Introduction

Navigating the complexities of billing disputes can feel overwhelming, especially when unexpected charges pop up on your credit statements. You’re not alone in this; many consumers share your concerns. The Fair Credit Billing Act (FCBA) is here to help, acting as a vital tool that empowers you to challenge those erroneous charges and protect your financial rights.

This article outlines ten essential steps that can simplify the dispute resolution process and significantly enhance your chances of a favorable outcome. But what if you’re feeling lost or unsure about your rights under the FCBA? Understanding the intricacies of this legislation and following a structured approach can truly make a difference in resolving disputes and reclaiming your peace of mind.

Let’s take this journey together, step by step, so you can feel confident and supported throughout the process.

Understand the Fair Credit Billing Act (FCBA)

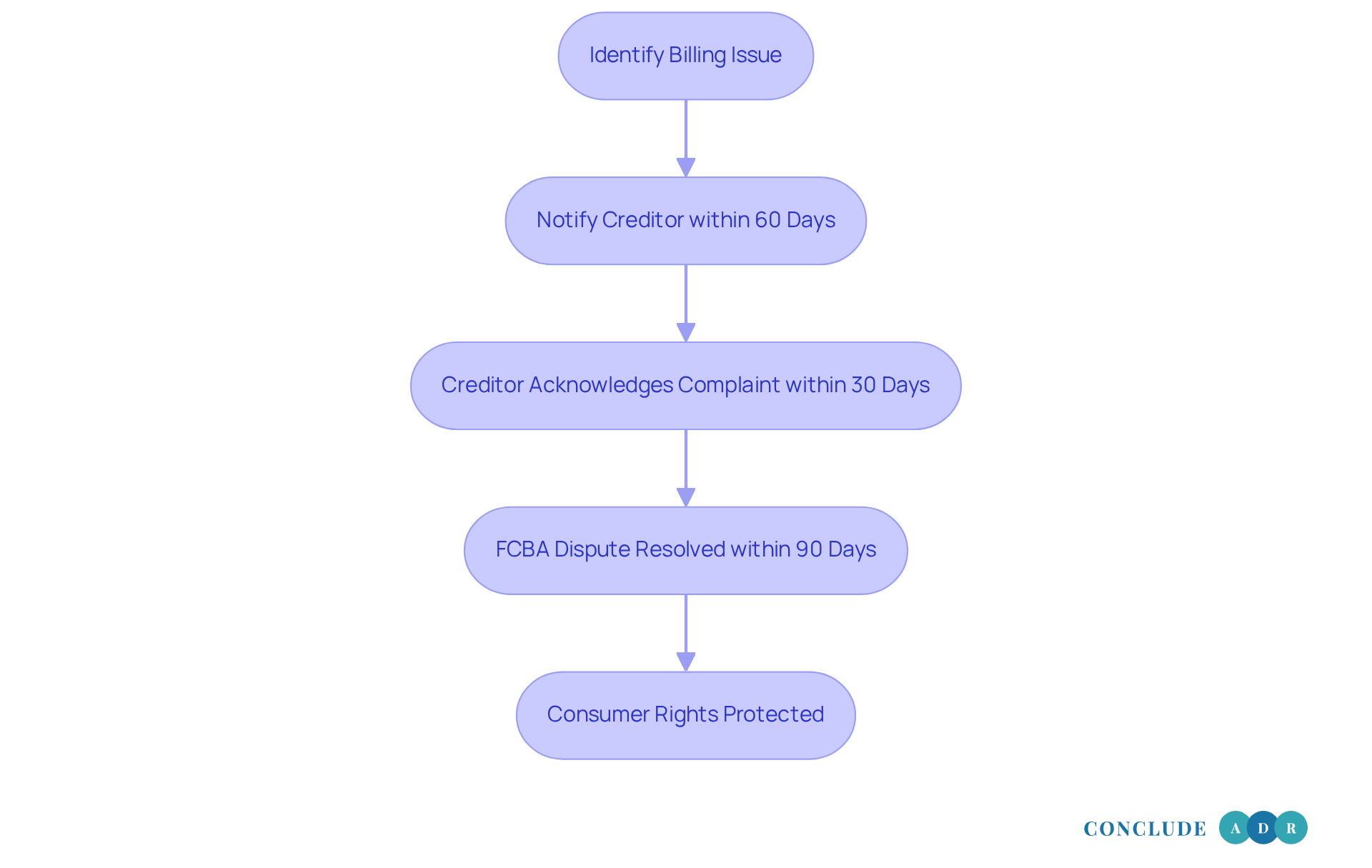

The Fair Credit Billing Act (FCBA) is more than just a federal statute; it’s a vital shield for individuals against unfair billing practices. Have you ever felt overwhelmed by unexpected charges on your credit card? The FCBA empowers you to challenge those charges, ensuring that lenders take your concerns seriously. If you spot a billing mistake, just let your creditor know within 60 days of receiving your statement. This way, you won’t be held responsible for unauthorized charges. It’s a straightforward process designed to help you resolve billing issues, ensuring the FCBA dispute is resolved while reinforcing your rights in credit transactions.

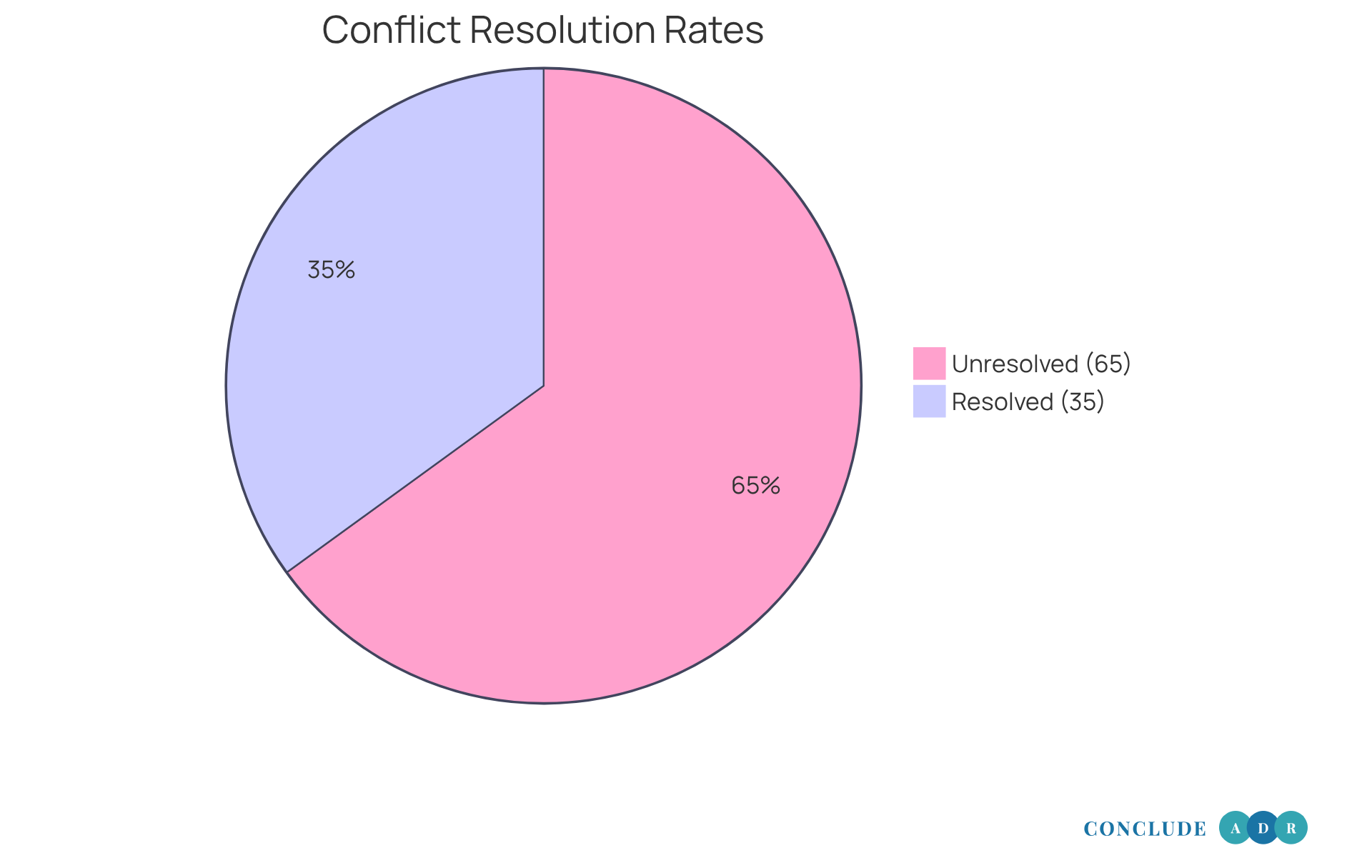

In 2025, over 65 million claims were submitted under the FCBA, indicating that the FCBA dispute resolved reflects a growing awareness among individuals about their rights. Recent updates to the Act have made it even more protective for consumers. Creditors are now required to acknowledge complaints within 30 days and ensure the FCBA dispute is resolved within 90 days. These enhancements are essential for maintaining trust in our credit systems.

Consumer protection advocates emphasize how crucial it is for anyone facing billing issues to have their FCBA dispute resolved. It allows you to challenge erroneous charges without worrying about negative impacts on your credit score during the investigation. For example, if you find an unauthorized charge, you can ask your issuer to withhold payment from the merchant while the FCBA dispute is resolved. This offers you a vital layer of financial protection.

Overall, the FCBA is a cornerstone for customer rights, ensuring fair treatment in credit billing and promoting a more transparent financial environment. Remember, the FCBA specifically applies to open-end consumer credit accounts, like credit cards. Understanding your rights and protections is essential, and we’re here to support you every step of the way.

Document All Relevant Information

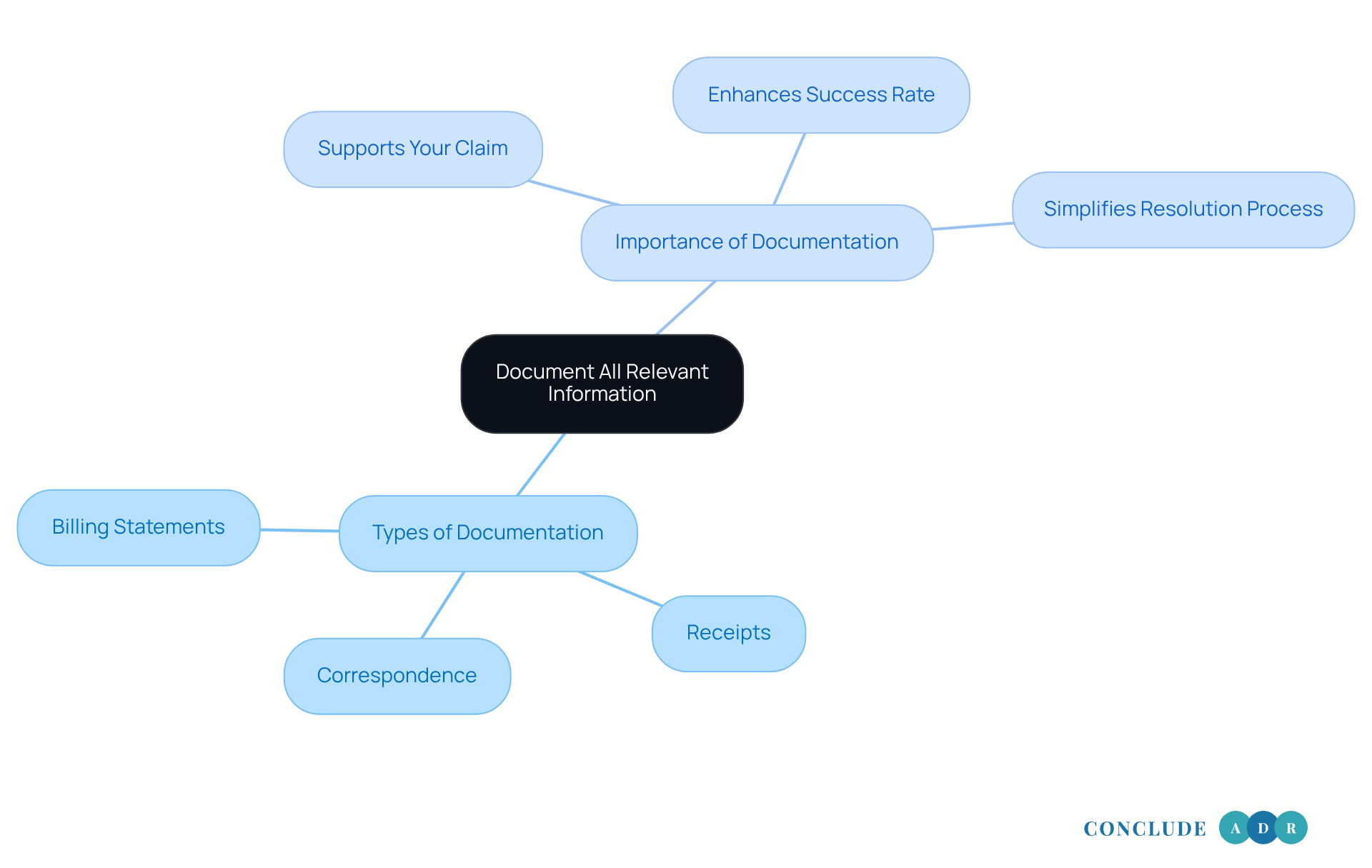

When it comes to addressing a billing error, we understand how frustrating and stressful it can be. To tackle this challenge effectively, it’s important to gather all the necessary documentation. This includes your billing statements, receipts, and any correspondence with the creditor. Think of this documentation as your vital evidence, supporting your claim and helping you navigate this situation.

Keeping copies of all your correspondence is crucial, especially if the conflict escalates. A well-documented case can significantly enhance your chances of a positive outcome. Did you know that studies show disputes backed by thorough documentation tend to have a higher success rate? This is where your efforts can really pay off.

Consumer advocates emphasize that maintaining detailed records not only strengthens your position but also simplifies the resolution process. It makes it easier for everyone involved to reach an agreement. So, as you gather your documents, remember that you’re not just preparing for a dispute; you’re taking proactive steps toward an fcba dispute resolved that works for you.

We’re here to support you through this process, and we believe that with the right approach, you can find a satisfactory resolution.

Communicate Promptly with Creditors

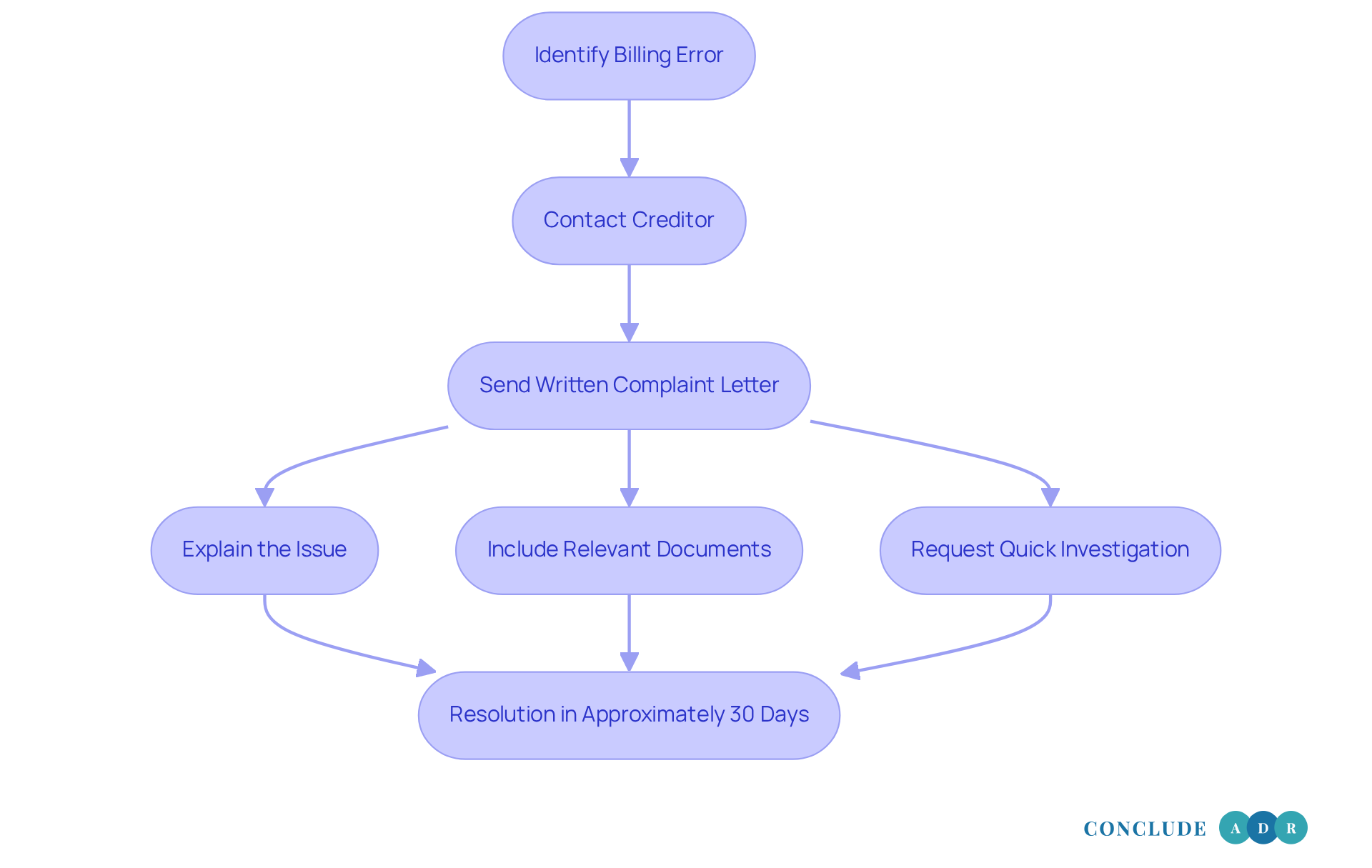

If you’ve found a billing error, it’s really important to reach out to your creditor right away. The Fair Credit Billing Act (FCBA) gives you a window of 60 days to send a written complaint letter after receiving the bill. In your letter, make sure to clearly explain what the issue is, include any relevant documents, and ask for a quick investigation.

Why is this so crucial? Prompt communication not only helps resolve the problem faster but also shows that you’re committed to finding a solution. Financial experts agree that being concise and direct can greatly improve your chances of a positive outcome. Did you know that addressing conflicts in a timely manner can lead to resolutions in about 30 days? This really highlights the benefits of being proactive when dealing with creditors.

Successful resolutions often stem from clear and timely communication, which is why it is so important to have the FCBA dispute resolved quickly. Additionally, a recent survey found that 80% of people reported feeling worried and anxious because of billing issues and coverage denials. This shows just how emotionally taxing these disputes can be, underscoring the need for effective communication. Remember, you’re not alone in this - reaching out can make a world of difference.

Utilize Mediation Services from Conclude ADR

When direct communication with your creditor feels overwhelming, it’s important to know that there’s a compassionate alternative available. Mediation services from Conclude ADR can be a lifeline. Imagine having an impartial third party who helps facilitate discussions and negotiations, guiding both sides toward a resolution that feels fair and acceptable. This approach not only saves you time and reduces stress but often leads to outcomes that leave everyone feeling satisfied. In fact, mediation often results in an fcba dispute resolved in about 70-80% of cases, far surpassing traditional litigation, which can be a long and costly process.

At Conclude ADR, we pride ourselves on our expert-driven, solution-focused approach. Our mediators and arbitrators come from diverse backgrounds in law, business, and conflict management, bringing a wealth of knowledge to the table. This expertise allows us to tailor solutions specifically to your situation, ensuring that your unique needs are met. You can easily book sessions at your convenience, including evenings and weekends, so you can fully engage in the resolution process.

We’re dedicated to providing practical, lasting solutions. Conclude that the fcba dispute resolved has successfully facilitated numerous mediation outcomes through ADR, empowering clients to manage their conflicts effectively and efficiently. By choosing mediation, you can sidestep the complexities of court proceedings and work towards a resolution that truly meets your needs.

Isn’t it time to take a step toward a more peaceful resolution? Let’s work together to find a solution that works for you.

Know Your Rights Under the FCBA

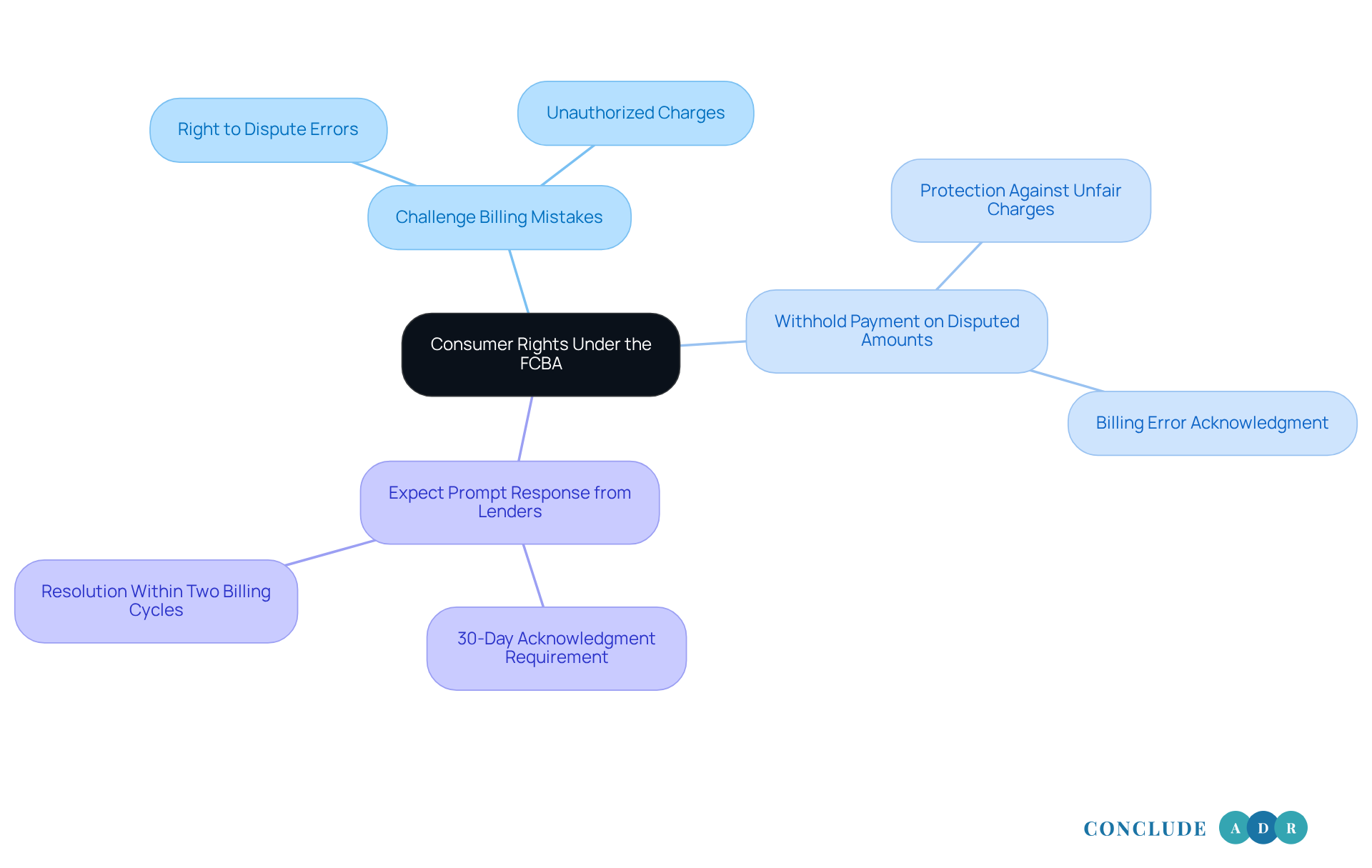

As a consumer, it's essential to know your rights under the Fair Credit Billing Act (FCBA). You have the right to:

- Challenge billing mistakes

- Withhold payment on disputed amounts

- Expect a prompt response from lenders

Isn’t it reassuring to know that creditors must acknowledge your disagreement regarding the FCBA dispute resolved within 30 days and find a resolution within two billing cycles?

Understanding these rights can empower you to handle conflicts effectively. It’s not just about knowing the rules; it’s about ensuring that lenders respect your rights and adhere to the law. When you stand up for yourself, you’re not only protecting your interests but also fostering a fairer financial environment for everyone.

So, take a moment to reflect: Are you aware of how these rights can benefit you? By being informed, you can navigate the FCBA dispute resolved process with confidence and clarity. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Follow Up on Your Dispute Status

Following up on your issue is crucial for finding a resolution that works for you. After you submit your claim, make it a habit to check in with your lender regularly. This not only keeps you informed but also shows your commitment to resolving the matter. Remember to document all your communications carefully - note the dates, times, and responses you receive. If you don’t hear back in a timely manner, don’t hesitate to reach out again.

- Persistence can make a real difference.

- Research indicates that 35% of conflicts are resolved after follow-up communications.

- Think about it: individuals who actively engage with their creditors often find that their efforts lead to quicker outcomes.

- This demonstrates their dedication to addressing the issue at hand.

Consumer advocates emphasize that persistence is key in conflict management. One advocate even said, "An ounce of mediation is worth a pound of arbitration and a ton of litigation!" This highlights the value of staying engaged.

So, remember, the more proactive you are, the better your chances of having the fcba dispute resolved satisfactorily. You’re not alone in this process; we’re here to support you every step of the way.

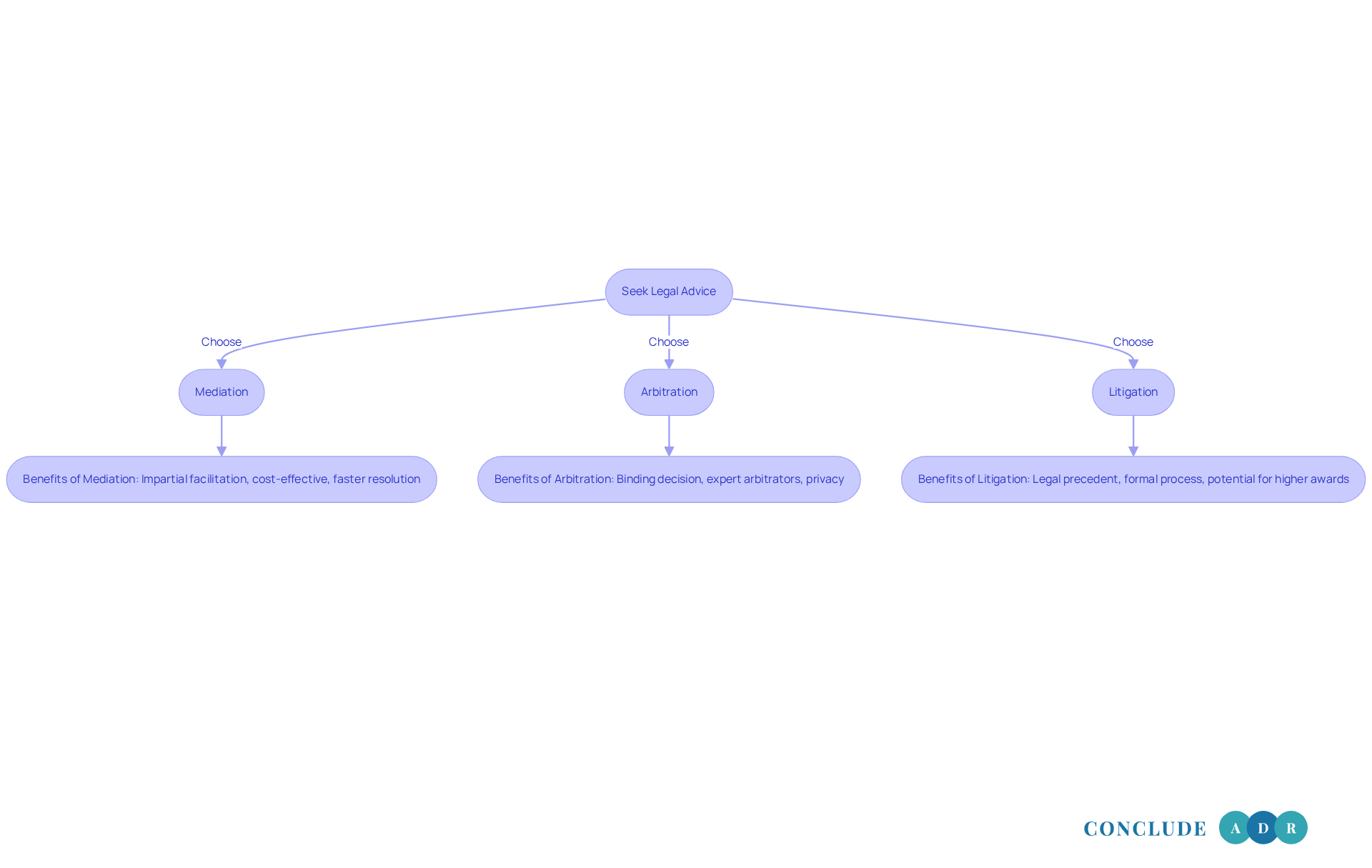

Seek Legal Advice When Necessary

When conflicts linger without resolution, it’s essential to seek legal advice to ensure the FCBA dispute is resolved. A consumer protection attorney can help clarify your options and advocate for your interests, guiding you through the next steps - whether that’s mediation, arbitration, or litigation. Did you know that conflicts resolved with legal representation have a much higher success rate? In 2025, 28% of cases led to customer awards, compared to 24% in 2023. This shows that having legal assistance not only boosts your chances of a positive outcome but also equips you with the knowledge to navigate complex billing disputes effectively.

Before jumping into legal action, consider the resolution-focused services offered by Conclude ADR. They provide mediation and arbitration, with a team of expert mediators and arbitrators who bring decades of experience in alternative conflict management. Their approach ensures impartial and skilled facilitation, making the process smoother for everyone involved.

As Allison Dunn, a seasoned attorney, wisely states, "Legal insights unlock clarity and confidence. Understand your boundaries to operate boldly and securely." This highlights how informed legal representation can significantly impact your ability to get an FCBA dispute resolved in a manner that meets your needs. Conclude ADR is here to offer practical, lasting solutions to help settle conflicts effectively. Together, we can navigate this journey toward resolution.

Understand Creditor Responses

When facing a challenge with creditors, it’s natural to feel a mix of emotions. They might respond in various ways: acknowledging the error, denying your claim, or asking for more information. It’s crucial to carefully review their response and think about your next steps. If a creditor acknowledges the error, make sure they correct it quickly to avoid any further issues.

Did you know that 53% of cardholders challenge transactions with their banks without first reaching out to retailers? This highlights the importance of clear communication. If your claim is denied, take a moment to assess their reasoning. Consider whether it’s time to escalate the dispute or seek legal advice. Financial expert Luke James notes, "Chargebacks are increasing swiftly, presenting considerable financial difficulties for merchants." This underscores the need to understand lender responses accurately.

Common outcomes of lender responses can include:

- Adjustments to billing statements

- Potential refunds

- The need for further negotiation

For example, if a creditor acknowledges an error, you might receive a prompt refund or correction to your billing statement. By being proactive and informed, you can navigate these responses effectively and work towards a satisfactory resolution.

Remember, you’re not alone in this process. We’re here to support you as you take the necessary steps to resolve your concerns.

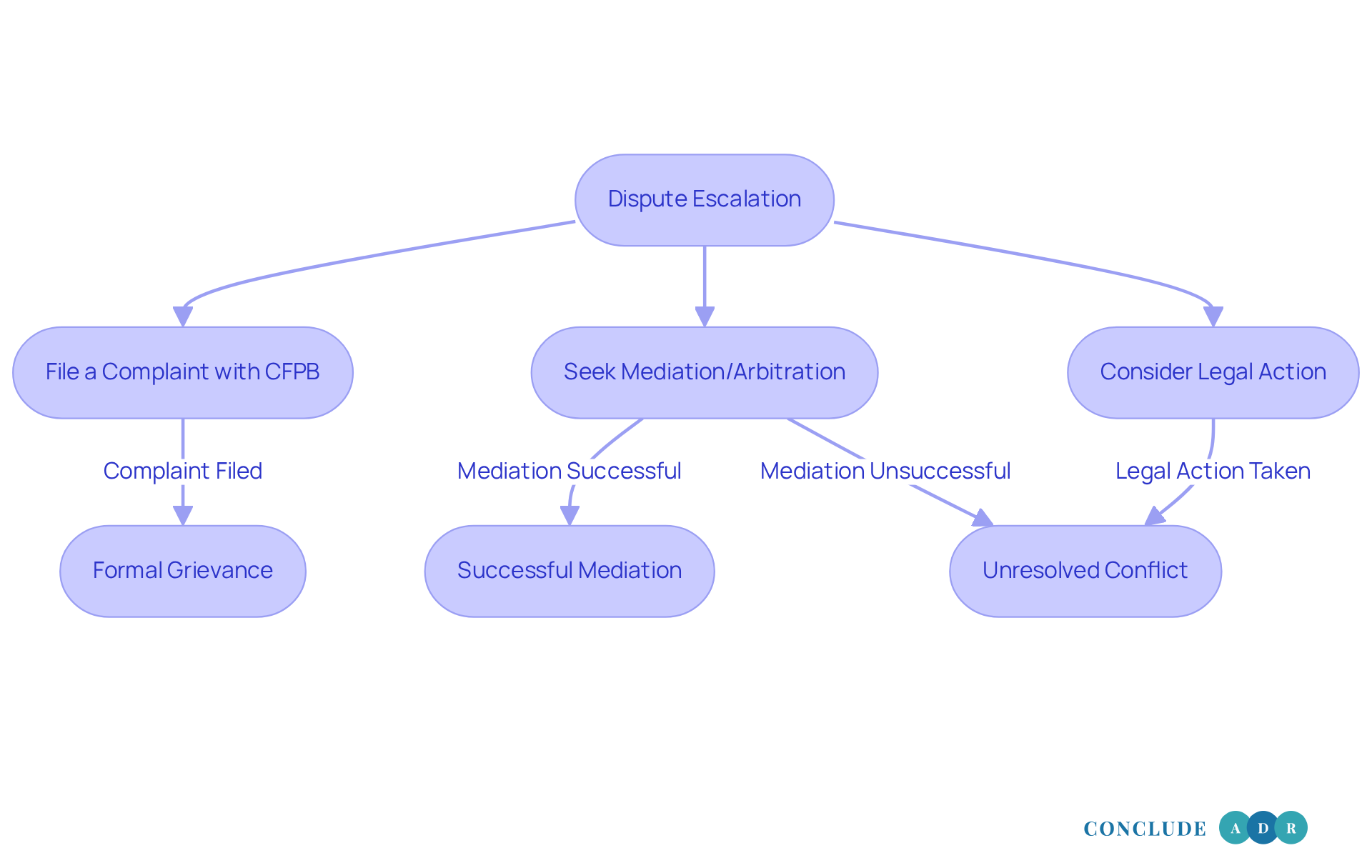

Know the Next Steps if Disputes Escalate

When conflicts escalate and remain unresolved, it’s crucial to think about steps that can protect your rights. Have you considered filing a complaint with the Consumer Financial Protection Bureau (CFPB)? This federal agency is dedicated to consumer protection and can be a valuable ally. In 2023, many conflicts turned into formal grievances, highlighting how important this stage is in the resolution process.

Alternatively, seeking mediation or arbitration through services like Conclude ADR can create a supportive environment for resolving disputes. Mediation, in particular, has shown promising results. In 2025, 311 cases were successfully settled through mediation, proving its effectiveness in reaching resolutions. Engaging with experienced neutrals can foster open communication and lead to agreements that benefit everyone involved.

Sometimes, legal action may be necessary, especially if the conflict is complex. But understanding the escalation process and your options can greatly enhance your ability to manage conflicts effectively. By staying proactive and informed, you can ensure your rights are protected and pursue the best path toward resolution. Remember, you’re not alone in this journey; we’re here to support you.

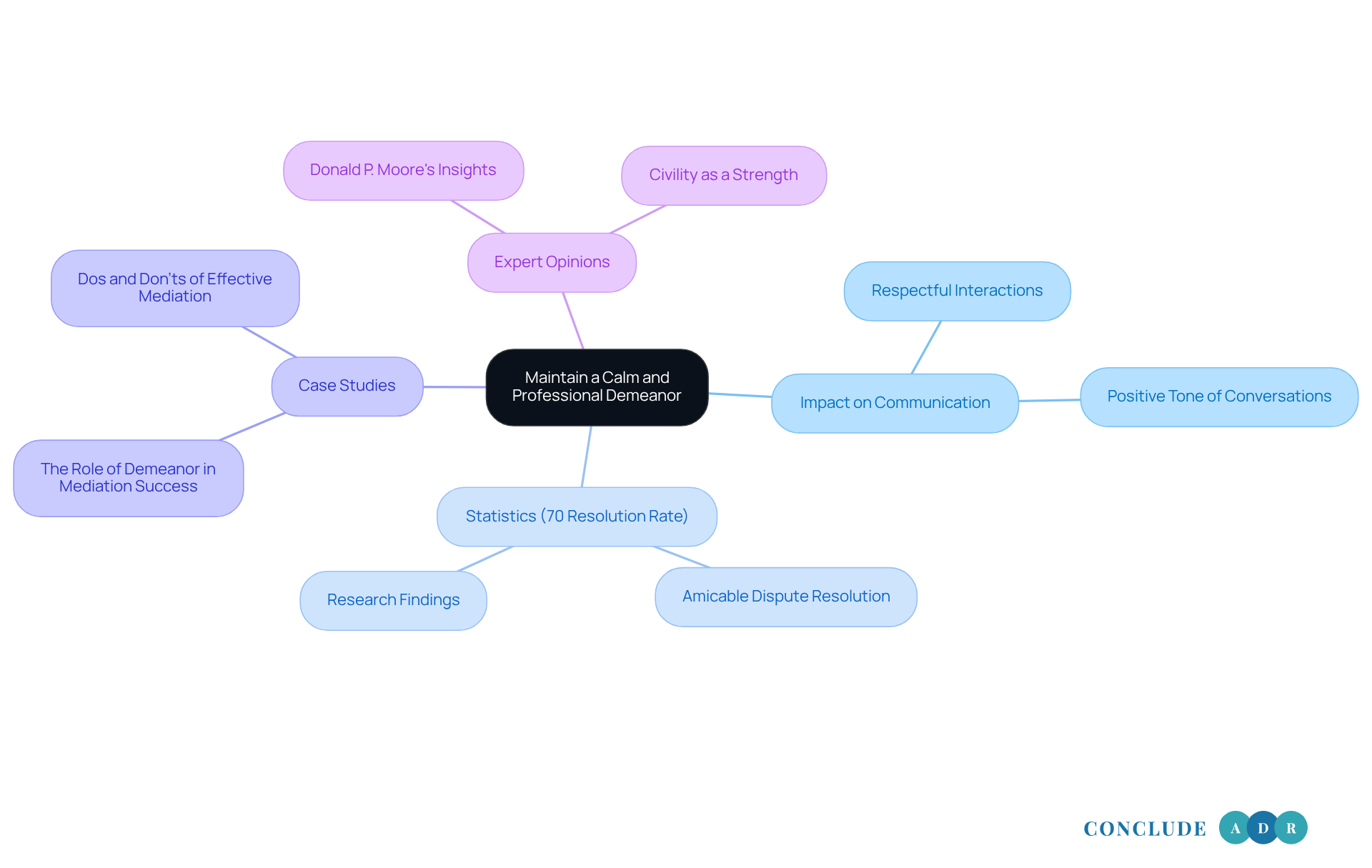

Maintain a Calm and Professional Demeanor

Maintaining a calm and professional demeanor during conflicts is crucial for fostering constructive communication and achieving positive outcomes. Have you ever noticed how respectful interactions can change the tone of a conversation? Research shows that about 70% of fcba disputes resolved amicably come from such interactions, underscoring the power of professional communication.

By steering clear of confrontational language and focusing on a clear, respectful presentation of your case, you can significantly enhance your chances of a favorable outcome. For example, case studies like 'The Role of Demeanor in Mediation Success' reveal that parties who stay composed, even in emotionally charged situations, are more likely to reach agreements that satisfy everyone involved.

Conflict resolution specialists, including Donald P. Moore, remind us that civility isn’t a sign of weakness; it reflects confidence and competence. This mindset can greatly influence the mediation process. By prioritizing a composed attitude, we can facilitate smoother negotiations and ultimately achieve more successful outcomes.

So, as you navigate through conflicts, remember: your demeanor matters. Let’s strive for respectful communication and watch how it transforms our interactions.

Conclusion

Resolving disputes under the Fair Credit Billing Act (FCBA) is not just a process; it’s a journey that empowers you as a consumer. By understanding your rights and navigating the dispute process with clarity, you can challenge unfair charges and protect your financial interests. The FCBA is a vital tool, ensuring that you are not only heard but also respected in your credit transactions.

In this article, we’ve outlined key steps for successful FCBA dispute resolution:

- Grasp the Act and document relevant information

- Communicate promptly with creditors

- Utilize mediation services

Each step reinforces the importance of being proactive and informed. Knowing your rights and maintaining a professional demeanor can truly help you advocate for yourself in challenging situations.

But remember, the journey toward resolving billing disputes is about more than just correcting errors; it’s about fostering a fair and transparent financial environment. By taking action and utilizing the resources available, you can navigate the complexities of credit disputes with confidence. Embracing these steps can lead to not only satisfactory resolutions but also a stronger understanding of your rights and protections under the FCBA.

So, are you ready to take charge of your financial well-being? Let’s work together to ensure that your voice is heard and your rights are upheld.

Frequently Asked Questions

What is the Fair Credit Billing Act (FCBA)?

The Fair Credit Billing Act (FCBA) is a federal statute that protects individuals against unfair billing practices, allowing them to challenge unauthorized charges on their credit cards.

How can I dispute a billing error under the FCBA?

If you spot a billing mistake, you must notify your creditor within 60 days of receiving your statement. This process allows you to dispute unauthorized charges without being held responsible for them.

What recent updates have been made to the FCBA?

Recent updates require creditors to acknowledge complaints within 30 days and resolve disputes within 90 days, enhancing consumer protections and trust in credit systems.

What should I do if I find an unauthorized charge?

You can ask your issuer to withhold payment from the merchant while the dispute is being resolved, providing you with financial protection during the investigation.

What types of accounts does the FCBA apply to?

The FCBA specifically applies to open-end consumer credit accounts, such as credit cards.

What documentation should I gather to address a billing error?

You should gather billing statements, receipts, and any correspondence with the creditor, as this documentation serves as vital evidence to support your claim.

Why is it important to keep copies of all correspondence?

Keeping copies of all correspondence is crucial because it strengthens your position and simplifies the resolution process, increasing your chances of a positive outcome.

How quickly should I communicate with creditors about a billing error?

You should reach out to your creditor immediately upon discovering a billing error, as the FCBA allows you 60 days to send a written complaint letter.

What should I include in my complaint letter to the creditor?

Your complaint letter should clearly explain the issue, include relevant documents, and request a prompt investigation.

How does timely communication affect the resolution of billing disputes?

Prompt communication can lead to faster resolutions, often within about 30 days, and demonstrates your commitment to resolving the issue.