Overview

California law on divorce alimony plays a crucial role in ensuring that both partners can maintain a similar standard of living after separation. This support is not just a financial obligation; it reflects a commitment to care for one another even in challenging times. Key factors that influence spousal support include:

- The length of the marriage

- The financial circumstances of both partners

- The needs of the receiving partner

Have you considered how these elements are evaluated in court? Understanding this process can be empowering. Courts differentiate between temporary and long-term support, each serving its purpose in the journey of divorce. This distinction is vital for effective financial planning and negotiation.

As you navigate this emotional landscape, remember that you are not alone. Recognizing the importance of these aspects can help you approach the situation with clarity and confidence. Take the time to explore your options and seek support. Your journey toward a stable future begins with informed decisions today.

Introduction

Navigating the complexities of divorce can feel overwhelming, especially when it comes to understanding alimony laws in California. Alimony, or spousal support, is vital in helping both partners maintain a similar standard of living after separation. In this article, we will explore the essential aspects of California’s divorce alimony laws.

Together, we’ll uncover:

- How spousal support is determined

- The differences between temporary and long-term assistance

- How remarriage can impact financial obligations

As you embark on this challenging journey, you may wonder: how can you effectively prepare for and navigate the intricacies of alimony to safeguard your future?

Explore the Basics of Alimony in California

Alimony, often known as spousal assistance, represents a financial obligation that one partner may need to provide to the other during or after a divorce. Under California law divorce alimony, the primary aim of spousal support is to help both individuals maintain a similar standard of living post-divorce.

When the court evaluates spousal support, it considers various factors related to California law divorce alimony. These include:

- The length of the marriage

- The financial circumstances of both partners

- The needs of the partner receiving support

Understanding these key elements is crucial for anyone navigating a divorce journey.

This knowledge lays the groundwork for further discussions about responsibilities and rights. It’s important to approach this process with compassion and clarity, ensuring that both parties feel supported as they transition into this new chapter of their lives.

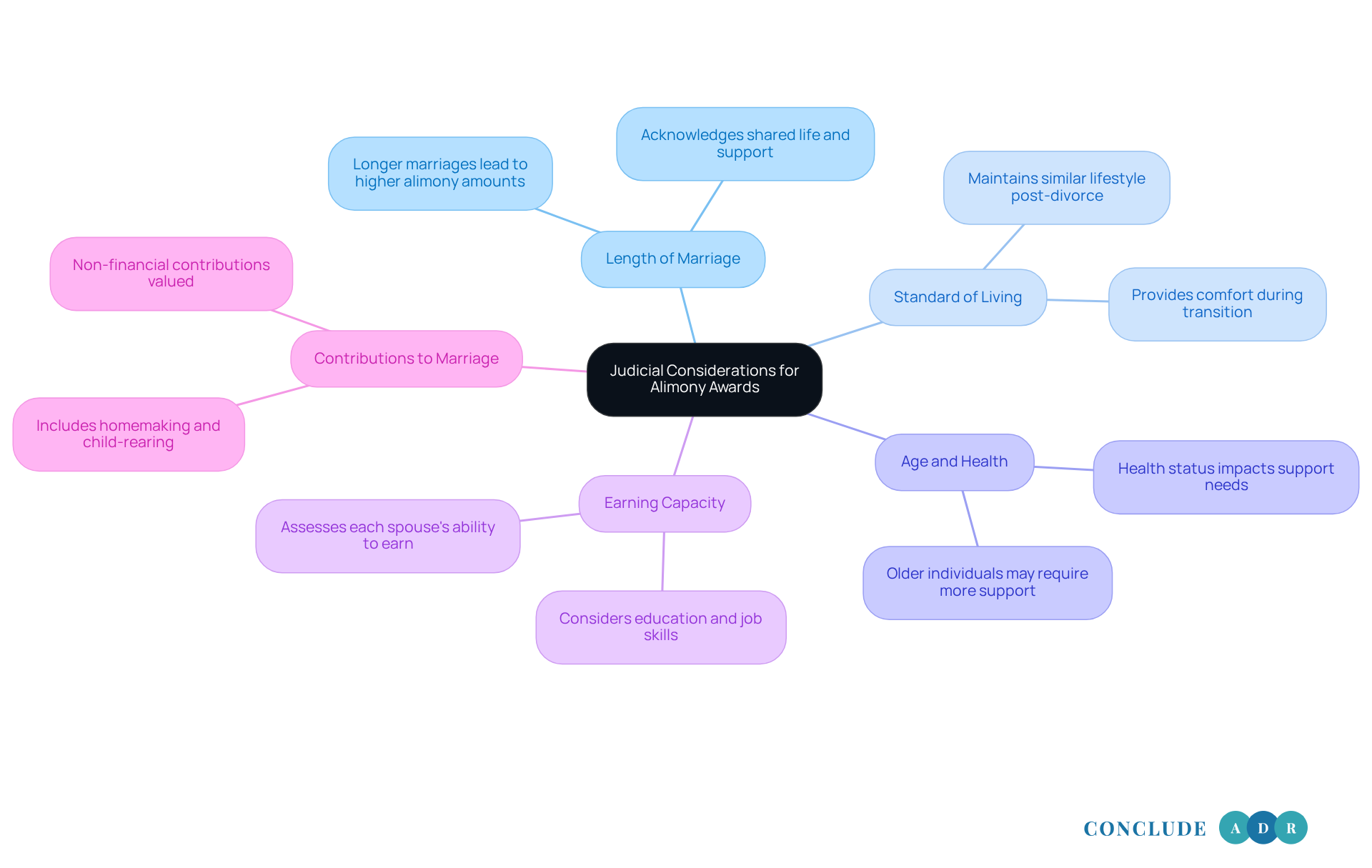

Understand Judicial Considerations for Alimony Awards

When navigating the complexities of [alimony awards in California](https://blog.concludeadr.com/10-benefits-of-hiring-an-attorney-mediator-in-san-diego), it's essential to recognize the various factors that judges consider. Have you ever wondered how these decisions are made?

- The length of the marriage: Typically, longer marriages lead to higher alimony amounts. This acknowledges the shared life and support that has developed over time.

- The standard of living during the marriage: Courts strive to maintain a similar lifestyle for both parties after divorce. This consideration aims to provide comfort during a challenging transition.

- The age and health of both partners: Older or less healthy individuals may require additional support. Understanding this can help you prepare for your needs moving forward.

- The earning capacity of both spouses: Each spouse's ability to earn income is assessed, taking into account education and job skills. This evaluation is crucial in ensuring fairness.

- Contributions to the marriage: Non-financial contributions, such as homemaking or child-rearing, are valued and considered. They play a significant role in the overall partnership.

By understanding these considerations, you can better and court proceedings. Remember, you are not alone in this journey. We encourage you to seek support and guidance as you navigate these important decisions.

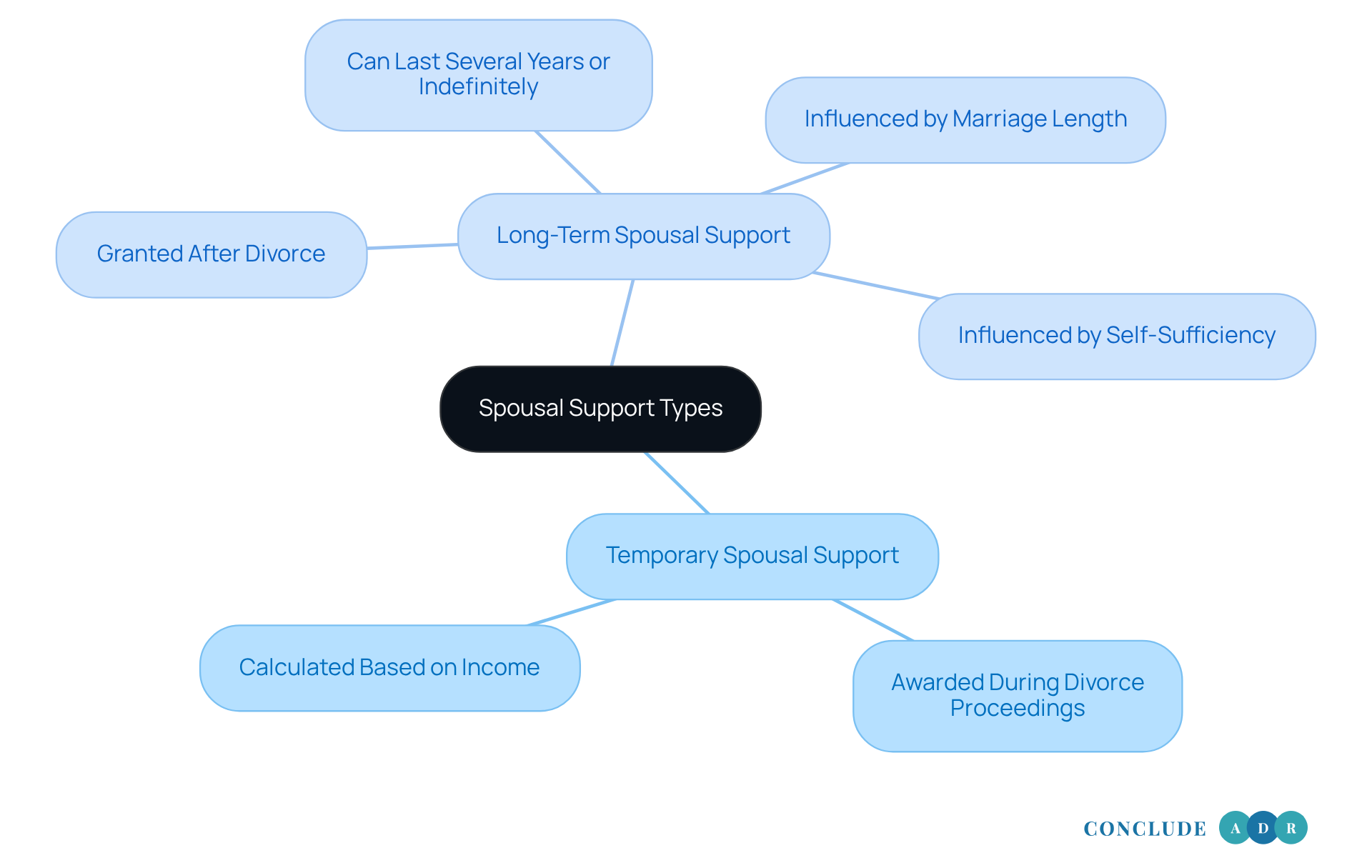

Differentiate Between Temporary and Long-Term Spousal Support

Under California law, divorce alimony, spousal support can be categorized into two main types: temporary and long-term.

- Temporary Spousal Support is awarded during the divorce proceedings. It aims to provide financial assistance until a final decision is made. This support is typically calculated based on a formula that considers the income of both spouses.

- On the other hand, Long-Term Spousal Assistance is granted after the divorce is finalized. This aid can last for several years or even indefinitely, depending on individual circumstances. Factors that influence long-term support under California law divorce alimony include the length of the marriage and the recipient's ability to become self-sufficient.

Understanding these distinctions is essential. It helps individuals manage their expectations and plan their budgets effectively. How do you feel about navigating this process? Remember, you are not alone in this journey.

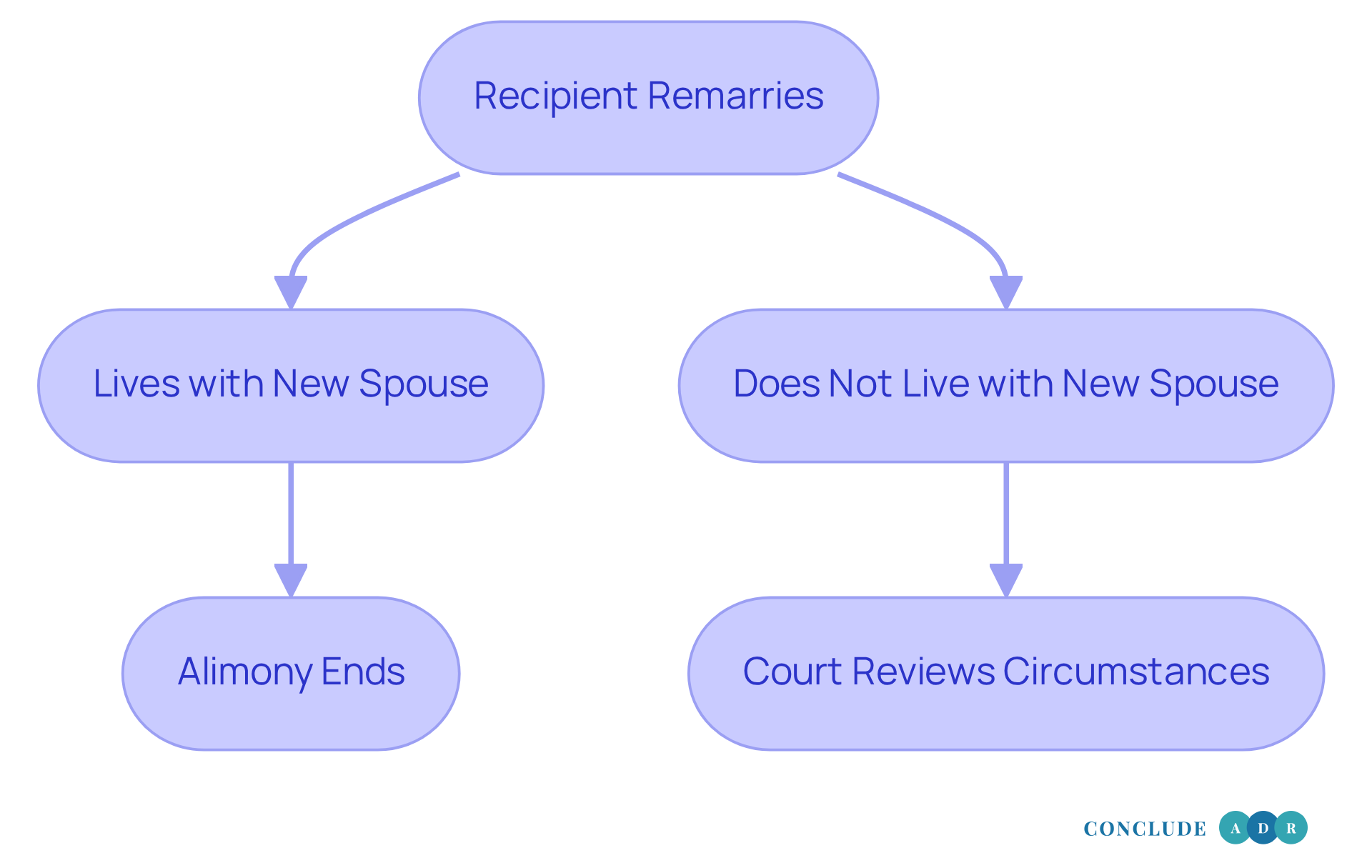

Assess the Impact of Remarriage on Alimony Obligations

In the context of california law divorce alimony, it’s important to understand that when a recipient partner remarries, it often leads to the end of alimony obligations. This change occurs because the income of the new partner can help meet the recipient's financial needs. However, what if the recipient remarries but doesn’t live with their new spouse? In such cases, the court may still take a closer look at the specific circumstances before making a decision.

This situation can feel overwhelming, and it’s essential for both parties to grasp these implications. Understanding how california law divorce alimony and remarriage affects financial planning and obligations after divorce can significantly impact your future. By being informed, you can navigate these changes with confidence and clarity. If you have questions or concerns, consider reaching out for support—after all, you don’t have to face this alone.

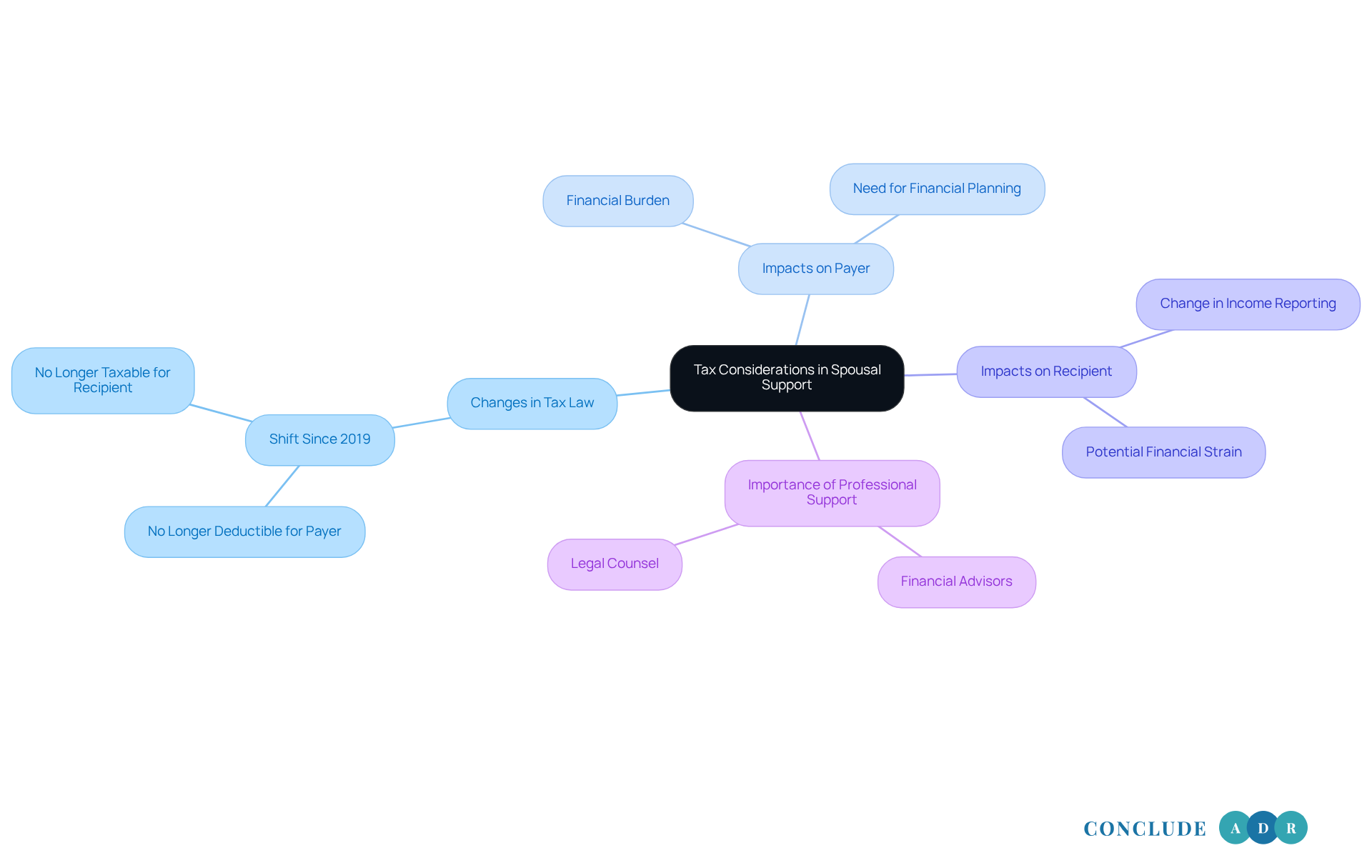

Evaluate Tax Considerations Related to Spousal Support

In the past, spousal support payments were tax-deductible for the payer and considered taxable income for the recipient. However, starting in 2019, changes in tax law have made alimony payments no longer deductible for the payer, nor taxable income for the recipient. This shift can feel overwhelming, and it’s important for both parties to carefully evaluate how these payments impact their overall financial well-being.

Understanding these tax implications is crucial for effective financial planning and negotiation during divorce proceedings. It’s natural to have concerns about how these changes will affect your situation. By acknowledging these feelings, we can work together to .

As you consider your options, remember that seeking support from professionals can help clarify these matters. It’s about ensuring that you feel informed and empowered to make decisions that are right for you. Let’s take this journey together, focusing on your needs and the best path forward.

Conclusion

Understanding California's divorce alimony laws is essential for anyone facing the complexities of spousal support. Alimony serves as a means to ensure that both partners can maintain a reasonable standard of living after a divorce. This highlights the importance of financial stability during a challenging transition. By grasping the nuances of alimony, you can navigate your divorce process with greater confidence and clarity.

This article delves into critical aspects of alimony in California, including the factors that influence both temporary and long-term spousal support. Key considerations, such as the length of marriage, standard of living, and each partner's financial situation, play a significant role in determining support amounts. Additionally, understanding the impact of remarriage on alimony obligations and the recent tax law changes regarding spousal support payments can provide crucial insights for your financial planning and negotiations during divorce proceedings.

Ultimately, being informed about California's alimony laws empowers you to make educated decisions regarding your financial future. Seeking professional guidance and support can further ease the process, ensuring that you understand your rights and obligations. Embracing this knowledge not only aids in navigating the legal landscape but also fosters a smoother transition into the next chapter of your life.

Frequently Asked Questions

What is alimony in California?

Alimony, also known as spousal assistance, is a financial obligation that one partner may need to provide to the other during or after a divorce, aimed at helping both individuals maintain a similar standard of living post-divorce.

What factors does the court consider when evaluating alimony?

The court considers several factors, including the length of the marriage, the financial circumstances of both partners, and the needs of the partner receiving support.

How does the length of the marriage affect alimony awards?

Typically, longer marriages lead to higher alimony amounts, acknowledging the shared life and support that has developed over time.

What role does the standard of living during the marriage play in alimony decisions?

Courts strive to maintain a similar lifestyle for both parties after divorce, aiming to provide comfort during a challenging transition.

How do the age and health of both partners influence alimony awards?

Older or less healthy individuals may require additional support, which is taken into consideration during alimony evaluations.

How is the earning capacity of both spouses assessed in alimony cases?

The earning capacity of each spouse is evaluated based on their ability to earn income, taking into account education and job skills to ensure fairness in support decisions.

Are non-financial contributions considered in alimony evaluations?

Yes, non-financial contributions, such as homemaking and child-rearing, are valued and play a significant role in the overall partnership, influencing alimony awards.