Overview

This article is dedicated to identifying seven compassionate debt mediators who provide tailored solutions for individuals navigating financial challenges. Have you ever felt overwhelmed by debt? You're not alone. These mediators understand your struggles and utilize structured negotiation processes along with expert guidance to help you achieve favorable debt resolutions. This support not only alleviates financial stress but also promotes sustainable repayment plans that can lead to a brighter future.

Imagine having a partner in your journey towards financial stability. These mediators are here to guide you every step of the way, ensuring that you feel supported and informed. By working collaboratively, you can find a resolution that truly meets your needs. Remember, seeking help is a sign of strength, and taking action today can pave the way for a more secure tomorrow.

Introduction

Navigating the complexities of debt can feel overwhelming, leaving many individuals unsure of their options for resolution. Do you feel trapped by your financial situation? Debt mediation has emerged as a promising solution, offering tailored strategies that can alleviate financial burdens while preserving relationships with creditors. However, with various mediation services available, how can you determine the best fit for your unique situation? This article explores seven expert debt mediators that provide customized solutions, empowering you to reclaim control over your financial future.

Conclude ADR: Expert Mediation Services for Debt Resolution

Conclude ADR is recognized as a leading provider of conflict management services, specifically designed for financial settlements, with the involvement of debt mediators. Their experienced neutrals foster a safe and constructive environment for dialogue, which is crucial for effective negotiations. This approach is supported by conflict resolution specialists who emphasize the importance of in enhancing understanding and cooperation among all parties involved.

By prioritizing value-based pricing, Conclude ADR ensures that clients receive expert-driven solutions without the burden of excessive fees. This alleviates stress and promotes a focus on mutually beneficial agreements, allowing everyone to feel more at ease during challenging times.

The benefits of negotiation in financial settlements are significant. Debt mediators provide a structured and cost-effective way to resolve disputes, significantly increasing the likelihood of successful outcomes, with an industry success rate exceeding 90%. Successful case studies, particularly those involving complex financial negotiations, illustrate how facilitation can lead to agreeable outcomes that preserve relationships and foster understanding.

As we look to 2025, the impact of negotiation on financial settlement results continues to grow, with more individuals and companies recognizing its advantages. The typical cost of conflict resolution services for financial disputes is considerably lower than that of litigation, making it an appealing choice for those seeking efficient and effective solutions. By leveraging the expertise of skilled debt mediators and an efficient booking process, Conclude ADR empowers clients to navigate their financial challenges confidently, ultimately leading to fair and feasible outcomes.

Have you considered how mediation could ease your financial disputes? It’s time to explore these compassionate options that not only resolve conflicts but also nurture relationships.

TurboDebt: Comprehensive Debt Relief and Mediation Solutions

At TurboDebt, we understand the weight of financial burdens and offer a comprehensive range of financial relief services designed with your needs in mind. Our strong focus on negotiation with debt mediators aims to secure favorable terms with creditors, ultimately reducing your stress and creating clear pathways to debt alleviation. We work closely with you to develop customized strategies that reflect your unique economic situation, ensuring that each negotiation session is not only productive but also geared towards achieving satisfactory results.

Did you know that mediation can resolve disputes at an impressive rate of 80-92%? When both parties are committed to resolution, the potential success rates can reach up to 90%. This speaks volumes about the effectiveness of our approach at TurboDebt. Additionally, successful financial negotiations often lead to settlements that are 30% to 50% lower than the initial balance, providing you with substantial monetary relief. In fact, debt mediators successfully settle about 55% of accounts, highlighting the positive impact of our services.

Debt mediators emphasize the importance of patience and readiness in negotiations. One specialist notes that understanding the negotiation process can significantly enhance your chances of resolving obligations for less than what is owed. As Joyce Brothers humorously pointed out, "Credit buying is much like being a drunk. The buzz happens immediately, and it gives you a lift. The hangover comes the day after." Our client success stories further demonstrate our effectiveness—74% of enrollees successfully settle at least one account within the first 36 months. This proven track record underscores our commitment to delivering tailored solutions that cater to your diverse needs.

When it comes to negotiation, the : reaching an agreement, declaring a stalemate, or finalizing and signing a contract. We are here to assist you in managing your expectations and navigating this journey with care and support.

Mediator Debt Solutions: Tailored Programs for Effective Debt Resolution

At Mediator Debt Solutions, we understand the unique challenges you face when working with debt mediators to manage financial obligations. Our skilled debt mediators are here to help, engaging in proactive negotiations with creditors to secure significant reductions in both principal balances and monthly payments. In 2024, clients enrolled in DebtWave's Debt Management Program (DMP) experienced an average payment reduction of $220, with the average minimum payment decreasing from $915 to $695. These outcomes illustrate the tangible benefits of effective conflict resolution strategies.

We recognize that the , and we approach it with both effectiveness and empathy. By focusing on your specific circumstances, we strive to ensure that resolutions are practical while also being considerate of your overall well-being. Many of our clients have successfully transitioned from negative discretionary income to positive income, significantly alleviating their monetary stress. In 2024, the typical household in the U.S. owed $7,236, underscoring the economic challenges many encounter.

Expert opinions highlight that negotiating reduced principal balances can lead to substantial long-term savings. For example, the average settlement involving multiple accounts can yield savings of approximately $5,440 over 36 months after fees. Additionally, DebtWave reported an impressive 85% acceptance rate for DMP proposals, indicating a supportive environment for clients seeking financial solutions. This emphasizes the opportunity for you to restore financial stability through well-organized negotiation programs facilitated by debt mediators. At Mediator Debt Solutions, we are committed to being a valuable partner on your journey toward financial recovery.

ADR Times: Insights and Resources for Debt Mediation

ADR Times serves as a vital resource for individuals and companies seeking to navigate the complexities of financial negotiation. This comprehensive platform offers a wealth of articles, case studies, and professional insights that illuminate the negotiation process and highlight effective strategies for financial resolution. By tapping into the knowledge shared by ADR Times, you can deepen your understanding of successful negotiation techniques with creditors, ultimately paving the way for more favorable outcomes.

Have you ever felt overwhelmed by the thought of negotiating debt? You're not alone. Statistics show that educational resources significantly boost the effectiveness of debt negotiation, empowering everyone involved to engage in informed discussions. For instance, conflict resolution has proven to enhance the likelihood of reaching a consensus, with many courts now mandating such processes before trial to alleviate pressure on the judicial system. As Joseph Grynbaum wisely remarked, "An ounce of mediation is worth a pound of arbitration and a ton of litigation!"

Mediation professionals share several best practices for achieving successful debt resolution, including:

- Establishing clear communication channels to foster transparency and trust.

- Preparing thoroughly by gathering all relevant financial documents and understanding your position.

- Approaching negotiations with a collaborative mindset, focusing on mutual benefits rather than adversarial tactics.

Consider some effective negotiation strategies for managing financial obligations, such as proposing realistic payment plans, exploring settlement options, and utilizing debt mediators to facilitate discussions. The case study on the '' illustrates how this approach can lead to higher settlement rates, providing a practical example of how these strategies can be applied. By adopting these strategies, you can navigate your financial challenges more effectively, leading to resolutions that are both practical and sustainable. Remember, you are not alone in this journey—support is available, and positive outcomes are within reach.

Minneapolis Fed: Lessons Learned from 22 Years of Debt Mediation

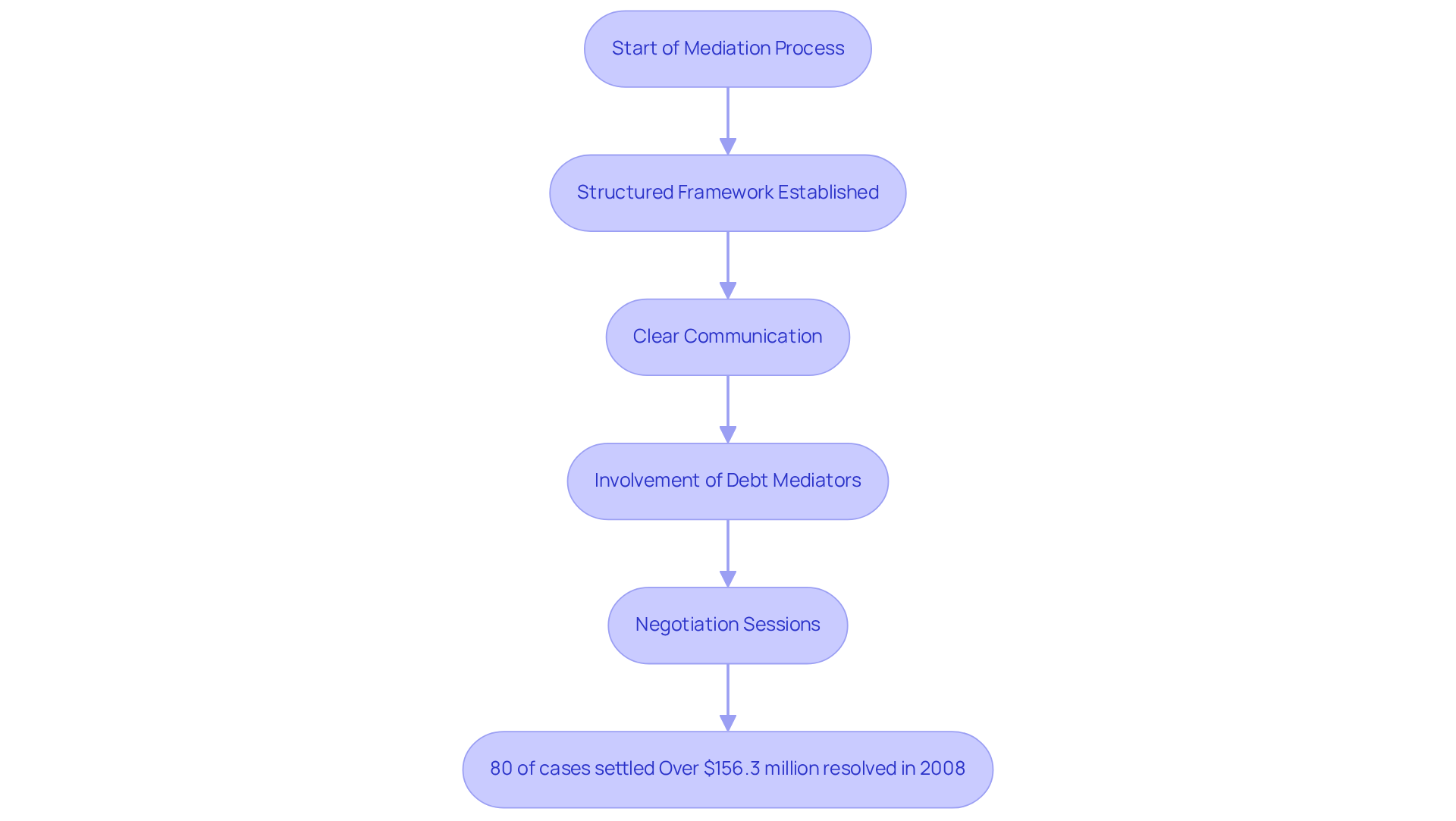

The Minneapolis Fed has gathered invaluable insights from over twenty years of experience in debt negotiation, particularly through the involvement of debt mediators in its Farmer-Lender Negotiation Program. These lessons highlight the importance of structured processes and clear communication in fostering productive discussions. A well-defined framework not only enhances the effectiveness of conflict resolution but also empowers mediators to navigate complex disputes with confidence.

Consider this: nearly 80% of cases in the Minnesota Farmer-Lender Mediation Program, which involved debt mediators, reached a settlement. This statistic illustrates the tangible benefits of a structured approach. Seasoned debt mediators emphasize that 'a party-driven, non-binding process in which disputants seek an impartial individual to help them in settling their differences' creates an environment conducive to finding solutions.

This organized approach is essential in achieving favorable outcomes. For instance, in 2008, debt mediators facilitated the resolution of over $156.3 million in financial obligations during negotiation sessions, ensuring that both lenders and borrowers could reach a consensus. By prioritizing organization and clarity, mediators can significantly enhance the likelihood of favorable resolutions, ultimately benefiting everyone involved.

As we reflect on these insights, it's clear that by embracing a structured mediation process, we can create pathways to resolution that are not only effective but also compassionate. Together, let’s prioritize understanding and clarity in our discussions, paving the way for .

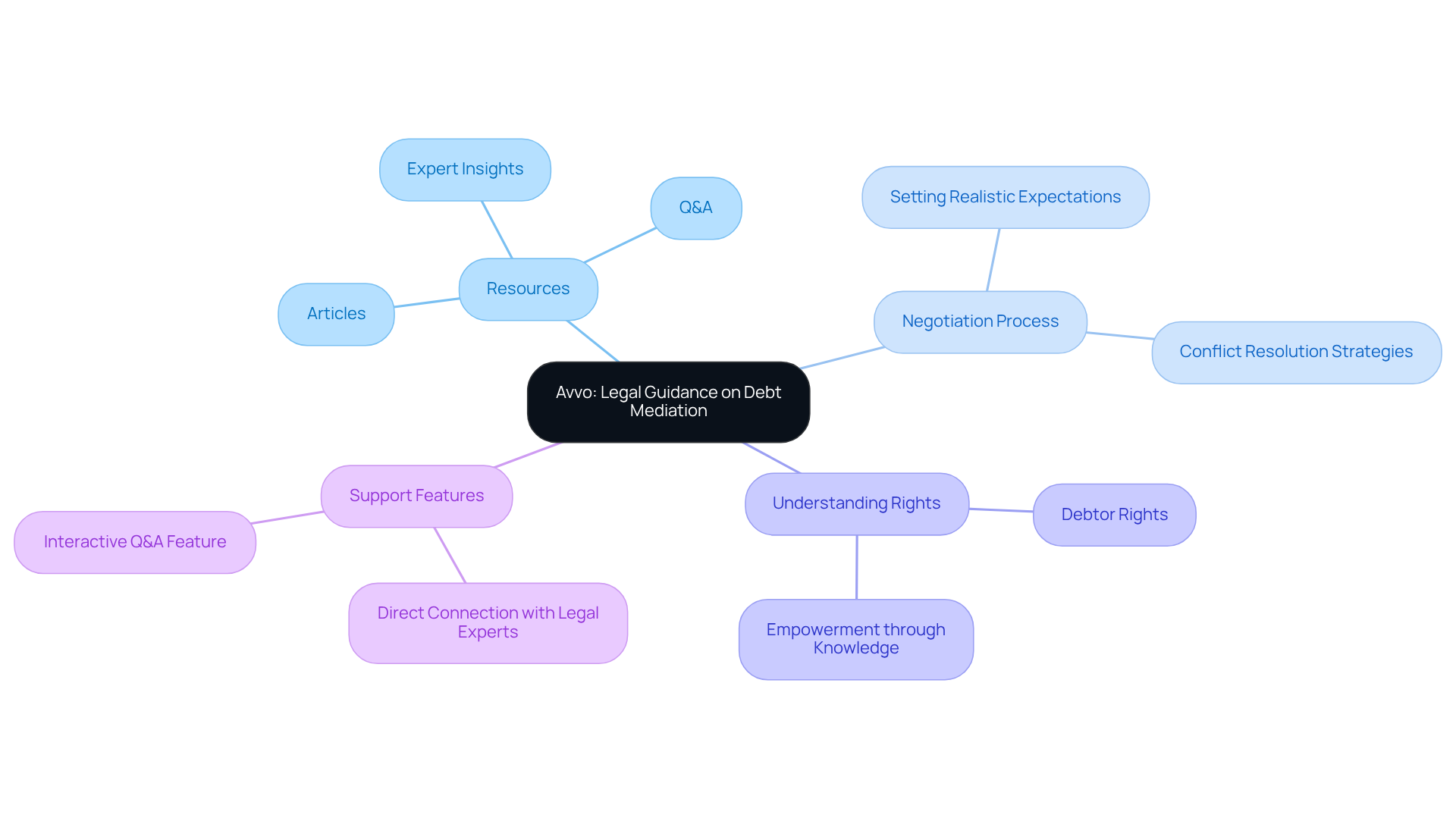

Avvo: Legal Guidance and Answers on Debt Mediation

Avvo serves as a vital resource for individuals facing financial challenges, offering compassionate legal advice and solutions provided by debt mediators for debt resolution. You can explore a wealth of articles, Q&A sections, and expert insights that illuminate the and clarify your rights as a debtor. By tapping into Avvo's resources, you can gain a deeper understanding of how to navigate conflict resolution, set realistic expectations, and protect your interests during negotiations.

In recent years, Avvo has addressed a significant number of inquiries related to debt resolution, including those involving debt mediators, responding to over 17 million legal questions across various topics. This platform not only sheds light on your rights during resolution but also highlights the successful outcomes achieved through negotiation. Legal experts emphasize the importance of understanding these rights, as they empower debtors to navigate the negotiation landscape with confidence, especially when working with debt mediators.

Moreover, Avvo's Q&A feature allows you to connect directly with legal experts, promoting swift responses to urgent questions about financial negotiations. This interactive aspect enhances your experience, ensuring you have the information necessary to make informed decisions. By leveraging Avvo's extensive resources, you can enter negotiations with greater confidence, ultimately leading to more favorable outcomes.

Remember, you are not alone in this journey. Avvo is here to support you every step of the way.

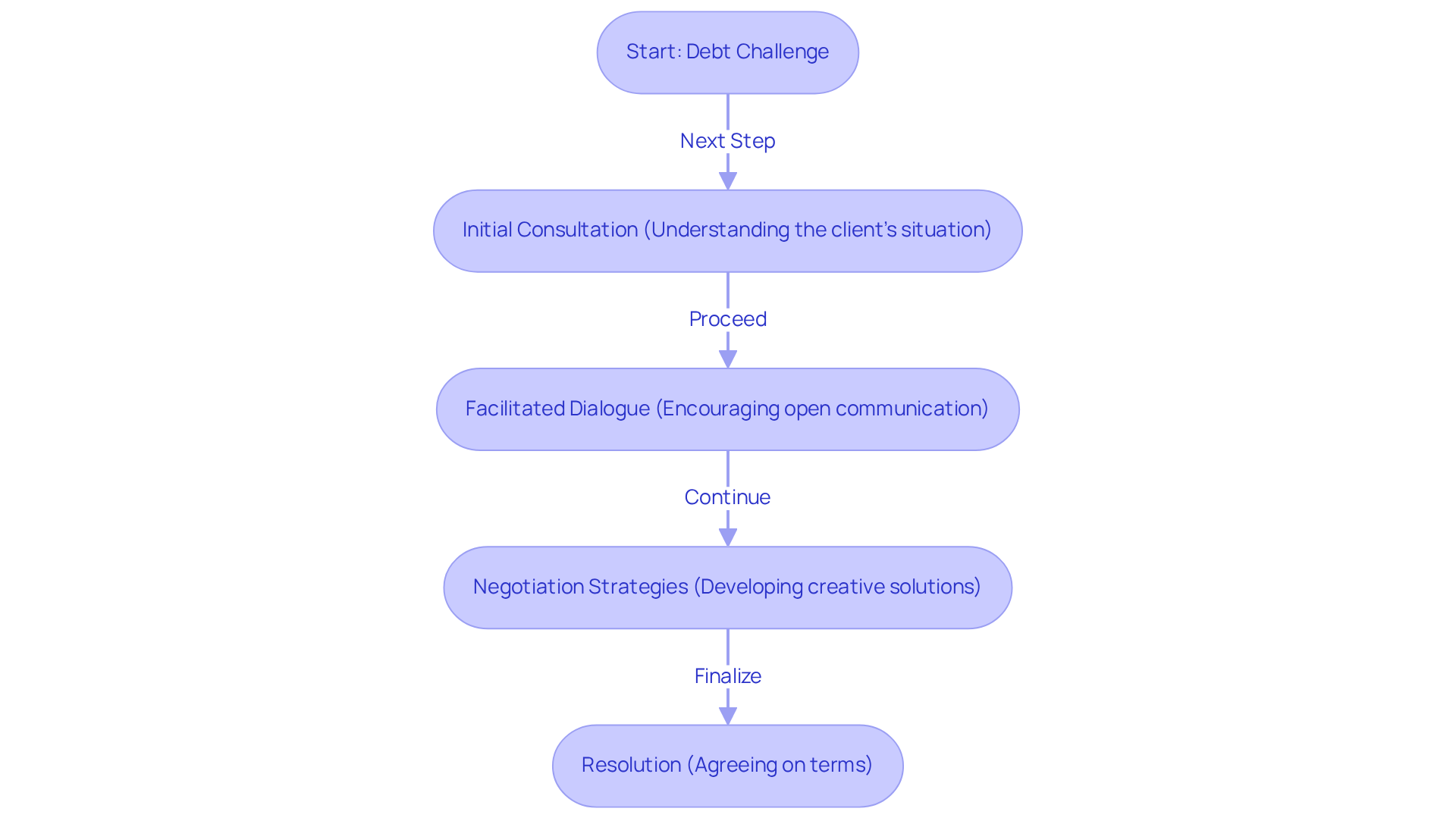

Professional Debt Mediation, Inc.: Navigating Debt Challenges with Expert Help

At Professional Debt Resolution, Inc., we understand that navigating debt challenges can be overwhelming. Our dedicated team excels in guiding clients through these intricate situations by leveraging the expertise of debt mediators for negotiation services. We specialize in facilitating constructive discussions between debtors and creditors through debt mediators, always striving for resolutions that benefit everyone involved.

As Jeff Cohen wisely states, "Mediation is conflict's way of looking at itself," which speaks to the reflective nature of our process. By adopting a structured approach to conflict resolution with debt mediators, we ensure that you receive comprehensive support tailored to your unique financial circumstances.

Typically, our last between one to three hours, providing ample time for thorough dialogue and negotiation. In 2025, effective conflict resolution strategies focus on fostering open communication, encouraging creative problem-solving, and promoting understanding and collaboration.

Niels Bohr's insight that 'every great and deep difficulty bears in itself its own solution' reminds us that through facilitation, clients can explore options beyond their usual thinking. This commitment to organized and tactical negotiation not only helps in settling conflicts but also empowers you to reclaim authority over your economic future through the help of debt mediators. Together, we can navigate this journey toward financial stability.

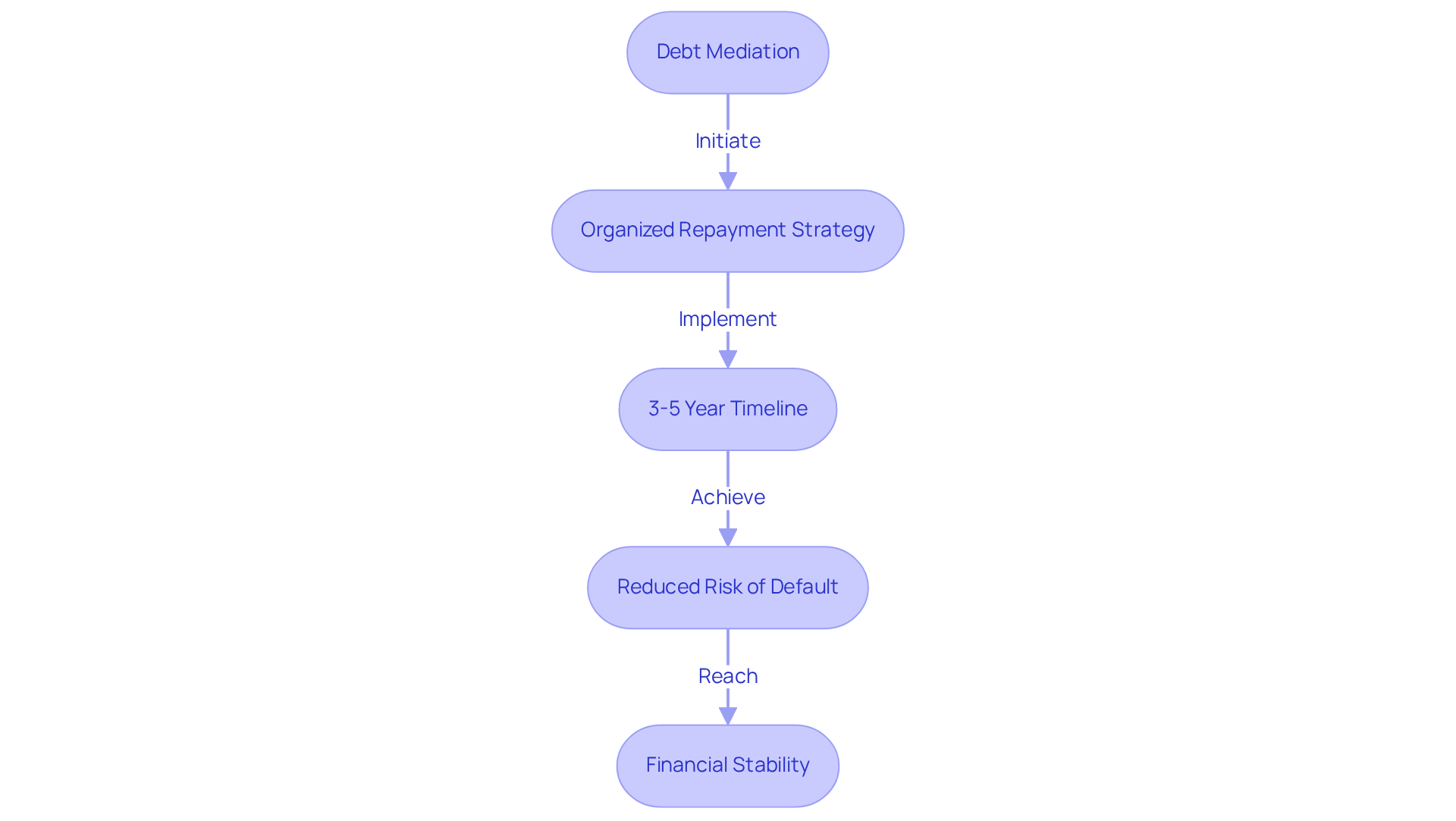

Structured Repayment Plans: A Key Component of Debt Mediation

Organized repayment strategies by debt mediators are essential in mediation, offering a clear framework for you to manage your financial responsibilities effectively. These plans are designed to align with your unique economic situation, ensuring that your payments remain manageable and sustainable over time. By using a systematic approach, debt mediators can significantly reduce the risk of default, helping you achieve financial stability and successfully resolve your obligations.

Have you ever felt overwhelmed by debt? Recent developments in repayment plans reveal that average terms negotiated by debt mediators typically span three to five years. This provides a your financial obligations, helping to alleviate the stress associated with debt. As you observe your progress toward economic independence, you may find a sense of empowerment growing within you.

Financial advisors often highlight the importance of having a well-defined repayment strategy. Not only can it improve your mental well-being, but it also allows you to focus on rebuilding your financial health without the constant worry of bankruptcy looming overhead. Remember, you’re not alone in this journey; with the right support and a structured plan, you can take meaningful steps toward a more secure financial future.

Pros and Cons of Debt Mediation: Weighing Your Options

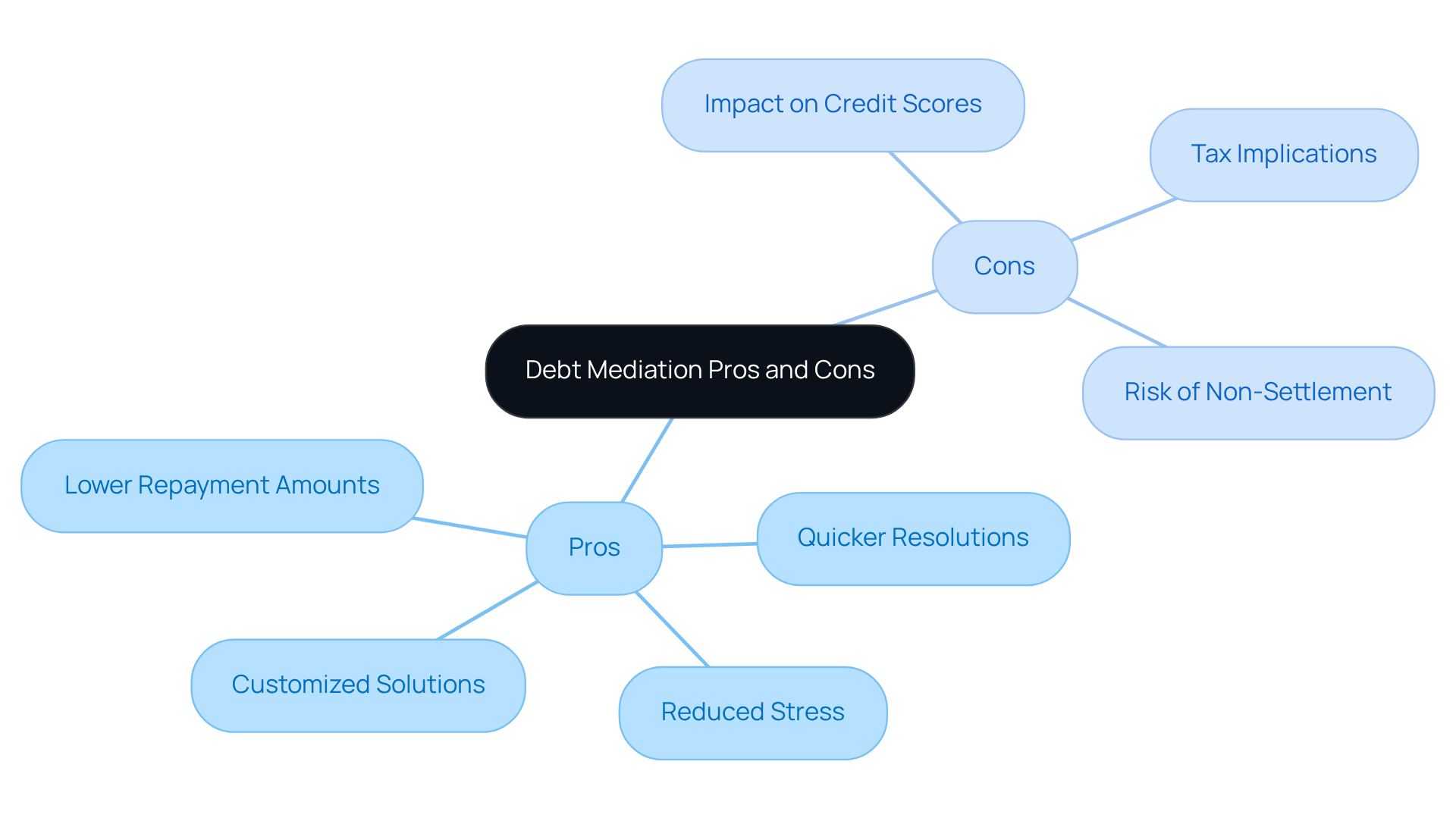

Debt negotiation can be a valuable option for those feeling overwhelmed by financial pressures. It offers numerous benefits, such as reduced stress, quicker resolutions, and the possibility of lower repayment amounts. Many financial experts emphasize that negotiation can lead to customized solutions tailored to your unique circumstances. This approach allows you to engage directly with creditors, avoiding the complications of litigation. Have you ever considered how much easier it might be to resolve your debts with debt mediators? A recent survey revealed that 58% of participants view credit resolution as an effective solution, reflecting a growing acceptance among consumers towards monetary mediation as a viable option for handling economic challenges.

However, it’s essential to be aware of the potential drawbacks. One significant concern is the impact on credit scores; a financial settlement can remain on your credit report for up to seven years, potentially causing a decline of more than 100 points. As financial expert Hanna Horvath wisely notes, "If you can afford to pay off a debt, it's generally a much better solution than settling because your credit score will improve, rather than decline." While settling small accounts might have a minimal impact if larger loans are current, the overall effect on your credit can hinder future lending opportunities. How does that make you feel about the choices you have?

Recent studies show that negotiation often leads to successful outcomes, with Florida reporting a success rate of approximately 70-80% in various cases. This effectiveness is attributed to trained debt mediators who help facilitate fair solutions and guide parties toward agreements without the need for court intervention. Yet, there is a risk; data indicates that about , underscoring the importance of voluntary collaboration among parties. Isn’t it reassuring to know that many people find success through this process?

Furthermore, it’s crucial to remember that the amount waived in a financial settlement may be considered taxable income by the IRS, adding another layer of complexity to your decision-making process.

In summary, while financial negotiation can alleviate monetary pressures and pave the way to resolution, it’s vital to weigh the potential effects on your credit score, tax implications, and the risk of unproductive discussions against the benefits of achieving a more manageable financial situation. We encourage you to explore your options and consider what feels right for you.

Types of Debt Resolved Through Mediation: What You Need to Know

Debt negotiation serves as a compassionate tool for resolving various financial obligations, including credit card balances, medical expenses, personal loans, and business debts. Have you ever felt overwhelmed by your financial responsibilities? You're not alone. The success rates of conflict resolution can vary depending on the type of obligation involved. For instance, many borrowers find hope in negotiating credit card debts, often securing lower interest rates or reduced amounts owed. In fact, recent statistics reveal an impressive 87% settlement rate in 2024, up from 85% in 2023, showcasing the growing effectiveness of this approach in resolving monetary disputes.

Understanding the is crucial when engaging in negotiation. For credit card debt, mediators typically suggest new repayment terms that align with the debtor's current financial situation, leading to more manageable monthly payments. Similarly, medical expenses, which can accumulate rapidly and create significant financial stress, are often addressed through negotiation. Many have successfully negotiated substantial reductions in their medical bills, alleviating their financial strain. Imagine being able to modify your payment arrangements, perhaps by extending the loan duration or lowering interest rates, making repayments feel less daunting.

Personal loans and business debts can also greatly benefit from mediation. By participating in this process, debtors can work alongside creditors to develop realistic repayment plans that consider their unique financial circumstances. This collaborative approach not only helps in reducing the total amount owed but also paves a more sustainable path toward financial recovery.

However, it’s essential to acknowledge that financial negotiation may have potential downsides, such as a possible negative impact on credit scores when settling debts for less than what is owed. It's important to weigh these factors carefully when considering negotiation as a viable solution.

In summary, debt mediators offer a supportive solution for individuals facing various types of debt. By leveraging the expertise of debt mediators, you can navigate your financial challenges more effectively, paving the way for a healthier financial future. Remember, you don’t have to face this journey alone; support is available to help you regain control of your finances.

Conclusion

Exploring debt mediation opens up a compassionate pathway for individuals striving to ease their financial burdens and manage their obligations with renewed confidence. This article has illuminated the numerous benefits of collaborating with skilled debt mediators who offer personalized solutions tailored to unique financial situations. Through structured negotiations, clients can achieve favorable outcomes while nurturing understanding and cooperation with creditors.

Key insights from various mediation services reveal that successful debt resolution is not only achievable but increasingly within reach. With impressive success rates, such as those reported by TurboDebt and Mediator Debt Solutions, the potential for significant reductions in debt amounts and improved repayment terms becomes clear. Furthermore, the focus on organized repayment plans empowers individuals to manage their financial responsibilities sustainably, paving the way for a more secure economic future.

In light of these compelling advantages, it is essential for anyone facing financial challenges to consider the role of debt mediation in their recovery journey. By embracing this compassionate and effective approach, you can regain control over your finances, reduce stress, and create a healthier financial landscape. Seeking assistance from expert mediators can transform the daunting process of debt resolution into a collaborative and empowering experience, ultimately fostering long-lasting financial stability.

Frequently Asked Questions

What services does Conclude ADR provide?

Conclude ADR offers conflict management services specifically designed for financial settlements, utilizing experienced debt mediators to foster a safe and constructive environment for dialogue.

How does Conclude ADR ensure affordability for clients?

Conclude ADR prioritizes value-based pricing, allowing clients to receive expert-driven solutions without excessive fees, which helps alleviate stress and promotes mutually beneficial agreements.

What is the success rate of debt mediation at Conclude ADR?

Conclude ADR has an industry success rate exceeding 90% for financial settlements, significantly increasing the likelihood of successful outcomes.

What advantages does TurboDebt offer for debt relief?

TurboDebt provides a comprehensive range of financial relief services focusing on negotiation with debt mediators to secure favorable terms with creditors, reducing stress and creating clear pathways to debt alleviation.

What is the typical success rate of mediation according to TurboDebt?

Mediation can resolve disputes at an impressive rate of 80-92%, with potential success rates reaching up to 90% when both parties are committed to resolution.

How much can clients potentially save through financial negotiations at TurboDebt?

Successful financial negotiations often lead to settlements that are 30% to 50% lower than the initial balance, providing substantial monetary relief.

What outcomes can clients expect from negotiations with Mediator Debt Solutions?

Possible outcomes include reaching an agreement, declaring a stalemate, or finalizing and signing a contract, with assistance in managing expectations throughout the process.

What tangible benefits have clients experienced with Mediator Debt Solutions?

Clients enrolled in DebtWave's Debt Management Program (DMP) experienced an average payment reduction of $220, with the average minimum payment decreasing from $915 to $695.

What is the average savings clients can achieve with effective negotiation strategies at Mediator Debt Solutions?

The average settlement involving multiple accounts can yield savings of approximately $5,440 over 36 months after fees.

How does Mediator Debt Solutions support clients in their financial recovery?

Mediator Debt Solutions focuses on specific circumstances to ensure practical resolutions while considering clients' overall well-being, helping them transition from negative to positive discretionary income.