Introduction

Contractor misclassification isn’t just a bureaucratic error; it has serious implications for businesses, workers, and taxpayers alike. When individuals are misclassified, they miss out on essential benefits and protections. This can leave them vulnerable, while companies may face hefty penalties and legal repercussions that could threaten their very existence.

How can we navigate this complex landscape of misclassification and mediation effectively? It’s crucial to ensure fairness and compliance while managing costs. This guide will explore the essential steps and pricing factors involved in contractor misclassification mediation in San Diego. Together, we can empower stakeholders to make informed decisions and seek equitable resolutions.

Define Contractor Misclassification and Its Implications

Contractor mislabeling is a serious issue that affects many businesses and workers alike. When a worker is inaccurately identified as an independent contractor instead of an employee, it can lead to significant legal and financial consequences for everyone involved. Have you ever thought about how this misclassification impacts not just the companies, but also the individuals who rely on fair treatment?

For businesses, the stakes are high. They may face civil penalties ranging from $5,000 to $25,000 for each violation, along with back taxes and unpaid benefits. In fact, in 2021, misclassification in the construction industry resulted in an estimated loss of $1.9 billion in overtime pay and $5 billion in unpaid workers' compensation premiums. This is not just a number; it represents real people who are missing out on what they rightfully deserve.

On the flip side, misclassified workers are losing access to essential protections like minimum wage, overtime pay, and unemployment benefits. This can be devastating for individuals trying to make ends meet. Understanding these implications is crucial for both businesses and workers, as it lays the groundwork for resolving conflicts through contractor misclassification mediation San Diego pricing.

Moreover, taxpayers are feeling the pinch too, losing between $5 billion and $10 billion each year due to lost revenue from improper categorization and off-the-books payments. This affects us all.

The final rule published on January 10, 2024, sheds light on the legal context surrounding contractor misclassification. It emphasizes the importance of compliance for businesses, not just to avoid penalties, but to foster a fair working environment for everyone. Let’s work together to ensure that all workers receive the protections they deserve.

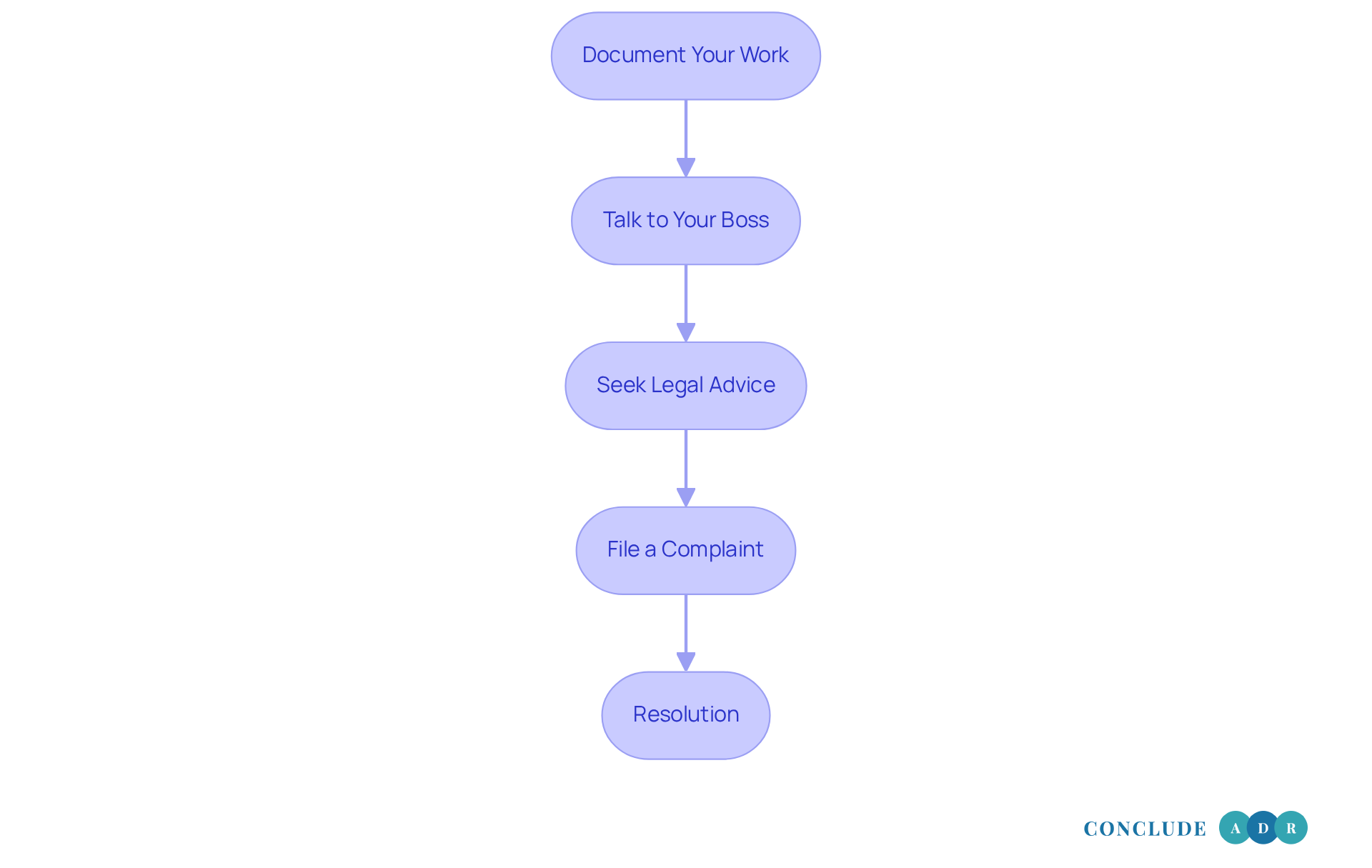

Identify Steps to Take If Misclassified

If you suspect that you’ve been misclassified as an independent contractor, it’s important to take steps to address this concern effectively. Here’s how you can navigate this situation with care:

-

Document Your Work: Start by keeping detailed records of your work hours, tasks completed, and all communications with your supervisor. This documentation is crucial for supporting your claims about your employment status. It’s your story, and having the facts at hand can make a difference.

-

Talk to Your Boss: Have an open conversation with your supervisor about your classification. Misclassification often happens unintentionally, and a friendly dialogue can lead to a quick resolution. As employment lawyer Haley Harrigan emphasizes, understanding the true nature of your working relationship is key to avoiding risks of improper classification. Remember, companies have legal obligations to pay taxes and provide benefits, as Jody Calemine points out. If there’s an error, it could have significant financial implications for both you and your employer.

-

Seek Legal Advice: It might be helpful to consult with an employment attorney who specializes in classification issues. Their expertise can clarify your rights and the potential claims you might pursue. Legal professionals stress the importance of knowing local laws and the specific criteria for classification. You deserve to understand your position fully.

-

File a Complaint: If your discussions don’t lead to a satisfactory outcome, consider filing a formal complaint with the relevant state labor department or the IRS. This step can help resolve your classification concern and may prompt an investigation into your employer's practices. It’s worth noting that misclassification can lead to an estimated loss of $12 billion annually due to unpaid taxes and benefits, highlighting the broader economic impact of this issue.

By following these steps, you can navigate the complexities of contractor categorization with confidence and work towards a fair resolution. Remember, you’re not alone in this journey.

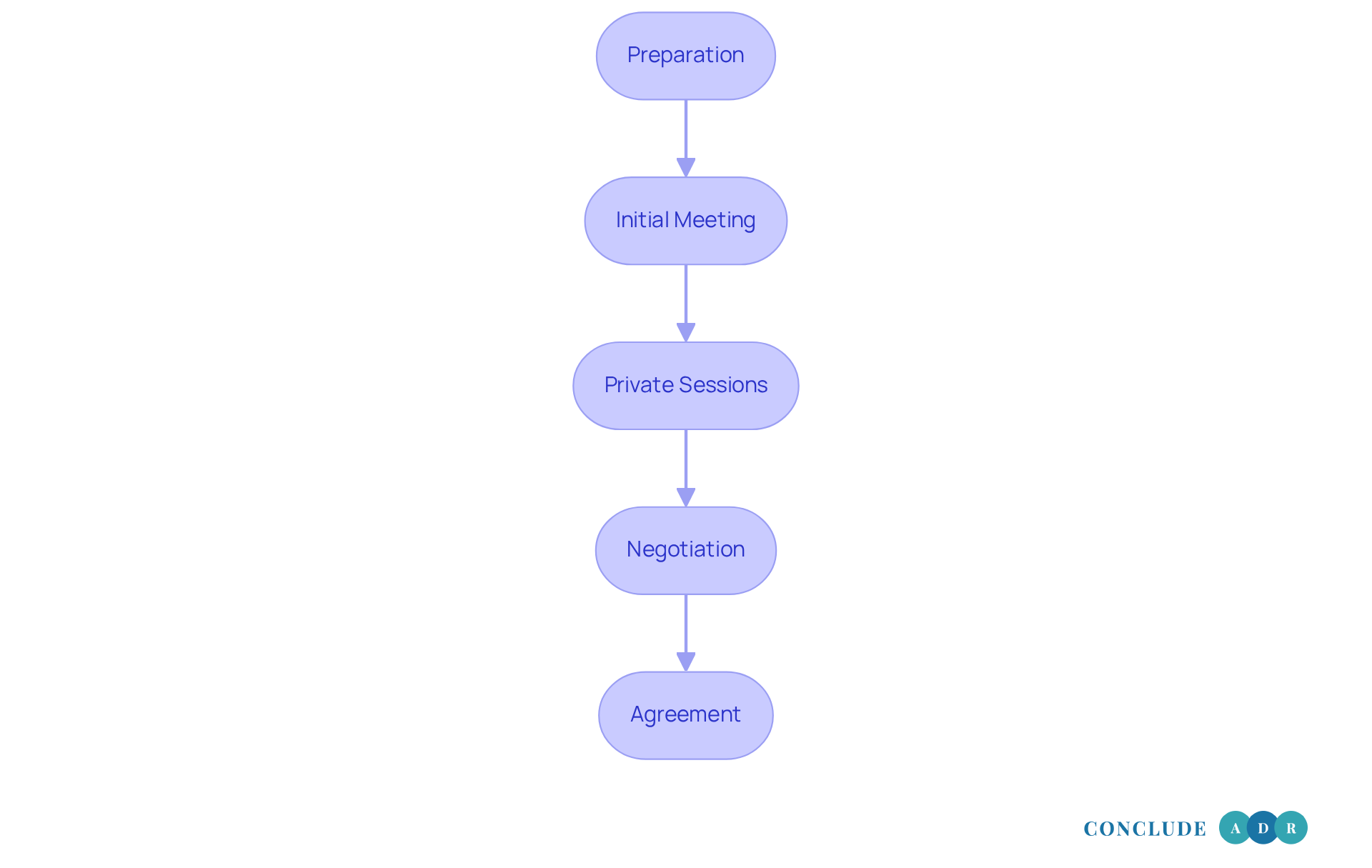

Understand the Mediation Process for Misclassification Cases

The mediation process for contractor misclassification unfolds through several key steps that can truly make a difference:

-

Preparation: It’s crucial for both sides to gather relevant documents and evidence - think contracts, pay stubs, and communication records. This preparation isn’t just about paperwork; it’s about empowering yourself to present persuasive arguments. Understanding the ABC test is also vital, as it clarifies the criteria for proper classification, helping both workers and employers navigate these disputes with confidence.

-

Initial Meeting: Here, the mediator facilitates a space where both sides can express their viewpoints. This step is essential for fostering a respectful dialogue and clarifying core issues. It’s about ensuring everyone involved comprehends the situation, which can ease tensions and pave the way for understanding.

-

Private Sessions: The mediator may conduct private sessions with each group to discuss sensitive issues and explore potential solutions. These moments can be invaluable, addressing emotional tensions and power imbalances, and creating a balanced environment for negotiation.

-

Negotiation: Guided by the mediator, individuals engage in discussions to reach a mutually acceptable resolution. This phase often involves compromises and creative solutions. The mediator encourages brainstorming sessions, helping everyone overcome resistance to compromise and find common ground.

-

Agreement: If a resolution is achieved, the mediator assists in drafting a written agreement that outlines the terms, which both parties will sign. This written record is essential for clarity and enforceability, helping to avoid future misunderstandings.

Mediation sessions for contractor misclassification mediation San Diego pricing typically conclude within a few days or weeks, with a high success rate of 92%. Isn’t it encouraging to know that by 2025, it’s projected that 60-70% of cases will conclude on the day of discussion? This demonstrates the effectiveness of mediation in resolving conflicts efficiently, allowing everyone to move forward with peace of mind.

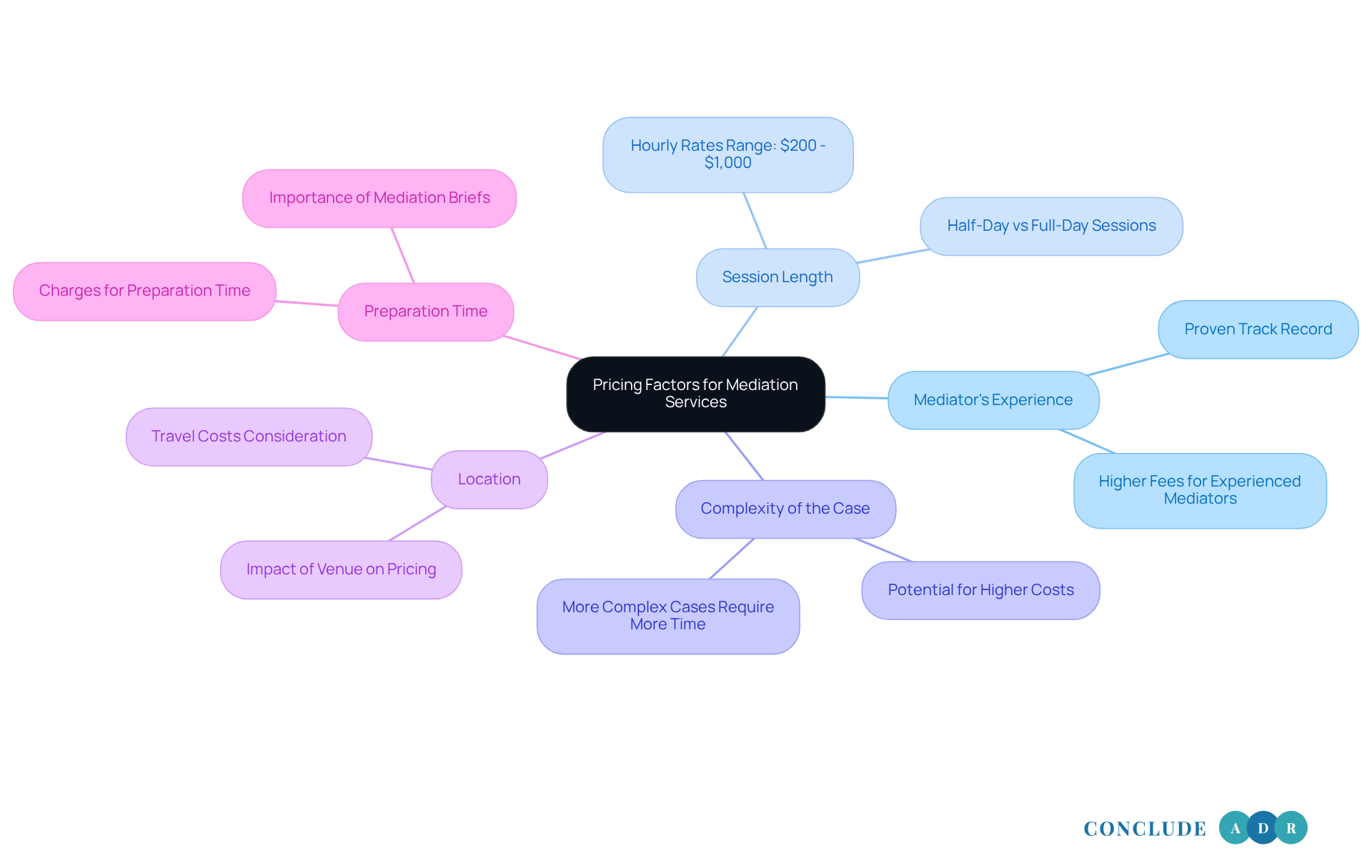

Explore Pricing Factors for Mediation Services

When it comes to contractor misclassification mediation San Diego pricing, it’s important to consider several factors that can influence the costs. Have you thought about how these elements might affect your situation?

- Mediator's Experience: More experienced mediators often charge higher fees, reflecting their expertise and proven track record. This can be a crucial factor in ensuring you receive the best guidance.

- Session Length: Mediation sessions can vary in length, and costs are typically calculated based on hourly rates. In San Diego, these rates usually range from $200 to $1,000 per hour. Understanding this can help you plan better.

- Complexity of the Case: If your case is more complex, it may require additional time and resources, which can lead to higher costs. This is something to keep in mind as you navigate your options.

- Location: The venue for mediation can also impact pricing, especially if travel is involved. Have you considered where you’d like to hold your session?

- Preparation Time: Mediators may charge for the time they spend preparing for your session, which can add to the overall cost.

By understanding these factors, you can better budget for contractor misclassification mediation San Diego pricing and select the right mediator for your needs. Remember, you’re not alone in this process; we’re here to support you every step of the way.

Conclusion

Addressing contractor misclassification is crucial for creating a fair and equitable work environment. Have you ever felt uncertain about your classification? You're not alone. The implications of misclassification reach far beyond individual cases, impacting businesses, workers, and taxpayers alike. By understanding the legal context and potential consequences, we can work together - employers and employees alike - to resolve disputes effectively and promote compliance.

Key steps in addressing misclassification include:

- Documenting work

- Engaging in open dialogue with employers

- Seeking legal advice

- Filing formal complaints if necessary

The mediation process offers a structured approach to resolving these conflicts. It emphasizes preparation, negotiation, and reaching a mutually acceptable agreement. With a high success rate and the potential for quick resolutions, mediation can be a viable solution for many. Imagine the relief of finding a resolution that works for everyone involved.

Ultimately, recognizing the significance of contractor misclassification and taking proactive steps can lead to better outcomes for all parties. Whether you're navigating the complexities of mediation pricing in San Diego or understanding your rights as an employee, informed action is crucial. Engaging in these processes not only safeguards your rights but also contributes to a more just and accountable labor market. Together, we can foster a work environment that values fairness and respect.

Frequently Asked Questions

What is contractor misclassification?

Contractor misclassification occurs when a worker is inaccurately identified as an independent contractor instead of an employee, leading to potential legal and financial consequences for businesses and workers.

What are the implications of contractor misclassification for businesses?

Businesses may face civil penalties ranging from $5,000 to $25,000 for each violation, along with back taxes and unpaid benefits. Misclassification can also lead to significant financial losses, such as the estimated $1.9 billion lost in overtime pay and $5 billion in unpaid workers' compensation premiums in the construction industry in 2021.

How does contractor misclassification affect workers?

Misclassified workers lose access to essential protections such as minimum wage, overtime pay, and unemployment benefits, which can be devastating for individuals trying to make ends meet.

What is the financial impact of contractor misclassification on taxpayers?

Taxpayers lose between $5 billion and $10 billion each year due to lost revenue from improper categorization and off-the-books payments resulting from contractor misclassification.

What does the final rule published on January 10, 2024, address regarding contractor misclassification?

The final rule emphasizes the importance of compliance for businesses to avoid penalties and to foster a fair working environment for all workers.

Why is it important for both businesses and workers to understand contractor misclassification?

Understanding the implications of contractor misclassification is crucial for both parties as it lays the groundwork for resolving conflicts and ensuring that all workers receive the protections they deserve.