Introduction

Debt mediation shines as a beacon of hope for those facing financial challenges. It offers a structured and friendly alternative to the often stressful world of litigation. This process encourages open communication between debtors and creditors, creating a unique chance to find solutions that work for everyone involved.

Yet, many people feel uncertain about how effective it can be and worry about losing control during negotiations. What if the way to financial relief isn’t through courtrooms, but through collaborative discussions led by a skilled mediator?

Imagine a space where your concerns are heard, and solutions are crafted together. With mediation, you can explore options that might not be available in a courtroom setting. It’s about finding common ground and working towards a brighter financial future.

So, why not consider this path? It could be the supportive step you need to regain control over your financial situation.

Define Debt Mediation: Understanding the Core Concept

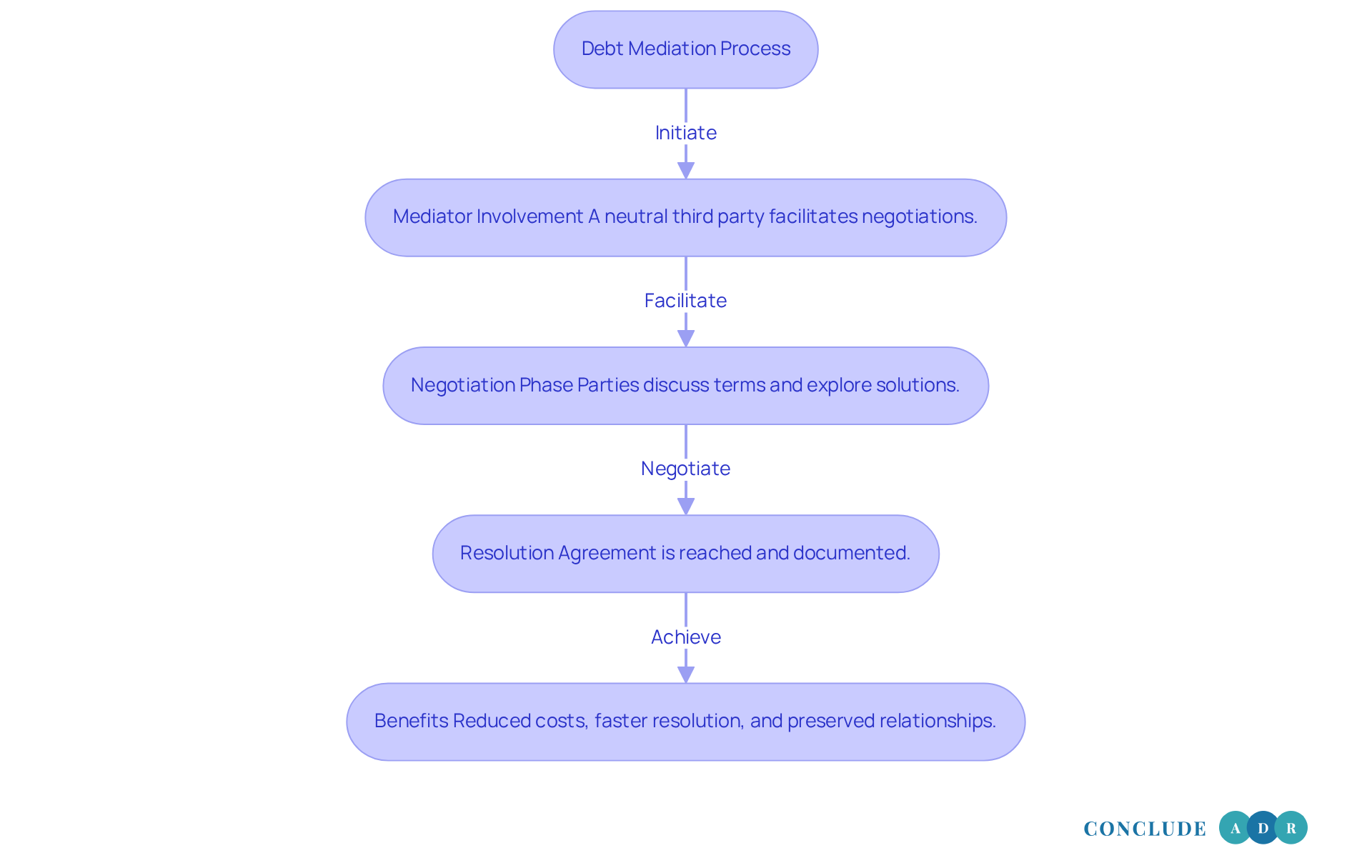

Debt mediation is a structured process where a neutral third party, known as a mediator, helps facilitate negotiations between you and your creditors. The main goal? To find a solution that eases your financial burden while allowing creditors to recover some of what they’re owed. Unlike litigation, which can feel adversarial and costly, mediation encourages open communication and collaboration, making it a more amicable choice for everyone involved.

At Conclude ADR, we focus on finding resolutions that truly meet your needs. Our experienced team of mediators and arbitrators has decades of expertise in alternative dispute resolution. We guide disputes toward efficient resolutions, all while minimizing stress and maximizing mutual benefit. We understand that your time is valuable, which is why we offer flexible session times, including evenings and weekends, to accommodate urgent or complex disputes.

The benefits of debt resolution are especially significant for individuals and businesses facing overwhelming debt. It provides a way to negotiate terms that are more manageable and sustainable, helping you regain control over your financial situation. Did you know that recent studies show conflict resolution has a success rate of about 70% to 80%? This highlights its effectiveness in resolving disputes efficiently.

Financial experts point out that negotiation can reduce legal costs - often by 60% to 80% compared to traditional litigation - while also preserving relationships between borrowers and creditors. This is crucial, as maintaining a positive rapport can make future dealings and negotiations smoother. In fact, many debtors find negotiation to be a more favorable option than litigation, with statistics showing a significant preference for this approach.

There are numerous successful examples of debt negotiation, including high-profile cases where this process was key in resolving complex disputes among stakeholders. These instances showcase how negotiation can lead to effective resolutions that benefit everyone involved, reinforcing its growing appeal as a preferred method for resolving financial disputes.

Explore the Debt Mediation Process: Step-by-Step Guide

-

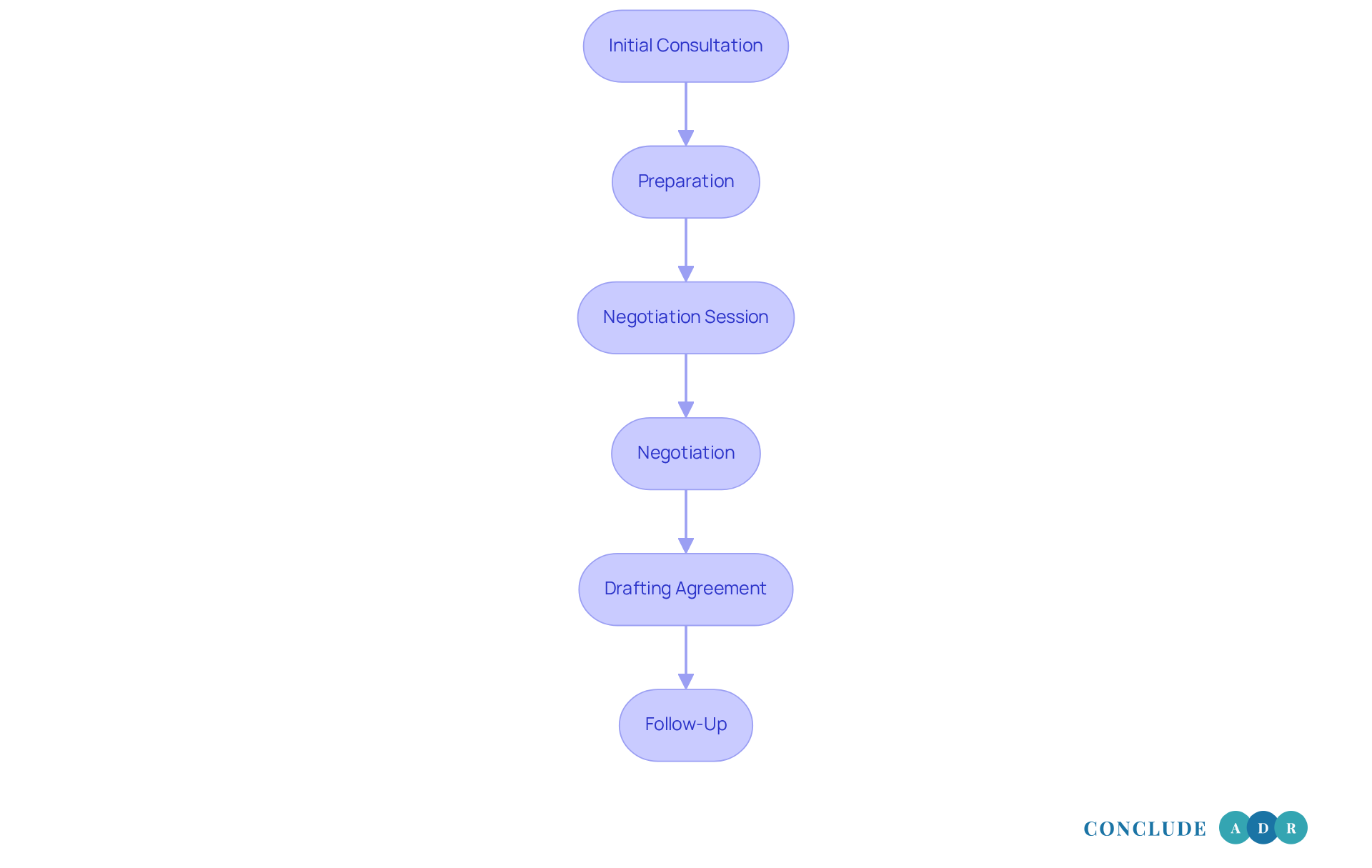

Initial Consultation: The journey toward debt resolution begins with a warm, preliminary meeting. Here, the debt mediator takes the time to understand the debtor's economic situation alongside the creditors' demands. This initial assessment is vital, as it lays the groundwork for meaningful negotiations that can lead to a brighter financial future.

-

Preparation: We encourage both parties to gather essential documentation, like financial statements and correspondence with creditors. This preparation is not just a formality; it equips everyone with the necessary information for informed discussions. When both sides are well-prepared, it significantly boosts the chances of a successful outcome.

-

During the negotiation session, the debt mediator facilitates the gathering of the debtor and creditors in a supportive environment. Each group shares their perspectives, while the mediator clarifies any misunderstandings and helps find common ground. Remarkably, mediation sessions often resolve disputes in just one to three meetings, showcasing how this approach can be much more efficient than traditional litigation, which can drag on for months or even years.

-

Negotiation: The debt mediator plays a crucial role in guiding the negotiation process, encouraging both sides to propose solutions that work for everyone. This might involve discussing payment plans, debt reductions, or other terms that can lead to a settlement. With a success rate of around 70-80% in Florida, mediation proves to be an effective path toward resolution.

-

Once a consensus is reached, the debt mediator assists in drafting a formal agreement that clearly outlines the terms of the settlement. This document is essential, as it ensures that both parties are committed to the agreed-upon terms, providing a solid framework for compliance and peace of mind.

-

Follow-Up: After the agreement is signed, the debt mediator may conduct follow-up sessions to ensure compliance and address any emerging issues. This ongoing dialogue fosters a collaborative atmosphere, which is crucial for maintaining relationships and preventing future disputes. Remember, we’re here to support you every step of the way.

Identify the Benefits of Debt Mediation: Why Choose This Approach?

-

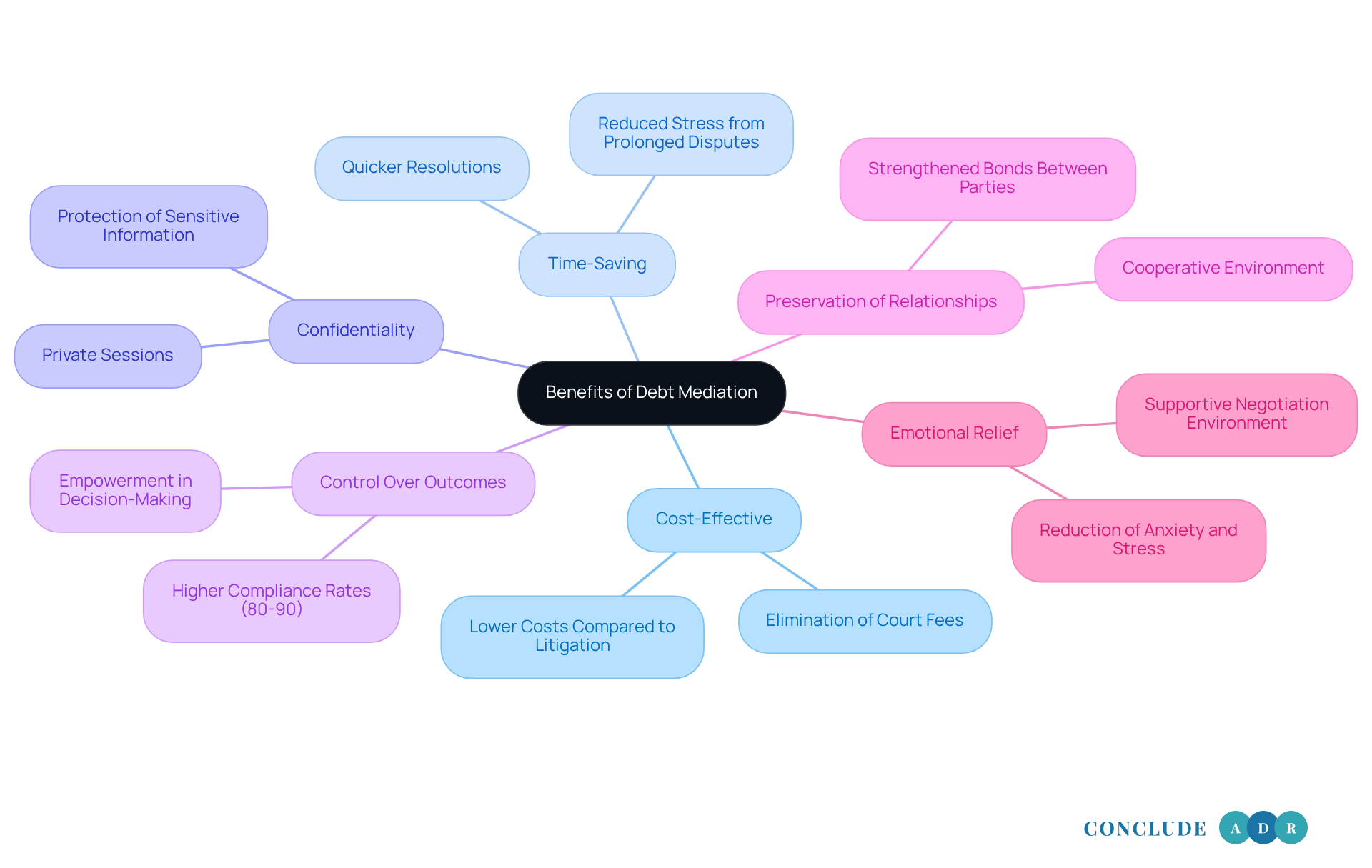

Cost-Effective: Have you ever felt overwhelmed by the costs of legal battles? Debt resolution can be a breath of fresh air, as it’s significantly less expensive than litigation. By eliminating court fees and lengthy legal processes, it becomes an appealing option for individuals and small businesses alike. In a world where nearly 350 million Americans are facing debt, a debt mediator offers a practical solution to the economic challenges many are grappling with.

-

Time-Saving: Imagine resolving your disputes in just a few weeks instead of waiting months or even years in court. The mediation process is designed for efficiency, alleviating not just financial burdens but also the stress that comes with prolonged disputes. This swift resolution allows you to move forward more quickly, bringing a sense of relief.

-

Confidentiality: Your financial matters are personal, and mediation respects that. With private sessions, sensitive information stays under wraps, protecting the reputations of both borrowers and creditors. This confidentiality creates a safe space for open dialogue and negotiation, allowing you to express your concerns freely.

-

Control Over Outcomes: Wouldn’t it feel empowering to have a say in the outcome of your situation? Unlike court rulings, mediation allows both parties to influence the resolution, leading to solutions that truly fit their needs. This collaborative approach not only enhances satisfaction but also boosts compliance, with voluntary adherence to mediated agreements reaching an impressive 80%-90%, compared to just 40%-53% for court-imposed judgments.

-

Preservation of Relationships: Maintaining relationships during financial disputes is crucial. A debt mediator fosters a cooperative environment that helps to strengthen the bond between debtors and creditors. This ongoing communication and trust are essential for successful monetary negotiations in the future.

-

Emotional Relief: The stress and anxiety of debt disputes can be overwhelming. Mediation offers a supportive environment for negotiation, allowing individuals to tackle their financial challenges with newfound confidence and tranquility. As financial advisor Adam Ludwin points out, a debt mediator simplifies the debt collection process, making it a valuable tool for those seeking resolution.

If you’re feeling the weight of debt, consider mediation as a compassionate path forward.

Address Common Challenges: Navigating Misconceptions in Debt Mediation

-

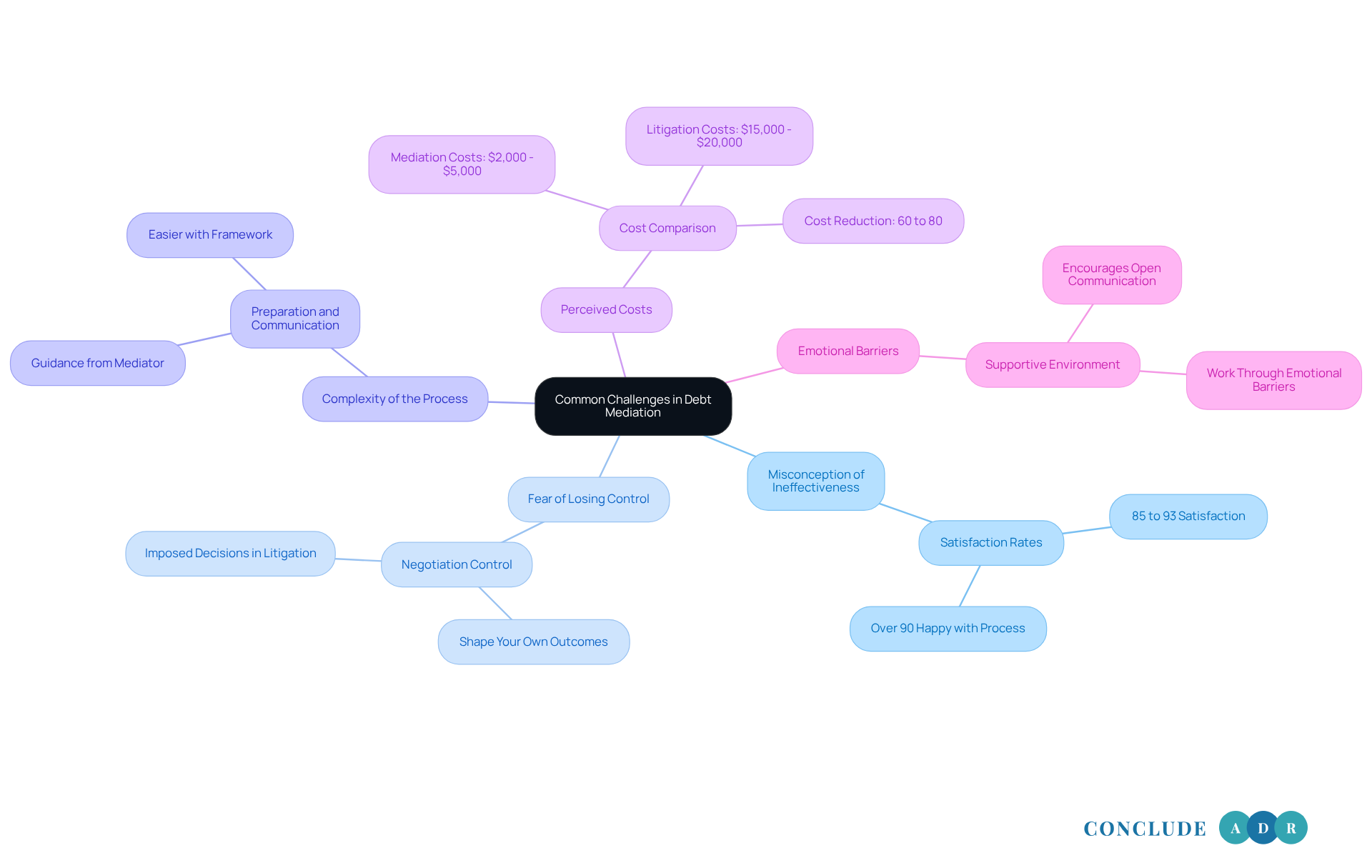

Misconception of Ineffectiveness: Many people worry that conflict resolution isn’t as effective as litigation. But here’s the good news: studies show that conflict resolution achieves satisfaction rates between 85% and 93%. Over 90% of participants report feeling happy with the process! This collaborative approach encourages open dialogue, leading to outcomes that benefit everyone involved.

-

Fear of Losing Control: It’s natural to fear losing control over the outcome. However, negotiation allows both sides to discuss terms that truly meet their needs. This means you play a significant role in shaping the final agreement. As one expert noted, "Mediation allows parties to shape their own outcomes, while litigation results in decisions imposed by a judge." This sense of control is a major advantage of mediation over litigation.

-

Complexity of the Process: You might think negotiation is complicated, but understanding its framework can make it much easier. Preparation and clear communication are key to navigating the process effectively. A debt mediator is there to guide you through each step, making the experience more accessible and less daunting.

-

Perceived Costs: Many assume that conflict resolution comes with costs similar to litigation. In reality, mediation typically costs between $2,000 and $5,000 per person, which is significantly less than the $15,000 to $20,000 often associated with litigation. In fact, mediation can reduce legal costs by 60% to 80% compared to traditional court proceedings, making it a smart choice for many.

-

Emotional Barriers: Emotional stress can sometimes get in the way of negotiations. That’s where a skilled debt mediator comes in. They create a safe environment that encourages open communication, allowing you to express your concerns and work through emotional barriers. This supportive atmosphere is crucial for reaching amicable resolutions.

Conclusion

Debt mediation offers a compassionate and effective way to resolve financial disputes, helping both individuals and businesses regain control over their financial situations. By bringing in a neutral mediator, this process encourages open communication and collaboration, leading to outcomes that benefit everyone involved-without the stress of traditional litigation.

Throughout this article, we’ve explored key aspects of debt mediation. We’ve looked at the structured process, the many benefits like cost-effectiveness and time-saving, and addressed common misconceptions that might hold people back from seeking this solution. The step-by-step guide emphasizes preparation, negotiation, and follow-up, all crucial elements that contribute to the high success rates associated with mediation. Understanding these factors can empower you to face your financial challenges with confidence and clarity.

Ultimately, embracing debt mediation not only eases financial burdens but also helps preserve relationships and creates a supportive environment for resolving disputes. If you’re grappling with debt, considering mediation as a viable option could lead to a more manageable and hopeful financial future. Taking that first step toward resolution might just be the turning point you need to reclaim your peace of mind and financial stability.

Frequently Asked Questions

What is debt mediation?

Debt mediation is a structured process where a neutral third party, known as a mediator, facilitates negotiations between individuals or businesses and their creditors to find a solution that eases financial burdens while allowing creditors to recover some of what they are owed.

How does debt mediation differ from litigation?

Unlike litigation, which can be adversarial and costly, debt mediation encourages open communication and collaboration, making it a more amicable choice for all parties involved.

What are the benefits of debt mediation?

Debt mediation helps negotiate more manageable and sustainable terms for individuals and businesses facing overwhelming debt, allowing them to regain control over their financial situation while reducing legal costs and preserving relationships with creditors.

What is the success rate of conflict resolution through mediation?

Recent studies show that conflict resolution through mediation has a success rate of about 70% to 80%, highlighting its effectiveness in resolving disputes efficiently.

How much can negotiation reduce legal costs compared to traditional litigation?

Negotiation can reduce legal costs by 60% to 80% compared to traditional litigation, making it a more cost-effective option for resolving financial disputes.

Why is maintaining a positive rapport with creditors important?

Maintaining a positive rapport with creditors can make future dealings and negotiations smoother, which is crucial for individuals and businesses looking to resolve their debts.

Are there successful examples of debt negotiation?

Yes, there are numerous successful examples of debt negotiation, including high-profile cases where this process was key in resolving complex disputes among stakeholders, reinforcing its appeal as a preferred method for resolving financial disputes.

What services does Conclude ADR offer in relation to debt mediation?

Conclude ADR offers experienced mediators and arbitrators who guide disputes toward efficient resolutions while minimizing stress and maximizing mutual benefit, with flexible session times available to accommodate urgent or complex disputes.