Overview

FINRA Rule 2268 plays a crucial role in dispute resolution, focusing on transparency, informed consent, and the protection of clients' rights in predispute arbitration agreements. Have you ever felt uncertain about the implications of such agreements? This rule ensures that clients are fully aware of what they are signing, fostering trust and empowering them to pursue claims without limitations.

By emphasizing these principles, we can create an environment where clients feel supported and informed. This not only nurtures their confidence but also safeguards their rights. It's vital that clients understand the significance of their agreements—after all, their peace of mind is paramount.

As we consider the importance of these steps, let's reflect on how they benefit us all. Together, we can promote a culture of understanding and support in financial dealings. Remember, you are not alone in this journey; we are here to help you navigate these complexities.

Introduction

Navigating the complexities of dispute resolution can feel overwhelming, especially when it comes to financial agreements. We understand that the details can be daunting. That’s where FINRA Rule 2268 comes in. This important framework is designed to protect you, ensuring transparency and informed consent in predispute arbitration agreements. As you engage with these contracts, you might find yourself asking: how can you truly safeguard your rights and make informed decisions amidst the legal jargon?

This article will explore the essential principles and practical steps of FINRA Rule 2268, empowering you to confidently navigate your agreements and advocate for your interests. Together, we can demystify this process and help you feel more secure in your decisions.

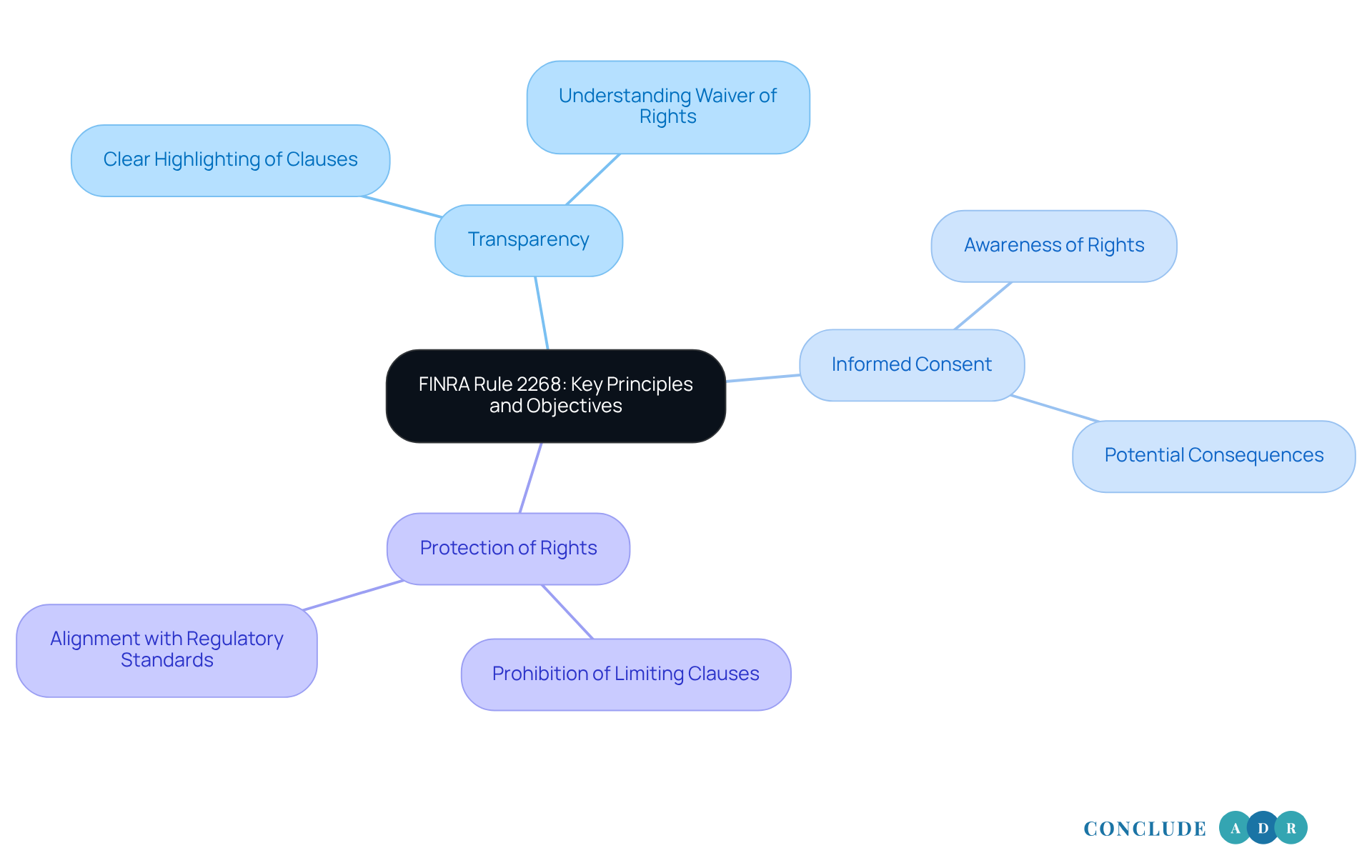

Explore FINRA Rule 2268: Key Principles and Objectives

FINRA Rule 2268 was established to ensure that you, as a client, are well-informed about the implications of predispute dispute resolution contracts. Let's explore some key principles that are designed with your understanding and protection in mind:

- Transparency: It’s essential that all predispute arbitration clauses are clearly highlighted in customer agreements. This way, you can fully grasp that by signing, you are waiving your right to sue in court.

- Informed Consent: You deserve to know your rights and the potential consequences of entering such agreements. This promotes informed decision-making, in line with FINRA Rule 2268, empowering you in the process.

- Protection of Rights: The FINRA Rule 2268 prohibits any clauses that may limit your ability to seek claims or that contradict regulatory standards. This is all about safeguarding your rights during dispute resolution.

These principles are not just legal requirements; they aim to foster trust and fairness in the dispute resolution process. It's crucial for both companies and you, the client, to fully understand them. We encourage you to reflect on these aspects as you navigate your agreements, ensuring that your voice and rights are always prioritized.

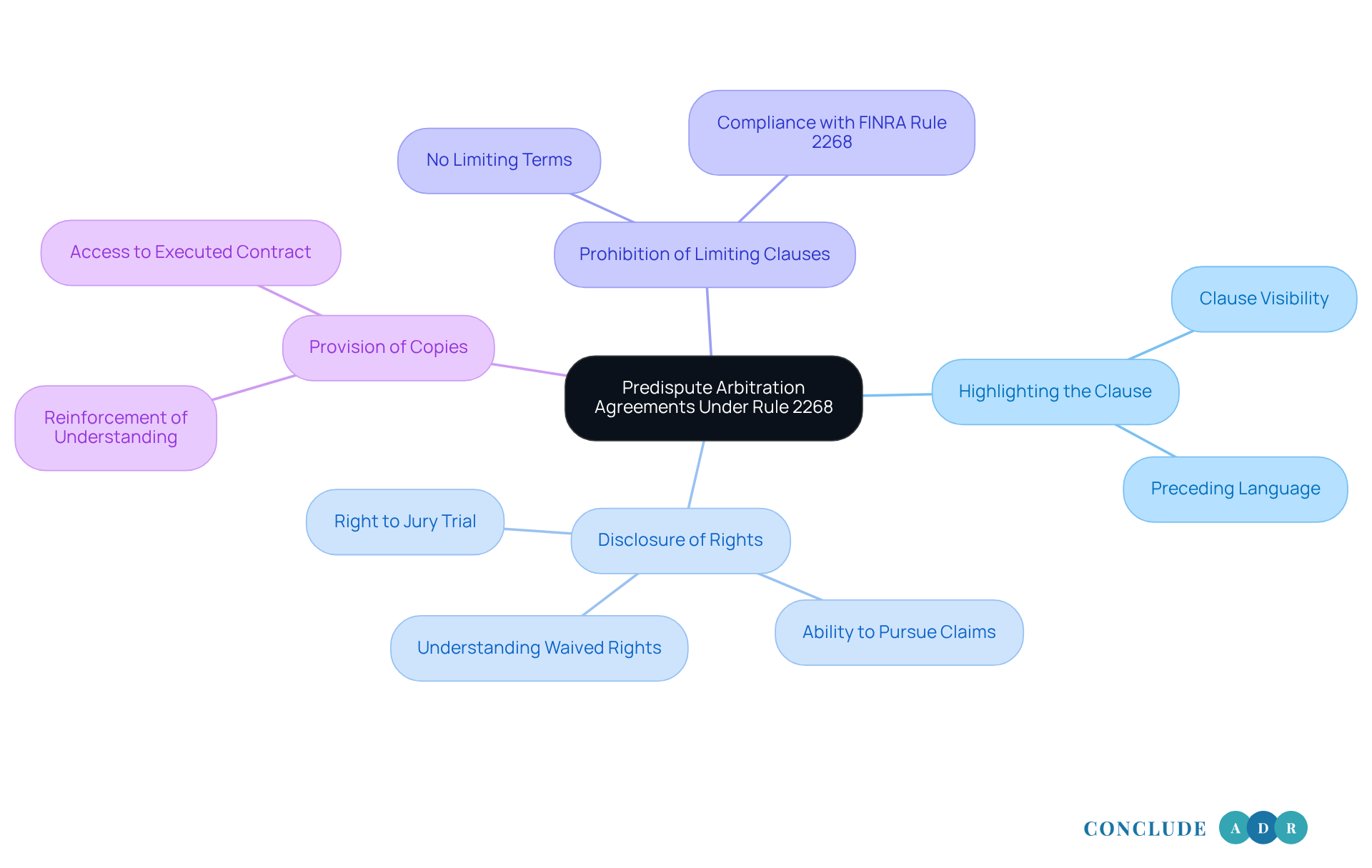

Understand Requirements for Predispute Arbitration Agreements Under Rule 2268

When it comes to predispute arbitration agreements, it’s essential to be aware of the key requirements outlined under FINRA Rule 2268. This knowledge can empower you and ensure that your rights are protected.

-

Highlighting the Clause: It’s important that the arbitration clause stands out clearly. This clause should be immediately preceded by specific language that informs you about your rights, so you feel fully informed.

-

Disclosure of Rights: You deserve to know exactly what rights you are waiving. This includes understanding that you may be giving up your right to a jury trial and the ability to pursue claims in court. Being informed is crucial.

-

Prohibition of Limiting Clauses: It’s reassuring to know that agreements cannot include terms that limit your ability to file claims or contradict the FINRA Rule 2268. This ensures that you retain essential rights, providing you with peace of mind.

-

Provision of Copies: After signing, you should receive a copy of the executed contract. This way, you have access to the terms you agreed to, reinforcing your understanding and consent.

These criteria are designed with your best interests in mind, ensuring that you are fully aware before entering into any dispute resolution contracts. Remember, your rights matter, and being informed is the first step towards safeguarding them.

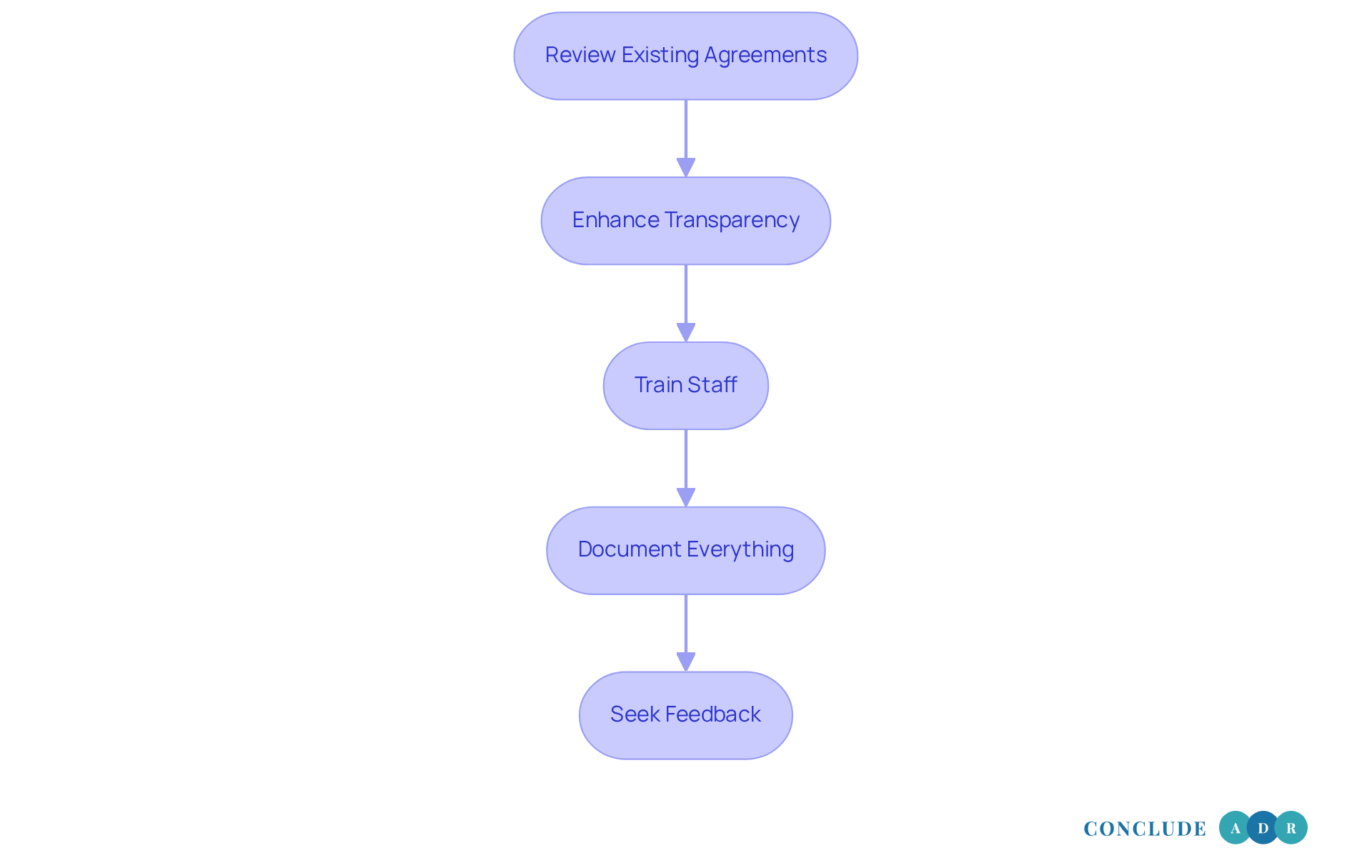

Apply FINRA Rule 2268: Practical Steps for Effective Dispute Resolution

To effectively apply FINRA Rule 2268 in dispute resolution, let’s explore some practical steps together:

- Review Existing Agreements: It’s important to regularly examine your predispute conflict resolution agreements. This ensures they align with the latest regulatory requirements and reflects your commitment to your clients’ needs.

- Enhance Transparency: Make sure that all dispute resolution clauses are clearly highlighted. Providing comprehensive explanations of customer rights fosters trust and understanding.

- Train Staff: Consider offering training for your team on the implications of FINRA Rule 2268. This empowers them to communicate these important details effectively to clients, enhancing their confidence.

- Document Everything: Keeping detailed records of all contracts and communications regarding dispute resolution clauses is essential. This practice safeguards against potential conflicts and shows your dedication to clarity.

- Seek Feedback: After arbitration processes, why not solicit feedback from clients? This can help identify areas for improvement in how agreements are presented and understood, reinforcing your commitment to their experience.

By implementing these steps, we can not only comply with FINRA regulations but also cultivate trust and transparency with our clients. Together, let’s create a supportive environment that prioritizes understanding and resolution.

Conclusion

Understanding FINRA Rule 2268 is crucial for both clients and financial professionals, as it establishes a foundation for fair and transparent dispute resolution processes. This rule highlights the importance of informed consent and the protection of client rights, ensuring that individuals are fully aware of the implications of predispute arbitration agreements before they sign.

Have you ever felt uncertain about the agreements you sign? This article sheds light on key principles that can ease those concerns. It emphasizes the necessity for transparency in customer agreements, the requirement for clear disclosure of rights, and the prohibition of limiting clauses that could undermine a client’s ability to seek justice. Practical steps, such as reviewing existing agreements, enhancing transparency, and training staff, are essential for effectively applying these principles in real-world scenarios.

Ultimately, embracing the guidelines of FINRA Rule 2268 fosters trust between clients and financial institutions. It reinforces the significance of informed decision-making in dispute resolution. By prioritizing clarity and understanding, we can create a more equitable financial environment where clients feel empowered and protected.

Taking these steps is not just about compliance; it is about building a foundation of trust that benefits everyone involved. Together, let’s work towards a future where transparency and support are at the forefront of our financial interactions.

Frequently Asked Questions

What is FINRA Rule 2268?

FINRA Rule 2268 was established to ensure that clients are well-informed about the implications of predispute dispute resolution contracts.

What are the key principles of FINRA Rule 2268?

The key principles include Transparency, Informed Consent, and Protection of Rights.

What does Transparency mean in the context of FINRA Rule 2268?

Transparency means that all predispute arbitration clauses must be clearly highlighted in customer agreements, allowing clients to understand that by signing, they are waiving their right to sue in court.

How does FINRA Rule 2268 promote Informed Consent?

FINRA Rule 2268 promotes Informed Consent by ensuring clients know their rights and the potential consequences of entering predispute arbitration agreements, empowering them to make informed decisions.

What does Protection of Rights entail under FINRA Rule 2268?

Protection of Rights entails prohibiting any clauses that limit a client's ability to seek claims or that contradict regulatory standards, safeguarding clients' rights during dispute resolution.

Why are the principles of FINRA Rule 2268 important?

These principles are important because they aim to foster trust and fairness in the dispute resolution process, ensuring that both companies and clients understand their rights and responsibilities.