Overview

Navigating spousal support can be an emotional journey, especially when it comes to understanding its tax implications in California. Since January 2019, spousal support is generally not taxable for the recipient, a significant change that eliminated the deductibility of these payments for the payer. This shift can raise many questions and concerns.

It's essential to consider key factors that determine the taxability of these payments. The nature of the payments and the relationship status between the payer and recipient play crucial roles. Have you thought about how these changes might affect your situation?

We understand that tax laws can be complex and overwhelming. That's why it's important to consult with tax professionals who can provide personalized guidance tailored to your unique circumstances. Seeking support from experts can help you navigate these regulations with confidence and peace of mind.

Introduction

Navigating the financial obligations that arise from divorce can feel overwhelming, especially when considering spousal support in California. We understand that as couples face the complexities of alimony, the looming question of tax implications can add to the stress, particularly in light of recent changes in tax regulations. This article aims to explore the critical factors that determine whether spousal support is taxable, providing you with essential insights and practical steps to feel well-informed and prepared.

Have you ever wondered how the nuances of spousal support might impact your financial future? It’s vital to consider what you need to avoid costly pitfalls. Together, we can explore these important aspects and ensure you’re equipped to make informed decisions during this challenging time.

Understand Spousal Support Basics in California

In California, marital assistance, often referred to as alimony, represents a financial responsibility one partner may have to the other during or following a divorce. Its primary aim is to help the lower-earning spouse maintain a standard of living similar to that enjoyed during the marriage. There are two main types of marital assistance: temporary and permanent. Temporary assistance is provided during the divorce proceedings, offering immediate financial relief, while permanent aid is established post-divorce. This is based on various factors outlined in California's Family Code, particularly California Family Code 4320, which considers elements such as the duration of the marriage, the age and health of both parties, and their respective incomes and earning capacities.

As we look ahead to 2025, it's important to understand that average spousal assistance payments can vary significantly. These variations are influenced by the duration of the marriage and the financial situations of both parties. For unions lasting under ten years, assistance typically continues for half the length of the marriage. In contrast, longer unions may lead to extended obligations. Judges often consider factors like income, earning potential, and the standard of living established during the marriage when deciding on financial assistance amounts.

Real-life examples illustrate the complexities of spousal assistance. For instance, if one partner has been living with a non-marital companion, courts may choose to lower or eliminate payment obligations, reflecting the changing financial needs after divorce. Additionally, the Gavron warning serves as a legal tool that encourages aided spouses to seek financial independence, which can affect ongoing obligations. This warning aims to motivate recipients to make reasonable efforts toward self-sufficiency, a crucial aspect of modifying marital assistance.

Understanding these fundamentals is essential, as they directly impact the question of whether . Notably, since January 2019, marital assistance payments are no longer deductible for the contributor and this situation leads to the inquiry of whether spousal support is taxable in California for the beneficiary. This change signifies a major shift in tax consequences for separating couples. As Garwood Reeves, an expert family law attorney, emphasizes, 'At Garwood Reeves, we understand how challenging this phase can be, and our team of expert family law attorneys is here to guide you at every step.

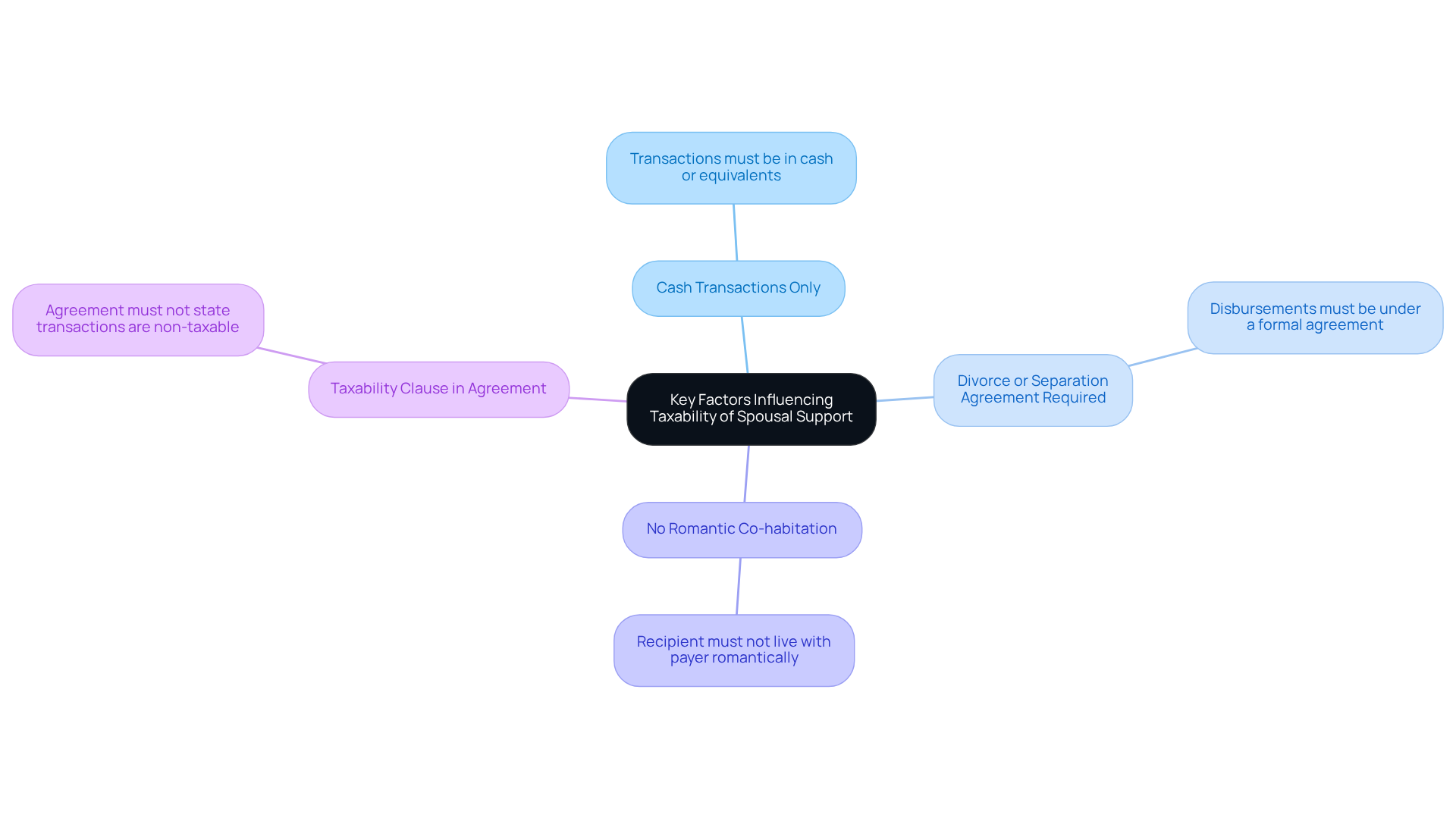

Identify Key Factors Influencing Taxability of Spousal Support

Understanding if spousal support is taxable in California can be a source of concern for many. Several key factors come into play, and it’s important to be aware of them.

- Transactions need to be conducted in cash or cash equivalents; property transfers simply do not qualify. Have you thought about how this might affect your situation?

- These disbursements must be made under a divorce or separation agreement. This ensures clarity in your financial arrangements.

- It’s essential that the recipient is not living with the payer in a romantic relationship. This can significantly impact the question of whether spousal support is taxable in California.

- The agreement must not indicate that the transactions are not taxable. Understanding these factors is essential for determining if spousal support is taxable in California. Remember, being informed can empower you to make the best decisions for your future. We’re here to support you through this process.

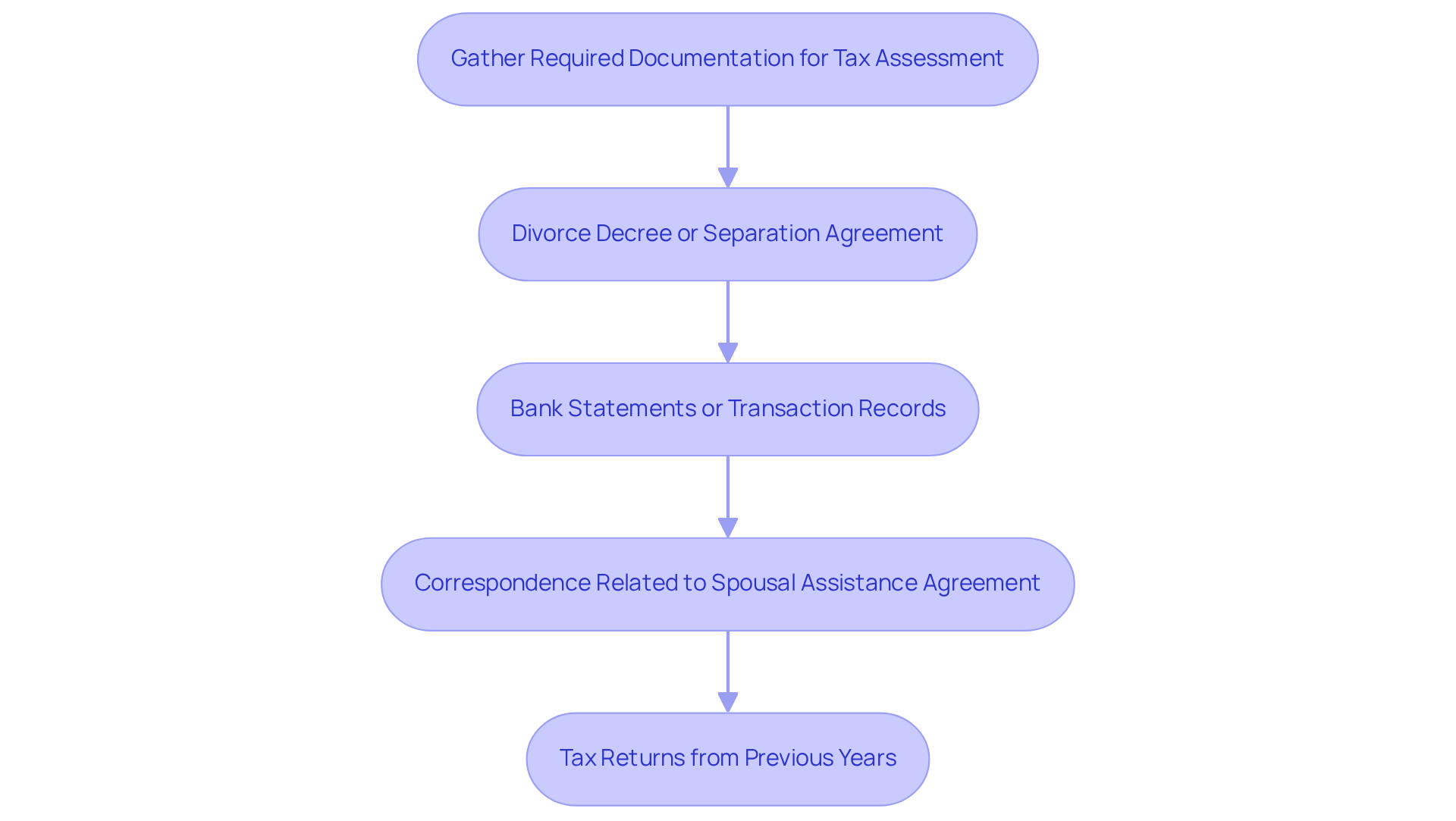

Gather Required Documentation for Tax Assessment

Understanding the complexities of spousal assistance can be overwhelming, particularly when considering if spousal support is taxable in California. To help you navigate this process, it's essential to gather the right documentation. Here are some important items to consider:

- The divorce decree or separation agreement that outlines the terms of the spousal assistance.

- Bank statements or transaction records that show the amounts disbursed.

- Any correspondence related to the spousal assistance agreement.

- Tax returns from previous years that might provide helpful context.

Having these documents organized can bring clarity to your tax situation and help you understand whether spousal support is taxable in California, thereby strengthening any claims made on your tax filings. Remember, you are not alone in this, and taking these steps can help ease your concerns.

Consult Tax Professionals for Expert Guidance

Once you have gathered all the necessary information and documentation, it’s a good idea to reach out to a tax professional who specializes in family law and tax matters. As Michelle Hoover wisely points out, 'Support funds after divorce aren’t just about how much—they also raise the question of is spousal support taxable in California.' These experts can provide valuable insights into whether and how marital assistance payments might affect your tax situation. They can help you understand potential deductions and ensure you comply with both federal and state tax regulations.

It’s important to note that while partner assistance is not deductible for federal taxes after 2018, the topic of is spousal support taxable in California is still significant as it remains deductible at the state level. Additionally, remember that child assistance has never been deductible for the paying parent and is not considered taxable income for the receiving parent. A tax professional can also assist you in preparing your tax returns accurately, reducing the risk of audits or penalties.

Given the ever-evolving landscape of tax regulations—especially with the changes introduced by the Tax Cuts and Jobs Act (TCJA)—consulting a skilled tax expert is a vital step in managing the financial implications of partner assistance. Real-life examples show how tax advisors have effectively guided clients through the complexities of spousal support taxation, particularly addressing the question of whether is spousal support taxable in California, ensuring that financial arrangements are optimized for tax efficiency. Have you considered how these changes might impact your situation? Seeking support can make a significant difference.

Conclusion

Understanding the intricacies of spousal support in California is essential for anyone facing the challenges of divorce. It’s important to recognize that the determination of whether spousal support is taxable depends on various factors, such as:

- The nature of the payments

- The relationship between the parties

- The specific details outlined in divorce agreements

With changes in tax law, especially since 2019, grasping how these regulations impact both the payer and the recipient is crucial.

Key considerations include:

- The requirement for payments to be made in cash or equivalents

- The necessity of formal divorce agreements

- How living arrangements can affect taxability

Have you gathered the right documentation? Proper documentation is vital for accurately assessing tax implications. Collecting essential documents, like divorce decrees, bank statements, and past tax returns, can simplify this process and clarify the financial landscape post-divorce.

Ultimately, consulting with tax professionals who specialize in family law is a proactive step towards understanding the potential tax consequences of spousal support. Their expertise can guide you through the evolving tax landscape, ensuring compliance while optimizing your financial arrangements. By staying informed and seeking expert guidance, you can make empowered decisions regarding your spousal support obligations and tax responsibilities in California.

Frequently Asked Questions

What is spousal support in California?

Spousal support, often referred to as alimony, is a financial responsibility one partner may have to the other during or following a divorce, aimed at helping the lower-earning spouse maintain a standard of living similar to that enjoyed during the marriage.

What are the two main types of spousal support?

The two main types of spousal support are temporary support, which is provided during the divorce proceedings for immediate financial relief, and permanent support, which is established post-divorce.

What factors influence the determination of spousal support in California?

Factors influencing spousal support include the duration of the marriage, the age and health of both parties, and their respective incomes and earning capacities, as outlined in California Family Code 4320.

How does the duration of marriage affect spousal support payments?

For marriages lasting under ten years, spousal support typically continues for half the length of the marriage. In contrast, longer marriages may result in extended support obligations.

Can living with a non-marital companion affect spousal support payments?

Yes, if one partner lives with a non-marital companion, courts may choose to lower or eliminate spousal support obligations, reflecting the changing financial needs after divorce.

What is the Gavron warning?

The Gavron warning is a legal tool that encourages aided spouses to seek financial independence, motivating them to make reasonable efforts toward self-sufficiency, which can affect ongoing spousal support obligations.

Are spousal support payments taxable in California?

Since January 2019, spousal support payments are no longer deductible for the contributor, which raises questions about whether these payments are taxable for the beneficiary. The tax consequences have shifted for separating couples as a result of this change.