Introduction

As consumer debt continues to rise, projected to hit a staggering $18.33 trillion by mid-2025, it’s clear that many are feeling overwhelmed. This situation underscores the urgent need for effective financial resolution strategies that truly understand your concerns.

Debt mediation services stand out as a compassionate resource, offering a collaborative alternative to the often stressful paths of litigation and bankruptcy. By fostering open communication between borrowers and lenders, these services not only help you regain control over your financial situation but also nurture healthier relationships within the economic landscape.

How can debt mediation transform the way you navigate your financial obligations? What unique benefits does it offer in our increasingly complex economic environment?

Consider this:

- Empowerment: You take an active role in resolving your debt.

- Collaboration: Build a bridge between you and your lenders.

- Support: Access guidance tailored to your unique situation.

In a world where financial stress can feel isolating, debt mediation offers a path forward that prioritizes your well-being. Let’s explore how this approach can not only ease your burdens but also help you foster a more positive relationship with your finances.

Define Debt Mediation Services

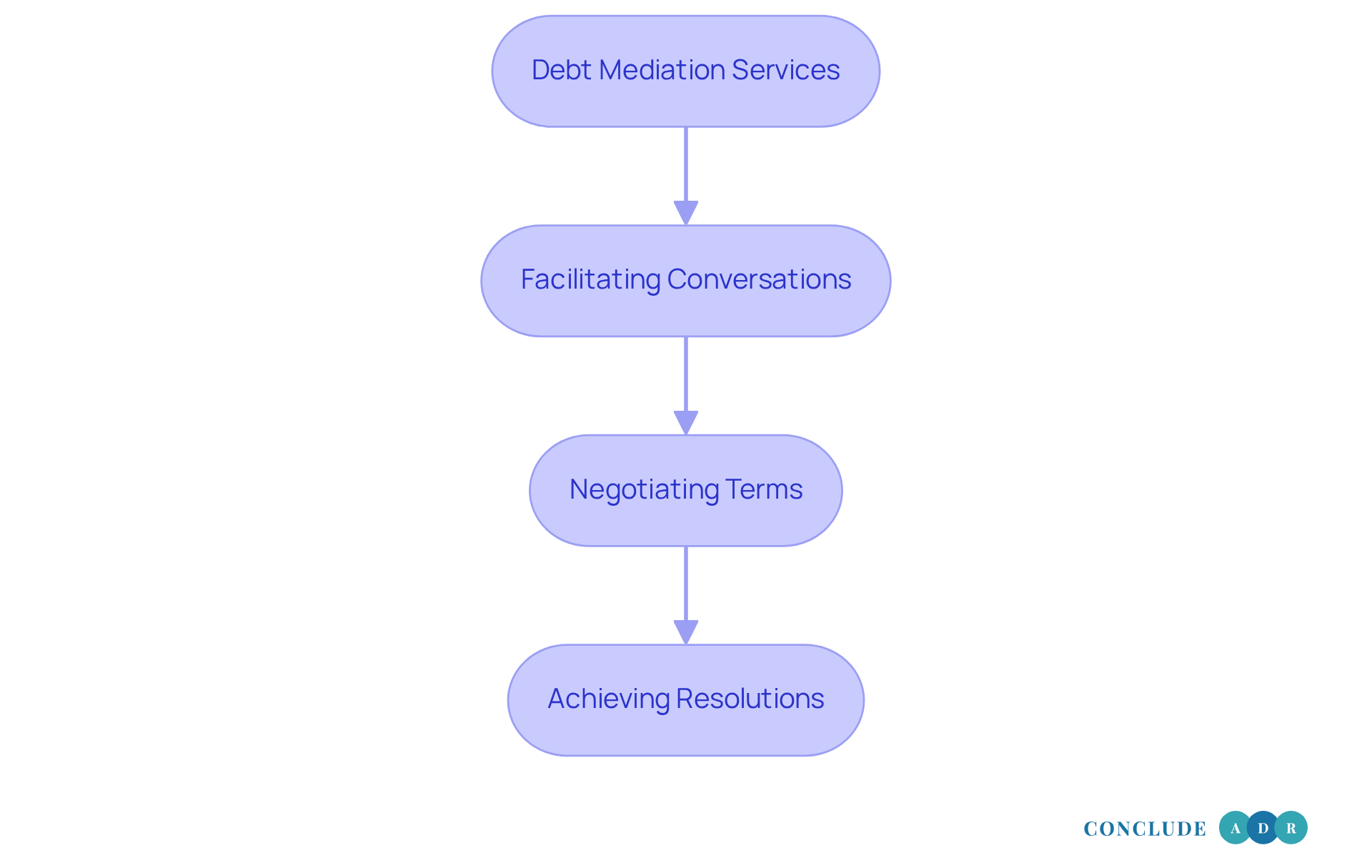

At Conclude ADR, we understand that navigating financial obligations can be overwhelming. Our debt mediation services provide a structured method where our impartial mediators facilitate conversations between borrowers and lenders, aiming for a mutually beneficial resolution. Unlike traditional settlement methods that may involve aggressive tactics or legal actions, our approach prioritizes collaboration and open communication.

Our seasoned mediators, with decades of experience in alternative dispute resolution, play a vital role in helping both parties express their needs and concerns. This nurturing environment ultimately guides them toward a solution that satisfies everyone involved. Whether it’s negotiating lower payments, restructuring financial terms, or creating a repayment plan tailored to the borrower’s unique situation, our debt mediation services are designed to support you.

The effectiveness of financial negotiation is evident in the statistics: a significant percentage of borrowers successfully settle their obligations through this compassionate approach. For instance, in 2024, 45% of customer claimant cases resulted in compensation, showcasing the potential for positive outcomes in settlement environments. These successful loan negotiations not only alleviate monetary strain but also foster positive relationships between borrowers and lenders.

Financial specialists emphasize the importance of financial negotiation in resolving conflicts. It not only helps individuals regain control over their finances but also promotes a friendlier resolution process. By acting as a bridge between borrowers and lenders, Conclude ADR enhances the likelihood of achieving feasible and lasting agreements through debt mediation services, ultimately contributing to improved economic well-being for all parties involved.

Additionally, our flexible scheduling options and streamlined booking process ensure that you can access our services conveniently, accommodating urgent or complex disputes effectively. We’re here to help you navigate this journey with care and understanding.

Context and Importance of Debt Mediation

The increasing burden of consumer obligations is a pressing concern for many, highlighting the urgent need for effective resolution strategies. With U.S. consumer debt soaring to $18.33 trillion by mid-2025-a 3.2% rise from $17.76 trillion in June 2024-it’s clear that debt mediation services have become a vital resource in our current economic landscape. Conflict resolution offers a compassionate alternative to adversarial methods like litigation or bankruptcy, allowing individuals and businesses to negotiate manageable repayment solutions without the stigma or long-term repercussions that bankruptcy can bring. After all, who wants to face the stress of a severely impacted credit score and uncertain financial future?

Debt mediation services not only pave the way for a more amicable resolution but also nurture relationships between debtors and creditors. By fostering a collaborative environment, conflict resolution encourages open communication, leading to more sustainable agreements. For instance, creditors who engage in negotiation often report higher recovery rates and fewer disputes. In fact, statistics show that these processes can enhance recovery rates by up to 70%. Isn’t it reassuring to know that there are mutual benefits to this approach?

In 2025, we’ve seen a significant increase in the number of consumers turning to conflict resolution for monetary disputes, with reports indicating a 25% rise in usage compared to the previous year. Case studies reveal that borrowers frequently experience lowered balances and structured payment plans through negotiation, alleviating the stress of constant collection calls and potential legal actions. This cooperative strategy not only reduces defaults but also contributes to a more stable economic ecosystem.

The advantages of debt mediation services extend beyond personal instances; they have a broader impact on our economic system. By decreasing the number of bankruptcies and promoting responsible repayment practices, debt mediation services play a crucial role in maintaining economic stability. As more individuals recognize the benefits of alternative dispute resolution over litigation and bankruptcy, it’s becoming an increasingly favored option for settling monetary disagreements. With roughly 46% of Americans currently holding credit card balances, the importance of resolution services in addressing these prevalent financial challenges cannot be overstated.

Key Benefits of Conflict Resolution:

- Preserves relationships between debtors and creditors.

- Enhances recovery rates for creditors.

- Reduces stress for borrowers.

- Contributes to economic stability.

So, if you find yourself overwhelmed by debt, remember that there are compassionate options available. Let’s explore these together and find a path that works for you.

How Debt Mediation Works

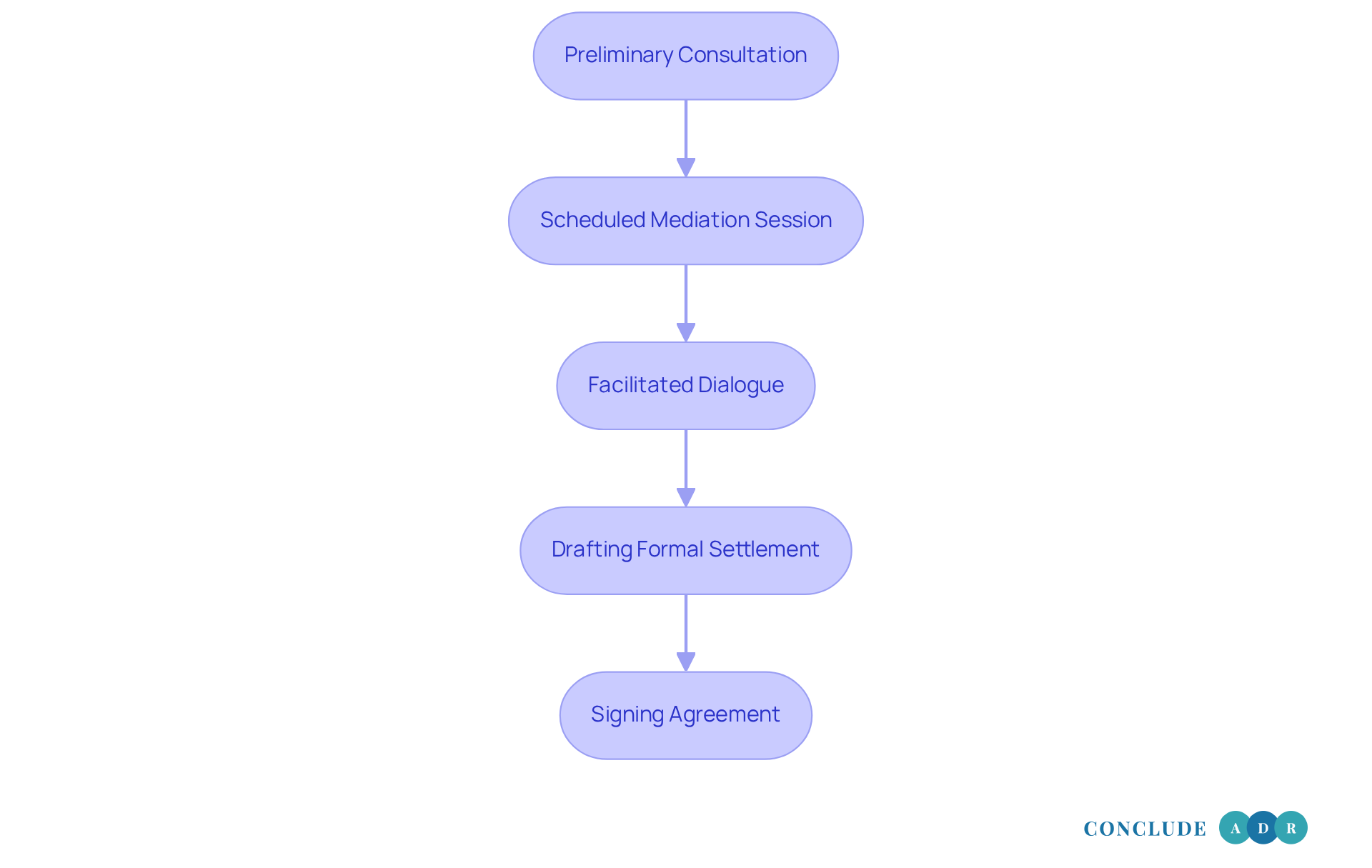

Navigating the debt mediation services process can feel overwhelming, but it begins with a preliminary consultation. Here, a facilitator takes the time to understand your financial situation in relation to what your creditor is asking. This initial evaluation sets the stage for a scheduled mediation session, where both sides can share their perspectives in a safe environment.

During mediation, the mediator plays a vital role in facilitating dialogue. They ensure that everyone has the opportunity to voice their concerns and needs. It’s a space where your feelings matter, and the mediator may suggest various solutions, guiding everyone toward a compromise that feels fair.

Once an agreement is reached, the mediator helps draft a formal settlement that clearly outlines the terms of your resolution. This document is signed by both parties, creating a legally binding framework for repayment or restructuring. It’s important to remember that the negotiation process is optional; both sides must agree to the terms for the resolution to hold legal weight.

Consider the benefits of this approach:

- Lowered balances

- Structured payment plans

- Improved recovery rates for creditors

Statistics from recent years show the effectiveness of mediation. For example, in 2025 year-to-date, 28% of cases resulted in customer awards, totaling 60 cases. Many borrowers report feeling relieved and supported through this process. The collaborative nature of negotiation not only eases the pressure associated with financial recovery but also fosters a more amicable resolution process, ultimately benefiting everyone involved.

The length of negotiation sessions can vary, but they are typically designed to be effective, facilitating prompt resolutions that help you avoid the lengthy court disputes often associated with traditional collection methods.

Are you ready to explore this compassionate approach to resolving your debt? We’re here to support you every step of the way.

Types of Debts Suitable for Mediation

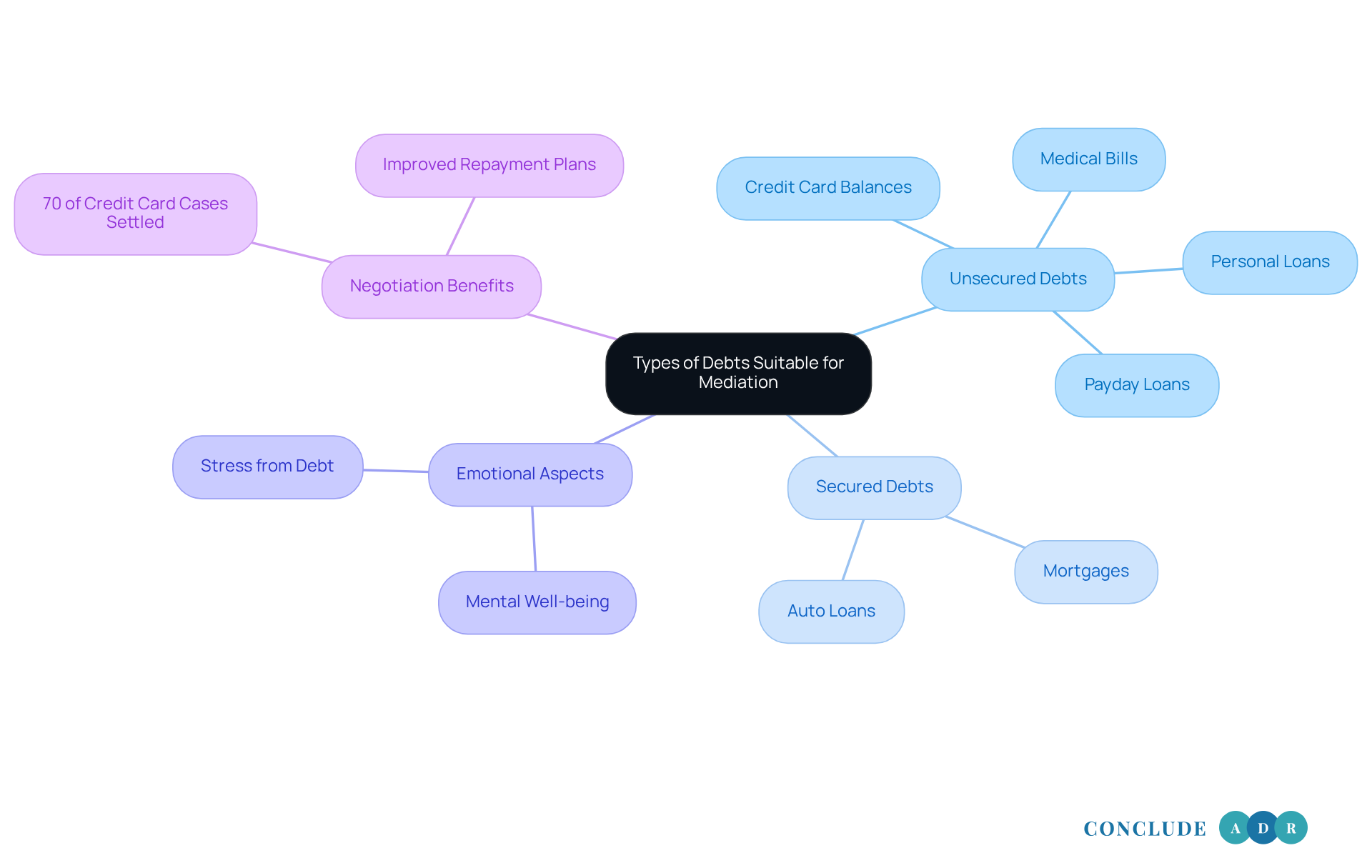

Managing unsecured liabilities can feel overwhelming, especially when they’re not tied to specific assets. Think about credit card balances, medical bills, personal loans, and payday loans. These debts often come with high interest rates, making them tough to handle. For instance, a retired disabled veteran found himself under significant financial strain, draining nearly $10,000 from his savings just to keep up with rising obligations. This situation underscores the urgent need for effective resolution strategies.

Debt mediation services can be a lifeline, especially for small businesses. Maintaining positive relationships with creditors is crucial for keeping operations running smoothly. Did you know that around 70% of credit card financial obligation cases are settled through negotiation? This statistic highlights how debt mediation services can create win-win arrangements that benefit everyone involved.

While secured obligations like mortgages or auto loans might seem less negotiable due to the collateral, conflict resolution still plays a vital role in discussing terms. This is particularly important for debtors facing economic hardship. Open conversations can lead to more manageable repayment plans with the help of debt mediation services, easing the burden of financial stress. By fostering dialogue, conflict resolution not only alleviates pressure but also supports a more sustainable economic future.

Financial specialists emphasize that addressing the emotional toll of debt is just as important as resolving the financial aspects. Negotiation can help solve financial problems while also nurturing mental well-being. Remember, you’re not alone in this journey. Seeking help through debt mediation services can be a step towards regaining control and achieving peace of mind.

Advantages and Disadvantages of Debt Mediation

Debt mediation services can be a lifeline for many, offering significant cost savings compared to traditional legal routes. Did you know that conflict resolution expenses typically range from $3,000 to $8,000? In contrast, litigation can skyrocket to $15,000 or even $30,000 per party. This financial relief is just one of the many benefits of debt mediation services, which also help maintain relationships between debtors and creditors. By fostering a collaborative environment, mediation encourages open dialogue and mutual understanding. Plus, flexible repayment plans tailored to your unique financial situation can ease stress and pave the way for a clearer recovery path.

However, it’s important to consider the potential downsides. Mediation doesn’t always guarantee a resolution. If an agreement can’t be reached, you might find yourself facing litigation, which can lead to additional costs and delays. While negotiation can lower your financial obligations, it may still impact your credit rating negatively. Lenders often report settled accounts as less favorable than fully paid ones, which could complicate future borrowing opportunities.

Before diving into debt mediation services, it’s crucial to assess your personal situation. A financial expert once shared that conflict resolution can feel less daunting than litigation, but it requires both parties to be willing to compromise. Case studies reveal that mediation often leads to higher satisfaction rates, with compliance for mediated agreements at an impressive 80-90%, compared to just 40-53% for court-imposed judgments. As the Georgia Center for Arbitration and Mediation puts it, "Mediation fosters fairness and control, making it particularly effective in preserving relationships and achieving win-win outcomes."

So, as you weigh your options, consider seeking professional advice. It’s a step towards navigating your financial journey with confidence and support.

Conclusion

Debt mediation services stand out as a vital lifeline for those of us facing overwhelming financial obligations. Imagine a space where borrowers and lenders can come together, not as adversaries, but as partners seeking understanding and resolution. This shift in approach not only eases stress but also nurtures healthier financial relationships, guiding both parties toward sustainable agreements.

Have you ever felt the weight of financial strain? Key insights reveal that debt mediation can significantly reduce defaults, enhance recovery rates for creditors, and preserve the dignity of those in debt. Statistics show a growing number of consumers choosing mediation as a compassionate alternative to litigation and bankruptcy. The structured process - starting with preliminary consultations and moving into guided negotiations - empowers borrowers to take back control of their finances while ensuring creditors benefit from amicable resolutions.

In a world where consumer debt is on the rise, embracing debt mediation services can lead to truly transformative outcomes. By valuing open communication and collaboration, you can navigate your financial challenges with newfound confidence and support. For anyone feeling overwhelmed by debt, seeking mediation isn’t just a practical step; it’s a chance to reclaim financial stability and contribute to a more resilient economic landscape for all of us.

Frequently Asked Questions

What are debt mediation services?

Debt mediation services provide a structured method where impartial mediators facilitate conversations between borrowers and lenders to reach a mutually beneficial resolution, focusing on collaboration and open communication rather than aggressive tactics or legal actions.

How do debt mediation services work?

Experienced mediators help both parties express their needs and concerns, guiding them toward solutions like negotiating lower payments, restructuring financial terms, or creating tailored repayment plans.

What is the success rate of debt mediation?

In 2024, 45% of customer claimant cases resulted in compensation, indicating a significant potential for positive outcomes through debt mediation.

Why is financial negotiation important?

Financial negotiation helps individuals regain control over their finances and promotes a friendlier resolution process, enhancing the likelihood of feasible and lasting agreements.

What are the benefits of using debt mediation services?

Benefits include preserving relationships between debtors and creditors, enhancing recovery rates for creditors, reducing stress for borrowers, and contributing to overall economic stability.

How has consumer debt influenced the need for debt mediation services?

With U.S. consumer debt expected to rise to $18.33 trillion by mid-2025, debt mediation services have become essential for providing effective resolution strategies and avoiding the negative consequences of bankruptcy.

What trends have been observed in the usage of debt mediation services?

In 2025, there was a 25% increase in the number of consumers turning to conflict resolution for monetary disputes compared to the previous year, highlighting a growing preference for mediation over litigation.

How can debt mediation services impact the economy?

By decreasing the number of bankruptcies and promoting responsible repayment practices, debt mediation services help maintain economic stability, benefiting both individuals and the broader economic ecosystem.

What makes Conclude ADR's debt mediation services accessible?

Conclude ADR offers flexible scheduling options and a streamlined booking process to accommodate urgent or complex disputes, ensuring convenient access to their services.