Introduction

Navigating the complexities of insurance claim arbitration can feel overwhelming. Many policyholders find themselves in challenging situations, often at odds with insurance companies over claims. But there’s hope! This method of dispute resolution offers a compassionate alternative to traditional litigation. It promises efficiency, confidentiality, and a chance for both parties to be heard.

As the landscape of insurance arbitration evolves, you might wonder:

- What are the key steps to ensure a successful outcome?

- What challenges could arise along the way?

Understanding these intricacies not only empowers you to advocate for your rights but also highlights the vital role legal representation plays in achieving favorable resolutions.

Let’s explore this journey together. By embracing the process, you can navigate these waters with confidence and clarity.

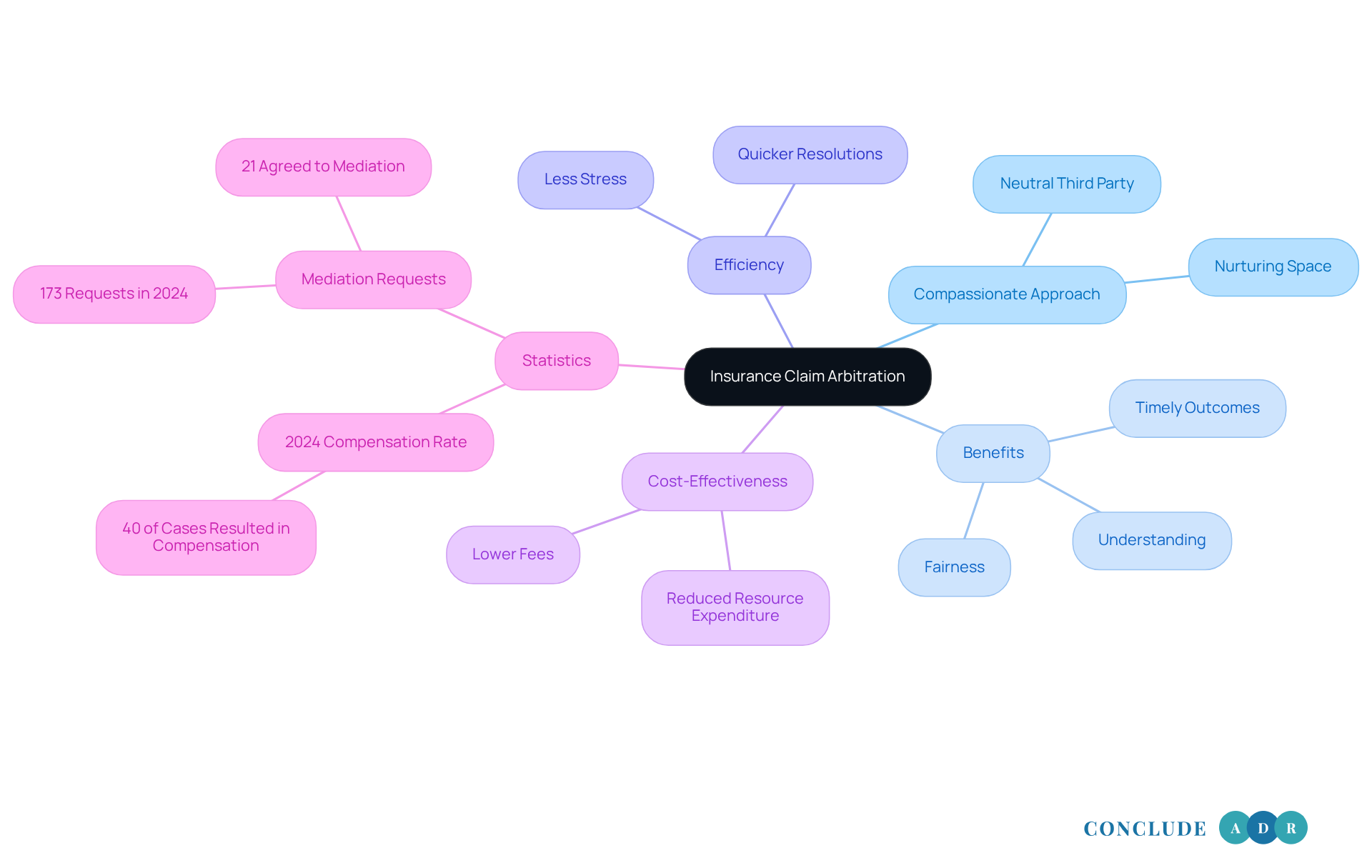

Define Insurance Claim Arbitration and Its Importance

Insurance claim arbitration is a compassionate approach to resolving conflicts between policyholders and insurance companies. Imagine a situation where you feel unheard or overwhelmed by the complexities of your claim. Mediation offers a nurturing space, facilitated by a neutral third party known as an arbitrator, to help you find resolution.

This process is often preferred because it’s not only efficient but also cost-effective and confidential. Who wouldn’t want a quicker resolution, especially in the insurance sector where timely outcomes can make a significant difference? Mediation allows both sides to present their cases without the stress and delays that often come with traditional court litigation.

In fact, in 2024, 40% of customer claimant cases resulted in compensation, excluding those that were dismissed. This statistic highlights the potential for positive outcomes through mediation. It’s reassuring to know that there’s a pathway to resolution that prioritizes fairness and understanding.

Moreover, the Independent Dispute Resolution (IDR) system, established under the No Surprises Act, enhances this mediation framework. It ensures that both parties have equal opportunities to engage in the dispute resolution process.

So, if you find yourself facing an insurance claim arbitration dispute, consider mediation as a viable option. It’s a step towards a just resolution, where your voice matters, and your concerns are addressed with care.

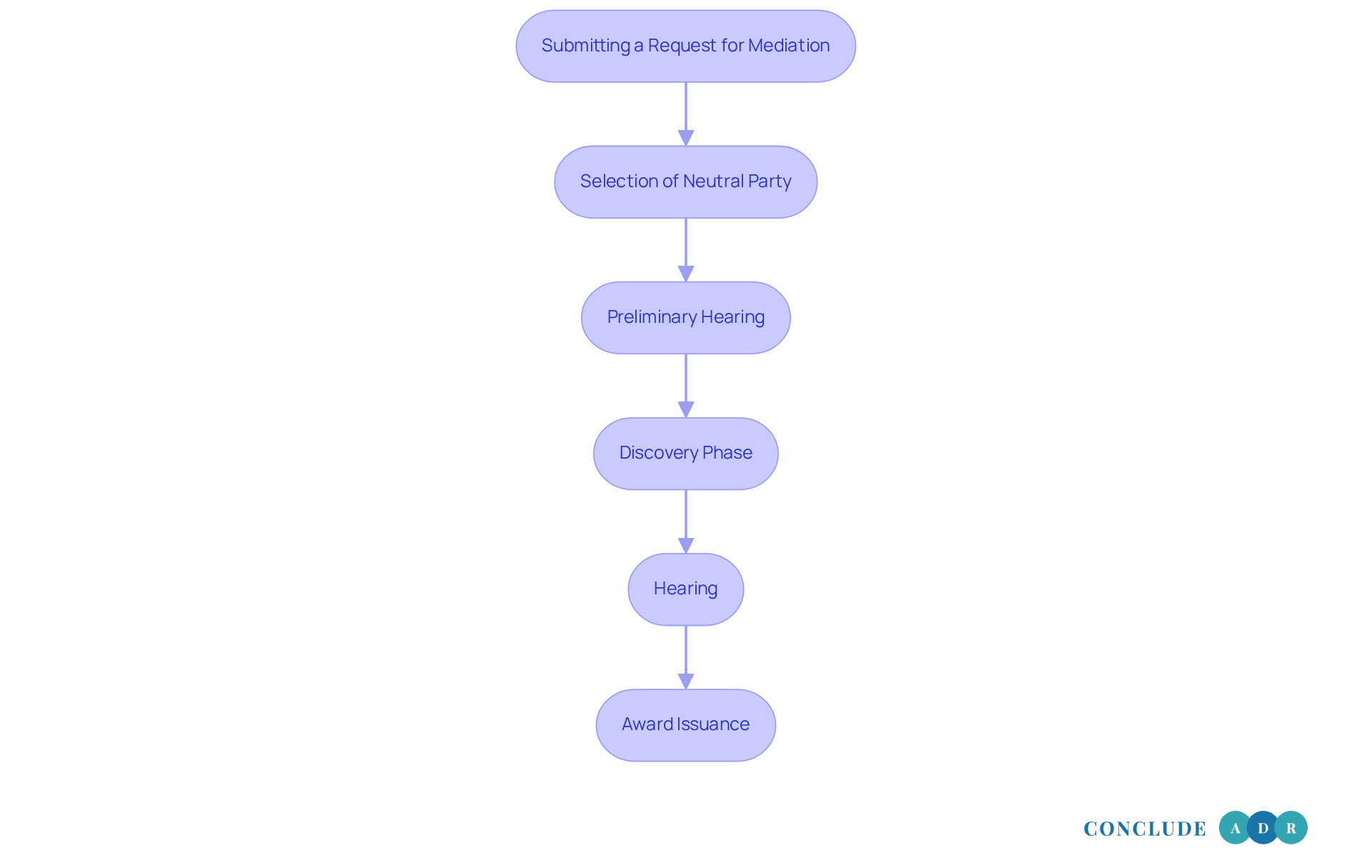

Outline the Arbitration Process: Steps from Filing to Resolution

-

Submitting a Request for Mediation: It all begins when one party reaches out to a mediation organization, sharing their concerns and the resolution they seek. At this stage, it’s essential to grasp the arbitration agreement, as it sets the foundation for resolving the dispute. Have you ever felt overwhelmed by disagreements? Understanding this process can help ease those worries.

-

Selection of Neutral Party: Next, both sides typically agree on a neutral mediator or a team of mediators. This choice is vital; the mediator's expertise can greatly influence the outcome. Involving skilled advisors during this phase can help minimize delays and ensure a smoother experience. Imagine having someone who truly understands your situation guiding you through this journey.

-

Preliminary Hearing: A preliminary hearing might take place to outline the rules and procedures for arbitration, including timelines for submissions and evidence. This step ensures that both parties are on the same page, which can help prevent potential delays. It’s comforting to know that everyone is aligned, isn’t it?

-

Discovery Phase: During this phase, both sides share relevant documents and information to prepare their cases. This exchange is crucial for ensuring that both parties have access to the necessary evidence, which can impact the decision-maker's judgment. Did you know that electronic document sharing can cut discovery time by 40%? That’s a significant boost in efficiency!

-

Hearing: The arbitration hearing is where both parties present their cases, including witness testimonies and evidence. The mediator listens to both sides before reaching a conclusion, marking a pivotal moment in the process. It’s a chance for your voice to be heard and understood.

-

Award Issuance: After careful consideration, the arbitrator issues a binding decision, known as an award, which resolves the dispute. This award is enforceable in court, much like a court judgment. Typically, dispute resolution procedures, such as those managed by the AAA, take around 11.6 months. This highlights how effective mediation can be, especially for settling conflicts through insurance claim arbitration. Isn’t it reassuring to know that there’s a structured way to find resolution?

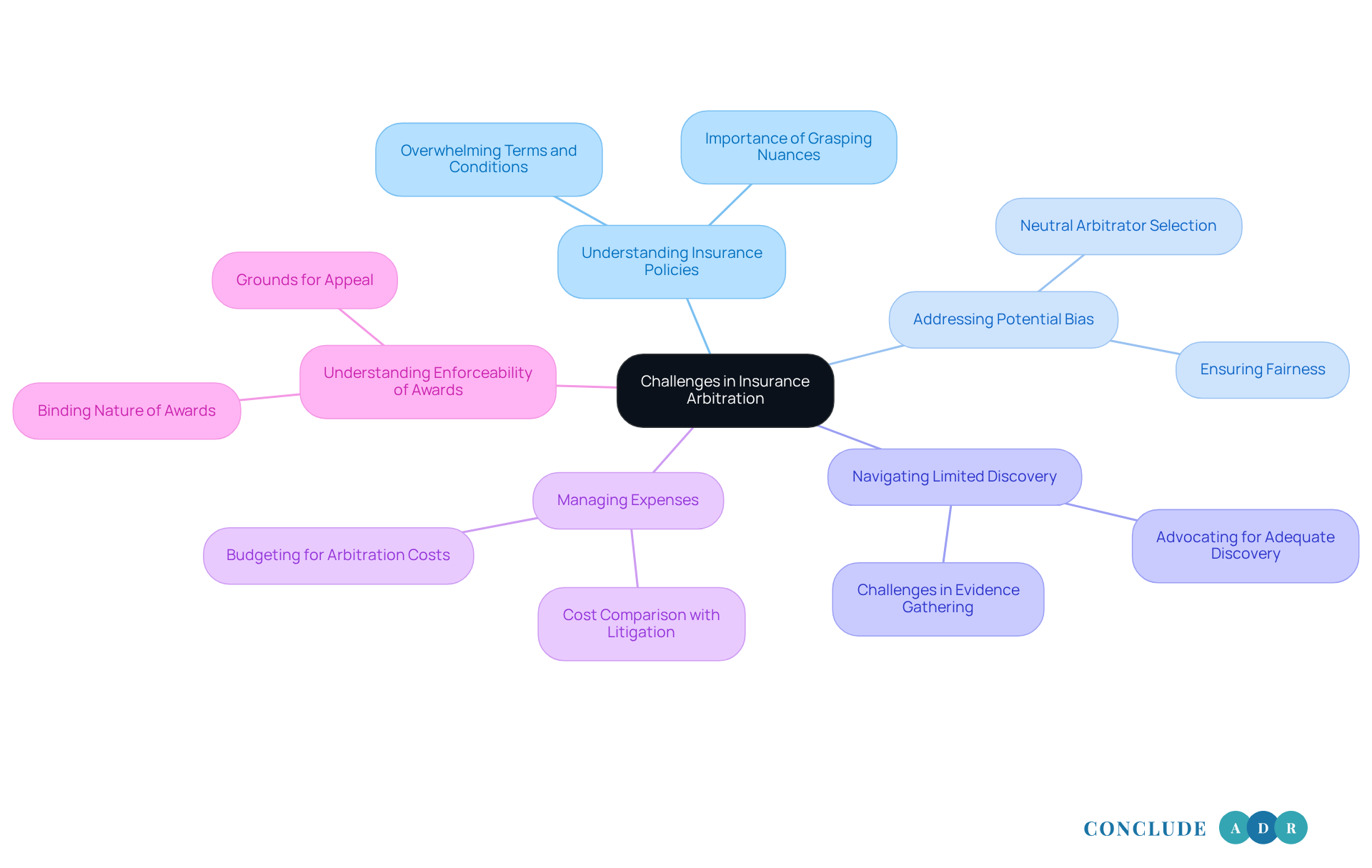

Discuss Challenges and Considerations in Insurance Arbitration

-

Understanding Insurance Policies: We know that insurance policies can feel overwhelming. With their specific terms and conditions, it’s easy to see how disputes over coverage can arise. That’s why grasping these nuances is so important for effective insurance claim arbitration. Have you ever felt lost in the fine print?

-

Addressing Potential Bias: It’s natural to worry about bias, especially if the mediator has previously worked with insurance companies. Choosing a neutral arbitrator is key to ensuring fairness in insurance claim arbitration and achieving peace of mind. How can we ensure that everyone feels heard and valued in this process?

-

Navigating Limited Discovery: Unlike traditional court proceedings, the discovery process in alternative dispute resolution can sometimes be limited. This might make it harder for you to gather essential evidence. It’s crucial to be prepared to advocate for adequate discovery during insurance claim arbitration. Are you ready to stand up for what you need?

-

Managing expenses is important because resolving disputes through insurance claim arbitration is often less expensive than litigation, though costs can still accumulate, especially if multiple hearings are required. It’s wise to budget for these expenses to avoid surprises. Have you thought about how to plan for these potential costs?

-

Understanding Enforceability of Awards: Dispute resolution awards are usually binding, but there are instances where they can be challenged in court. Knowing the grounds for appeal is vital for both parties involved in insurance claim arbitration. How can we ensure that you’re fully informed and prepared for any outcome?

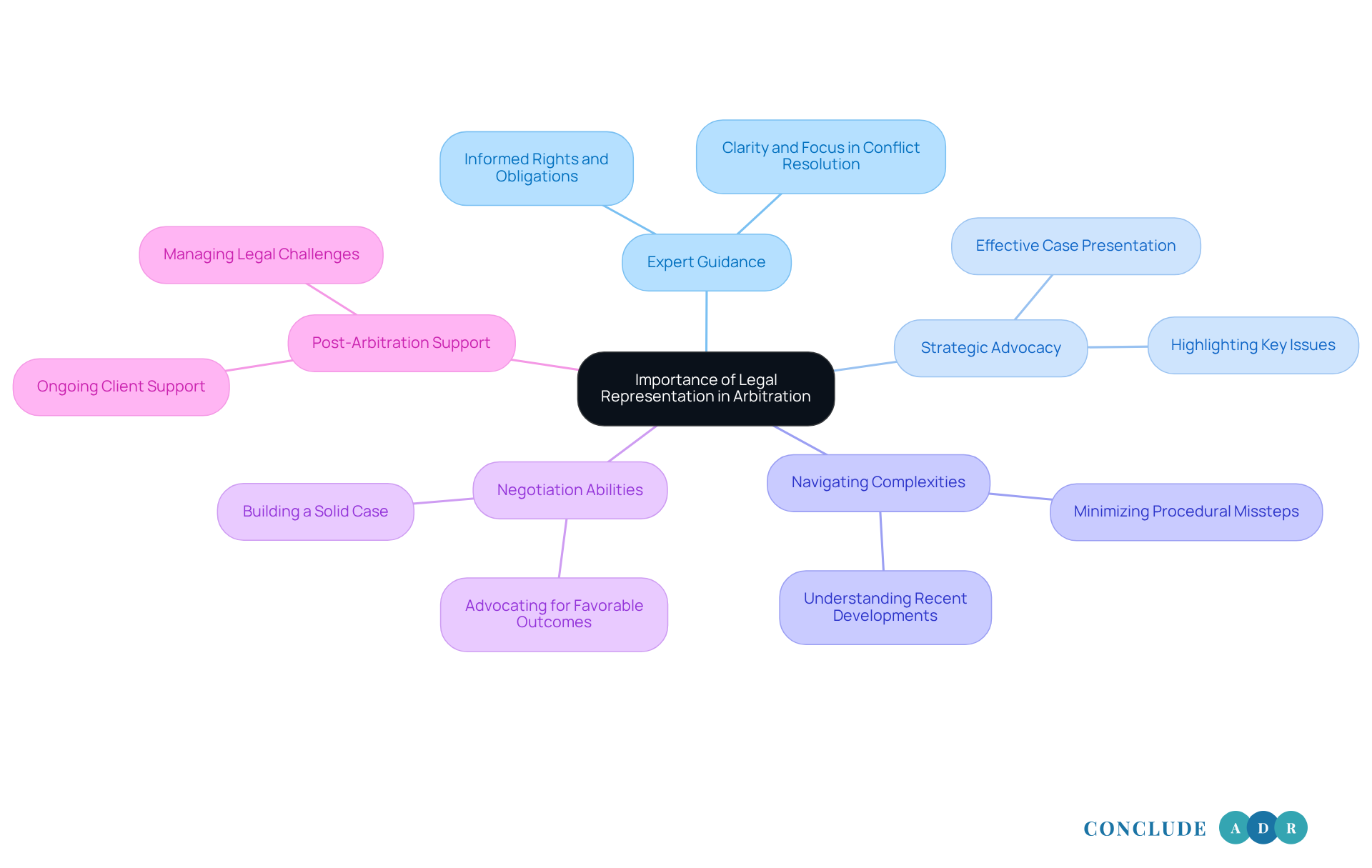

Highlight the Importance of Legal Representation in Arbitration

Legal representation in arbitration is vital for several important reasons that truly matter to you:

-

Expert Guidance: When you have an attorney experienced in dispute resolution by your side, you gain invaluable insights into the process. They ensure you’re well-informed about your rights and obligations. As the American Arbitration Association emphasizes, clarity and focus are key in resolving conflicts, and a lawyer can help you achieve that.

-

Strategic Advocacy: A skilled lawyer knows how to craft a strategic approach to present your case effectively. They communicate all relevant evidence to the arbitrator, helping to highlight the main issues and important facts that are essential for a successful resolution. This legal advice is crucial in navigating your situation.

-

Navigating Complexities: The dispute resolution process can often feel overwhelming, with intricate legal and procedural issues at play. Having legal counsel means you have someone who can navigate these complexities for you, minimizing the risk of any procedural missteps that could jeopardize your insurance claim arbitration. Recent developments in procedural rules and tools also promote efficiency, underscoring the need for expert guidance.

-

Negotiation Abilities: Lawyers possess strong negotiation skills, allowing them to advocate for you effectively and potentially achieve more favorable outcomes during dispute resolution. A skilled personal injury lawyer can build a solid case that stands up in mediation, increasing your chances of a successful resolution.

-

Post-arbitration support is crucial in the context of insurance claim arbitration, especially if an arbitration award is contested, highlighting the importance of legal representation. Your lawyer will help you manage any subsequent legal challenges, ensuring you feel supported throughout the entire process.

In this journey, remember that you’re not alone. Seeking legal representation can make a significant difference in your experience and outcomes.

Conclusion

Insurance claim arbitration is a vital way to resolve disputes between policyholders and insurance companies. It offers a compassionate and structured approach to conflict resolution, ensuring that you feel heard and valued throughout your journey. By embracing mediation as a viable option, you can achieve fair and timely resolutions, highlighting the importance of this alternative to traditional litigation.

In this article, we’ve outlined key steps in the arbitration process, such as:

- Submitting requests

- Selecting neutral parties

- Navigating hearings

Each stage is crucial for allowing both parties to present their cases effectively, ultimately leading to a binding decision that provides closure. We’ve also discussed challenges like:

- Understanding complex insurance policies

- Addressing potential biases

- The importance of legal representation

This underscores the multifaceted nature of the arbitration landscape.

As you face insurance disputes, it’s essential to recognize the value of informed decision-making and expert guidance. Engaging legal representation can significantly enhance your experience, ensuring clarity and strategic advocacy throughout the arbitration process. By taking proactive steps and understanding the intricacies of insurance claim arbitration, you can empower yourself to navigate this complex terrain and achieve just outcomes.

Remember: You’re not alone in this journey. With the right support, you can find resolution and peace of mind.

Frequently Asked Questions

What is insurance claim arbitration?

Insurance claim arbitration is a process for resolving conflicts between policyholders and insurance companies, facilitated by a neutral third party known as an arbitrator. It provides a compassionate and supportive environment for both parties to present their cases.

Why is insurance claim arbitration important?

It is important because it offers an efficient, cost-effective, and confidential way to resolve disputes, allowing for quicker resolutions compared to traditional court litigation. This can be particularly significant in the insurance sector where timely outcomes are crucial.

What are the benefits of mediation in insurance claims?

Mediation in insurance claims allows both sides to present their cases without the stress and delays of court litigation. It prioritizes fairness and understanding, leading to positive outcomes, as evidenced by the 40% compensation rate for customer claimant cases in 2024.

What is the Independent Dispute Resolution (IDR) system?

The Independent Dispute Resolution (IDR) system, established under the No Surprises Act, enhances the mediation framework by ensuring that both parties have equal opportunities to engage in the dispute resolution process.

What should I consider if facing an insurance claim arbitration dispute?

If facing an insurance claim arbitration dispute, consider mediation as a viable option. It provides a pathway to a just resolution where your concerns are addressed with care and your voice is heard.