Introduction

Mediation in the insurance sector has become a compassionate way to resolve disputes, offering a structured yet informal alternative to the often intimidating courtroom battles. Have you ever felt overwhelmed by the thought of a legal fight? This article explores the nuances of mediation, showcasing its many benefits - from saving costs to improving communication - and sharing essential tips for navigating the process effectively.

But how can you or your company use mediation not just to settle conflicts, but also to strengthen relationships and achieve satisfying outcomes? By exploring this question, we uncover the potential of mediation as a powerful ally in the insurance landscape.

Imagine a scenario where disputes are resolved amicably, fostering understanding and collaboration. Mediation can be that bridge, helping you find common ground and build lasting connections.

Define Mediation in Insurance Context

Mediation insurance refers to a structured process where a neutral third party, known as a mediator, helps facilitate discussions between conflicting parties, typically a covered individual and their coverage provider. This approach is different from litigation; it’s informal, voluntary, and non-binding, allowing everyone involved to negotiate terms without the stress of a courtroom.

The benefits of alternative dispute resolution in claims are significant. It encourages open dialogue, giving both sides a chance to share their perspectives and work together toward a solution. This is especially important in mediation insurance disputes, where emotions and financial stakes can run high. Mediation not only helps maintain relationships but also avoids the hefty costs associated with litigation, which can soar to between $76 billion and $122 billion annually in the current tort system.

Did you know that negotiation has a success rate of 75% to 90% in avoiding litigation? That’s right! It can save approximately $50,000 per claim. Plus, conflict resolution often leads to satisfaction rates of around 90% for both plaintiffs and defendants. For example, early apology and disclosure programs have shown success rates of 50% to 67% in preventing litigation, proving that proactive communication can lead to positive outcomes.

Key aspects of negotiation in insurance conflicts include:

- Flexibility in scheduling

- The ability to maintain confidentiality

- The opportunity for creative problem-solving

For claims of 30 lakhs and below, negotiation can be pursued after a grievance officer's rejection, allowing complainants to choose between negotiation and the Ombudsman. By including conflict resolution clauses in contracts, insurers can utilize mediation insurance to address grievances before they escalate to arbitration or litigation. This not only streamlines the dispute resolution process but also enhances customer satisfaction.

In conclusion, mediation offers a compassionate alternative to traditional litigation. It’s about finding common ground and working together toward a resolution that benefits everyone involved. So, let’s consider how we can incorporate these practices into our processes for a more harmonious outcome.

Outline the Mediation Process for Insurance Claims

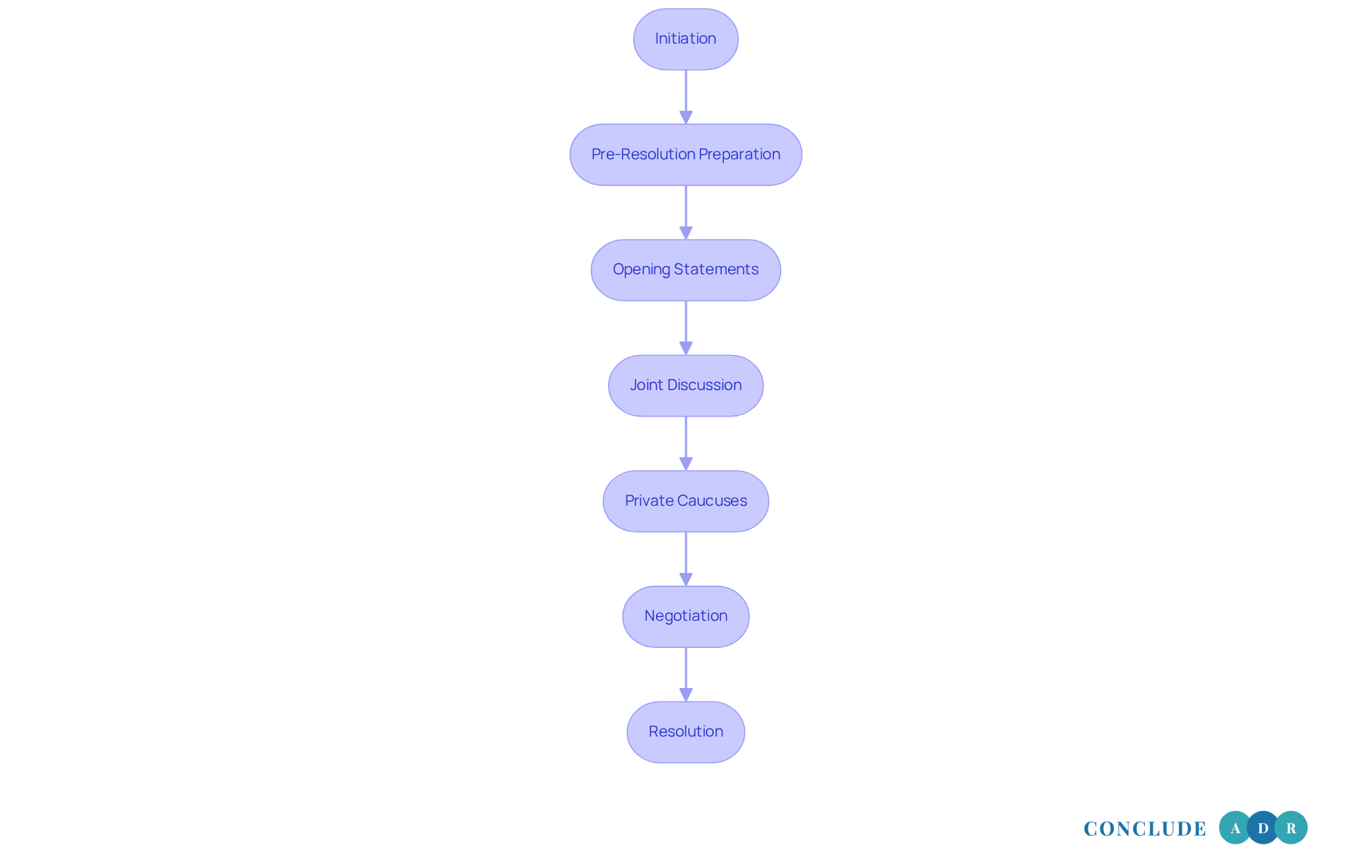

Navigating the mediation insurance process for claims can feel overwhelming, but understanding the steps involved can make it more manageable. Here’s how it typically unfolds:

-

Initiation: Mediation often begins when either party feels that initial negotiations haven’t led to a resolution. At this point, a mediator is chosen - either by mutual agreement or through a facilitation service. This choice is crucial, as the right mediator can help ease tensions and foster understanding.

-

Pre-Resolution Preparation: Before diving into discussions, it’s essential to prepare thoroughly. Gather relevant documents, outline your position, and identify the key issues you want to address. This groundwork is vital for clear communication during mediation, helping everyone feel heard and understood.

-

Opening Statements: Each side has the opportunity to share their perspective on the dispute. This initial exchange is not just about stating positions; it’s about setting the stage for constructive dialogue. By expressing priorities and concerns in a joint session, both parties can begin to see the situation from each other’s viewpoint.

-

Joint Discussion: Here, the mediator plays a pivotal role, facilitating a conversation that encourages both groups to voice their concerns and interests. Clarifying questions from the mediator help ensure that everyone understands each other, which is essential for effective negotiation.

-

Private Caucuses: Sometimes, sensitive issues arise that are best addressed in private. The mediator may hold individual meetings with each group, allowing for confidential discussions that can lead to potential solutions.

-

Negotiation: This is where the magic happens. The mediator guides the parties in negotiating terms, helping them work toward a mutually acceptable agreement. It’s important to approach initial offers with realistic expectations, as these often serve as starting points for deeper discussions. Brainstorming creative solutions can lead to breakthroughs that satisfy everyone involved.

-

Resolution: If an agreement is reached, the mediator will assist in drafting a settlement document that clearly outlines the terms. However, if an agreement isn’t possible, it’s okay to explore alternative dispute resolution methods or even consider litigation.

Mediation insurance provides more than just a process; it’s a supportive journey where a neutral intermediary helps disputants understand each other’s viewpoints and convey settlement proposals. This approach often leads to high success rates in achieving satisfactory settlements, reducing costs, and giving everyone involved a greater sense of control. By following these steps, you can navigate the negotiation process effectively, enhancing your chances of reaching a resolution that feels right for you.

Highlight Benefits of Mediation in Insurance Disputes

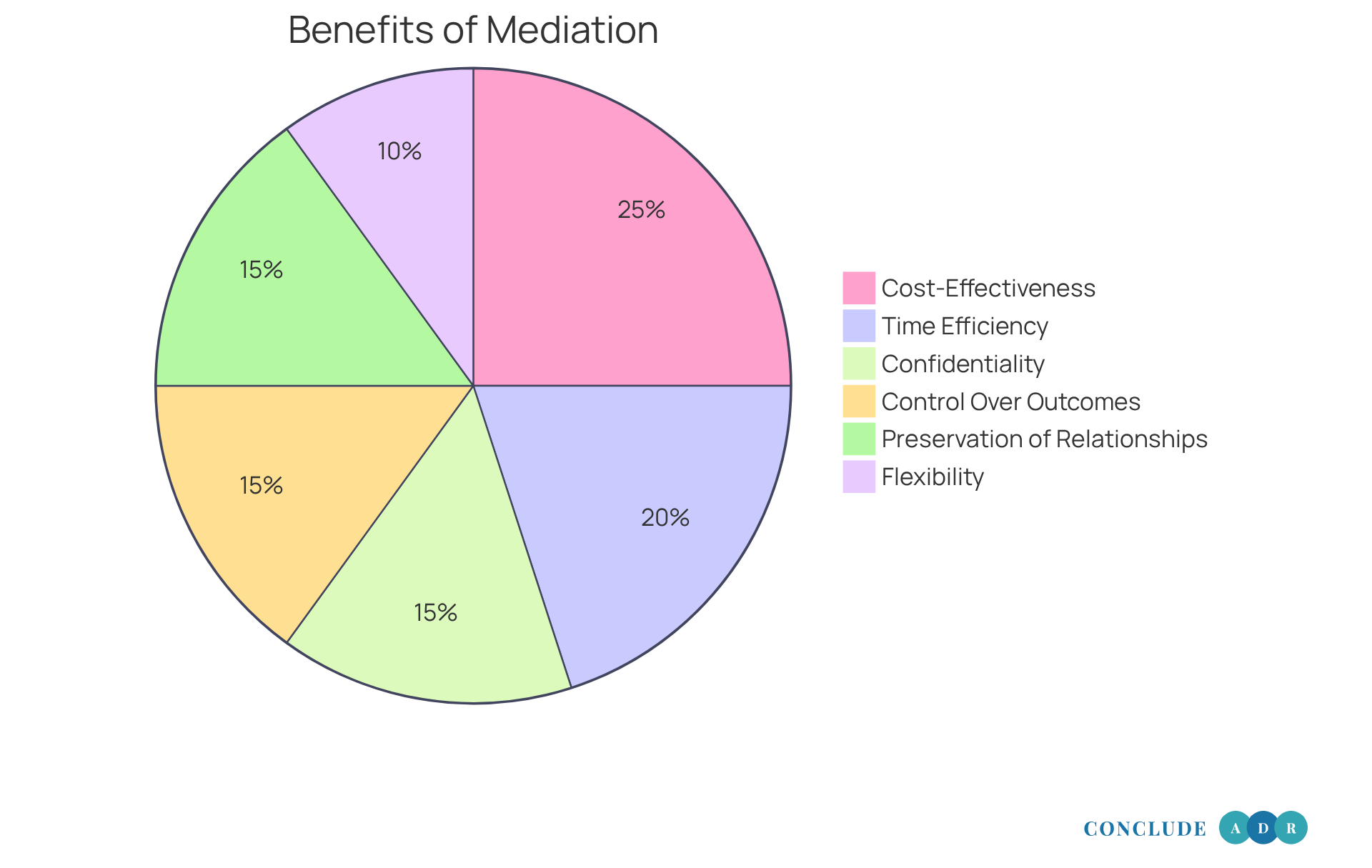

Mediation offers several key benefits in the context of insurance disputes that can truly make a difference:

-

Cost-Effectiveness: Mediation is generally less expensive than litigation, as it avoids court fees and lengthy legal processes. Virtual sessions often come at a lower cost than traditional face-to-face meetings, making it an appealing option for those wanting to resolve conflicts without the burden of significant financial strain.

-

Time Efficiency: Imagine settling your issues in just a few weeks instead of months or even years. Mediation can often resolve a case in a single day, significantly easing the emotional and financial toll on everyone involved.

-

Confidentiality: Unlike court proceedings, mediation is private. This protects your interests and sensitive information from public scrutiny, which is especially important in disputes involving personal and financial details.

-

Control Over Outcomes: You have more control over the resolution process, allowing you to craft solutions that truly meet your needs. This empowerment is crucial for achieving outcomes that feel right for you.

-

Preservation of Relationships: Mediation encourages collaboration and communication, helping to maintain professional relationships that might otherwise suffer through adversarial litigation. This is particularly valuable in the insurance industry, where mediation insurance plays a crucial role in maintaining ongoing partnerships.

-

Flexibility: The negotiation process is adaptable, allowing for creative solutions that may not be available in a court setting. This flexibility can lead to more satisfactory outcomes for everyone involved.

Real-life examples show just how effective mediation can be. Many conflicts have been resolved in a single day, significantly reducing the emotional and financial burden on individuals. Plus, numerous coverage plans now require negotiation before legal action, highlighting the growing recognition of mediation insurance as a practical and efficient resolution method. As Kimberly Taylor, CEO and President, points out, "Mediation has been around actually for quite a long time," underscoring its established role in conflict resolution. As the legal landscape evolves, mediation is increasingly seen as a vital tool for effective management.

So, if you’re facing a dispute, consider mediation as a compassionate and effective way to find resolution.

Provide Tips for Successful Mediation Engagement

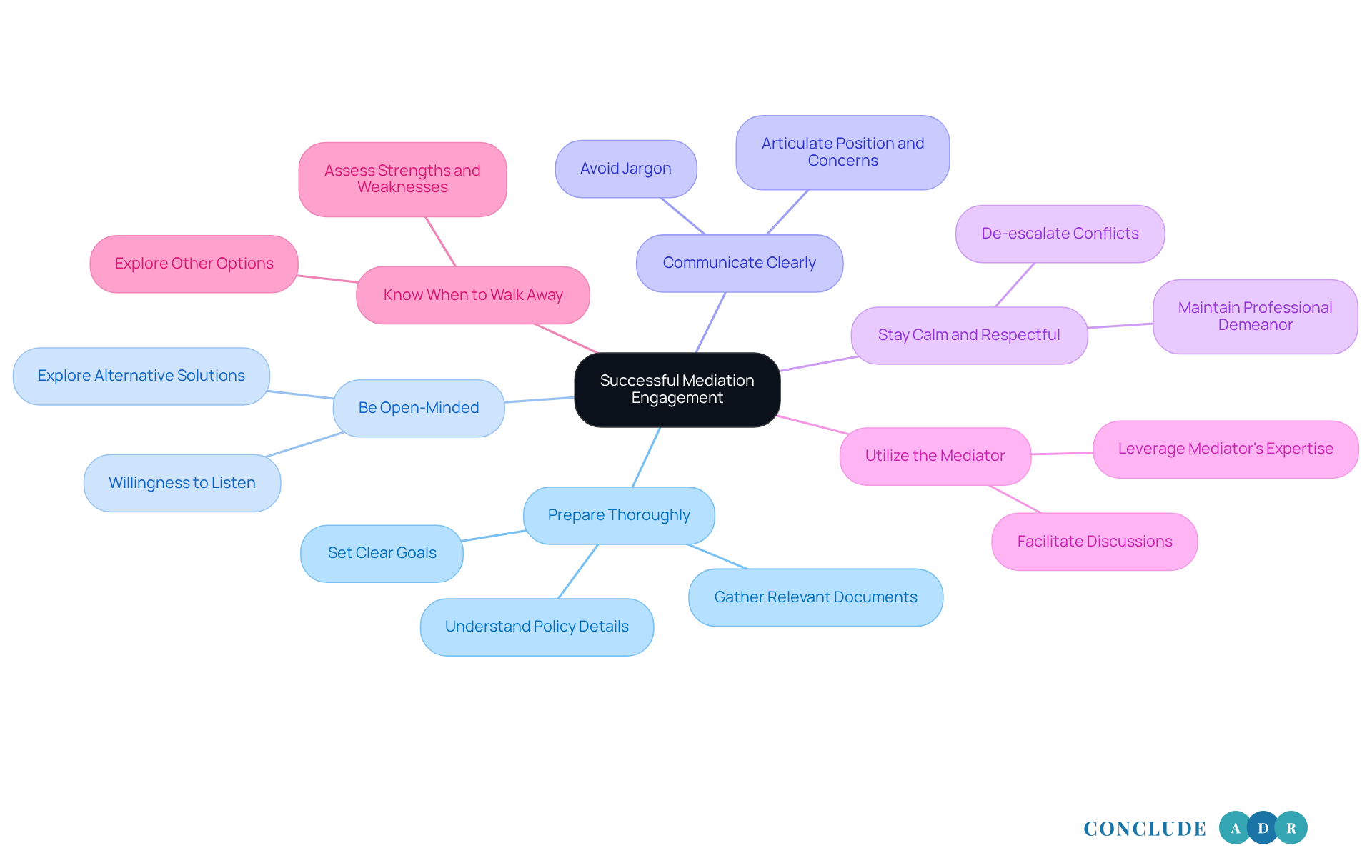

To maximize the effectiveness of mediation in insurance disputes, let’s explore some strategies that can truly make a difference:

-

Prepare Thoroughly: Before you step into the negotiation session, gather all relevant documents, understand your policy details, and set clear goals. This preparation is crucial; successful negotiations often hinge on having the right information at hand.

-

Be Open-Minded: Approach mediation with a willingness to listen and explore alternative solutions. Being adaptable can lead to innovative outcomes that satisfy both sides, boosting the chances of a favorable resolution.

-

Communicate Clearly: It’s important to articulate your position and concerns during discussions. Avoid jargon and focus on the key issues. Remember, effective communication is vital for understanding and resolution.

-

Stay Calm and Respectful: Maintaining a professional demeanor is essential, even if discussions get tense. Respectful communication creates a more productive environment and can help de-escalate conflicts.

-

Utilize the Mediator: Don’t hesitate to leverage the mediator's expertise. They can facilitate discussions and help navigate challenging topics. With decades of experience in alternative dispute resolution, seasoned mediators are there to assist both parties in reaching an agreement. As Andrew M. Reidy notes, having a mediator with strong expertise can significantly influence the resolution process.

-

Know When to Walk Away: If an agreement seems out of reach, be prepared to explore other options. Sometimes, stepping back can lead to better outcomes in future negotiations. Joseph M. Saka emphasizes that understanding the strengths and weaknesses of both your argument and the insurer's defense is key to successful negotiation.

By implementing these strategies, you can significantly enhance your chances of achieving a favorable resolution in mediation insurance, where success rates can soar as high as 80%. At Conclude ADR, we prioritize your schedule, offering flexible session times, including evenings and weekends, to accommodate urgent or complex disputes. Remember, you’re not alone in this process; we’re here to support you every step of the way.

Conclusion

Mediation in the insurance context is more than just an alternative to traditional litigation; it’s a compassionate approach to resolving disputes. Imagine a process where open dialogue is facilitated by a neutral third party, easing the stress of courtroom battles. This method not only reduces pressure but also nurtures collaboration and understanding, making it a valuable tool for both insurers and policyholders.

Have you ever felt overwhelmed by the complexities of conflict? Mediation offers a way out. It’s cost-effective, time-efficient, and helps preserve relationships. The mediation process unfolds in several steps-from initiation and preparation to negotiation and resolution-each designed to enhance communication and foster mutually agreeable outcomes. The benefits are clear:

- Substantial savings

- High satisfaction rates

- A more harmonious resolution process

Ultimately, embracing mediation as a strategy in insurance disputes can truly transform how we manage conflicts. By prioritizing preparation, open-mindedness, and effective communication, we can navigate the mediation process successfully. As the landscape of conflict resolution evolves, integrating mediation into our standard practices not only empowers everyone involved but also paves the way for more amicable and efficient resolutions.

So, why not consider mediation as your first step in resolving disputes? Together, we can create a more understanding and supportive environment for all.

Frequently Asked Questions

What is mediation in the context of insurance?

Mediation in insurance refers to a structured process where a neutral third party, called a mediator, facilitates discussions between conflicting parties, such as a covered individual and their coverage provider. It is informal, voluntary, and non-binding, allowing for negotiation without the stress of litigation.

What are the benefits of mediation in insurance disputes?

Mediation encourages open dialogue, helps maintain relationships, and avoids the high costs associated with litigation, which can be substantial. It also has a high success rate in avoiding litigation and leads to high satisfaction rates for both parties involved.

How successful is negotiation in avoiding litigation?

Negotiation has a success rate of 75% to 90% in avoiding litigation, potentially saving approximately $50,000 per claim.

What are the key aspects of negotiation in insurance conflicts?

Key aspects include flexibility in scheduling, the ability to maintain confidentiality, and the opportunity for creative problem-solving.

What options do complainants have for claims of 30 lakhs and below?

For claims of 30 lakhs and below, negotiation can be pursued after a grievance officer's rejection, allowing complainants to choose between negotiation and the Ombudsman.

How can insurers utilize mediation insurance?

Insurers can include conflict resolution clauses in contracts to utilize mediation insurance, addressing grievances before they escalate to arbitration or litigation, which streamlines the dispute resolution process and enhances customer satisfaction.

What is the overall goal of mediation in insurance?

The goal of mediation is to find common ground and work together toward a resolution that benefits everyone involved, offering a compassionate alternative to traditional litigation.