Overview

Navigating disputes in the financial industry can be daunting, but the FINRA arbitration rule is here to help. It aims to provide an efficient and equitable process for resolving issues like misrepresentation and unauthorized trading. Understanding this process is crucial for anyone facing such challenges.

This article highlights key aspects of the arbitration process, including:

- How to file a claim

- How to select an arbitrator

Recent updates have been made to enhance transparency and streamline procedures, making it easier for you to find resolution.

By familiarizing yourself with these elements, you can feel more empowered in your journey toward effective dispute resolution. Remember, you are not alone in this process—we're here to support you every step of the way.

Introduction

Navigating the complexities of financial disputes can feel overwhelming, especially in the intricate world of arbitration. We understand that these situations can be stressful, and that’s why the Financial Industry Regulatory Authority (FINRA) offers a structured method for resolving conflicts between investors and brokerage firms. This approach serves as a valuable alternative to traditional litigation, providing a sense of relief amidst the chaos.

In this article, we will explore the essential rules, processes, and recent updates to the FINRA arbitration system. Together, we will shed light on how these changes can impact you, the participant. With high stakes and deep emotions often at play, it’s crucial to be prepared. How can you ensure that you are ready to navigate this system and achieve a favorable outcome?

Let’s delve into this journey together, equipping you with the knowledge and confidence needed to face these challenges head-on.

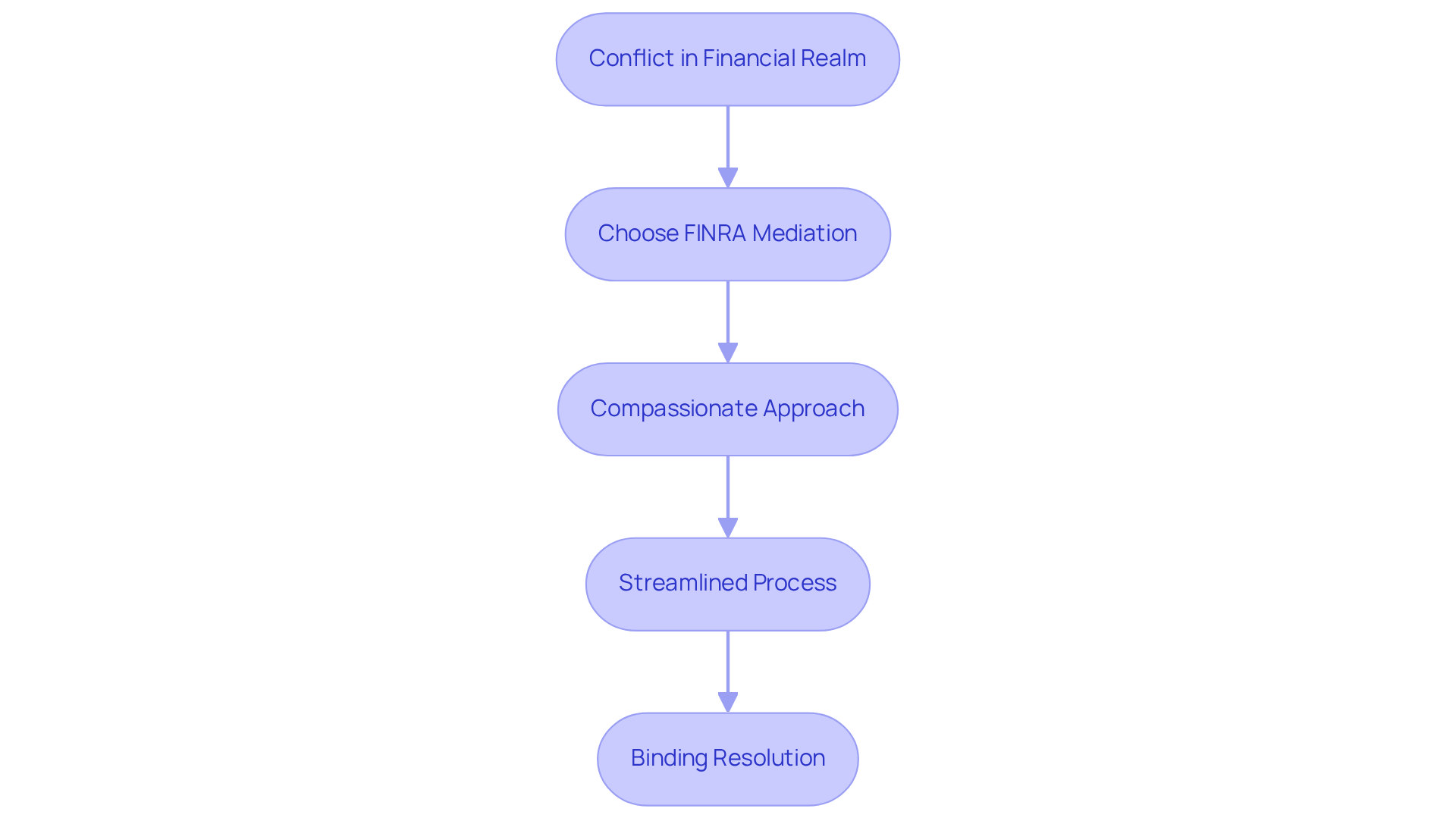

Define FINRA Arbitration and Its Purpose

The Financial Industry Regulatory Authority's mediation serves as a compassionate approach to resolving disagreements between investors and brokerage companies, or even among brokerage firms. Have you ever felt overwhelmed by a conflict in the financial realm? The primary purpose of FINRA mediation is to offer a streamlined, efficient, and cost-effective way to settle disputes without the stress of traditional court litigation. This process is especially crucial in the financial industry, where issues like misrepresentation, breach of fiduciary duty, or unauthorized trading can cause significant distress.

By choosing mediation, you can find a resolution that is not only binding but also enforceable, ensuring your concerns are addressed promptly. Imagine being able to move forward without the burden of unresolved issues weighing on you. Mediation allows for a supportive environment where your grievances can be heard and resolved, paving the way for a more positive financial experience. We encourage you to consider this as a step toward resolution.

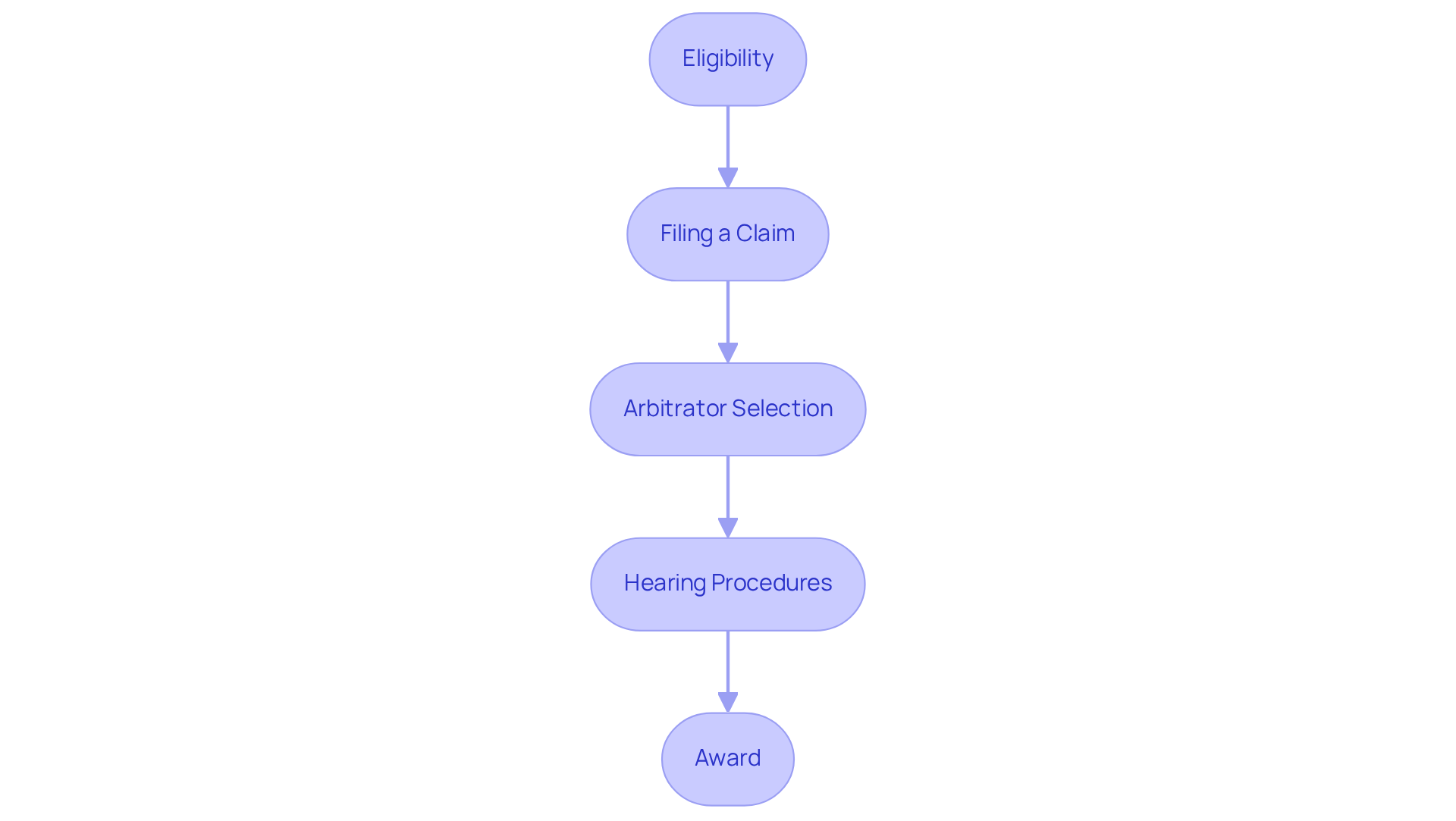

Explore the Key Rules and Regulations of FINRA Arbitration

The essential guidelines and policies of the regulatory body are thoughtfully outlined in the Code of Procedure for Dispute Resolution. Understanding the FINRA arbitration rule can be crucial for anyone navigating this process. Here are some key aspects to consider:

- Eligibility: FINRA arbitration is available for disputes involving members of FINRA, associated persons, and customers. A recent case involving Claimant Frederick Jack Dawson highlighted the flexibility of these eligibility guidelines. Dawson sought the expungement of a 2009 customer dispute from his record, a request that was not opposed by the Respondent, Raymond James. The arbitrator's ruling in favor of Dawson serves as a reminder that a strict interpretation of the eligibility rule may not always be fair, allowing for equitable principles to be taken into account.

- Filing a Claim: To begin the process, parties must submit a Statement of Claim to the regulatory body, detailing the nature of the dispute and the relief sought. This initial step is essential in preparing for the resolution procedure in accordance with the FINRA arbitration rule, ensuring that all voices are heard.

- Arbitrator Selection: It’s important to know that parties can choose their arbitrators from a roster provided by FINRA. This empowers you to have a say in who will hear your case, which can significantly influence the outcome of the dispute resolution.

- Hearing Procedures: The hearing process is designed to be akin to a court trial, yet it offers more lenient guidelines regarding evidence and procedure. This flexibility can create a more accessible environment for everyone involved, making the experience less daunting.

- Award: After deliberation, the arbitrators issue a written decision, known as an award, which is binding on all parties. Understanding the is vital for all participants in the dispute resolution journey.

As Arbitrator William Stephen Mailander wisely stated, "Equity avoids rigid guidelines; it relies on adaptability." This insight underscores the importance of grasping these guidelines for individual dispute resolvers. By doing so, you can navigate the resolution system more effectively, enhancing your chances for a positive outcome. Remember, you are not alone in this process; we are here to support you every step of the way.

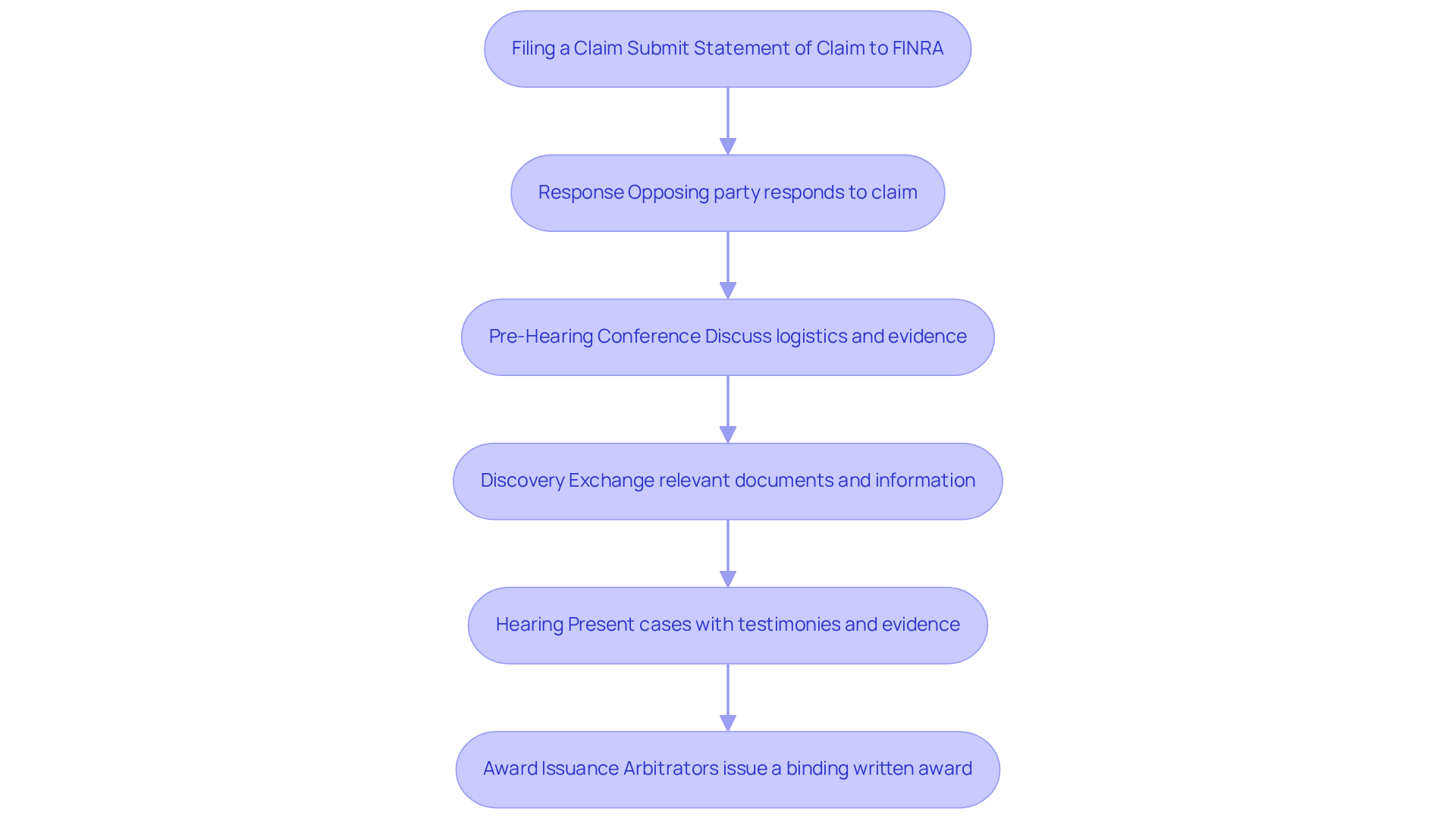

Outline the Arbitration Process: Steps and Expectations

The arbitration process follows the FINRA arbitration rule and unfolds through several key steps, each designed to ensure a fair and efficient resolution.

- Filing a Claim: If you find yourself in a dispute, the first step is to submit a Statement of Claim to FINRA. This document details your concerns and outlines the resolution you seek.

- Response: The opposing party will then have a specified timeframe to respond to your claim. They can either agree with your allegations or contest them, which is an important part of the process.

- Pre-Hearing Conference: A preliminary meeting may be convened to discuss logistical aspects of the process, including scheduling and the submission of evidence. This step helps ensure everyone is on the same page.

- Discovery: Both parties exchange relevant documents and information to prepare adequately for the hearing. This exchange is crucial for building your case.

- Hearing: During the mediation hearing, both parties present their cases, which includes witness testimonies and supporting evidence. This is your opportunity to share your side of the story.

- Award Issuance: After careful deliberation, the arbitrators will issue a written award that is binding and enforceable.

Each step is meticulously structured to keep the focus on the merits of the case rather than procedural complexities. It’s important to anticipate that the gatherings in FINRA mediation will involve a pledge to openness and collaboration.

Success rates can fluctuate at each phase, and having seasoned advisors by your side can make a significant difference in navigating the intricacies of dispute resolution. Have you considered how understanding these expectations might influence your mediation outcomes? Experts in conflict resolution emphasize that thorough preparation and clear presentation of evidence often lead to favorable results for claimants.

Additionally, it’s worth noting that punitive damages are granted in fewer than 1% of disputes handled by the organization, highlighting the rarity of such awards. Furthermore, the modifications to the Codes of Arbitration Procedure, effective March 4, 2024, represent significant improvements that support the FINRA arbitration rule and aim to enhance fairness, transparency, and efficiency in the resolution process.

Lastly, it’s essential to recognize that decisions from the regulatory body's dispute resolution process are final and not open to appeal unless relevant law states otherwise. This means the likelihood of a is minimal, but knowing this can help you prepare for what lies ahead.

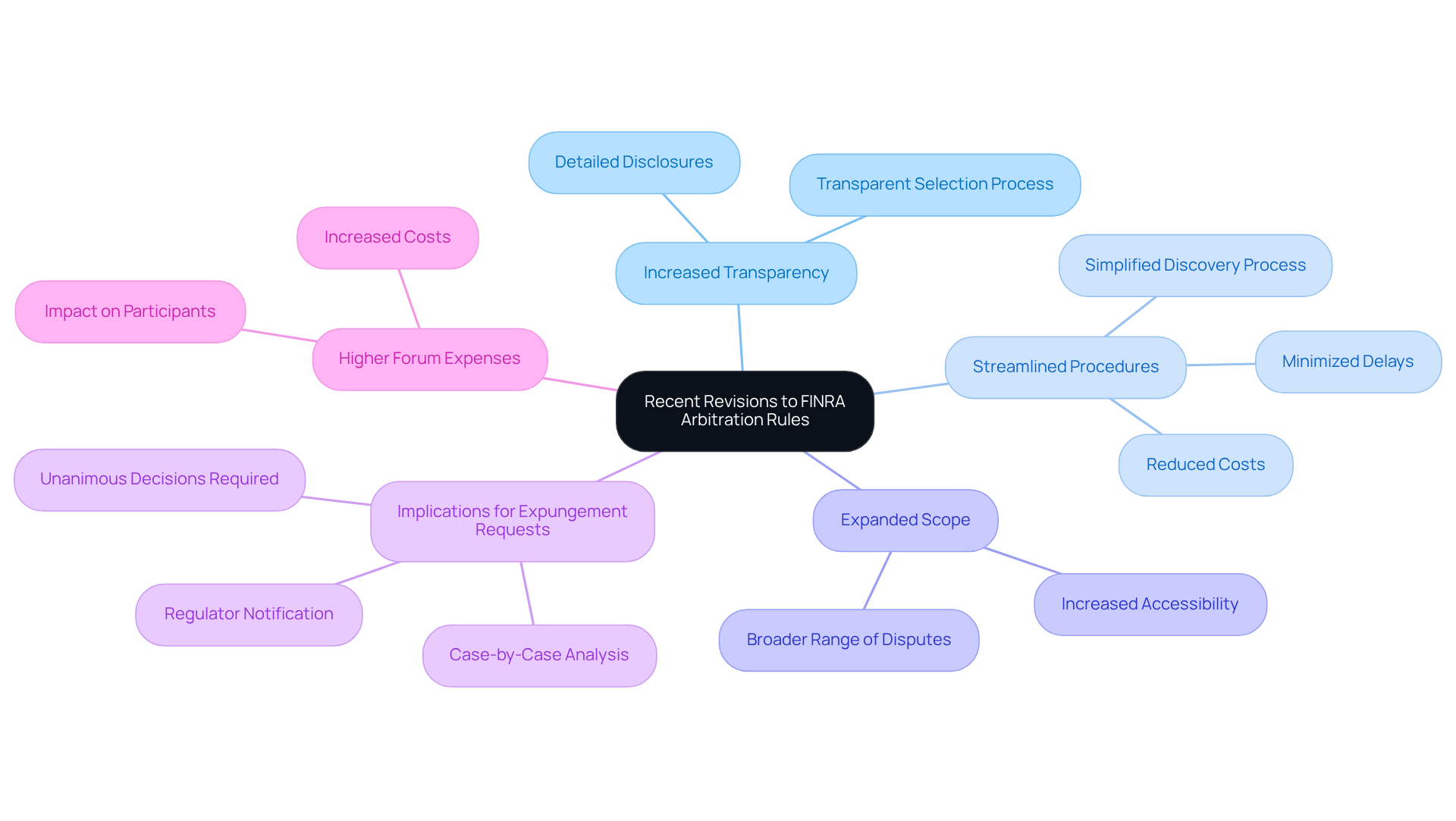

Analyze Recent Revisions to FINRA Arbitration Rules and Their Impact

Recent updates to the finra arbitration rule have introduced significant changes designed to enhance both the efficiency and fairness of the arbitration system. These updates are not just procedural; they reflect a deeper commitment to the needs of all participants involved.

- Increased Transparency: The new rules require arbitrators to provide more detailed disclosures about any potential conflicts of interest. This change is aimed at fostering a transparent selection process, ensuring that everyone is aware of factors that might influence an arbitrator's impartiality. How reassuring it is to know that transparency is prioritized!

- Streamlined Procedures: With revisions simplifying various procedural aspects—including the discovery process—these updates help minimize delays and reduce costs associated with dispute resolution. This streamlining is essential for maintaining the relevance and , allowing disputes to be resolved more swiftly.

- Expanded Scope: The guidelines now broaden the range of disputes eligible for mediation, which means more parties can access this valuable method for resolving conflicts. This expansion is a step toward making arbitration more inclusive and applicable to various situations within the financial community.

- Implications for Expungement Requests: A notable aspect of the new guidelines is the introduction of a 158-page document that limits or prohibits advisors from seeking expungement of customer dispute disclosures. This means that each expungement request will undergo careful examination, which is crucial for understanding the implications of these new regulations.

- Higher Forum Expenses: It’s important to note that these new regulations may lead to higher forum expenses, which could impact those involved in the resolution process.

These updates highlight the dedication of the FINRA arbitration rule to enhancing the arbitration experience for everyone involved. By ensuring the process adapts to the evolving needs of the financial sector, they are working to support all participants in navigating their disputes effectively.

Conclusion

Understanding the FINRA Arbitration Rule is vital for anyone in the financial sector. It offers a structured, supportive framework for resolving disputes, helping you avoid the complexities and stress of traditional litigation. This path not only addresses grievances but also nurtures a healthier financial environment for everyone involved.

In this article, we explore the intricate details of the FINRA arbitration process, shining a light on its key rules and recent updates. From eligibility criteria and claim filing procedures to the step-by-step arbitration process, each element is crafted to ensure fairness and transparency. Recent revisions to the arbitration rules enhance this framework, emphasizing increased transparency, streamlined procedures, and a broader scope for disputes. Together, these improvements aim to enrich your experience as a participant.

Ultimately, grasping the nuances of the FINRA arbitration process is essential for anyone navigating financial disputes. As the landscape of financial regulation evolves, staying informed about these changes can significantly impact your outcomes. Engaging with the FINRA arbitration system empowers you to resolve conflicts effectively while reinforcing the importance of integrity and fairness within the financial industry.

Have you considered how understanding this process can help you? We invite you to explore these resources and take proactive steps towards resolving your financial disputes with confidence.

Frequently Asked Questions

What is FINRA arbitration?

FINRA arbitration is a mediation process provided by the Financial Industry Regulatory Authority to resolve disputes between investors and brokerage firms, or among brokerage firms themselves.

What is the purpose of FINRA mediation?

The primary purpose of FINRA mediation is to offer a streamlined, efficient, and cost-effective way to settle disputes without the stress of traditional court litigation, particularly in the financial industry.

What types of issues can be addressed through FINRA mediation?

FINRA mediation can address issues such as misrepresentation, breach of fiduciary duty, or unauthorized trading, which can cause significant distress in the financial realm.

What are the benefits of choosing mediation over traditional litigation?

Mediation provides a binding and enforceable resolution, allows for a supportive environment to hear grievances, and helps individuals move forward without the burden of unresolved issues.

How does FINRA mediation contribute to a positive financial experience?

By facilitating a resolution to conflicts in a compassionate and efficient manner, FINRA mediation helps individuals address their concerns promptly, leading to a more positive financial experience.