Introduction

Understanding charged-off debt is crucial for anyone navigating the complexities of personal finance. This designation not only signifies a significant lapse in payment but also casts a long shadow on your credit score, potentially affecting future borrowing opportunities.

Have you ever felt overwhelmed by the weight of debt? You're not alone. Many face similar challenges, and it's important to know that there are effective dispute strategies and negotiation techniques available. These can help mitigate the impact of charged-off accounts, offering a pathway to reclaiming your financial stability.

But what steps can you take to challenge these negative marks and restore your creditworthiness amidst the daunting landscape of debt? Together, we can explore these options and find a way forward.

Define Charged-Off Debt: Understanding the Basics

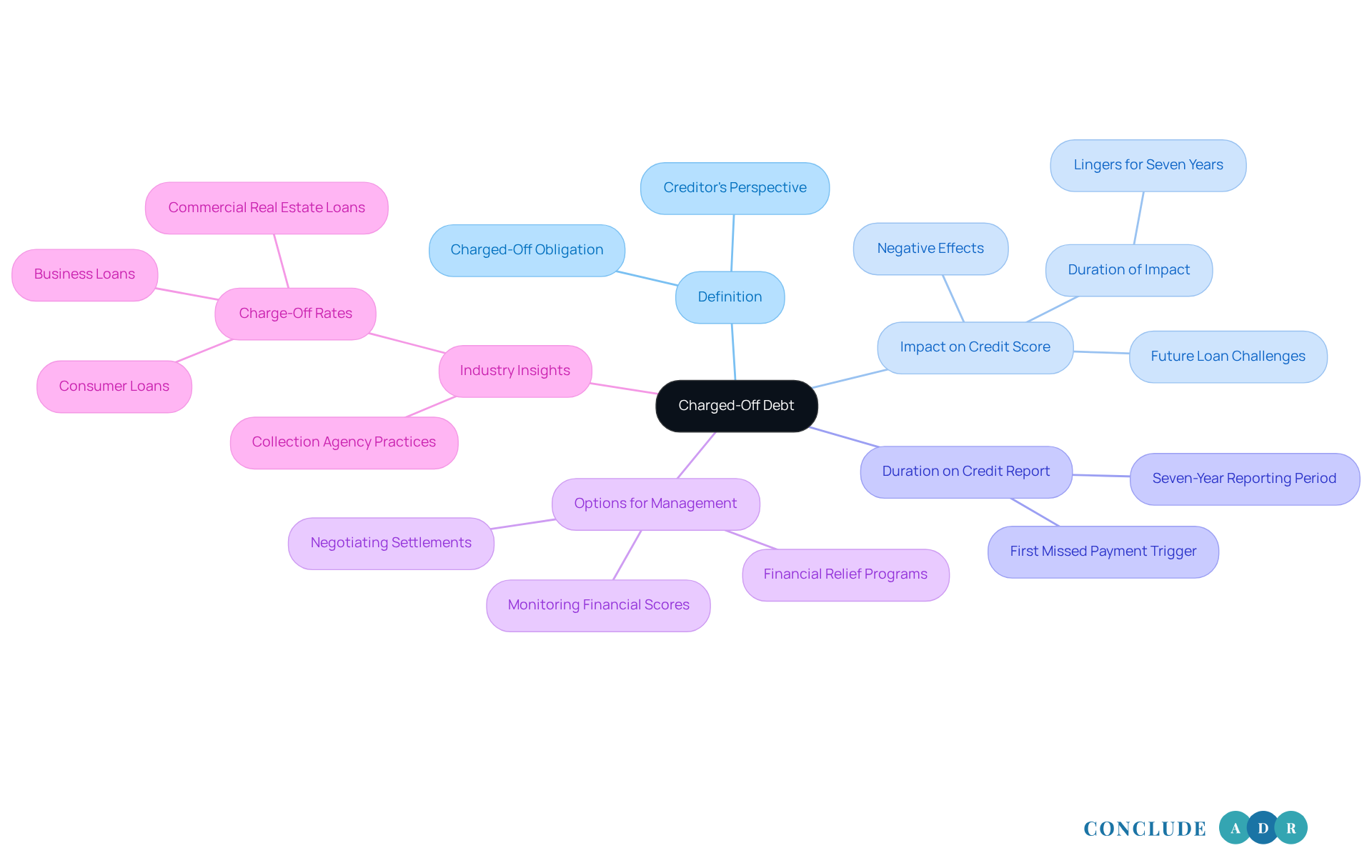

A charged-off obligation is more than just a term; it’s a situation that can weigh heavily on your mind. When a creditor marks an account as charged off as bad debt dispute resolved reported by grantor after about 180 days of non-payment, it indicates they believe it’s unlikely they’ll recover that debt. While this designation allows creditors to remove the debt from their balance sheets, it doesn’t erase your responsibility to repay it.

When an account is charged off as bad debt dispute resolved reported by grantor, it gets reported to financial agencies, which can significantly impact your credit score. Did you know that an account charged off as bad debt dispute resolved reported by grantor can linger on your credit report for up to seven years? This can make it challenging to secure future loans, and understanding the implications of these written-off accounts is crucial. It’s essential to handle these matters swiftly to minimize long-term financial repercussions.

If you find yourself facing written-off obligations, consider exploring options like negotiating settlements or enrolling in financial relief programs. These steps can lead to a more manageable financial situation. Additionally, keeping a close eye on your financial scores can help you track your progress in settling these obligations and improving your overall financial health.

As noted by the Board of Governors of the Federal Reserve System, charge-off rates for consumer loans at commercial banks provide valuable insight into the prevalence of defaulted financial obligations. It’s also important to remember that lenders may transfer accounts charged off as bad debt dispute resolved reported by grantor to collection agencies, which can lead to further collection actions and additional impacts on your financial ratings.

Jim Akin, a freelance writer, wisely points out, "A charge-off on your financial history may leave your scores in poor condition, but its detrimental effect will diminish significantly over the seven years it is present on your financial documents." So, take heart! With the right approach and support, you can navigate this challenging situation.

Explore Credit Score Impacts of Charged-Off Debt

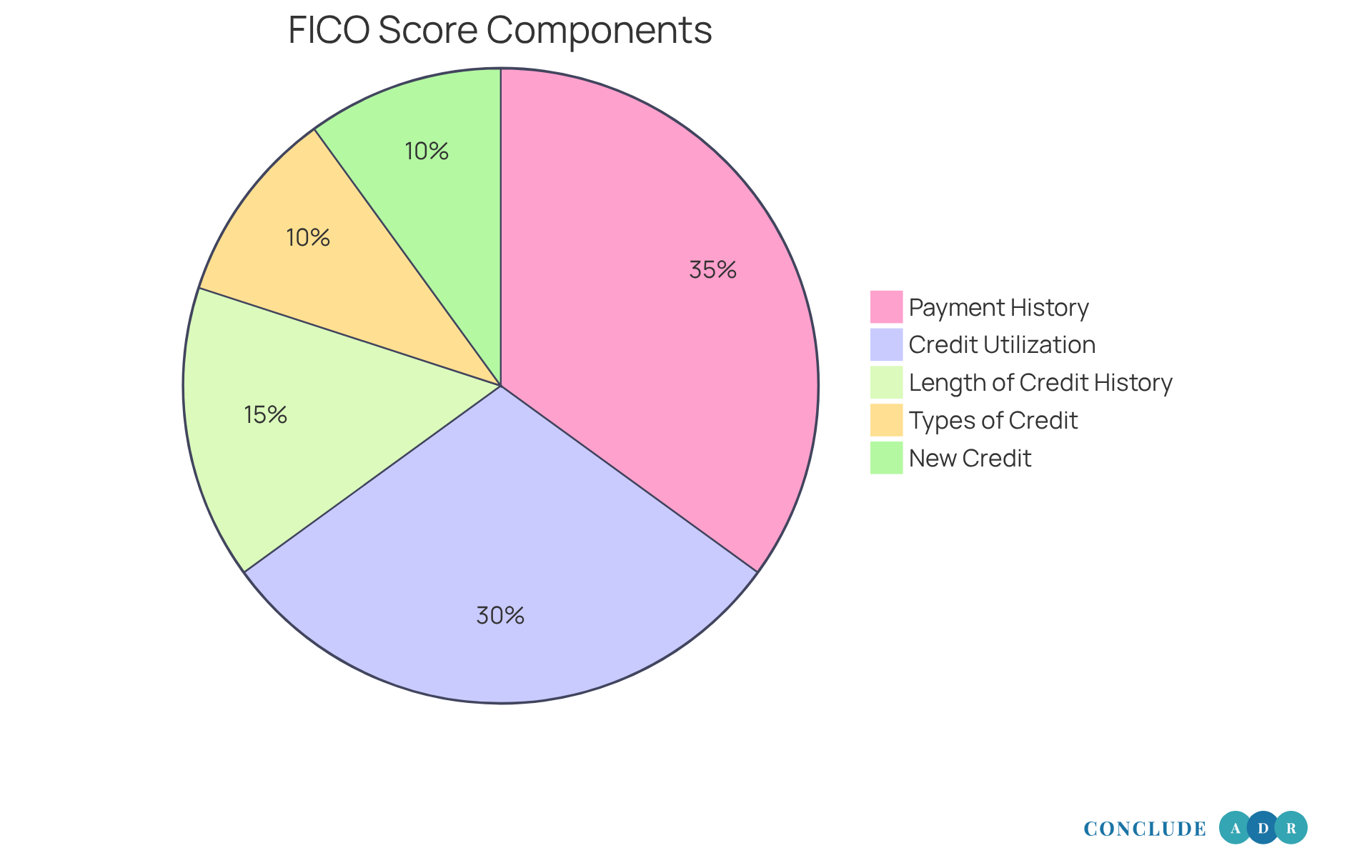

A debt that is charged off as bad debt dispute resolved reported by grantor can really take a toll on your credit score, often causing a drop of 50 to 150 points. This negative mark can linger on your financial report for up to seven years, making it tougher to secure loans, credit cards, or favorable interest rates. It’s important to understand that payment history accounts for 35% of your FICO score, which makes it the most crucial factor in determining your creditworthiness.

Have you ever felt overwhelmed by the thought of a charge-off? You're not alone. Many lenders might turn down loan applications because of this issue, but taking prompt action on debts that are charged off as bad debt dispute resolved reported by grantor is essential for restoring your financial health. Seeking help from financial counseling services or negotiating settlements can be effective ways to manage these debts.

Additionally, regularly reviewing your financial report can help you identify areas for improvement and ensure you’re actively managing your financial well-being. Remember, individuals who neglect their outstanding debts often face significant hurdles in obtaining new credit. This highlights the importance of being proactive in addressing these challenges.

Let’s take this step together. By understanding your options and seeking support, you can work towards a brighter financial future.

Resolve Charged-Off Debt: Dispute Processes and Negotiation Strategies

Resolving charged-off financial obligations can feel overwhelming, but you’re not alone in this journey. Here’s a compassionate guide to help you navigate through it:

-

Validate the Debt: Start by requesting documentation from your creditor to confirm the legitimacy of the debt. This step is crucial. Did you know that about 22% of U.S. consumers have a third-party collection tradeline on their record? This highlights just how important it is to validate claims before proceeding.

-

Dispute Errors: If you find any mistakes in your records, don’t hesitate to submit a dispute with the reporting agencies. You can do this online or via certified mail, just remember to include any supporting documents. It’s your right to ensure your financial history is accurate.

-

Negotiate a Settlement: Reach out to your creditor and discuss the possibility of a settlement. You might propose a one-time payment that’s lower than the total amount due. Have you considered a 'pay-for-delete' arrangement? This means they agree to remove the charge-off as bad debt dispute resolved reported by grantor from your financial history once you make the payment. Many financial experts recommend this approach, as it can significantly improve your financial reputation.

-

Follow Up: After you’ve reached an agreement, it’s essential to ensure that the creditor updates your credit report accordingly. Keeping records of all communications is vital for your future reference. Remember, you’re taking important steps towards regaining control of your financial health.

Conclusion

Navigating the complexities of charged-off debt can feel overwhelming, can’t it? Yet, understanding this financial issue is essential for anyone looking to restore their credit health. A charged-off account represents a significant hurdle, reflecting negatively on your credit report and making it harder to secure future loans. But don’t lose hope! With informed strategies and proactive measures, you can mitigate the impact of these debts and work towards a more favorable financial standing.

Let’s explore some essential steps to address charged-off debt:

- Start by validating the debt - this is your right.

- If you find any inaccuracies, don’t hesitate to dispute them.

- Negotiating settlements can also be a powerful tool.

- Remember to follow up with your creditors.

Each of these strategies is vital, not just for resolving the immediate issue but also for improving your overall credit score. Taking prompt action is crucial; neglecting these debts can lead to long-term financial consequences.

Ultimately, resolving charged-off debt isn’t just about clearing financial obligations; it’s about empowering yourself to regain control over your personal finances. By utilizing effective dispute strategies and negotiation techniques, you can pave the way for a brighter financial future. Taking these steps not only helps improve your credit score but also fosters a sense of financial responsibility and resilience that can lead to lasting success.

So, are you ready to take that first step? Remember, you’re not alone in this journey. Together, we can work towards a healthier financial future.

Frequently Asked Questions

What is charged-off debt?

Charged-off debt is a designation by a creditor indicating that they believe it is unlikely they will recover the debt after about 180 days of non-payment. It signifies that the account has been marked as bad debt.

Does a charged-off account mean I no longer owe the debt?

No, a charged-off account does not erase your responsibility to repay the debt. You are still obligated to pay it even if it has been charged off by the creditor.

How does a charged-off debt affect my credit score?

A charged-off debt can significantly impact your credit score, as it gets reported to financial agencies. This negative mark can remain on your credit report for up to seven years.

What can I do if I have a charged-off debt?

If you have a charged-off debt, you may consider negotiating settlements or enrolling in financial relief programs to manage your financial situation better.

How long does a charged-off account stay on my credit report?

A charged-off account can stay on your credit report for up to seven years.

What happens to charged-off accounts after they are reported?

Charged-off accounts may be transferred to collection agencies, which can lead to further collection actions and additional negative impacts on your financial ratings.

Are there any resources to help manage charged-off debts?

Keeping a close eye on your financial scores and seeking support from financial relief programs can help you manage charged-off debts and improve your overall financial health.