Introduction

Debt collection mediation offers a compassionate alternative in the often stressful world of financial disputes. It opens the door for meaningful conversations between creditors and debtors, creating a space where both sides can work together to find solutions that truly meet their needs.

But navigating this process can feel daunting. You might wonder: how can you effectively master debt collection mediation to achieve the best outcome?

By exploring the nuances of this mediation process, we can uncover valuable insights that empower both creditors and borrowers. Together, we can work towards equitable solutions that honor everyone's concerns.

Define Debt Collection Mediation and Its Importance

Debt collection mediation is a compassionate approach where a neutral mediator helps facilitate discussions between creditors and debtors. This method is essential because it offers a less confrontational alternative to litigation, allowing both parties to engage openly and work together towards a solution that respects their needs.

Have you ever felt overwhelmed by unpaid debts? Mediation can be a lifeline, helping to preserve relationships and reduce stress. It often leads to quicker resolutions than traditional court proceedings, making it a valuable option for those seeking peace of mind.

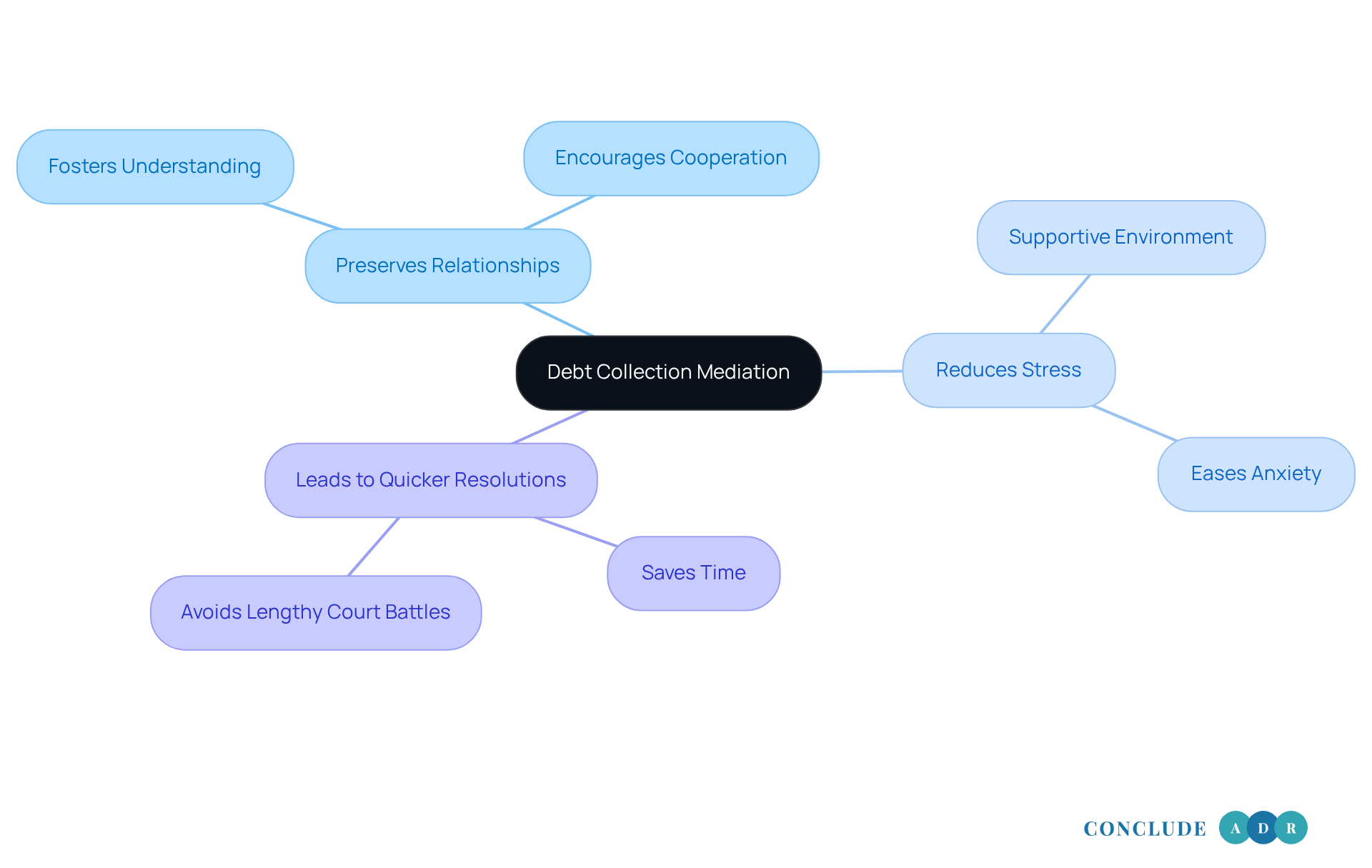

Consider the benefits of mediation:

- Preserves relationships: It fosters understanding and cooperation.

- Reduces stress: A supportive environment can ease anxiety.

- Leads to quicker resolutions: Save time and energy compared to lengthy court battles.

By choosing debt collection mediation, you’re taking a proactive step towards resolving your debt issues while honoring both your interests and those of your creditors. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Explain the Mediation Process in Debt Collection

Navigating debt collection mediation can feel overwhelming, but understanding its structure can bring peace of mind. Here’s a compassionate guide to help you through each essential step:

-

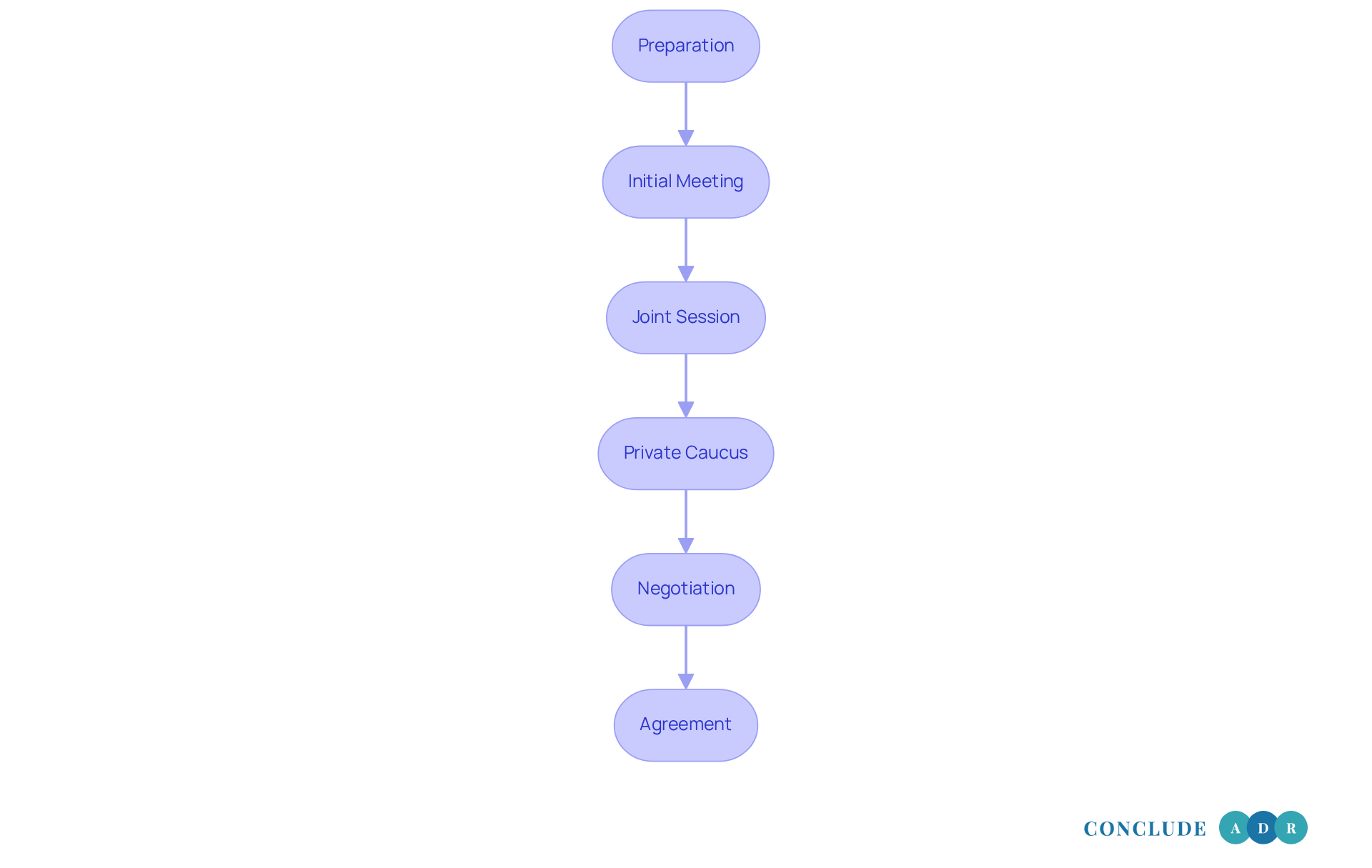

Preparation: Before diving in, it’s important for both sides to gather relevant documents - think financial statements, correspondence, and any evidence that supports your claims. This preparation isn’t just a formality; it’s your chance to present a strong case and feel confident.

-

Initial Meeting: When you first meet, the facilitator will introduce themselves and outline the mediation process. They’ll set ground rules to ensure that everyone communicates respectfully. This is a safe space for you to express your thoughts.

-

Joint Session: Here, both sides share their perspectives on the debt issue. This isn’t just about facts; it’s about understanding the underlying concerns and interests that each party holds. It’s a moment to foster empathy and clarity.

-

Private Caucus: The facilitator may hold individual meetings with each group. This allows for a deeper exploration of your stances and potential resolutions without the pressure of direct conflict. It’s a vital step for uncovering interests that might not come up in a joint session.

-

Negotiation: During this phase, the facilitator helps guide discussions, encouraging both sides to brainstorm options for resolution. This collaborative approach can spark creative problem-solving, leading to outcomes that benefit everyone involved.

-

Agreement: If you reach a resolution, the mediator will assist in drafting a written agreement that outlines the terms. This agreement is generally binding, which means both sides commit to the terms, enhancing compliance and reducing the chances of future disputes.

By following these steps, you can navigate the negotiation process with greater ease through debt collection mediation, leading to quicker and more cost-effective resolutions than traditional litigation. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Highlight the Benefits of Mediation for Creditors and Borrowers

Debt collection mediation offers a wealth of advantages for both creditors and borrowers, making it a compassionate choice for resolving disputes related to debt.

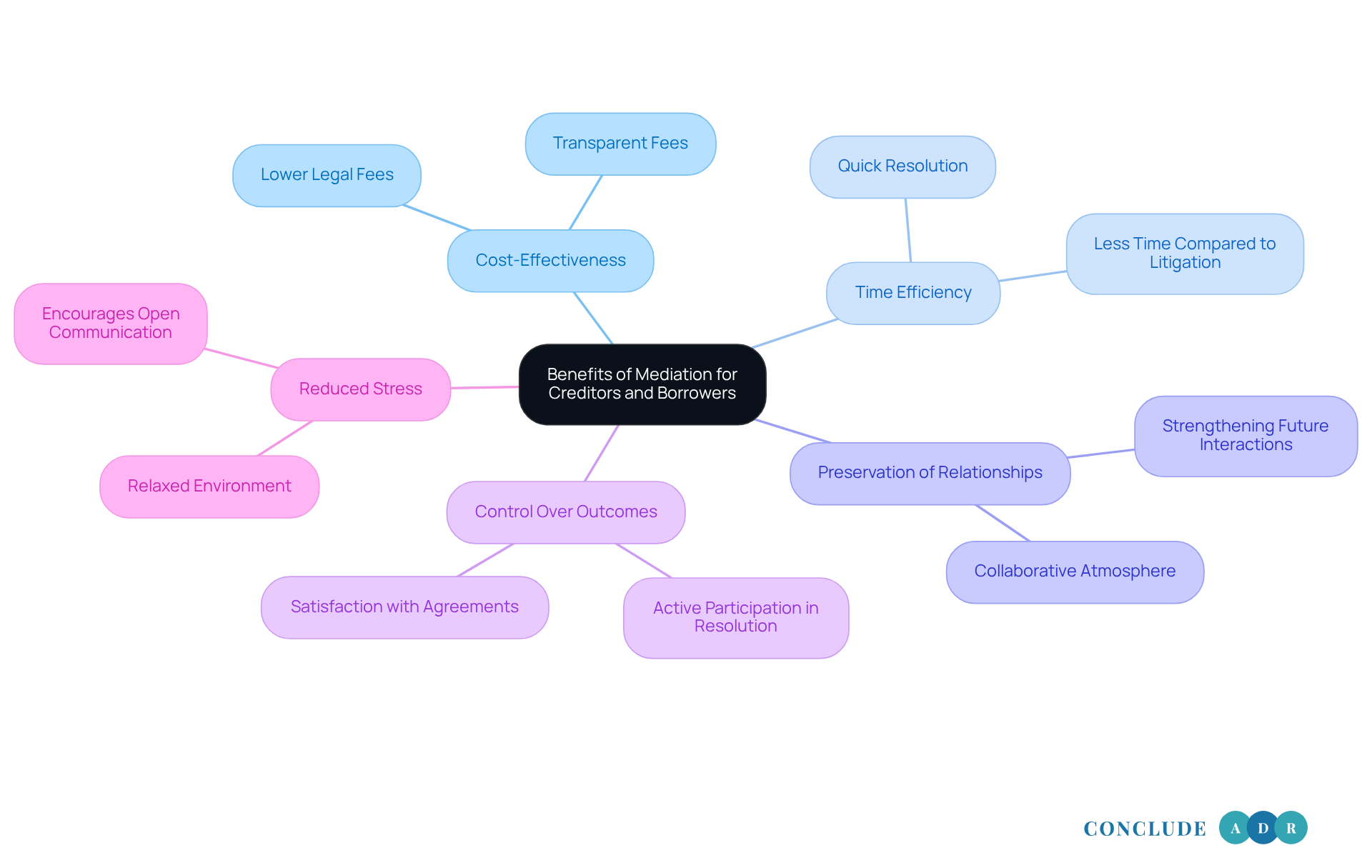

- Cost-Effectiveness: Mediation usually comes with lower costs than litigation, which means reduced legal fees and court expenses. This transparency in fees is especially appealing for those already facing financial challenges.

- Time Efficiency: The mediation process can often wrap up within hours or days, a stark contrast to the lengthy timelines of court cases that can stretch from months to years.

- Preservation of Relationships: By creating a collaborative atmosphere, mediation helps maintain or even strengthen relationships between creditors and borrowers-something vital for future interactions.

- Control Over Outcomes: Mediation allows both parties to actively shape the resolution, leading to agreements that are more likely to satisfy everyone involved.

- Reduced Stress: The relaxed environment of mediation eases the anxiety often tied to legal disputes, encouraging open communication and mutual understanding. This approach not only lightens the emotional burden but also fosters more constructive conversations among all parties.

With nearly 80% of Americans grappling with debt and around 350 million facing the possibility of bankruptcy, the role of negotiation in providing a practical, affordable, and less confrontational alternative to litigation is becoming increasingly recognized. As the legal landscape evolves, debt collection mediation is poised to play a more significant role in conflict management, assisting both creditors and borrowers in navigating their financial challenges more effectively. Together, we can reach resolutions swiftly and amicably.

Identify Challenges in Debt Collection Mediation and Solutions

Debt collection mediation can serve as a powerful tool for resolving disputes, although it often encounters challenges that can hinder progress. Let's explore these challenges together and see how mediation can help.

-

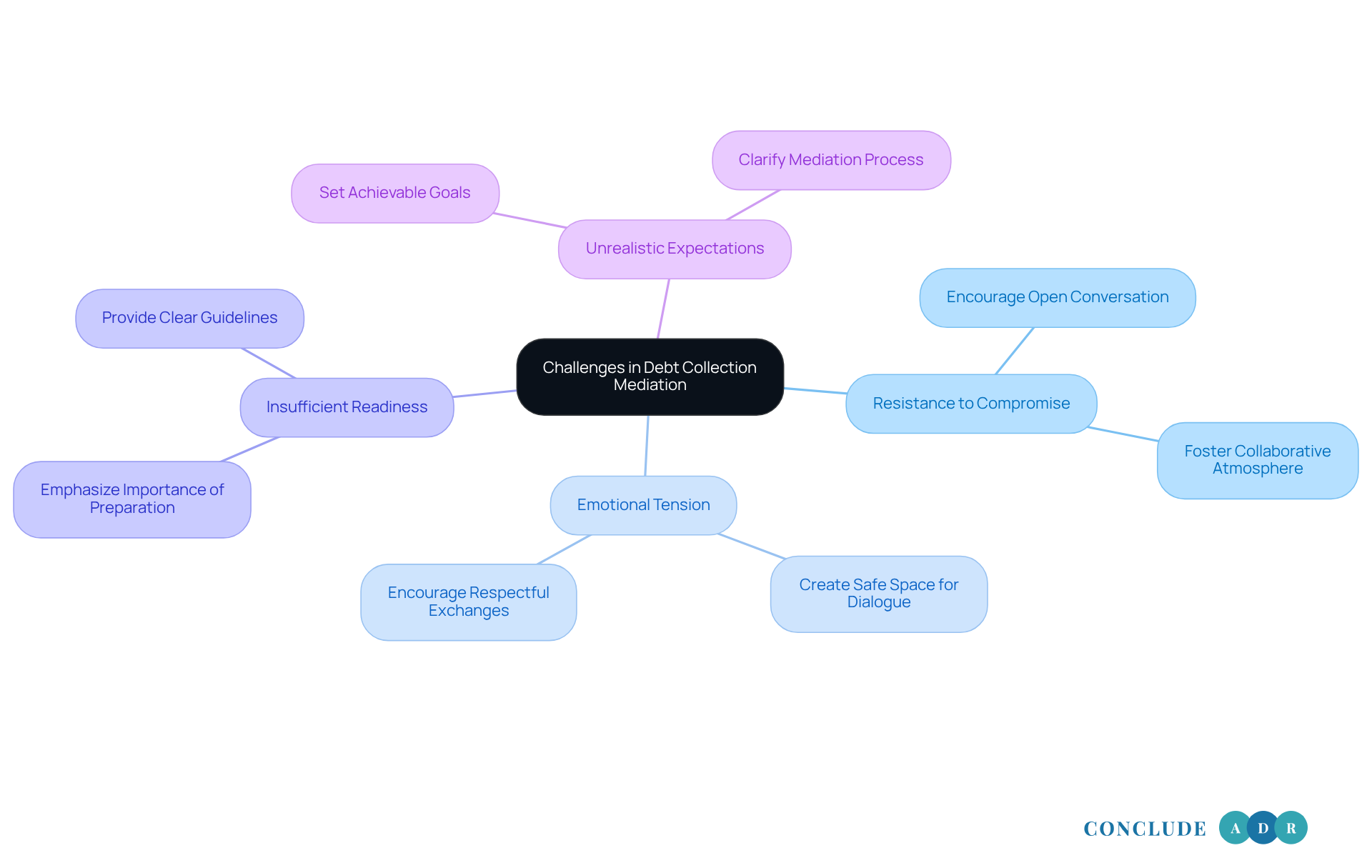

Resistance to Compromise: Sometimes, one party may hesitate to negotiate, which can stall discussions. A knowledgeable intermediary can encourage open conversation, helping both sides understand each other's perspectives and find common ground. This approach promotes a willingness to compromise, fostering a more collaborative atmosphere.

-

Emotional Tension: High emotions can cloud judgment and hinder effective communication. Here, the mediator plays a vital role in creating a safe space for dialogue. By encouraging respectful exchanges and allowing emotional expression, the mediator can help de-escalate tensions and pave the way for constructive discussions.

-

Insufficient Readiness: When parties arrive unprepared, it can significantly obstruct the resolution process. Mediators should emphasize the importance of preparation, providing clear guidelines on necessary documents and information to bring. This ensures that everyone is adequately equipped for meaningful discussions.

-

Unrealistic Expectations: It's common for parties to enter discussions with misconceptions about what can realistically be achieved. A skilled facilitator can help set achievable goals and clarify the mediation process, aligning expectations to foster a more productive dialogue.

Did you know that nearly 47% of reported debt collection calls in 2025 were flagged as abusive or threatening? This statistic highlights the emotional stakes involved in these discussions. By addressing these challenges head-on, mediators can enhance the likelihood of successful outcomes in debt collection mediation, transforming potentially contentious interactions into constructive resolutions.

Together, we can navigate these challenges and work towards a resolution that feels fair and supportive for everyone involved.

Conclusion

Debt collection mediation stands out as a vital strategy for resolving financial disputes, offering a supportive framework that emphasizes communication and collaboration. By bringing in a neutral mediator, both creditors and debtors can strive for solutions that benefit everyone involved. This compassionate approach not only eases the stress often tied to traditional debt collection methods but also helps preserve relationships, creating a more amicable environment for discussions.

Throughout this article, we’ve explored the key aspects of debt collection mediation. The process unfolds through several structured steps, from preparation to agreement, each crafted to enhance understanding and negotiation. The benefits of mediation are clear: it’s cost-effective, time-efficient, and significantly reduces emotional strain. However, we also recognize the challenges that can arise, such as resistance to compromise and emotional tension. By addressing these challenges and offering potential solutions, we can increase the chances of successful outcomes.

Ultimately, embracing debt collection mediation is a proactive choice that can lead to more satisfying resolutions for everyone involved. As financial struggles continue to impact many individuals, understanding and utilizing this method can transform the often daunting experience of debt negotiation into a constructive dialogue. By prioritizing mediation, we can navigate our financial challenges with greater ease and confidence, paving the way for healthier financial futures.

So, why not consider mediation as your first step? It’s a choice that not only supports your needs but also fosters a collaborative spirit. Together, we can turn challenges into opportunities for growth and understanding.

Frequently Asked Questions

What is debt collection mediation?

Debt collection mediation is a compassionate approach where a neutral mediator facilitates discussions between creditors and debtors to help them reach a mutually agreeable solution.

Why is debt collection mediation important?

It provides a less confrontational alternative to litigation, allowing both parties to engage openly and work together, which respects their needs and fosters understanding.

How can mediation help individuals overwhelmed by unpaid debts?

Mediation can serve as a lifeline by preserving relationships, reducing stress, and leading to quicker resolutions compared to traditional court proceedings.

What are the benefits of debt collection mediation?

The benefits include preserving relationships, reducing stress through a supportive environment, and achieving quicker resolutions than lengthy court battles.

What steps can I take if I choose debt collection mediation?

By choosing debt collection mediation, you take a proactive step towards resolving your debt issues while considering both your interests and those of your creditors. Support is available throughout the process.