Introduction

Mediation is vital in resolving conflicts, but it can come with unexpected challenges for facilitators. Have you ever thought about the stakes involved? Mediation malpractice insurance is more than just a safety net; it provides essential financial protection against claims of negligence and boosts a mediator's professional credibility.

But what if mediators choose to operate without this crucial coverage? The potential consequences can be daunting. Imagine the stress of facing claims without the necessary support. In a field where trust and accountability are paramount, these concerns raise important questions about the adequacy of protection.

We need to consider how this impacts not just the mediators, but also the individuals relying on their expertise. It’s essential to ensure that we are all protected in our roles. Let's explore how we can foster a safer environment for everyone involved.

Define Mediation Malpractice Insurance

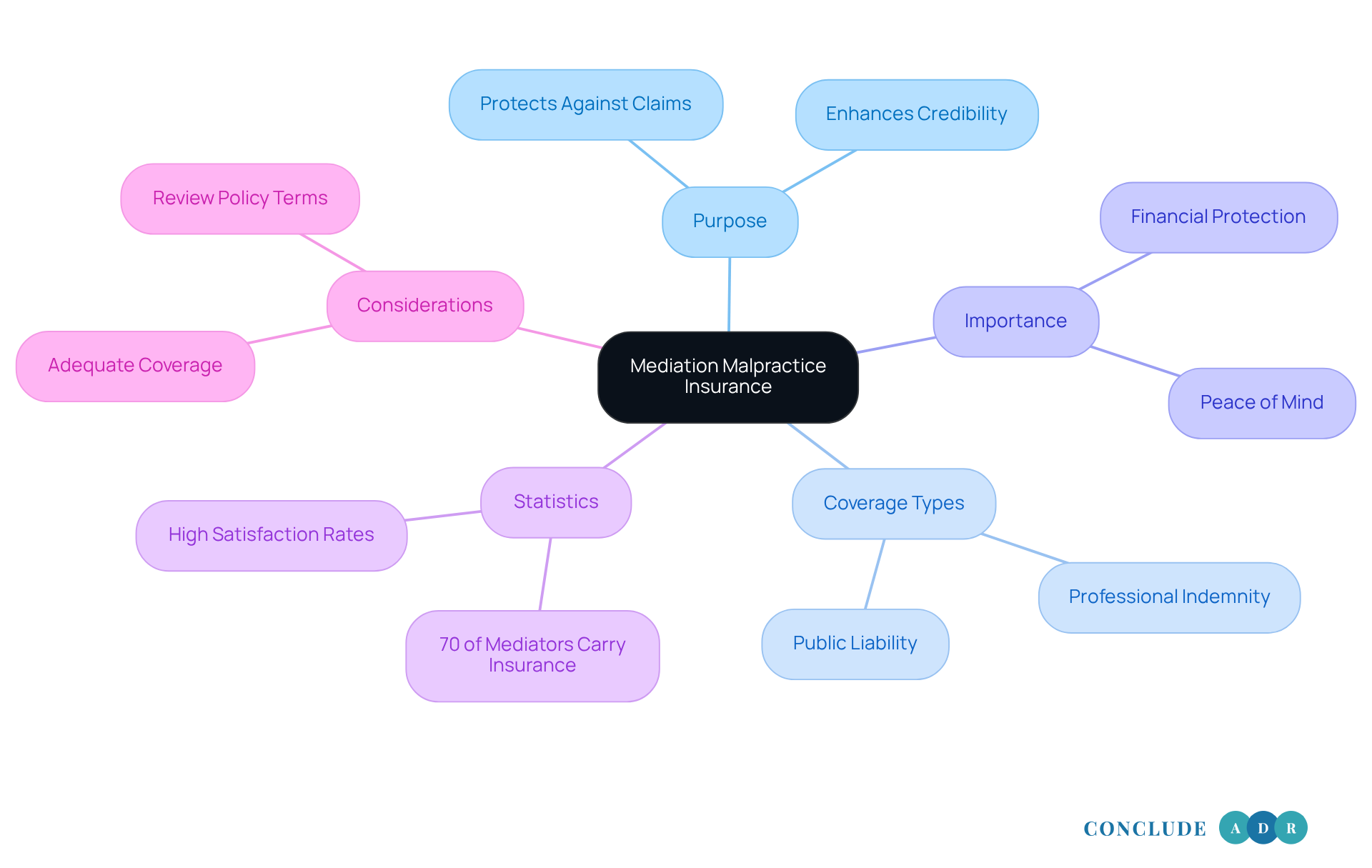

Mediation malpractice insurance is more than just a policy; it’s a vital safety net for those who help others navigate the often tricky waters of negotiation. This specialized type of professional liability protection, mediation malpractice insurance, is designed to shield facilitators from claims that may arise from their professional services. It typically includes coverage for Professional Indemnity and Public Liability, indicating that mediation malpractice insurance can help with legal expenses and damages if someone claims negligence, errors, or omissions during the facilitation process.

Think about it: negotiations can be emotionally charged, with significant stakes involved. This is where mediation malpractice insurance truly shines, allowing facilitators to work with confidence while helping others resolve conflicts. It’s essential for negotiators to understand the full scope of mediation malpractice insurance. Mediation malpractice insurance not only protects their financial interests but also enhances their credibility in the eyes of clients and stakeholders.

Have you ever considered the potential claims that could arise from facilitation activities? Accusations of biased facilitation or unethical behavior can occur, which underscores the importance of having adequate mediation malpractice insurance coverage. In fact, around 70% of mediators carry mediation malpractice insurance, which reflects its significance in the profession.

The evolving landscape of coverage acknowledges the unique risks associated with conflict resolution, highlighting the importance of mediation malpractice insurance. It offers flexible protection options, including coverage for temporary personnel or freelancers involved in arbitration activities.

In this field, having the right support can make all the difference. So, if you’re a mediator or facilitator, take a moment to reflect on your coverage. Are you adequately protected? Let’s ensure you have the peace of mind to focus on what you do best: helping others find resolution.

Contextualize the Importance of Mediation Malpractice Insurance

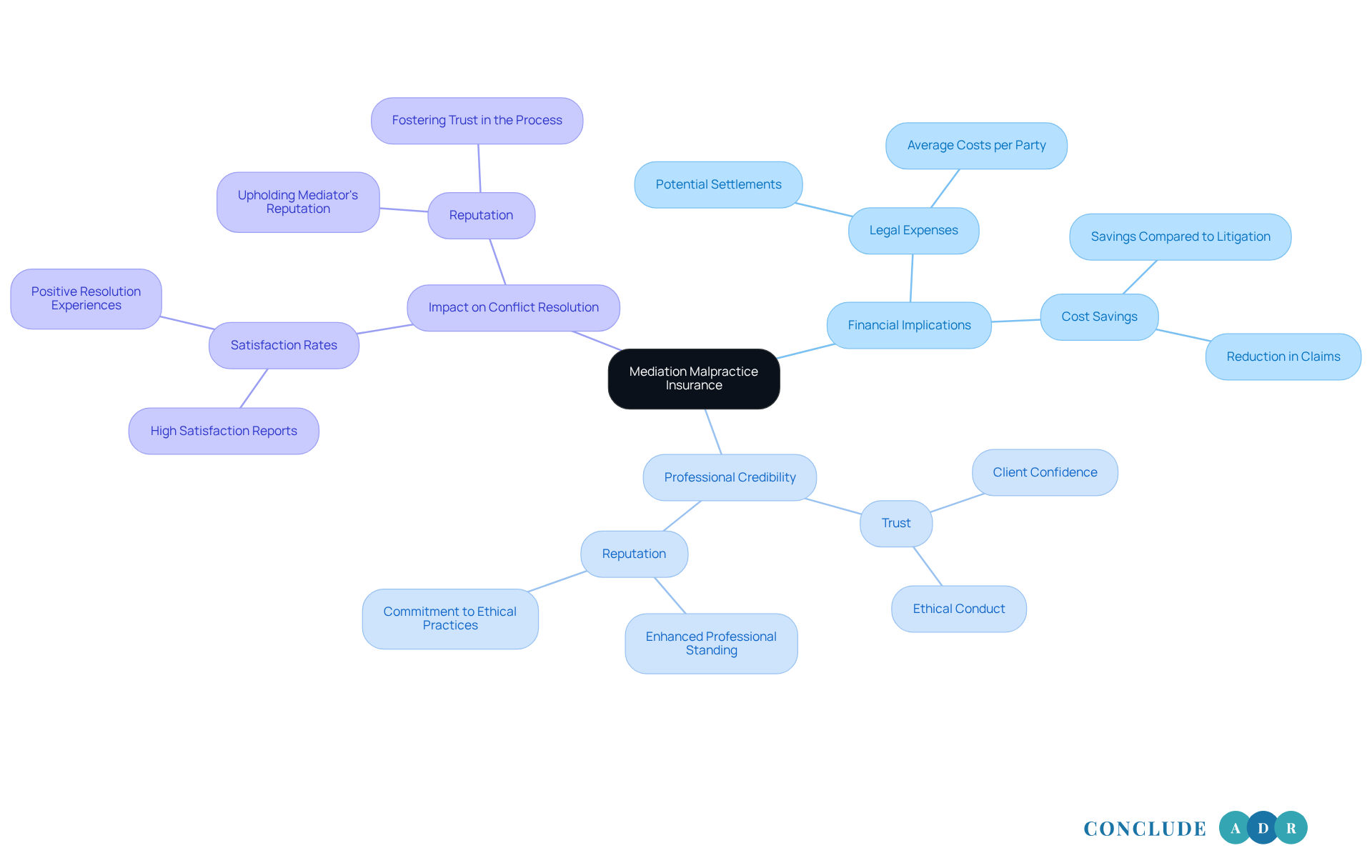

In today's complex and high-stakes conflict resolution landscape, the importance of malpractice coverage cannot be overstated. As facilitators guide negotiations, they may find themselves facing negligence claims, highlighting the importance of mediation malpractice insurance if the mediation doesn’t yield satisfactory results. Have you considered what could happen without sufficient coverage? The financial responsibilities can be overwhelming, with legal expenses averaging between $15,000 and $20,000 per party, not to mention the potential for settlements that could be financially devastating.

But there’s more to it than just numbers. Having mediation malpractice insurance not only protects you but also enhances your professional standing. It signals to your clients that you are committed to ethical conduct and prepared for unexpected challenges. In a field where trust and credibility are paramount, this coverage becomes an essential part of your professional toolkit.

Think about it: alternative dispute resolution has been shown to save an average of $50,000 per case compared to litigation. This highlights the financial advantages of effective conflict resolution. Moreover, research indicates that over 90% of participants in conflict resolution report high satisfaction with the process. Isn’t it reassuring to know that upholding a mediator's reputation through malpractice coverage can contribute to this satisfaction?

So, as you navigate your role in conflict resolution, consider the peace of mind that comes with being covered. It’s not just about protecting yourself; it’s about fostering trust and ensuring a positive experience for everyone involved.

Outline Key Coverage Components of Mediation Malpractice Insurance

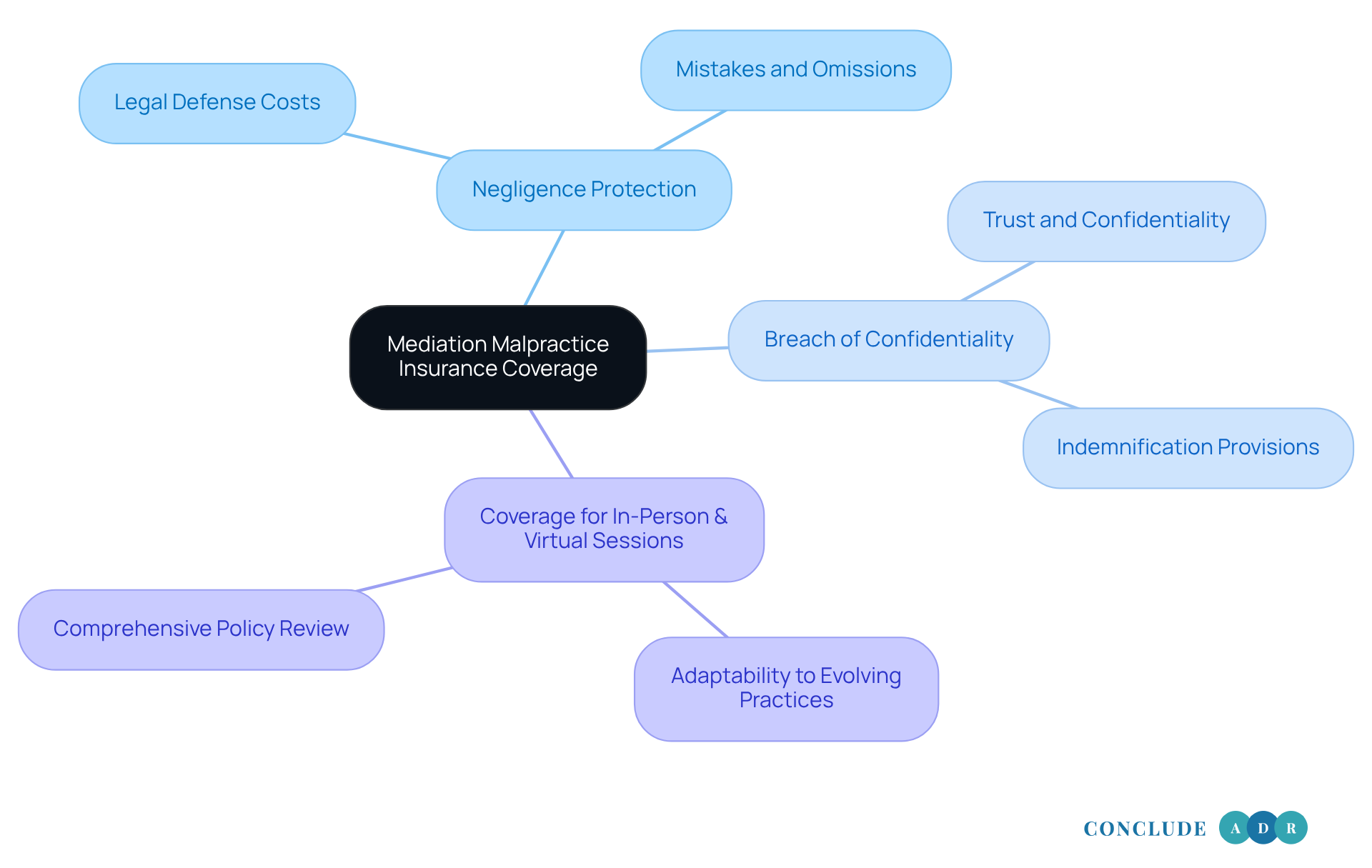

It’s essential to understand the coverage elements of mediation malpractice insurance that can truly protect you. This mediation malpractice insurance generally protects against allegations of negligence, mistakes, and omissions that might arise during the facilitation process. Imagine facing legal defense costs, settlements, or judgments related to such claims - these can be daunting.

Moreover, some policies that include mediation malpractice insurance offer protection for breach of confidentiality, which is crucial in conflict resolution environments where sensitive information is exchanged. Think about the trust your clients place in you; safeguarding their information is paramount.

As facilitators, it’s wise to seek mediation malpractice insurance that provides coverage for both in-person and virtual conflict resolution sessions. The landscape of dispute resolution is evolving, and your insurance should reflect that change.

Understanding these elements is vital for you to choose a policy that truly safeguards your interests. After all, you deserve peace of mind while helping others navigate their conflicts.

Examine Scenarios Requiring Mediation Malpractice Insurance

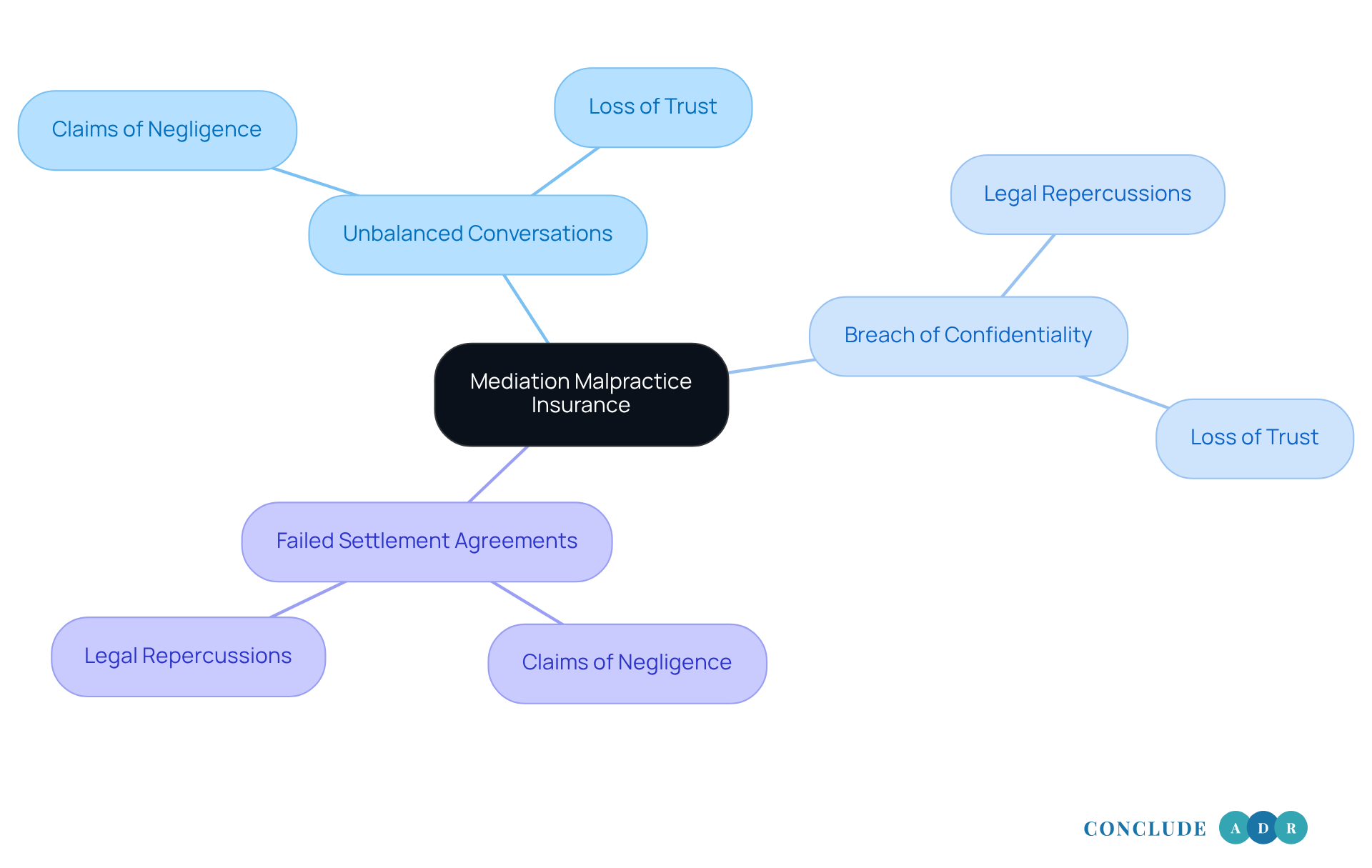

It is essential for anyone involved in the mediation process to have mediation malpractice insurance. Have you ever felt uneasy about how discussions are handled? If a facilitator doesn’t ensure a balanced conversation, one party might feel left out, which could lead to claims of negligence. This concern is especially significant in high-stakes situations, where fairness is everything.

Imagine a scenario where sensitive information slips out unintentionally. Such breaches of confidentiality can expose the facilitator to serious liability. Not only do these incidents shake trust, but they can also bring about significant legal repercussions. It’s a heavy burden to bear, isn’t it?

And what happens when a settlement agreement falls through? In those moments, parties may look to the facilitator, claiming their actions contributed to the breakdown. These situations underscore the unpredictable nature of mediation and how quickly disputes can escalate into legal claims.

That’s why having mediation malpractice insurance isn’t just a precaution; it’s a vital safety net for mediators. It protects you and helps maintain the integrity of the mediation process. By securing this insurance, you’re not only safeguarding your practice but also reinforcing the trust that is so crucial in mediation. Let’s ensure that everyone involved feels supported and protected.

Conclusion

Mediation malpractice insurance is more than just a safety net; it’s a vital support system for mediators. It allows you to navigate the complexities of conflict resolution without the looming worry of financial repercussions. This specialized coverage not only shields you from claims of negligence but also bolsters your credibility, helping you maintain trust with clients and stakeholders. Have you considered how this insurance can provide you with peace of mind, enabling you to focus on your primary role: guiding parties toward resolution?

Key insights throughout this discussion reveal the critical role of mediation malpractice insurance. It covers legal expenses, protects against breaches of confidentiality, and adapts to the evolving landscape of dispute resolution. With about 70% of mediators choosing this insurance, it’s clear that the profession acknowledges the importance of safeguarding against potential claims. The financial implications of malpractice claims can be daunting, making comprehensive coverage not just wise, but necessary.

Securing mediation malpractice insurance isn’t merely a precaution; it’s an essential part of your professional toolkit. By investing in this coverage, you’re not just protecting yourself from liabilities; you’re also fostering a more trustworthy and effective mediation process. As the world of conflict resolution continues to change, staying informed and adequately covered empowers you to facilitate negotiations with confidence and integrity. So, why wait? Take the step today to ensure your peace of mind and enhance your practice.

Frequently Asked Questions

What is mediation malpractice insurance?

Mediation malpractice insurance is a specialized type of professional liability protection designed to shield mediators from claims that may arise from their professional services, including coverage for Professional Indemnity and Public Liability.

What does mediation malpractice insurance cover?

It typically covers legal expenses and damages related to claims of negligence, errors, or omissions that occur during the facilitation process.

Why is mediation malpractice insurance important for mediators?

It protects mediators' financial interests, enhances their credibility with clients and stakeholders, and allows them to work with confidence in emotionally charged negotiation scenarios.

What percentage of mediators carry mediation malpractice insurance?

Approximately 70% of mediators carry mediation malpractice insurance, highlighting its significance in the profession.

What unique risks does mediation malpractice insurance address?

It acknowledges the unique risks associated with conflict resolution, including potential claims of biased facilitation or unethical behavior.

Does mediation malpractice insurance provide options for temporary personnel or freelancers?

Yes, mediation malpractice insurance offers flexible protection options, including coverage for temporary personnel or freelancers involved in arbitration activities.

How can mediators ensure they are adequately protected?

Mediators should reflect on their coverage to ensure they have the right support and peace of mind to focus on helping others find resolution.