Introduction

Navigating the financial markets can feel overwhelming, especially when it comes to understanding the nuances between material and non-material news. Material news, like earnings reports and regulatory changes, can cause immediate stock price fluctuations. On the other hand, non-material news, such as company gossip or market trends, often influences investor sentiment in more subtle ways.

So, how can you effectively leverage both types of information to enhance your decision-making and optimize your trading strategies? This article is here to help you explore the impact of these news categories on trading dynamics.

By understanding these differences, you can transform your approach to trading. Let’s dive in together and discover insights that can empower you in your investment journey.

Define Material and Non-Material News in Trading

Understanding the difference between material vs non-material news is crucial, as it can significantly influence a company's stock value or your investment choices. Think about it: when earnings reports, mergers, or regulatory changes come into play, they can lead to quick reactions from investors like you. For instance, a positive earnings report might boost stock values, reflecting the confidence you and others have in the company.

On the other hand, in the context of material vs non-material information, non-material insights like general market trends or company gossip often don’t have the same impact. These details might only lead to subtle or delayed effects on trading decisions. Understanding the distinction of material vs non-material is vital for traders. Significant information can create volatility, prompting the need for swift action, while less important news usually doesn’t carry the same urgency.

Financial analysts emphasize that recognizing the distinction between material vs non-material information types is essential for crafting effective trading strategies and making informed investment decisions. Moreover, the NYSE has specific rules about when significant announcements should be made. Companies must notify the exchange at least 10 minutes before sharing important information during trading hours. This regulatory framework is designed to promote transparency and fairness in the trading of securities.

So, as you navigate your investment journey, remember the importance of staying informed about material news. It can make a real difference in your decision-making process.

Analyze the Impact of Material News on Trading Dynamics

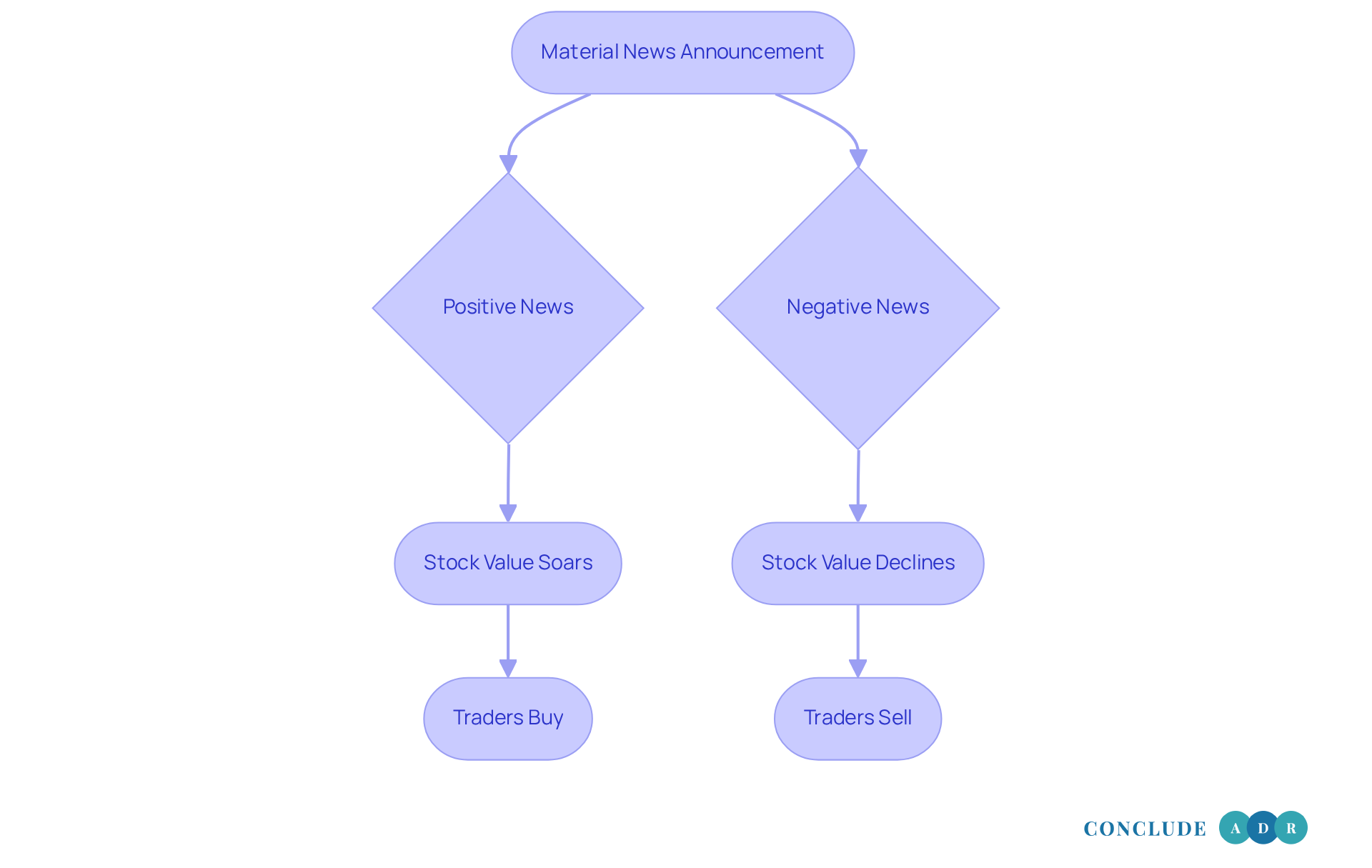

In the stock market, significant information often triggers quick reactions, leading to volatility and price adjustments. Have you ever noticed how a positive earnings report can make a stock's value soar? Conversely, negative news can result in sharp declines. For traders, being able to swiftly interpret and respond to this information can be a game-changer, allowing them to capitalize on these rapid price movements.

It's important to recognize that the frequency and timing of announcements can create patterns. Savvy traders can leverage these patterns to their advantage. This is why staying informed about upcoming disclosures is crucial. By doing so, you can position yourself to respond effectively and make informed decisions.

Remember, being proactive in understanding market signals not only helps you navigate volatility but also empowers you to take control of your investments. So, let’s stay aware and engaged together!

Examine the Role of Non-Material News in Trading Decisions

The distinction between material vs non-material information plays a subtle yet influential role in shaping market sentiment and trader behavior. Have you ever considered how something as simple as a company's charitable event or a new marketing campaign can affect your perception as an investor? While these elements may not lead to immediate changes in stock prices, when considering material vs non-material factors, they can significantly enhance a company's public image and influence investor confidence.

Think about it: when a company engages in positive community activities, it often resonates with investors, fostering a sense of trust and connection. Traders frequently take into account material vs non-material factors when making decisions, as they contribute to the overall market narrative. This narrative can impact future significant updates, shaping expectations and confidence in ways that might not be immediately visible.

So, as you navigate your investment journey, remember to consider the broader story behind the numbers. It’s not just about the immediate costs; it’s about the lasting impressions that can guide your decisions. Together, let’s stay informed and engaged, recognizing the power of these subtle influences.

Compare Material and Non-Material News: Pros, Cons, and Trading Strategies

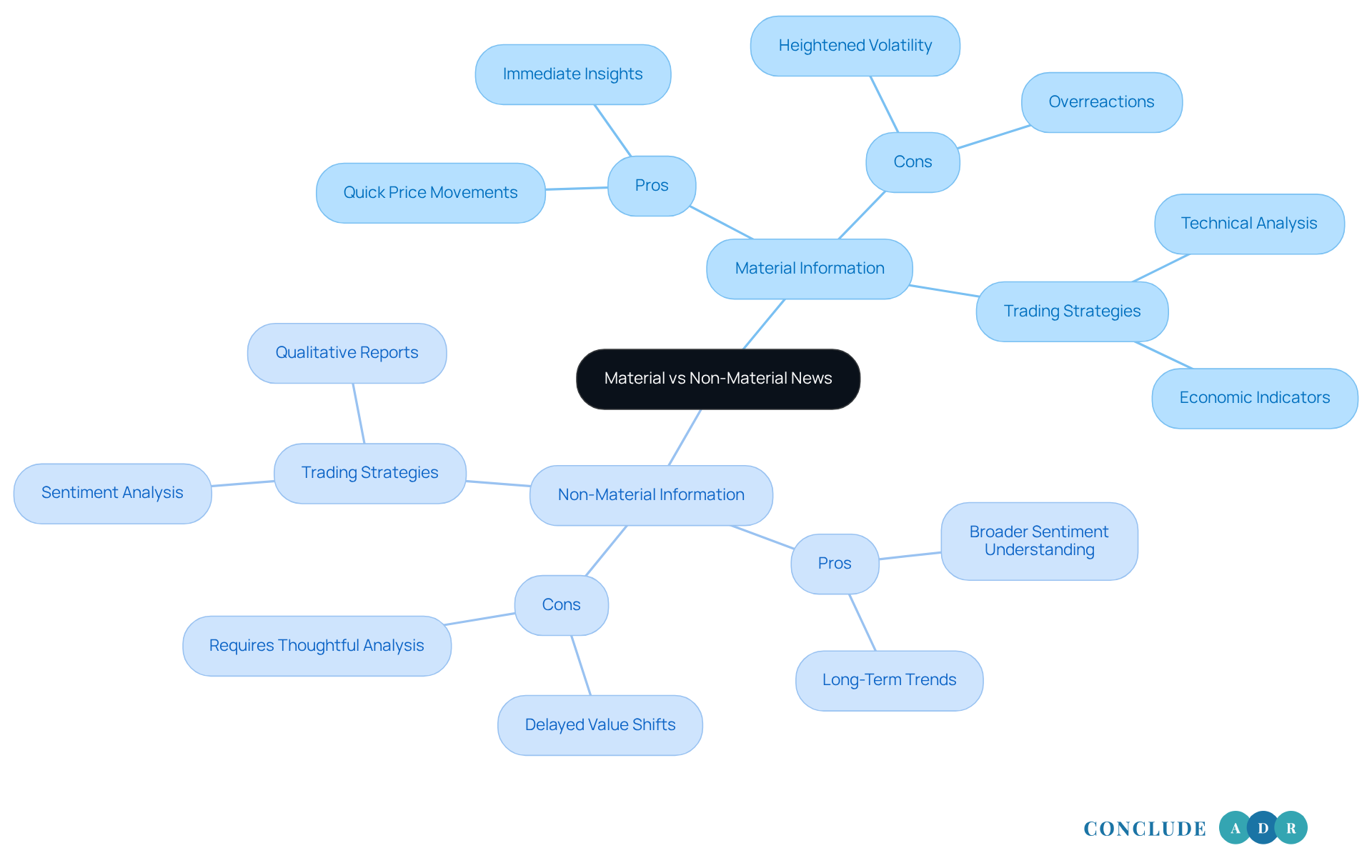

When we consider material vs non-material information, it’s clear that each has its own set of advantages and challenges. Material information often leads to quick price movements, giving traders immediate insights that can be acted upon swiftly. But this speed can also bring risks, like overreactions and heightened volatility. As Warren Buffett wisely points out, "The stock exchange is structured to shift funds from the Active to the Patient." This highlights the importance of having a disciplined strategy when faced with significant information.

On the flip side, the distinction between material vs non-material information might not cause instant value shifts, but non-material information plays a crucial role in understanding broader sentiment and context. Have you ever noticed how market moods can change based on the news? Trading strategies that focus on significant information often emphasize quick reactions and technical analysis. For instance, traders might use economic indicators or corporate earnings announcements to make rapid trades based on anticipated market reactions. The moments right after these announcements can be particularly lucrative for automated trading systems, which need to quickly compare actual results to expectations.

In contrast, strategies that rely on non-material information require a more thoughtful approach when considering the material vs non-material aspects. They focus on long-term trends and sentiment analysis. This could mean keeping an eye on social media sentiment or analyzing qualitative reports to understand consumer mood.

To make better decisions, it’s beneficial for traders to adopt a balanced approach that incorporates both tangible and intangible information. Using an economic calendar can be a great way to track important market events, helping you navigate the complexities of trading. By doing this, you can take advantage of the immediacy of material news while also considering the broader implications of non-material insights.

Key Benefits of a Balanced Approach:

- Informed Decisions: Combining both types of information leads to more comprehensive insights.

- Risk Management: Understanding the emotional context can help mitigate risks associated with quick trades.

- Long-Term Success: Focusing on sentiment can guide you toward sustainable trading strategies.

So, how can you start integrating these insights into your trading strategy? Let’s take a moment to reflect on how both material and non-material information can work together to enhance your trading journey.

Conclusion

Understanding the difference between material and non-material news is crucial for making informed trading decisions. Material news, like earnings reports and regulatory changes, can trigger immediate market reactions and price swings. On the other hand, non-material news, such as market sentiment and company reputation, shapes perceptions over time. By recognizing these distinctions, we can navigate the complexities of the market more effectively.

Consider how material news can prompt swift actions, creating opportunities for those who can seize immediate price movements. In contrast, non-material news contributes to the broader narrative that influences investor confidence and market sentiment. This often requires a more thoughtful approach to trading strategies. By integrating both types of information, we can develop a balanced strategy that enhances our decision-making processes.

Ultimately, the ability to discern and respond to both material and non-material news can significantly impact our trading success. As the market evolves, staying informed about these distinctions empowers us to make better decisions and adapt our strategies for long-term success. Embracing a comprehensive approach that considers both immediate and lasting influences is essential in navigating the dynamic landscape of trading.

So, let’s commit to understanding these nuances together, ensuring we’re well-equipped to thrive in our trading journeys.

Frequently Asked Questions

What is the difference between material and non-material news in trading?

Material news refers to significant information that can influence a company's stock value or investment choices, such as earnings reports, mergers, or regulatory changes. Non-material news includes general market trends or company gossip, which typically have a lesser impact on trading decisions.

Why is it important to understand material vs non-material news?

Understanding the distinction is crucial for traders because material news can create volatility and prompt swift action, while non-material news usually does not carry the same urgency and may lead to subtle or delayed effects on trading decisions.

How does material news affect stock values?

Positive material news, such as a strong earnings report, can boost stock values as it reflects investor confidence in the company, leading to quick reactions from investors.

What are some examples of material news?

Examples of material news include earnings reports, mergers, acquisitions, and regulatory changes.

What are some examples of non-material news?

Examples of non-material news include general market trends, company gossip, and other insights that do not significantly impact stock values.

What regulations exist regarding the announcement of material news?

The NYSE requires companies to notify the exchange at least 10 minutes before sharing important information during trading hours to promote transparency and fairness in securities trading.

How can understanding material news impact trading strategies?

Recognizing the difference between material and non-material information helps traders craft effective trading strategies and make informed investment decisions, as material news can significantly influence market movements.