Overview

Debt resolution services play a vital role in supporting individuals and companies as they navigate their financial challenges. By negotiating with creditors to lower debts and restructure payment plans, these services provide alternatives to bankruptcy that can significantly ease financial burdens. Have you ever felt overwhelmed by your debts? You're not alone. Many people face similar struggles, and that's where these services come in.

These services not only help alleviate financial stress but also promote economic stability. Imagine feeling the weight of your debt lifted, with reduced debt loads and lower monthly payments. This can lead to improved emotional well-being, allowing you to focus on what truly matters in life. Ultimately, these services empower clients to regain control over their financial futures.

If you're feeling uncertain about your financial situation, consider reaching out for support. You deserve to feel secure and confident in your financial decisions. Together, we can explore the options available to you and find a path that leads to peace of mind.

Introduction

In a time when financial burdens can feel overwhelming for many households, understanding debt resolution services is not just beneficial; it’s essential. These services can serve as a lifeline for both individuals and businesses, offering compassionate strategies to negotiate with creditors, reduce outstanding debts, and ultimately regain financial stability. But with so many options available, how can you find the most effective path to relief?

Exploring the nuances of debt resolution services reveals their vital role in alleviating monetary stress. It’s important to recognize the critical decisions that can shape your financial future. Let’s navigate this journey together, understanding that support is available to help you through these challenging times.

Define Debt Resolution Services and Their Purpose

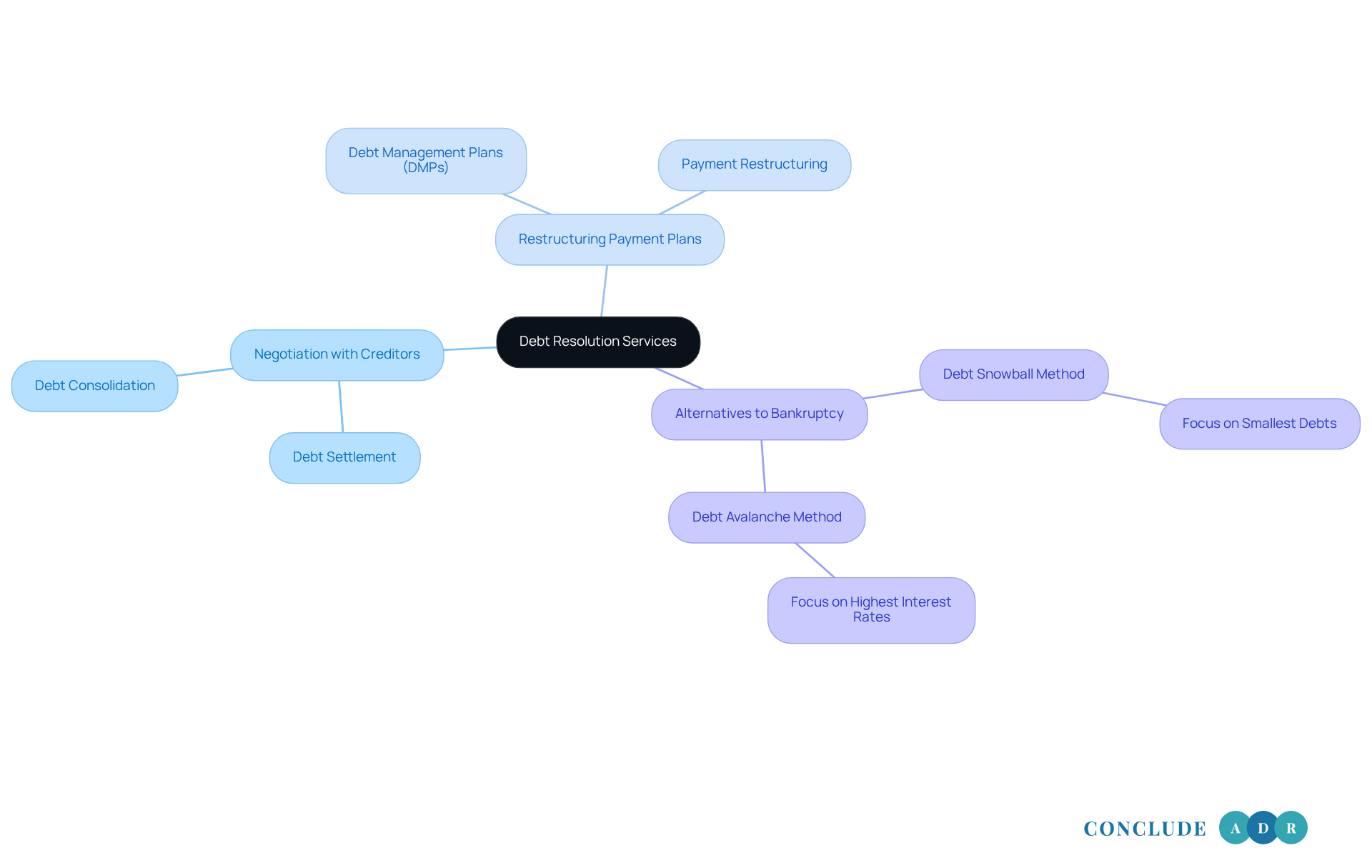

Debt resolution services encompass a range of compassionate approaches aimed at helping individuals and companies navigate and alleviate their financial burdens. These debt resolution services focus on negotiating with creditors to lower the total amount owed, restructuring payment plans, and providing alternatives to bankruptcy. The main goal of financial settlement is to relieve monetary stress and restore stability, empowering you to take control of your financial situation. By fostering open communication between borrowers and lenders, these solutions promote mutually beneficial arrangements that can significantly ease your overall financial burden.

In 2025, approximately 77% of U.S. households are grappling with credit card debt, highlighting the urgent need for effective resolution options. Financial advisors emphasize the importance of debt resolution services, as they provide essential support for those facing serious financial challenges. Have you ever felt overwhelmed by your financial obligations? Successful case studies illustrate the power of negotiation strategies, like the snowball and avalanche methods, which prioritize payments based on either the smallest balances or the highest interest rates. These methods not only aid in managing debts but also cultivate a sense of achievement as you witness your liabilities decrease over time.

Ultimately, debt resolution services are essential in guiding individuals through their economic hardships, offering pathways to a more stable and manageable financial future. Remember, you're not alone in this journey; there are solutions available to help you regain control and find peace of mind.

Context and Importance of Debt Resolution in Financial Recovery

In recent years, the importance of financial resolution assistance has grown significantly, particularly as economic pressures weigh heavily on both individuals and companies. With living expenses on the rise and unexpected monetary challenges becoming increasingly common, many are finding it harder to meet their repayment responsibilities. These debt resolution services offer crucial support by providing organized solutions that can help prevent the escalation of financial distress. Have you ever felt overwhelmed by your financial obligations? Proactive financial management can be a lifeline, assisting individuals in avoiding serious outcomes like bankruptcy, which not only devastates credit scores but also has lasting effects on financial well-being.

As of the second quarter of 2025, Americans owe approximately $1.209 trillion in credit card debt, with the average individual carrying 13% more credit card liabilities than the previous year, totaling $5,474 per person. This reality underscores the urgent need for effective financial management strategies.

Moreover, debt resolution services play a vital role in fostering overall economic stability. By helping consumers regain their financial footing, debt resolution services play a vital role in contributing to a healthier economy. When individuals manage their financial obligations effectively, they are better positioned to participate in the economy, promoting growth and stability. As Angelica Leicht wisely notes, instead of viewing consistent inflation as a reason to delay addressing obligations, it should be seen as an opportunity to tackle high-rate responsibilities while other economic pressures remain manageable.

The current economic landscape, characterized by persistent inflation and potential Federal Reserve rate reductions, presents a unique opportunity for individuals to seek financial relief. This context highlights the importance of financial recovery options as a crucial choice for those facing significant economic pressures. Together, we can navigate these challenges, ultimately supporting both individuals and the broader economy.

Types of Debt Resolution Services and Their Characteristics

Debt resolution services can be classified into several types, each possessing unique characteristics that may align with your current situation.

-

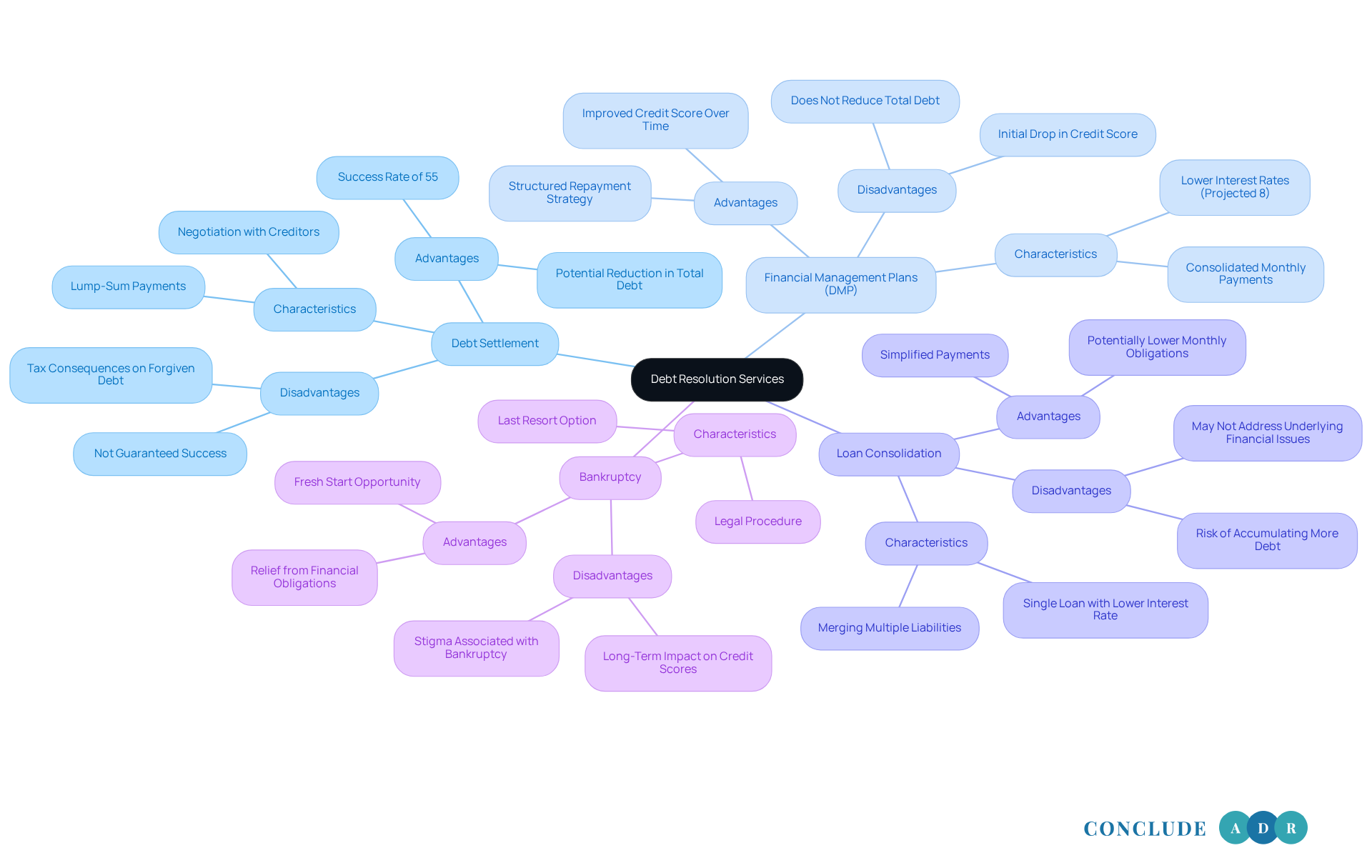

Debt Settlement: This approach involves negotiating with creditors to reduce the total amount owed. Often, clients stop making payments to creditors and instead save funds to provide a lump-sum payment, resolving their obligation for less than the total amount. It's worth noting that debt relief companies successfully settle about 55% of accounts, which highlights the potential effectiveness of this method.

-

Financial Management Plans (DMP): Offered by credit counseling organizations, DMPs create a structured repayment strategy that consolidates various obligations into a single monthly payment, often at a lower interest rate. As we look ahead to 2025, average interest rates for DMPs are projected to be around 8%, based on current trends and projections.

-

Loan Consolidation: This method merges several liabilities into a single loan, ideally with a lower interest rate. This can simplify payments and potentially lower your monthly obligations, making it easier to manage your finances.

-

Bankruptcy: While not a resolution option in itself, bankruptcy is a legal procedure that can provide relief from financial obligations. It should be considered a last resort due to its long-term impact on your credit scores.

Each of these debt resolution services comes with its own set of advantages and disadvantages. For instance, while financial settlement can lead to significant decreases in overall liabilities, it may also carry risks, such as potential tax consequences on forgiven sums. On the other hand, DMPs offer organized repayment but may not lower the overall amount owed.

Financial advisors emphasize the importance of understanding these distinctions to make informed choices regarding financial settlement. As Barry Cripps wisely observes, indebtedness is both a monetary and emotional strain. Recognizing this aspect can be crucial in selecting the right path toward economic recovery.

Remember, you're not alone in this journey, and taking the time to explore your options can lead to a brighter financial future.

Benefits and Outcomes of Engaging Debt Resolution Services

Engaging debt resolution services can lead to numerous benefits, including:

-

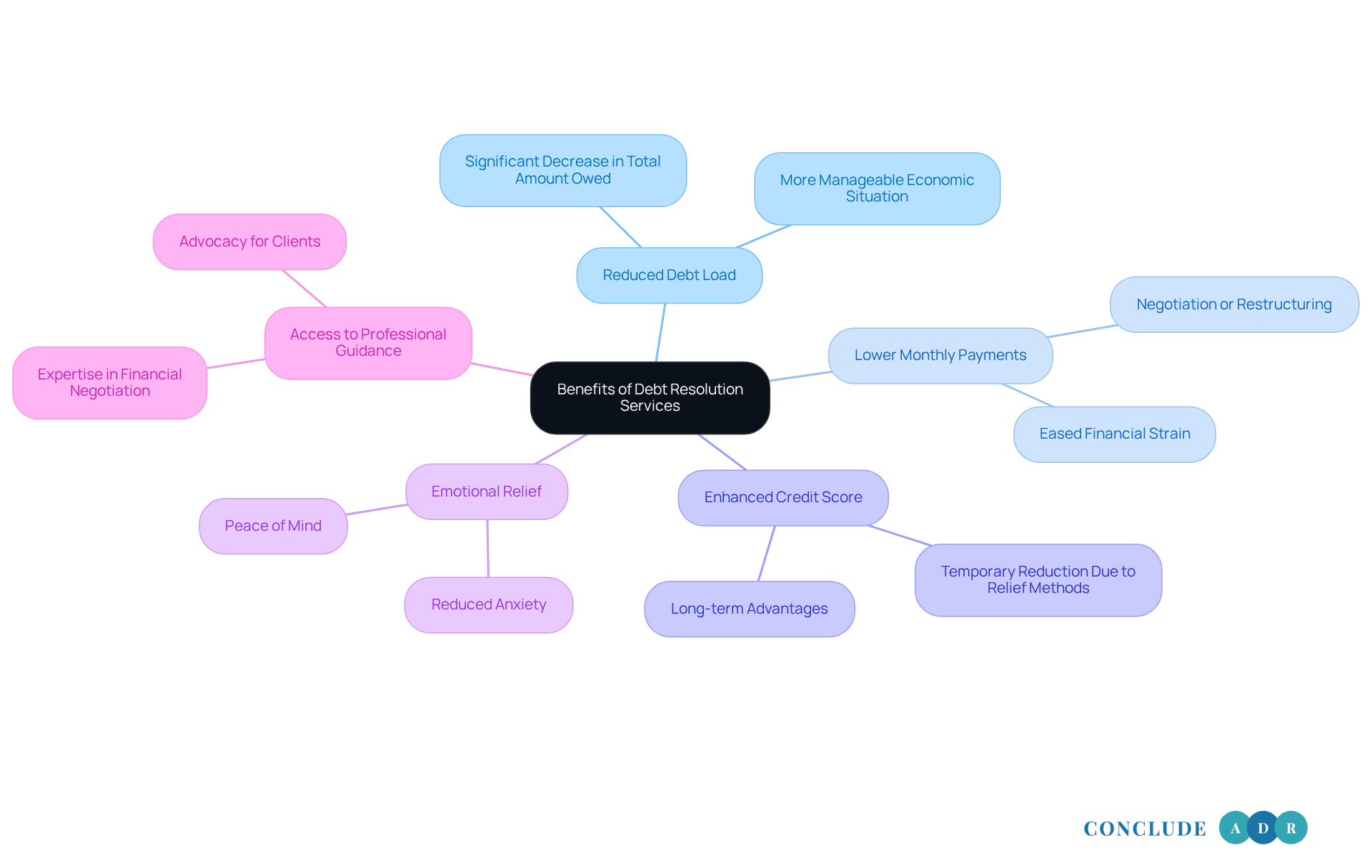

Reduced Debt Load: Many clients experience a significant decrease in the total amount owed, allowing for a more manageable economic situation. This is especially important given that total household liabilities in the U.S. reached $17.05 trillion in early 2023, with a rise of $2.9 trillion since the end of 2019. This highlights the urgent need for effective financial management.

-

Lower Monthly Payments: Through negotiation or restructuring, clients often find that their monthly payments are reduced, easing financial strain. This adjustment allows individuals to allocate resources more effectively toward essential expenses.

-

Enhanced Credit Score: Although early effects may be unfavorable, effectively addressing financial obligations can lead to enhanced credit scores over time. It’s essential to understand that certain financial relief methods may temporarily reduce credit scores, but the long-term advantages can surpass these initial disadvantages.

-

Emotional Relief: The pressure of unmanageable financial obligations can take a toll on mental health. Debt resolution services offer a systematic approach to tackling monetary problems, leading to peace of mind and reduced anxiety. As Barry Cripps observed, "Obligation is not merely a monetary vulnerability, it’s also an emotional one." This emphasizes the importance of tackling the emotional weight of obligation.

-

Access to Professional Guidance: Clients benefit from the expertise of professionals who understand the intricacies of financial negotiation and can advocate on their behalf. This guidance is invaluable, particularly for those who may lack the knowledge or confidence to address their monetary issues independently.

Overall, utilizing debt resolution services can greatly enhance your economic well-being and stability. It paves the way for a more secure monetary future. Real-world examples illustrate that those who have utilized these services often report not only improved financial conditions but also a renewed sense of hope and control over their financial lives. For instance, Earl Wilson's categorization of consumers into 'haves', 'have-nots', and those who haven't paid for what they have emphasizes the prevalence of debt and the importance of seeking resolution.

Conclusion

Debt resolution services are invaluable allies that help individuals and businesses reclaim control over their financial situations. By emphasizing negotiation and structured repayment plans, these services pave the way out of debt, offering relief and stability in an increasingly challenging economic landscape.

Have you ever felt overwhelmed by debt? The article explores various types of debt resolution services, including:

- Debt settlement

- Financial management plans

- Loan consolidation

- Bankruptcy

Each option comes with its own set of advantages and challenges, highlighting the importance of understanding your choices thoroughly. With many individuals facing credit card debt, the significance of these services becomes even clearer. They not only lighten financial burdens but also contribute to the overall health of our economy.

Ultimately, engaging with debt resolution services is not just about crunching numbers; it’s about reclaiming your peace of mind and nurturing your emotional well-being. As you confront your financial obligations, you have the power to transform your circumstances and enhance your quality of life. Seeking assistance is a proactive step toward a brighter financial future, reminding us of the vital role these services play in navigating the complexities of personal finance.

Frequently Asked Questions

What are debt resolution services?

Debt resolution services are approaches designed to help individuals and companies manage and alleviate their financial burdens by negotiating with creditors, restructuring payment plans, and providing alternatives to bankruptcy.

What is the main goal of debt resolution services?

The main goal is to relieve monetary stress and restore financial stability, empowering individuals to take control of their financial situation.

How do debt resolution services benefit borrowers and lenders?

These services promote open communication and mutually beneficial arrangements between borrowers and lenders, which can significantly ease the overall financial burden for borrowers.

What percentage of U.S. households were dealing with credit card debt in 2025?

Approximately 77% of U.S. households were grappling with credit card debt in 2025.

Why do financial advisors emphasize debt resolution services?

Financial advisors highlight the importance of these services as essential support for individuals facing serious financial challenges.

What are the snowball and avalanche methods in debt management?

The snowball method prioritizes payments based on the smallest balances, while the avalanche method focuses on paying off debts with the highest interest rates. Both methods help in managing debts and provide a sense of achievement as liabilities decrease.

How can debt resolution services guide individuals through financial hardships?

They offer pathways to a more stable and manageable financial future, helping individuals regain control and find peace of mind during challenging economic times.