Overview

This article highlights the essential mediation services that can truly enhance the effectiveness of debt collection. Have you ever felt overwhelmed by the debt recovery process? Mediation offers a compassionate alternative, emphasizing open communication and negotiation. By choosing mediation, you can significantly improve recovery rates and satisfaction levels compared to traditional litigation. Imagine a process that not only resolves your issues but also brings peace of mind.

The benefits of mediation are clear. It has demonstrated high success rates and reduced costs, making it an appealing option for those seeking resolution. Instead of the stress often associated with litigation, mediation provides a nurturing environment where your concerns are heard and addressed.

We understand that navigating debt collection can be daunting. By considering mediation, you are taking a positive step towards a resolution that prioritizes your well-being. Together, we can work towards a solution that not only meets your needs but also fosters a sense of understanding and support. Why not explore this compassionate option today?

Introduction

Mediation has emerged as a powerful tool in the realm of debt collection, providing a collaborative alternative to traditional litigation. By facilitating open dialogue between creditors and debtors, mediation not only enhances recovery rates but also nurtures relationships that can withstand financial disputes.

Have you ever felt overwhelmed by the complexities of debt? You're not alone. As the landscape of debt resolution evolves, a pressing question arises: how can we leverage expert mediation services to navigate these challenges effectively?

This article explores nine essential mediation services designed to streamline the debt recovery process while elevating the overall experience for everyone involved. Together, we can discover how these services can make a difference in your journey toward resolution.

Conclude ADR: Expert Mediation Services for Debt Collection

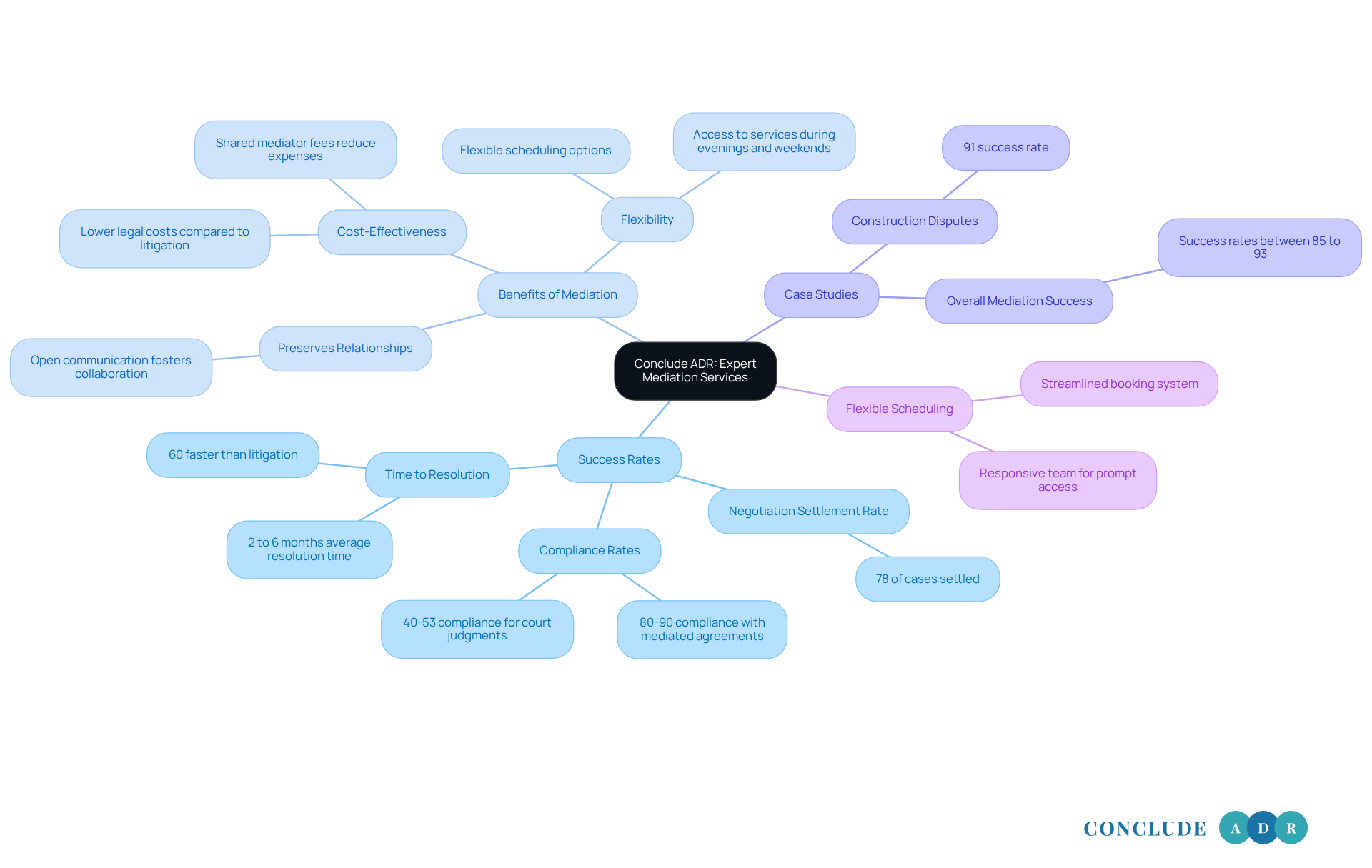

At , we truly understand the challenges you face in navigating . Our expert are designed with your needs in mind, ensuring that both creditors and debtors can reach fair outcomes. Did you know that ? This significantly boosts recovery rates, making it a more effective approach than conventional methods.

Open communication is essential in conflicts involving mediation services in debt collection. It creates a collaborative atmosphere where you can negotiate terms amicably. This not only helps preserve relationships but also leads to —80-90%, compared to just 40-53% for court-imposed judgments.

Consider the successful case studies that highlight the power of negotiation in mediation services in debt collection. For instance, a recent analysis showed a remarkable . This demonstrates that our methods can be effective across various sectors. Moreover, our professional can shorten the time to resolution, with most processes concluding within 2 to 6 months, unlike the lengthy timelines often associated with litigation.

We also recognize that your time is valuable. That’s why Conclude ADR offers , including evenings and weekends, ensuring you can access our services when you need them most. Our streamlined booking system and responsive team are here to provide and arbitration services. By prioritizing a resolution-focused strategy, we not only address your immediate financial concerns but also enhance the overall mediation services in debt collection experience, making us your preferred choice for effective and compassionate dispute resolution.

Understand the Role of Mediation in Debt Collection

are a voluntary process where a neutral third party facilitates discussions between creditors and debtors. This approach allows both sides to express their concerns and negotiate terms without the adversarial atmosphere often found in court proceedings. By fostering open communication, mediation services debt collection can enhance the likelihood of reaching outcomes that satisfy everyone involved.

The benefits of are truly significant. For creditors, it can lead to quicker resolutions, reducing the time and costs associated with prolonged litigation. Debtors often find mediation services debt collection less intimidating, which encourages their participation and can lead to more favorable terms. Did you know that has become a core element of restructuring strategies in complex ? It has shown notable success rates. In 2023, for example, achieved an impressive 85% settlement rate across 454 cases, and this trend continued into 2025, with an 82% settlement rate across 343 cases. This demonstrates its effectiveness in resolving disputes efficiently.

The effectiveness of negotiation in settling debt conflicts is further illustrated by , which managed to address over 99% of general claims through this process during its Chapter 11 proceedings. This not only streamlined the process but also maximized creditor recoveries while minimizing costs. Similarly, the Boy Scouts of America utilized negotiation as a cornerstone of their restructuring strategy, effectively addressing over 82,000 unique claims.

Experts in the field emphasize the importance of negotiation in mediation services debt collection for cooperative debt resolution. The Honourable Robert Drain has pointed out that the procedures and objectives of negotiation align well with US Chapter 11, highlighting its significance in bankruptcy situations. A debt collection can significantly reduce posturing and other dynamics that may hinder settlement, creating a supportive environment for constructive discussions. As one conflict resolution expert noted, this process is a 'party-driven, non-binding method' that allows disputants to seek impartial assistance in resolving their differences. This flexibility and adaptability make mediation services debt collection an .

Overall, negotiation stands out as a powerful method for financial recovery. It provides a pathway to agreeable solutions that benefit all parties involved. If you find yourself in a challenging financial situation, consider the and negotiation as a way to navigate through your concerns.

Utilize Flexible Scheduling Options for Mediation Sessions

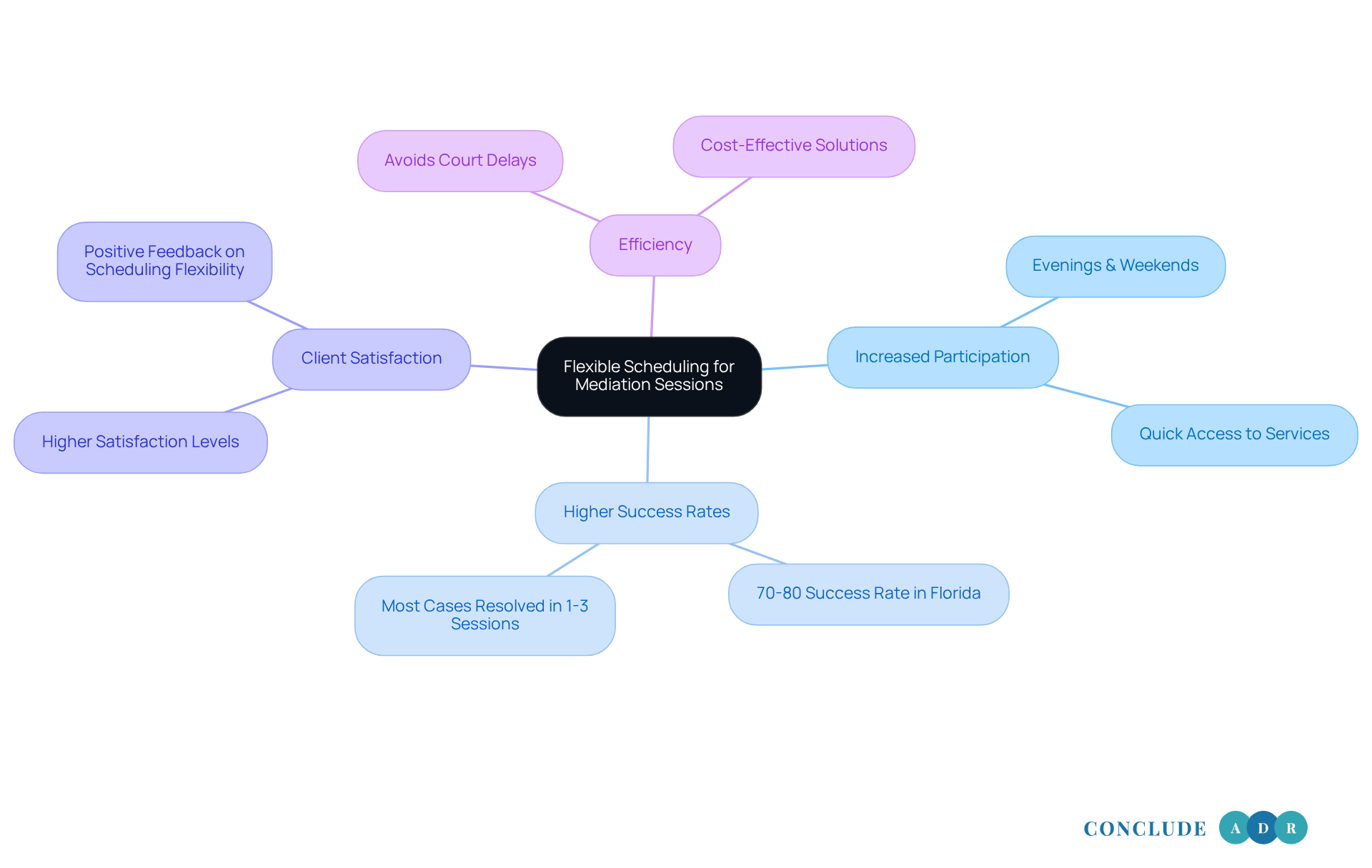

understands that your time is valuable, which is why we emphasize , including evenings and weekends. We believe that encouraging participation in resolution sessions is essential. This flexibility is especially important in cases, where the timing of meetings can significantly impact the resolution process.

By accommodating various schedules, Conclude ADR enhances the chances of achieving . Did you know that often conclude within just one to three meetings? This makes vital for everyone involved. Flexible scheduling not only boosts engagement but also helps avoid the delays that come with crowded court dockets, making it easier to utilize mediation services debt collection for resolving disputes more efficiently.

In Florida, mediation boasts a success rate of approximately 70-80%. This statistic underscores the importance of in reaching favorable resolutions. Clients consistently report when their scheduling needs are met. This reinforces the idea that effective negotiation relies on convening at convenient times for all parties.

To make the most of these adaptable scheduling options, we encourage you to reach out to Conclude ADR's responsive team. We are here to provide quick access to the you need, ensuring that your experience is both supportive and effective.

Prioritize Confidentiality in Mediation Processes

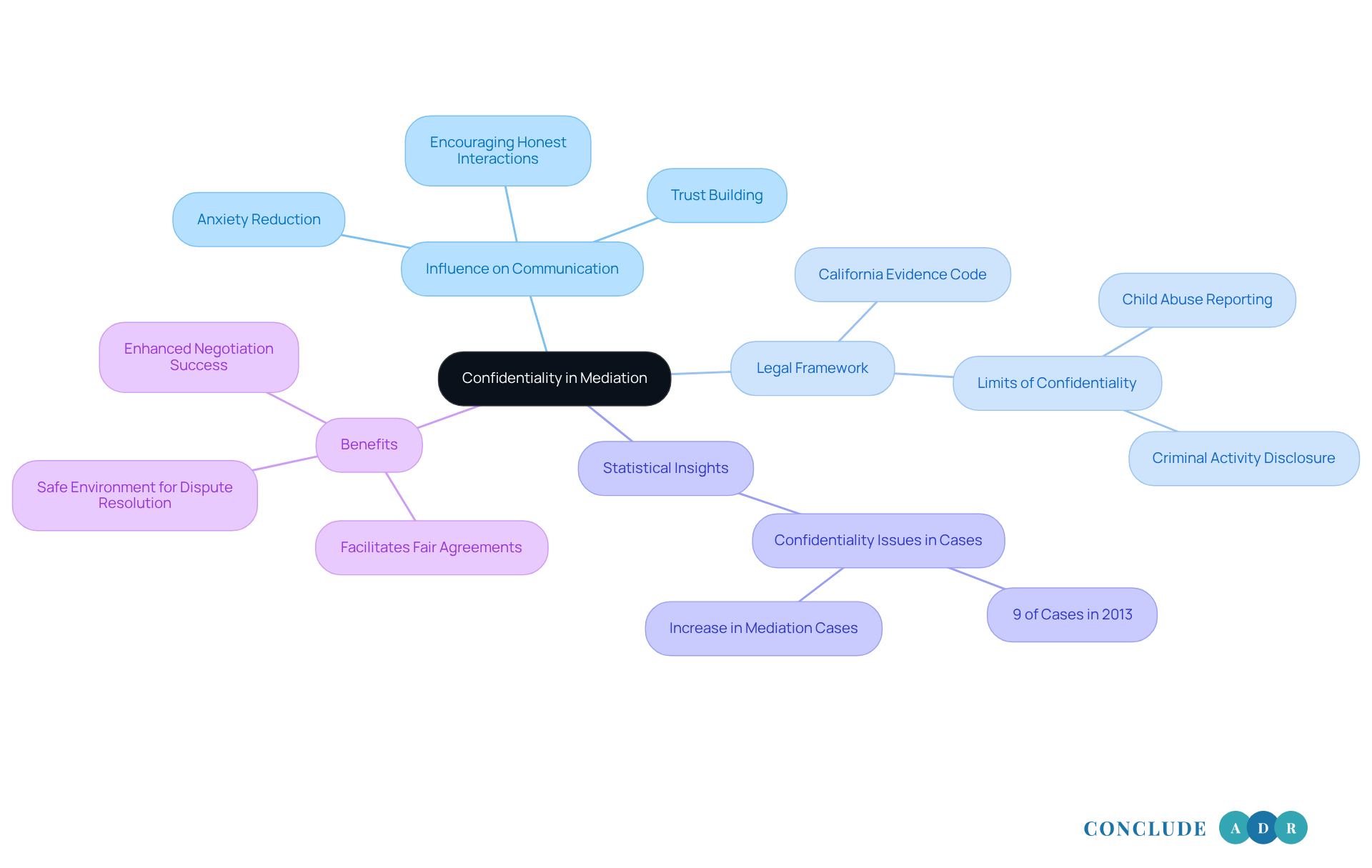

Confidentiality is truly a cornerstone of the negotiation process, significantly influencing its success. Have you ever felt anxious about sharing sensitive information? Rest assured, all conversations and agreements established during this process are kept confidential, fostering a safe environment for honest communication. This guarantee allows individuals to explore solutions without the fear of public exposure or legal repercussions, making it a compelling choice for . It's worth noting that , highlighting ongoing concerns about privacy in this essential process.

The assurance of confidentiality not only encourages open dialogue but also enhances the likelihood of reaching mutually beneficial agreements. Imagine being able to discuss terms freely, without the worry that your remarks could be used against you in future legal actions. This protective framework nurtures trust, enabling participants to engage more openly in discussions about sensitive financial matters. As experts remind us, "."

Moreover, . When parties trust that their communications will remain private, they are more inclined to engage in meaningful negotiations, ultimately leading to settlements that satisfy everyone involved. This dynamic is supported by the growing popularity of conflict resolution as an effective method for resolving disputes outside of court, with a significant increase in cases utilizing this approach over the years.

The California Evidence Code sections 1115-1128 regulate , reinforcing the principle that all communications during the process are inadmissible in court unless confidentiality is waived. In summary, prioritizing [confidentiality in dispute resolution](https://blog.concludeadr.com/9-essential-qualities-of-effective-divorce-mediators) not only protects participants but also enhances the overall effectiveness of the process. This is particularly crucial in scenarios involving mediation services debt collection, where is vital for resolution. Together, we can ensure that your concerns are addressed in a safe and supportive environment.

Consider Cost-Effectiveness of Mediation Over Litigation

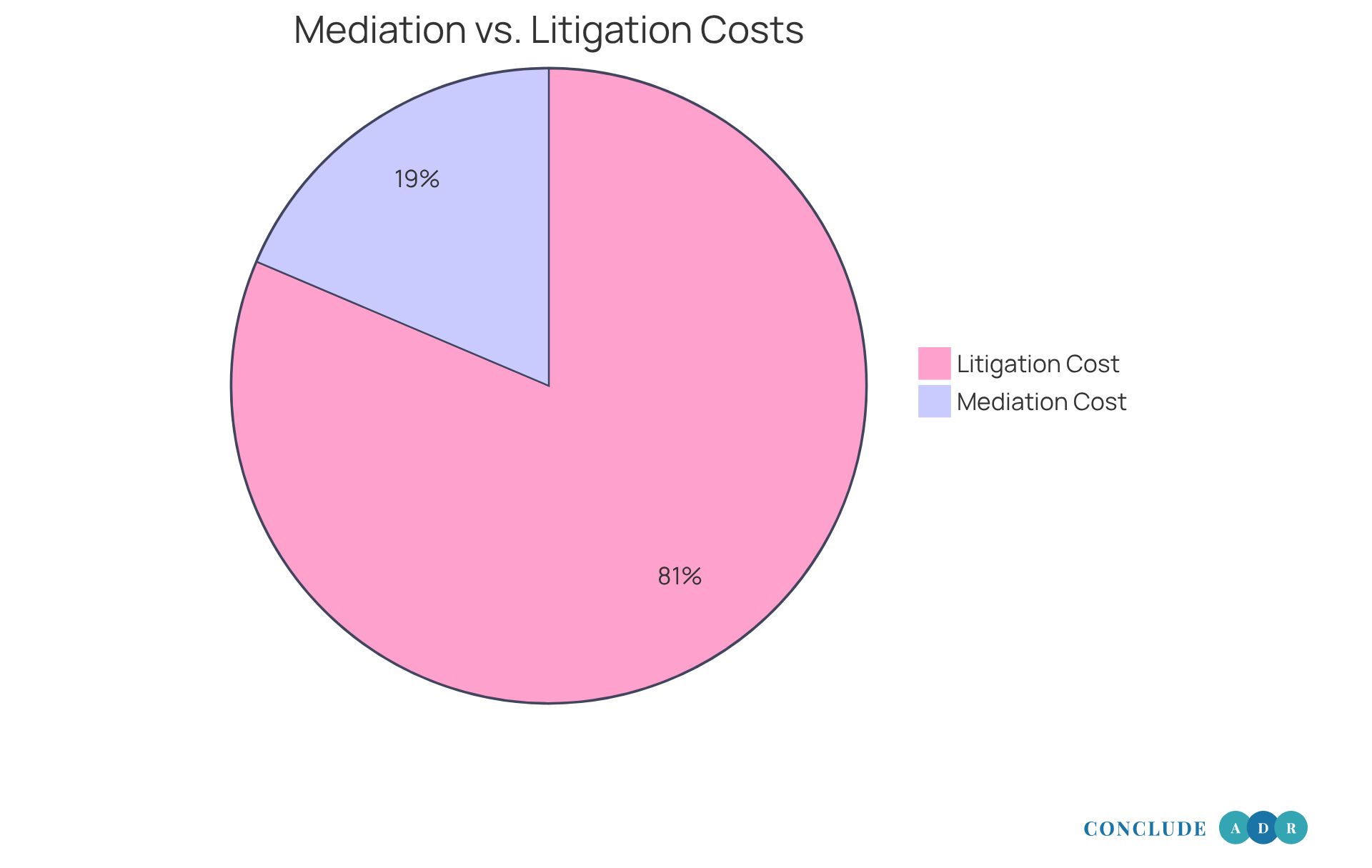

Mediation offers a remarkable , often leading to significant . By steering clear of court fees, attorney costs, and the lengthy timelines associated with legal processes, you can achieve satisfactory outcomes while alleviating financial stress. Have you considered that typically costs between $2,000 and $5,000 per party, with facilitator fees averaging around $300 to $375 per hour? In stark contrast, litigation expenses can skyrocket to $15,000 to $20,000. This clear difference underscores the , potentially reducing legal expenses by 60% to 80%.

Moreover, the commitment of (ADR) to value-based pricing enhances the affordability of its services, ensuring you receive tailored to your needs. The impressive —ranging from 85% to 93%—demonstrates its reliability as a dispute resolution method. This is especially true in specific contexts such as environmental and construction cases, which have shown success rates of 93% and 91%, respectively. This makes an appealing option for those facing challenges.

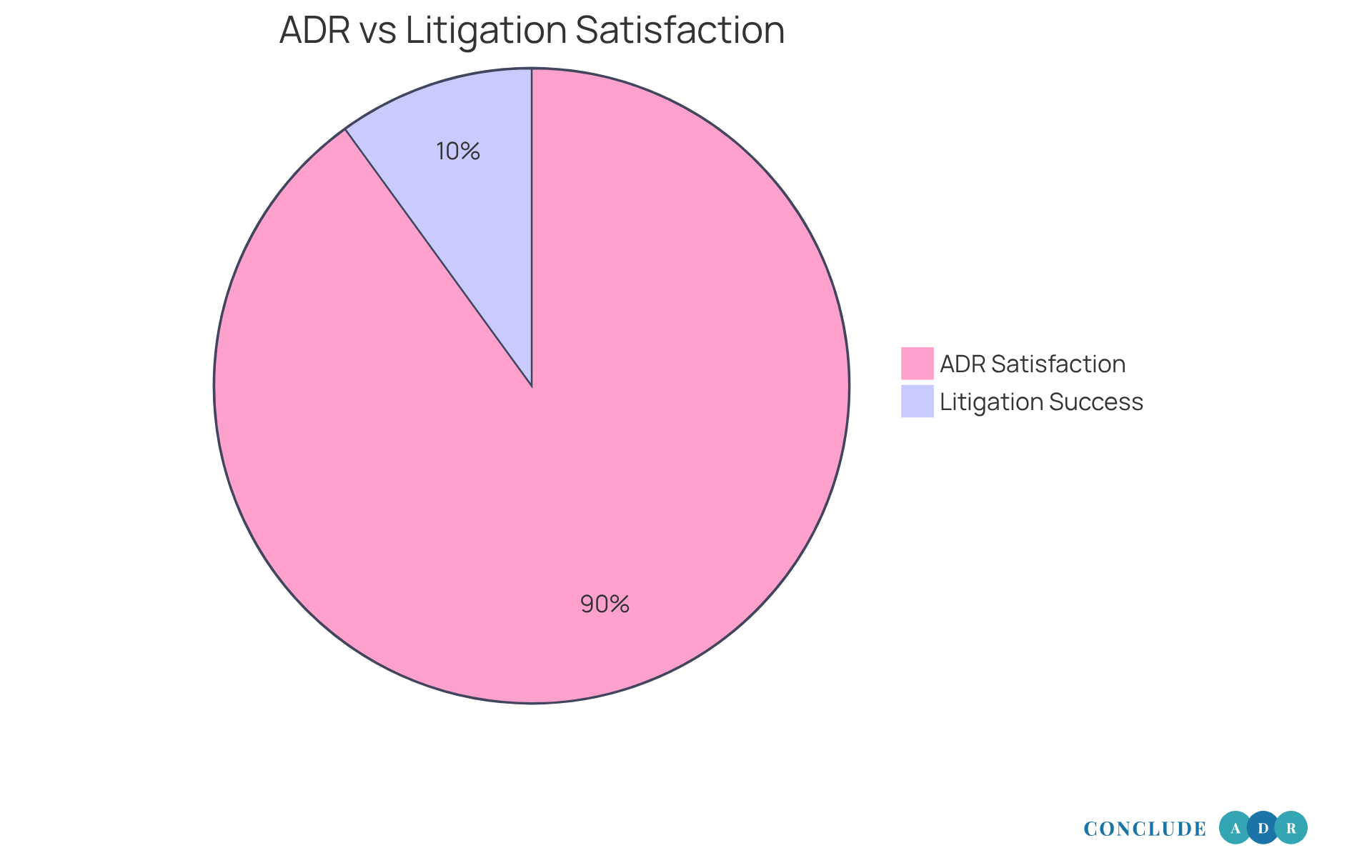

Additionally, over 90% of participants in conflict resolution report high satisfaction with the process. Why is that? It encourages open communication and teamwork, reinforcing the notion that mediation not only saves money but also fosters a more . As Timothy Warner, a mediator and arbitrator, wisely notes, "One of the most significant advantages of ADR is cost savings." Embracing mediation could be a transformative step towards resolving your disputes effectively and compassionately.

Empower Parties to Engage Actively in Mediation

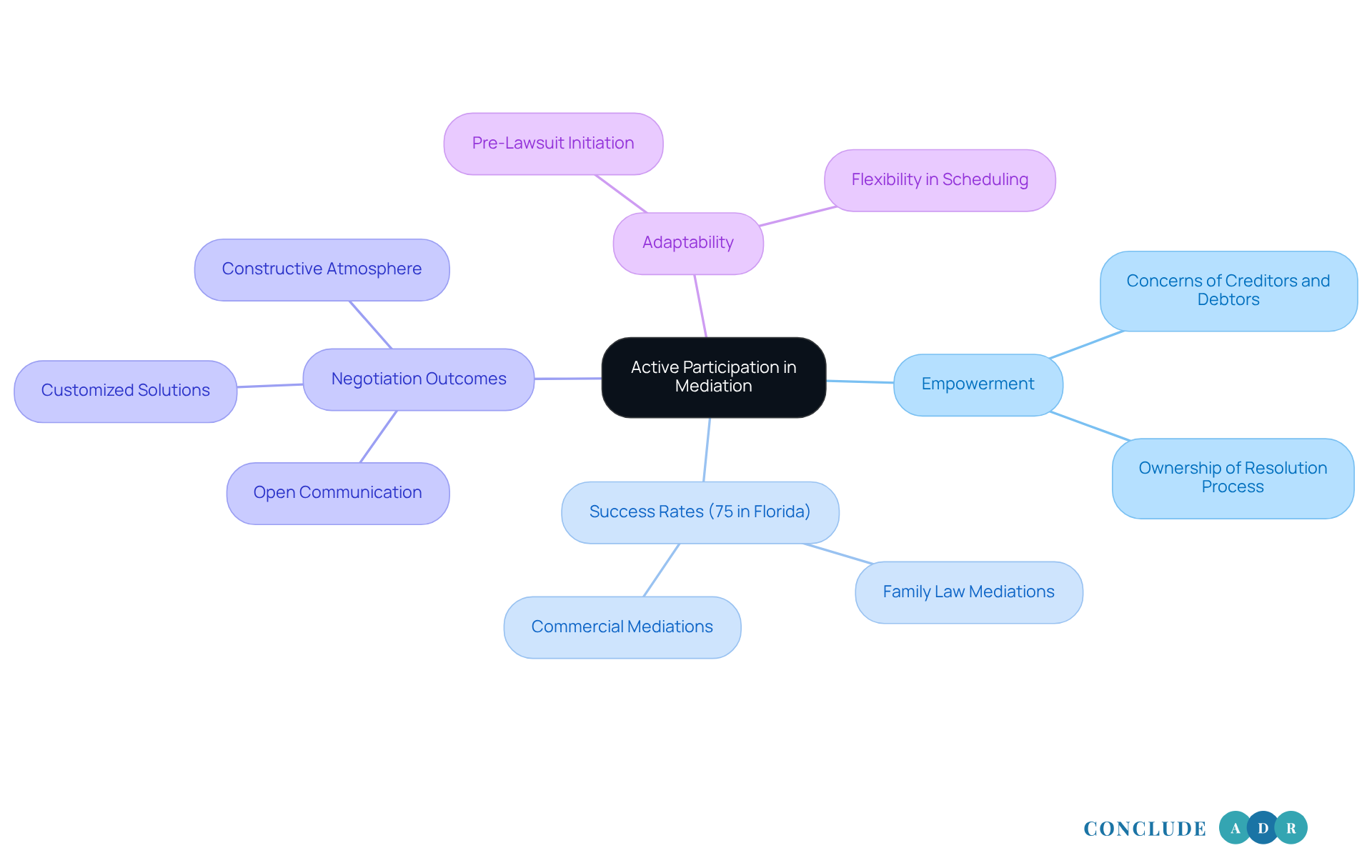

Active participation is essential for . We understand that both creditors and debtors have concerns and preferences that deserve to be heard during sessions. emphasizes the , fostering a sense of ownership over the resolution process. This nurturing approach significantly enhances the likelihood of achieving .

Studies suggest that when participants are actively involved, negotiation results improve. In Florida, for instance, , reaching about 75%. By encouraging open communication and collaboration, mediators can create a more amicable atmosphere, leading to . Imagine that in mediation services debt collection negotiation, allowing individuals to customize solutions can lead to agreements that are more likely to be upheld.

Mediation experts emphasize that when individuals feel empowered, they engage more fully in mediation services debt collection. This engagement can result in lasting agreements. As Chad Tamaroff, Esq. notes, "One of the primary benefits of choosing negotiation is the opportunity it provides for parties to maintain control over the issues at hand and the outcome of the case."

Furthermore, the adaptability of this process is remarkable; it can even commence prior to the filing of a lawsuit. This highlights its significance in various situations. We invite you to consider how or someone you know, leading to resolutions that feel right for everyone involved.

Identify and Tackle Common Challenges in Mediation

Negotiation can often feel daunting, with like , emotional tensions, and differing expectations. Have you ever found yourself in a situation where these issues seemed overwhelming? It's important to recognize that you're not alone in this experience.

At , our are here to help. They are trained to identify these challenges early on and facilitate discussions that truly address them. By proactively tackling these issues, we can help ensure that your negotiation remains effective and focused on resolution.

Imagine a negotiation where you feel heard, understood, and supported. By working together, we can create a space where your concerns are acknowledged, paving the way for a more . Let's take this step forward together, fostering a that leads to .

Acknowledge Higher Satisfaction Rates in Mediation

Studies show that groups involved in often feel a greater sense of satisfaction compared to those who pursue litigation. In fact, over 90% of participants in ADR report , reflecting its effectiveness in resolving disputes amicably. This satisfaction stems from the of the process, which fosters tailored solutions that truly address the unique needs of both parties. It's heartening to see how ADR's commitment to enhances these positive experiences. to engage in open dialogue and reach mutually beneficial agreements.

Consider the stark contrast with litigation, where , and defending a lawsuit can cost up to $80,000. Alternative dispute resolution allows for —typically within 2 to 6 months—and is generally 60% faster than litigation, which can take anywhere from 12 to 27.7 months. This efficiency not only alleviates stress but can also lead to significant , resulting in a more satisfying experience for everyone involved.

Isn't it comforting to know that there are options available that prioritize your needs and well-being? Embracing ADR can truly and lead to positive outcomes.

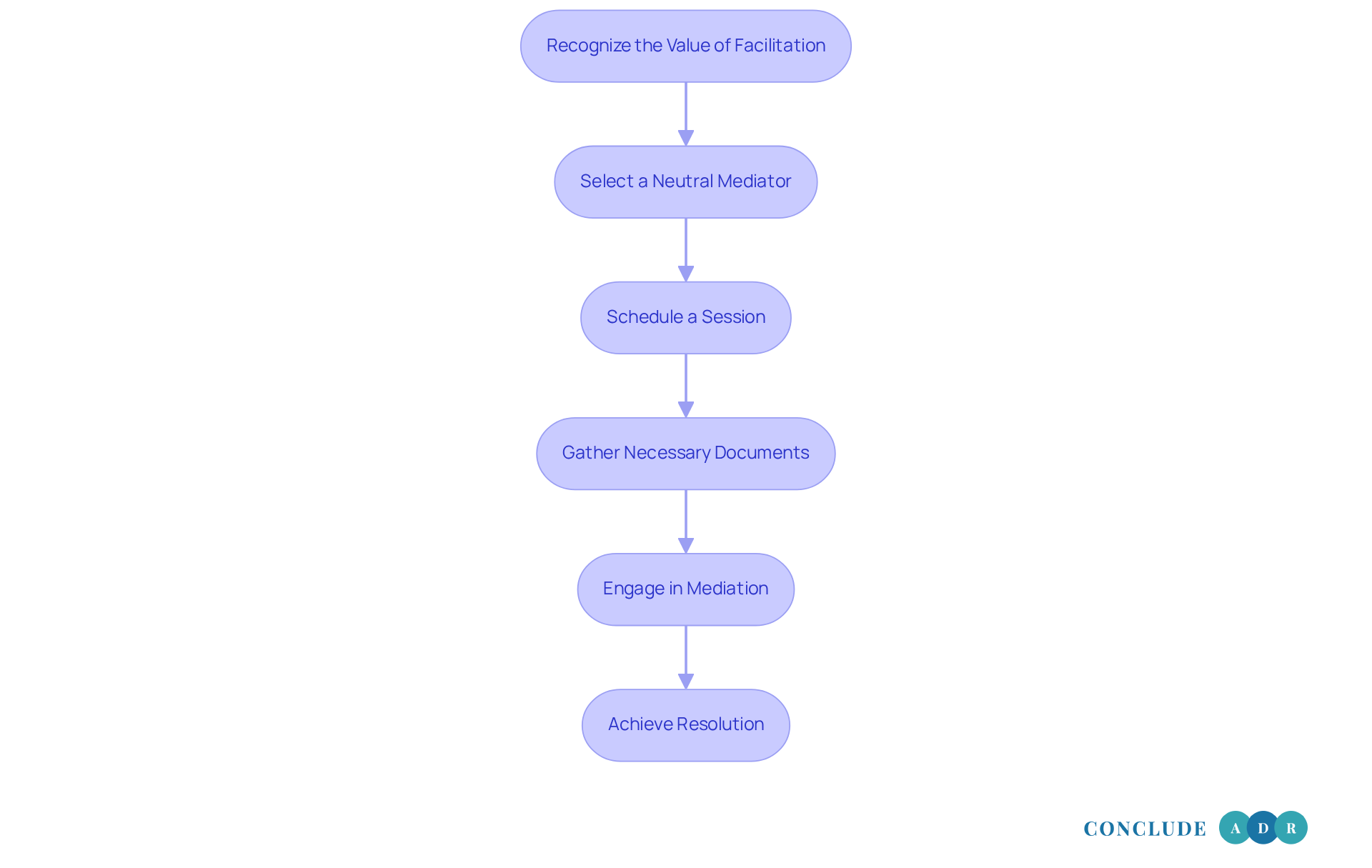

Follow Steps to Initiate the Mediation Process Effectively

To begin the negotiation process effectively, it’s essential for all parties to recognize the and select a neutral mediator together. This initial agreement lays the groundwork for a meaningful dialogue. Once established, becomes vital, alongside gathering any necessary documents to support the discussion. Have you considered how can ease the burden of court congestion? Research shows that over 70% of cases directed to this process find resolution before reaching trial.

simplifies this journey with a user-friendly booking system, enabling clients to effortlessly schedule sessions and securely submit all relevant information. As mediation professionals often say, " to take charge of their narratives." This empowerment can greatly increase the chances of a positive outcome in mediation services . By adopting this proactive approach, we not only enhance communication but also highlight the significance of emotional intelligence in resolving conflicts.

Isn't it comforting to know that there are ? Together, we can with understanding and support.

Clarify Legal Aspects of Mediation Agreements

Mediation agreements are not just legal documents; they are commitments that reflect the understanding and acceptance of both parties involved. It’s vital for you to grasp the . This understanding ensures that you can effectively.

Imagine the that comes from knowing exactly what you’re agreeing to. are here to help . They ensure that everyone feels informed and comfortable with the terms of their agreement.

By working together, we can , making sure that your concerns are addressed and that you .

Conclusion

Mediation services play a vital role in effective debt collection, offering a collaborative environment where creditors and debtors can negotiate terms in a friendly manner. This approach not only improves recovery rates but also nurtures relationships, making it a preferred alternative to traditional litigation. The benefits of mediation—such as higher compliance rates, cost-effectiveness, and confidentiality—highlight its importance in resolving financial disputes with care and efficiency.

Consider the impressive success rates of mediation, often exceeding 90%. This method also provides substantial savings compared to litigation. By prioritizing open communication, flexible scheduling, and active participation, mediation addresses immediate financial concerns while empowering everyone involved to take charge of their resolution process. Additionally, the legal implications of mediation agreements ensure that all parties feel informed and confident in their commitments.

With these advantages in mind, embracing mediation as a pathway for debt resolution is not just a practical choice; it represents a transformative step toward achieving fair and satisfactory outcomes. As the landscape of debt collection continues to evolve, exploring expert mediation services can lead to more effective and compassionate resolutions that truly benefit all parties involved. How can you take this step towards a more positive resolution today?

Frequently Asked Questions

What services does Conclude ADR provide for debt collection?

Conclude ADR offers expert mediation services designed to help creditors and debtors reach fair outcomes in debt collection disputes.

How effective is negotiation in resolving debt collection cases?

Negotiation can settle around 78% of debt collection cases, significantly boosting recovery rates compared to conventional methods.

What are the benefits of mediation services in debt collection?

Mediation fosters open communication, creating a collaborative atmosphere that leads to higher compliance rates with mediated agreements (80-90%) compared to court-imposed judgments (40-53%).

How quickly can disputes be resolved through Conclude ADR's mediation services?

Most mediation processes at Conclude ADR conclude within 2 to 6 months, which is much shorter than typical litigation timelines.

What scheduling options does Conclude ADR offer for mediation sessions?

Conclude ADR provides flexible scheduling options, including evenings and weekends, to accommodate clients' needs.

What is the success rate of mediation in Florida?

Mediation in Florida boasts a success rate of approximately 70-80%, highlighting its effectiveness in resolving disputes.

How does mediation differ from court proceedings in debt collection?

Mediation is a voluntary process facilitated by a neutral third party, allowing both creditors and debtors to negotiate terms in a non-adversarial environment, unlike the often confrontational nature of court proceedings.

Can you provide examples of successful mediation cases?

Notable examples include PG&E, which resolved over 99% of general claims during its Chapter 11 proceedings, and the Boy Scouts of America, which addressed over 82,000 unique claims through negotiation.

Why is flexibility in scheduling important for successful mediation?

Flexible scheduling enhances participation and engagement, which are crucial for achieving successful outcomes in mediation sessions.

How can I access Conclude ADR's mediation services?

You can reach out to Conclude ADR's responsive team for quick access to mediation and arbitration services tailored to your needs.