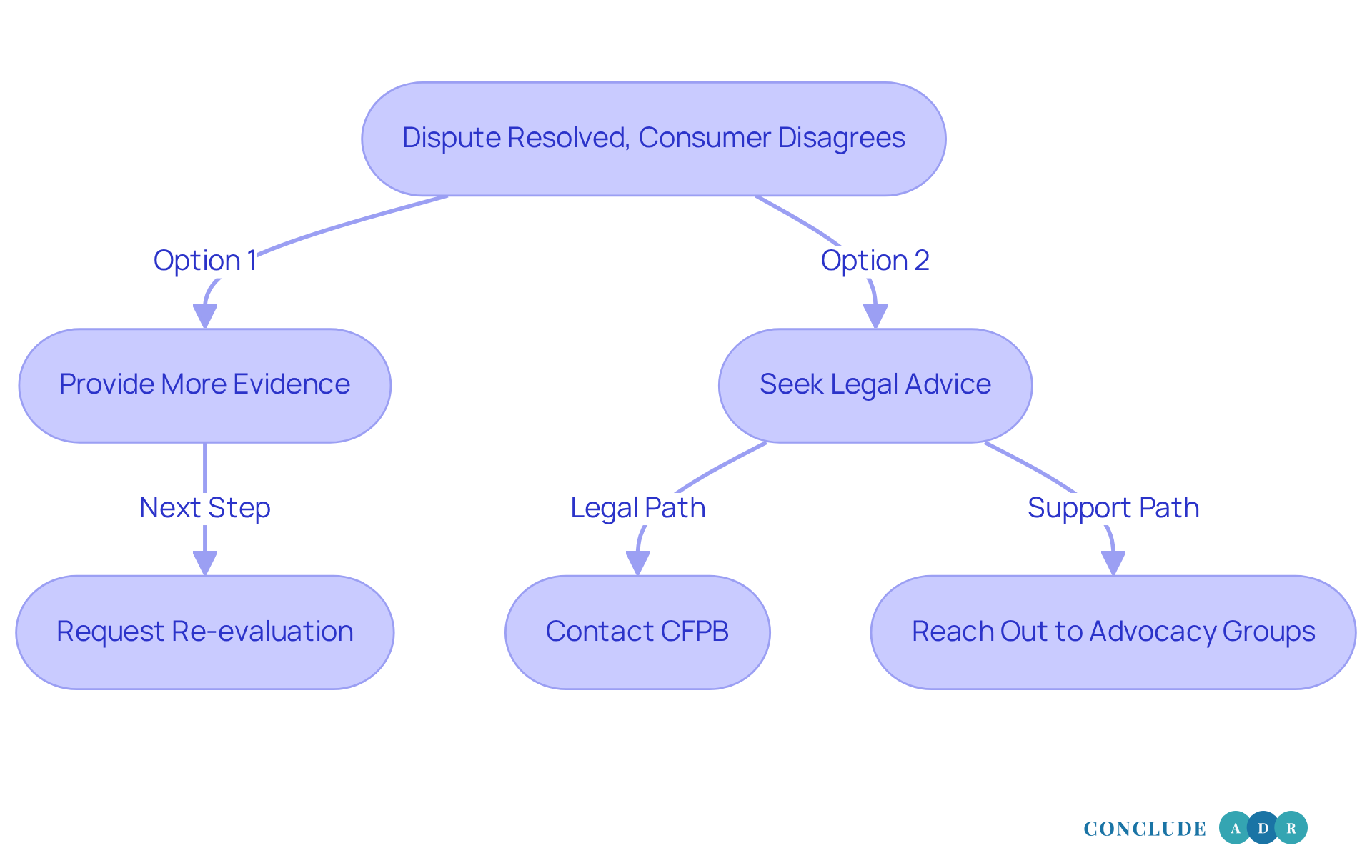

When you see 'FCBA dispute resolved consumer disagrees,' it means the creditor has looked into the charges and believes they’re valid, but you still feel differently. This notation can show up on your credit report, and it might impact your credit score and future applications. It’s important to know that you have the right to contest this finding. You can provide more evidence or ask for a re-evaluation of the situation.

If the creditor stands firm on their decision, consider reaching out to the Consumer Financial Protection Bureau (CFPB) or seeking legal advice. Did you know that over half of consumers feel they can’t convince reporting agencies to fix known mistakes? Many give up out of frustration or simply because they don’t have the time. This highlights how crucial it is to engage proactively; if you don’t act, that negative mark could linger on your credit report indefinitely, making it harder to access loans and credit.

Think about it: when lenders see 'fcba dispute resolved consumer disagrees,' they might question the accuracy of your account, which can affect your borrowing capacity until everything is sorted out. So, it’s vital to keep a detailed record of every interaction you have. If your initial efforts don’t yield results, consider reaching out to advocacy groups for additional support.

And remember, the law requires companies to cover legal fees, meaning you won’t have to worry about costs when seeking legal help. This can ease your concerns about getting the assistance you need.

Outline Next Steps for Consumers After Dispute Resolution

If you've found yourself in a situation where a fcba dispute has been resolved but you still disagree, it’s important to know that you’re not alone. Here are some steps you can take to navigate this challenging experience:

-

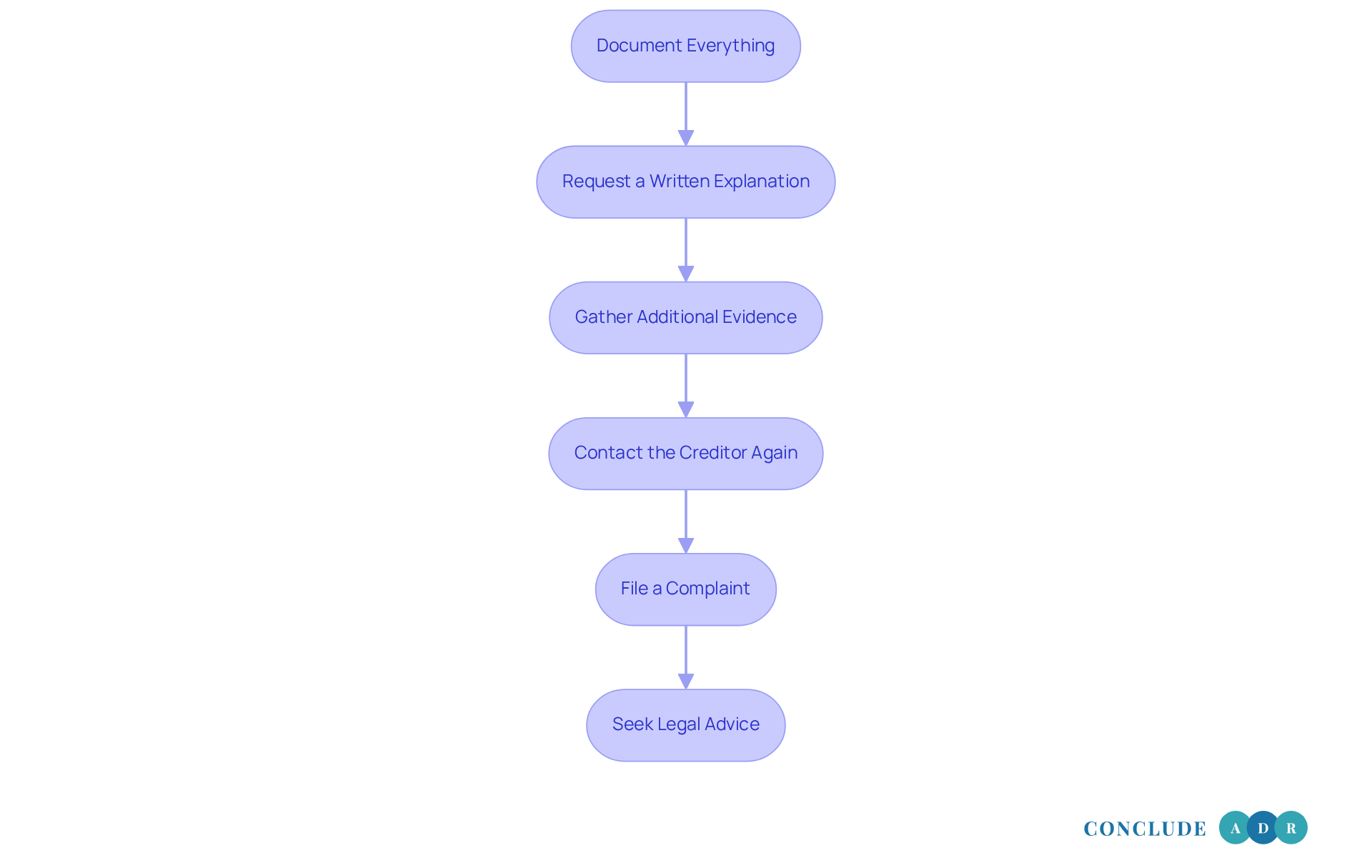

Document Everything: Start by keeping a detailed record of all your communications with the lender. Note down dates, times, and the names of the representatives you spoke with. This will help you stay organized and informed.

-

Request a Written Explanation: Don’t hesitate to ask the lender for a clear, written account of their findings. Understanding the evidence they used to reach their conclusion can provide you with valuable insights.

-

Gather Additional Evidence: If you have any further documentation that supports your claim, gather it. This additional evidence can strengthen your position and help clarify your perspective.

-

Contact the Creditor Again: Reach out to the creditor once more. Present your additional evidence and kindly request a re-evaluation of the issue. It’s important to advocate for yourself in this process.

-

File a Complaint: If the issue still isn’t resolved, consider filing a complaint with the CFPB or your state’s attorney general. This step can help escalate your concerns and prompt further action.

-

Seek Legal Advice: If you feel overwhelmed, consulting with a legal expert who specializes in client rights can be a wise move. They can help you explore additional options and provide guidance tailored to your situation.

Remember, you deserve to have your concerns heard and addressed. Taking these steps can empower you to seek the resolution you need.

Implement Strategies to Strengthen Future Dispute Resolutions

To enhance the effectiveness of future dispute resolutions, we can adopt several key strategies that truly make a difference:

-

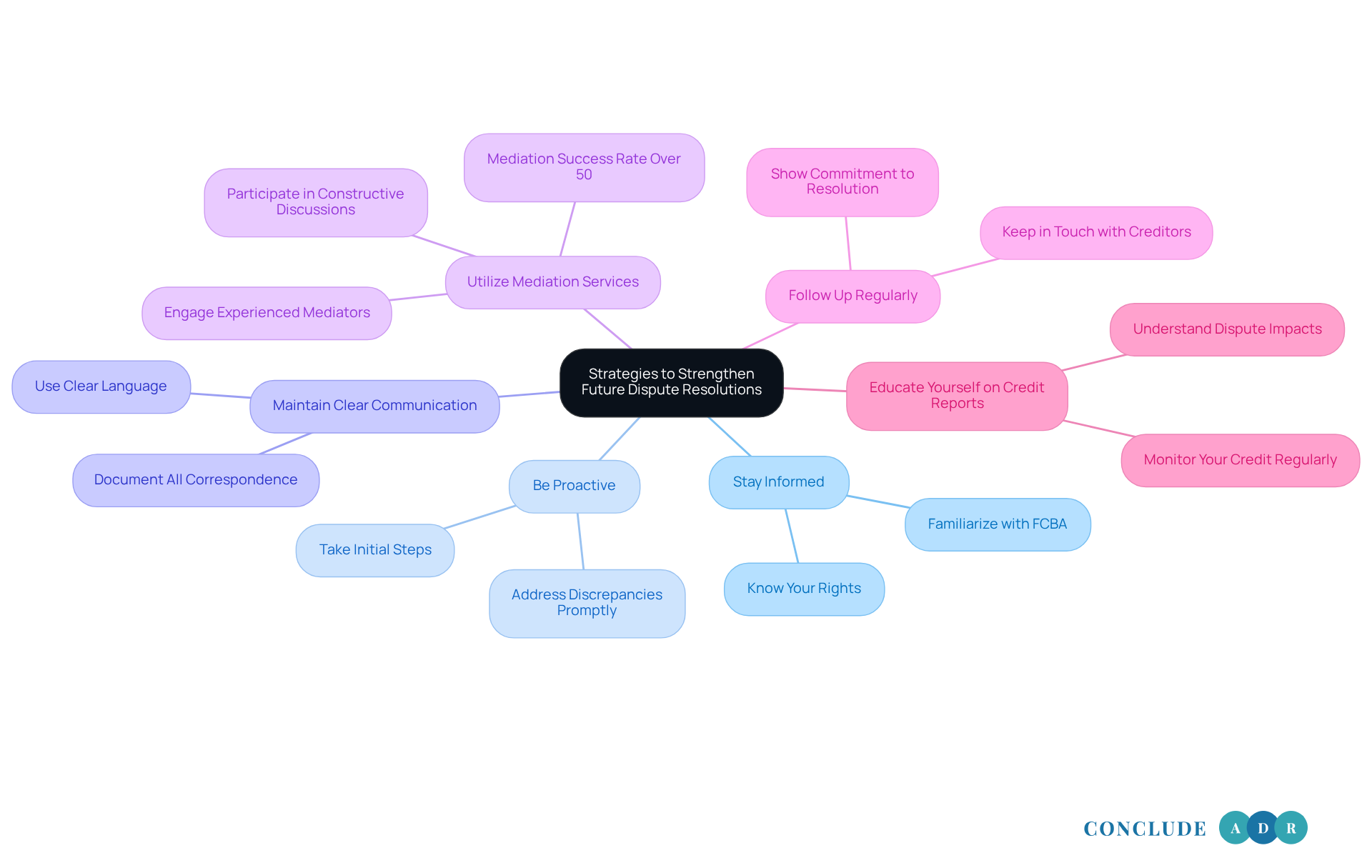

Stay Informed: It’s essential to familiarize yourself with your rights under the Fair Credit Billing Act (FCBA) and other protection laws. This knowledge empowers you to make informed decisions.

-

Be Proactive: Addressing billing discrepancies promptly can prevent escalation. Did you know that proactive consumers often resolve issues, especially when it comes to an FCBA dispute resolved if the consumer disagrees? Taking that first step can lead to positive outcomes.

-

Maintain Clear Communication: When communicating with lenders, use clear and concise language. Document all correspondence for reference; it’s a small step that can make a big difference in your case.

-

Utilize Mediation Services: Engaging mediation services, like those offered by Conclude ADR, can facilitate constructive discussions with lenders. Their seasoned mediators and arbitrators bring decades of expertise, ensuring impartial facilitation and tailored solutions. In fact, mediation has proven effective, with over 50% of FCBA disputes resolved even when the consumer disagrees through these sessions. Isn’t it comforting to know there’s a path to resolution?

-

Follow Up Regularly: Keeping in touch with creditors during the conflict process is crucial. Regular communication ensures your case is being managed in a timely manner, and it shows your commitment to resolving the issue.

-

Educate Yourself on Credit Reports: Understanding how disputes can impact your credit report is vital. By monitoring your credit regularly, you can stay aware of any changes and take proactive steps to protect your financial health.

Remember, you’re not alone in this process. By taking these steps, you’re not just addressing issues; you’re empowering yourself to navigate the complexities of dispute resolution with confidence.

Conclusion

Understanding the Fair Credit Billing Act (FCBA) is crucial for anyone facing billing disputes. This legislation not only protects your rights against unfair billing practices but also lays out the steps to take when disagreements linger after a dispute seems resolved. By staying informed and proactive, you can effectively advocate for yourself and work toward a fair resolution.

Have you ever felt overwhelmed by a billing issue? You're not alone. Throughout this article, we've highlighted key points like the importance of timely communication with creditors, the need for thorough documentation, and how unresolved disputes can impact your credit score. Remember, even if a creditor believes a dispute is resolved, you still have the right to contest that finding and seek further clarification or support. Engaging with resources like the Consumer Financial Protection Bureau or considering legal advice can open up additional paths for resolution.

The journey through billing disputes can feel daunting, but you don’t have to face it alone. Approach this process with confidence and knowledge. By implementing strategies such as staying informed about your rights, maintaining clear communication, and utilizing mediation services, you can empower yourself to navigate these challenges effectively.

Taking charge of your financial well-being starts with understanding your rights under the FCBA. Remember, you deserve to pursue the resolutions that are right for you. Let's take this journey together, ensuring that your voice is heard and your rights are upheld.

Frequently Asked Questions

What is the Fair Credit Billing Act (FCBA)?

The Fair Credit Billing Act (FCBA) is a federal law designed to protect consumers from unfair billing practices related to credit cards and revolving charge accounts.

What should I do if I find a billing error on my credit card statement?

You should inform your creditors in writing within 60 days of receiving the billing statement that contains the error.

What happens if I don't contest a billing error within the 60-day timeframe?

If you don't contest the error within this timeframe, you may lose your right to a legally protected claim.

What is the process after I file a dispute under the FCBA?

Once you file a dispute, lenders must acknowledge receipt within 30 days and resolve the issue within 90 days.

What protections do I have while my dispute is being investigated?

You are protected from liability for disputed charges during the investigation, and if you report unauthorized charges promptly, you are only liable for a maximum of $50.

Can I recover damages if my rights under the FCBA are violated?

Yes, if a violation occurs, you may recover actual damages incurred under the FCBA.

What types of disputes can be addressed under the FCBA?

Common disputes include unauthorized fees or incorrect amounts on billing statements, which can be contested in writing.

Does the FCBA protect my credit status during a dispute?

Yes, the act prohibits lenders from negatively impacting your credit status while an inquiry is ongoing.

Are there any limitations to the FCBA?

Yes, the FCBA does not cover disputes regarding the quality of goods or services.

How effective is the FCBA in helping consumers contest billing errors?

The FCBA has a high success rate, with E-Complish reporting over a 70% chargeback win rate, indicating its effectiveness in helping consumers contest billing errors.