Overview

The essential qualities of top debt resolution consultants truly matter. Their expertise in mediation, responsiveness, and unwavering commitment to client satisfaction create an environment where effective and supportive debt management can flourish. Have you ever felt overwhelmed by financial disputes? These qualities, including flexible scheduling and open communication, not only enhance your experience but also pave the way for more successful outcomes.

Imagine having a consultant who understands your concerns and is there for you every step of the way. By prioritizing your needs, they foster a sense of partnership that can transform your journey toward financial resolution. With their support, you can navigate the complexities of debt management with confidence and clarity.

In this collaborative process, you are not alone. The right consultant will ensure that your voice is heard, and your needs are met. Together, you can work toward a brighter financial future, where disputes are resolved and peace of mind is restored.

Introduction

Navigating the complexities of debt can often feel overwhelming, leaving many of us searching for effective solutions. The role of debt resolution consultants is more important than ever, as they provide personalized strategies aimed at easing financial burdens and helping you move toward a brighter financial future. But with so many options available, how can you identify the essential qualities that set top consultants apart? In this article, we will explore the ten key traits that define successful debt resolution consultants, offering insights to guide you on your journey toward financial stability.

Conclude ADR: Expert-Driven Solutions for Debt Resolution

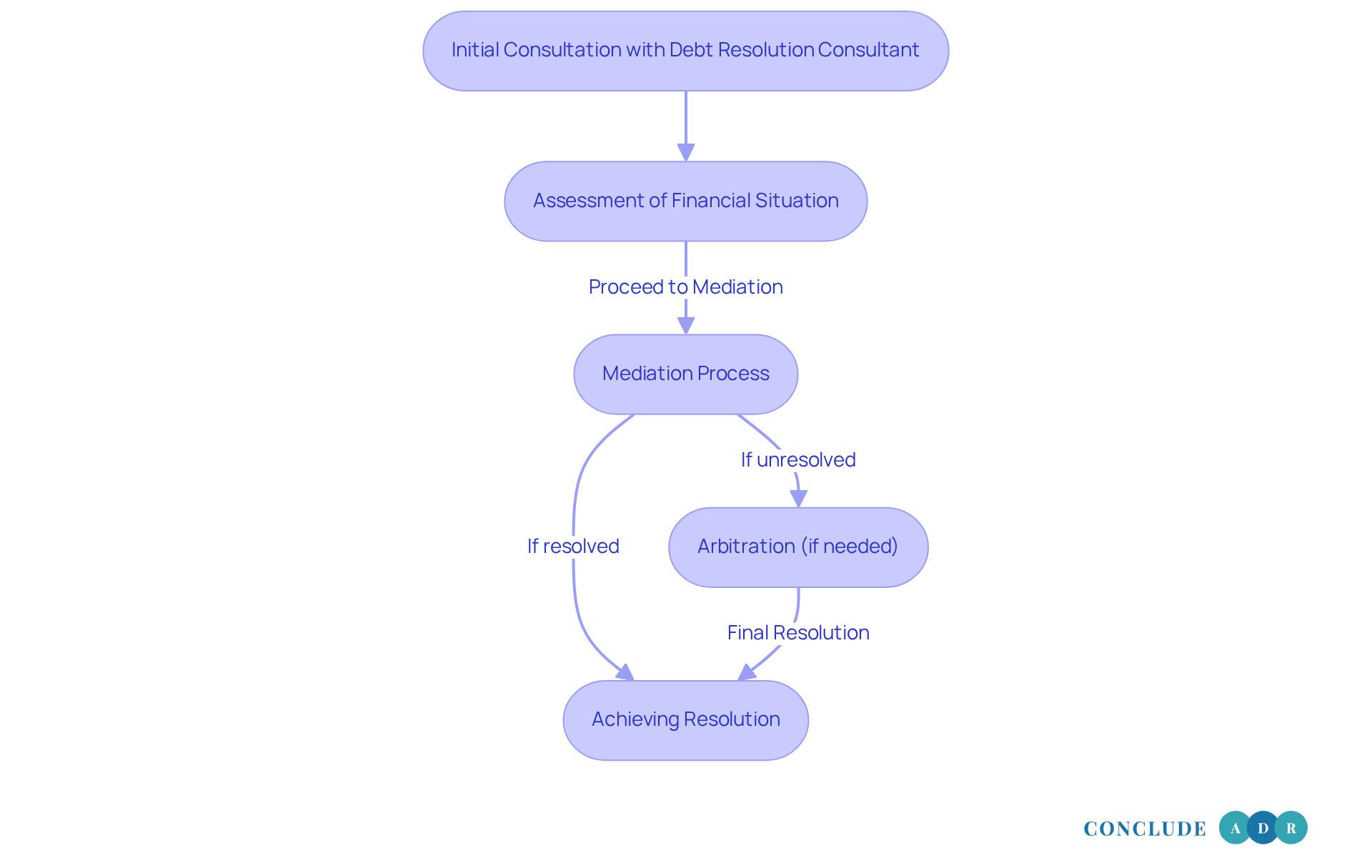

At Conclude ADR, we understand that navigating debt can be an overwhelming experience, which is why we offer support from debt resolution consultants. That's why we stand apart in the debt management field by offering expert-driven solutions through debt resolution consultants tailored to meet your unique needs. By focusing on mediation and arbitration, we bring together a panel of seasoned neutrals committed to facilitating fair and efficient outcomes.

Imagine a process where debt resolution consultants not only resolve disputes but also empower you to face your financial challenges with confidence. Our approach ensures that debt resolution consultants achieve solutions promptly and economically, allowing you to move forward with peace of mind.

We believe in . Together, we can confront these difficulties and find the path to a brighter financial future. Let us help you take that first step toward resolution today.

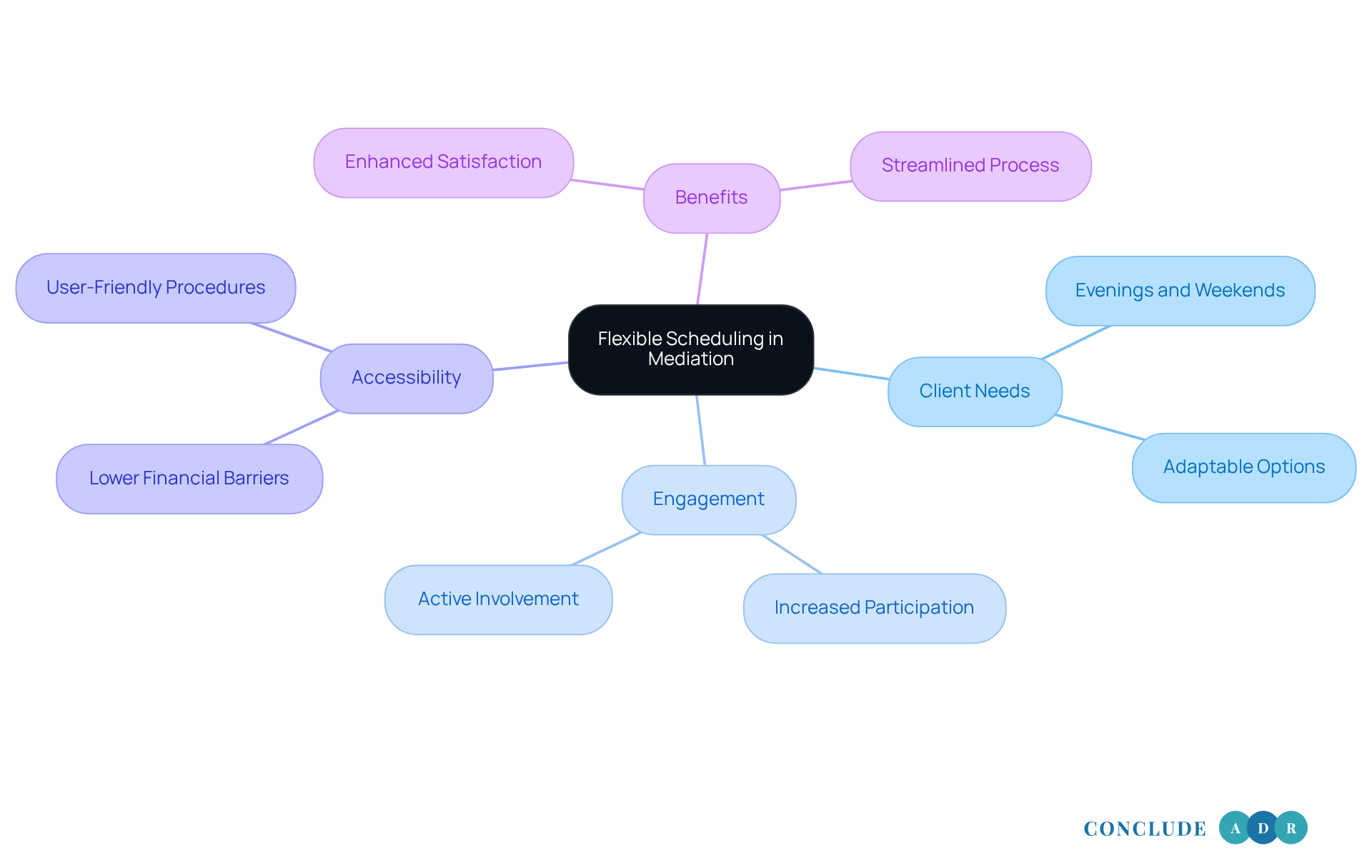

Flexible Scheduling: Accommodating Client Needs

Conclude ADR understands that managing challenging timetables can be overwhelming for many individuals. That’s why we offer adaptable scheduling options, including evenings and weekends, as a fundamental part of our services. This flexibility allows you to participate in negotiation or arbitration sessions at your convenience, significantly reducing barriers to your involvement.

Mediators emphasize that meeting your needs fosters a more cooperative problem-solving process, ultimately enhancing your satisfaction. As Marianne Gatti insightfully notes, "By offering enhanced accessibility, lowering expenses, and boosting comfort, these contemporary mediation techniques can lead to more efficient and effective outcomes."

Consider this: successful debt settlement cases have shown that when you can choose times that suit you, you’re more likely to engage actively in discussions. For example, one healthcare organization noted that by the second year of adopting self-scheduling, 20% of all slots were booked this way. This illustrates the positive impact that flexible scheduling can have on your engagement.

Moreover, adaptable scheduling empowers you in the mediation experience, leading to outcomes that are agreeable for everyone involved. By prioritizing your convenience, Conclude ADR not only streamlines the dispute resolution process but also nurtures a supportive environment that encourages open communication and mutual understanding.

Additionally, the new Consumer Mediation Procedures and Fee Schedule, launched on April 1, 2025, further enhance accessibility and flexibility in our mediation services. We invite you to and experience the difference they can make in your mediation journey.

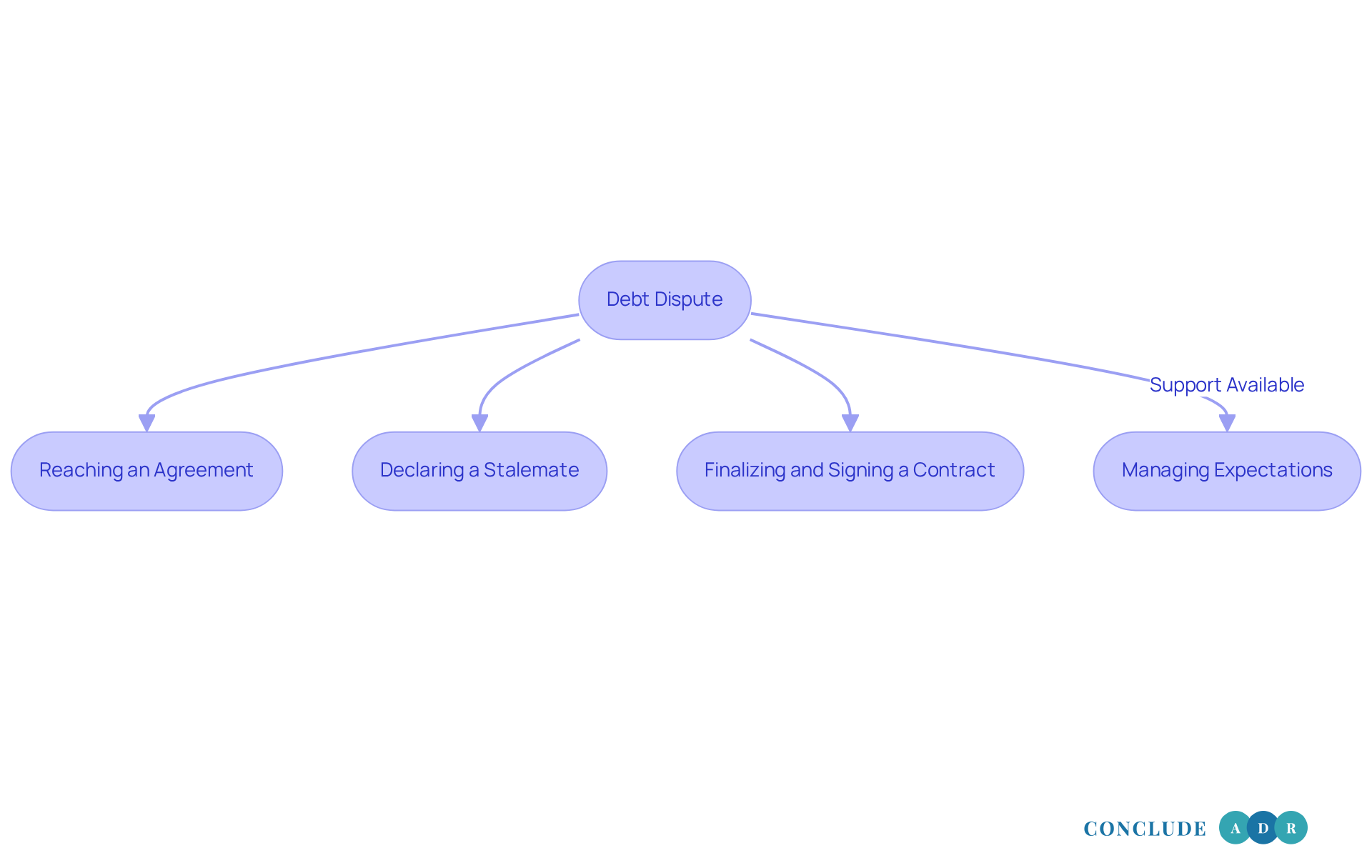

Resolution-Focused Approach: Prioritizing Practical Solutions

At Conclude ADR, we understand that resolving debt disputes can be challenging and emotionally taxing, which is why we offer the expertise of debt resolution consultants. Our resolution-focused approach is designed with your needs in mind, emphasizing practical solutions that directly tackle the root causes of your concerns. We strive to ensure that everyone involved leaves with a clear understanding of their obligations and a defined path forward.

This commitment to practicality not only helps you avoid future conflicts but also promotes long-term financial stability. Have you ever felt overwhelmed by financial disputes? Financial advisors note that negotiation can lead to successful outcomes, and many clients experience lasting financial well-being after working with debt resolution consultants. In fact, mediation has proven effective, resolving disputes at an impressive rate of 80-92%. When both parties are dedicated to finding a solution, potential success rates can soar to 90%.

As highlighted by Mediator Debt Solutions, debt resolution consultants can help achieve possible outcomes that include:

- Reaching an agreement

- Declaring a stalemate

- Finalizing and signing a contract

Throughout this process, we assist you in managing expectations, ensuring you feel supported every step of the way. By prioritizing these practical strategies and offering value-based pricing, Conclude ADR enhances the likelihood of favorable outcomes. Together, we can empower you to .

Responsive Team: Ensuring Prompt Access to Services

At Conclude ADR, we take pride in our responsive team, ensuring that you have prompt access to mediation services. We understand that timely replies to your questions are crucial, especially in the urgent context of , which is why debt resolution consultants emphasize that even small delays can heighten financial pressure. Did you know that 95% of consumers believe customer service interactions significantly impact brand loyalty? This is particularly important when it comes to debt management, as you need to trust your debt resolution consultants during these challenging times.

Research shows that 74% of debt settlement participants resolve one or more accounts within 36 months. This statistic highlights how vital prompt access to services is in achieving quicker outcomes. Industry leaders emphasize that a swift response not only fosters confidence but also streamlines the resolution process, leading to enhanced overall satisfaction.

As one senior contributor noted, "Customer experience in 2023 appears distinct from any previous time." This statement underscores the evolving expectations you may have as a customer. By prioritizing prompt access, Conclude ADR positions itself as a trusted partner in navigating the complexities of debt resolution consultants. We are here to support you every step of the way.

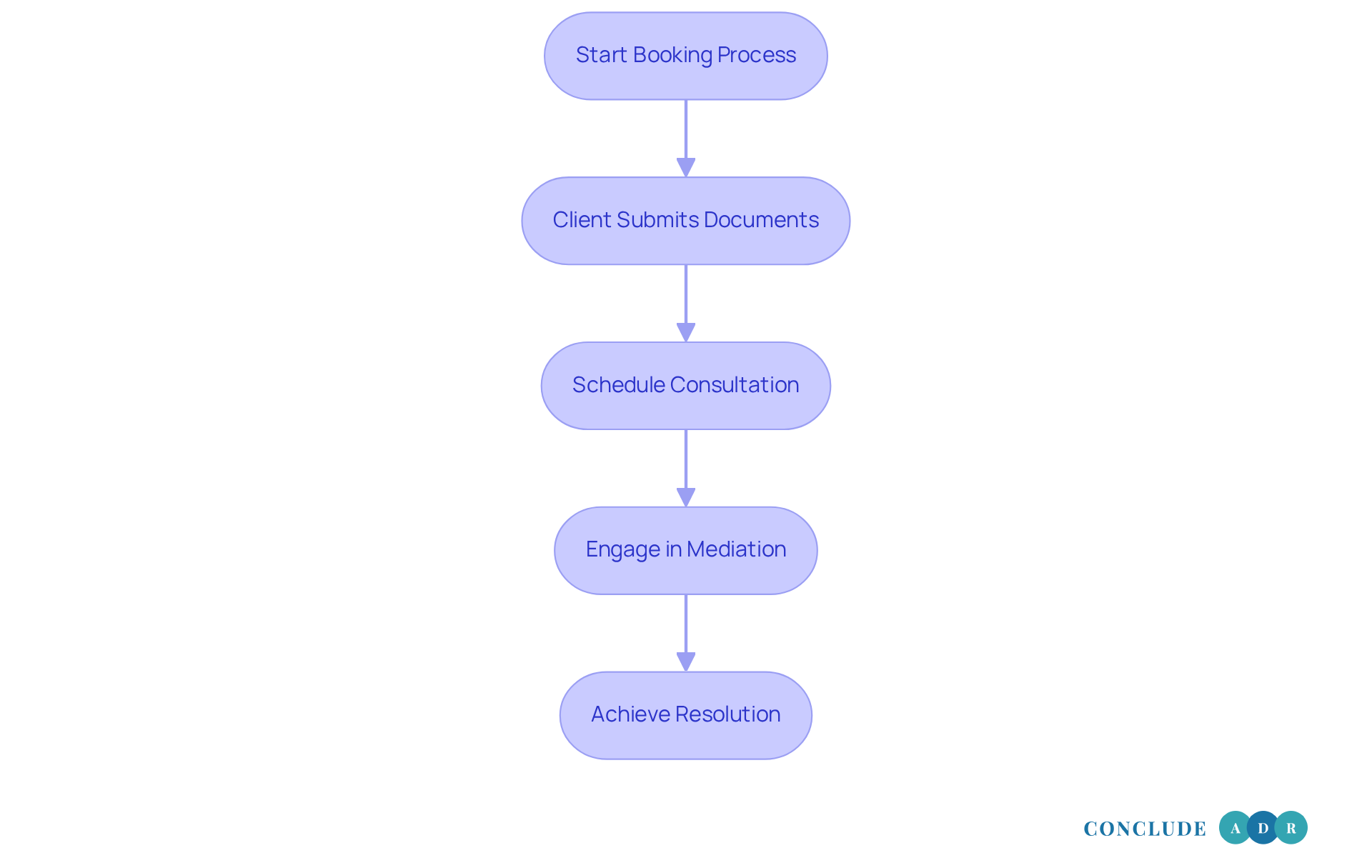

Streamlined Booking Process: Enhancing Client Experience

Conclude ADR's efficient booking system significantly enhances the customer experience in working with debt resolution consultants. Imagine being able to effortlessly participate in sessions and securely provide the necessary documents. This not only alleviates administrative burdens but also allows you to focus on what truly matters—finding a resolution.

It's important to acknowledge that statistics reveal at least 50% of successful individuals express dissatisfaction with their attorneys due to poor communication. This underscores the need for an . As Victor E. Frankl wisely noted, the mediator's role is to facilitate structured discussions, particularly in sensitive areas like those handled by debt resolution consultants.

By prioritizing a seamless experience, Conclude ADR empowers you to engage more fully in the mediation journey. This engagement is crucial, as it often leads to more effective and amicable outcomes. We understand that navigating these challenges can be daunting, but with the right support, you can feel confident in the process. Let us help you take that important step toward resolution.

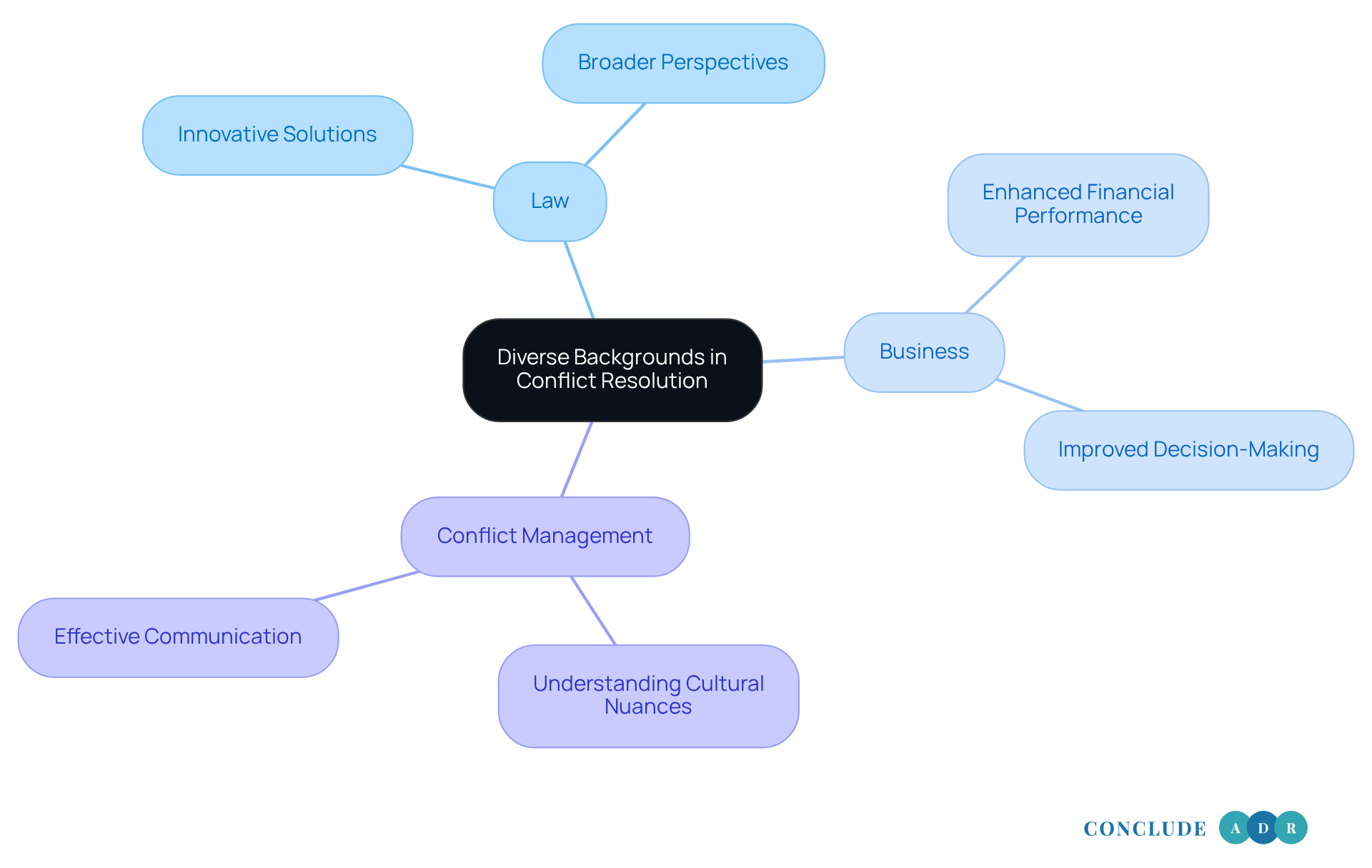

Diverse Backgrounds: Enriching Conflict Resolution Expertise

At ADR, we understand that navigating conflict can be challenging. Our panel of neutrals comes from varied backgrounds in law, business, and conflict management, bringing a wealth of perspectives to the table. This diversity not only enriches the conflict management process but also fosters innovative solutions that may not emerge in a more homogeneous setting.

Imagine having a team of debt resolution consultants who truly comprehend the multifaceted nature of debt disputes. By approaching these challenges from different angles, we can better serve you and your unique situation. You deserve a of your circumstances, and our team is here to provide just that.

We invite you to explore how our compassionate approach can make a difference in your conflict resolution journey. Together, we can navigate these complexities with understanding and care.

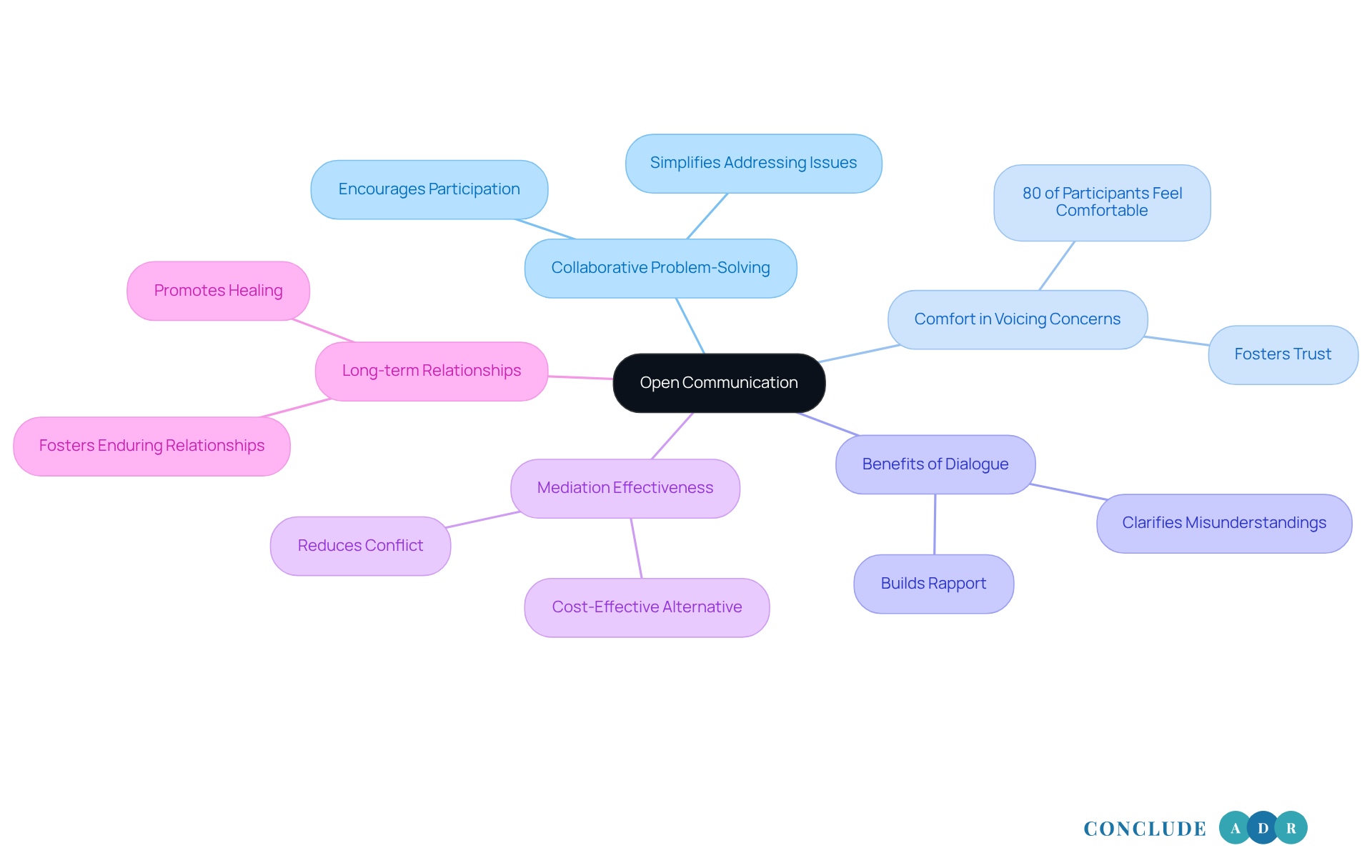

Open Communication: Fostering Collaborative Problem-Solving

Open communication is essential to conclude ADR's approach for effective debt management. By fostering an atmosphere where everyone feels comfortable voicing their concerns and needs, we promote collaborative problem-solving. This open dialogue not only clarifies misunderstandings but also builds rapport among participants, which is vital for achieving amicable resolutions.

Have you ever felt hesitant to share your concerns? Studies suggest that roughly 80% of participants report feeling at ease voicing their issues during the process, greatly improving the chances of favorable outcomes. As Hon. Larry G. Axelrood states, 'During the private mediation caucusing phase, I want each side to tell me about any special concerns or interests their clients may have.' Collaborative problem-solving not only simplifies the addressing process but also allows parties to actively participate in developing solutions that meet their needs.

This method has shown effectiveness in various debt settlements, making it beneficial for debt resolution consultants to achieve arrangements that are acceptable for everyone involved. Ultimately, it reduces conflict and fosters enduring relationships. Additionally, mediation is often a more economical option compared to conventional litigation, enabling parties to control costs while striving for an agreement.

Consider how much easier it could be to reach a resolution when everyone feels heard and valued. Together, we can create a supportive environment that leads to .

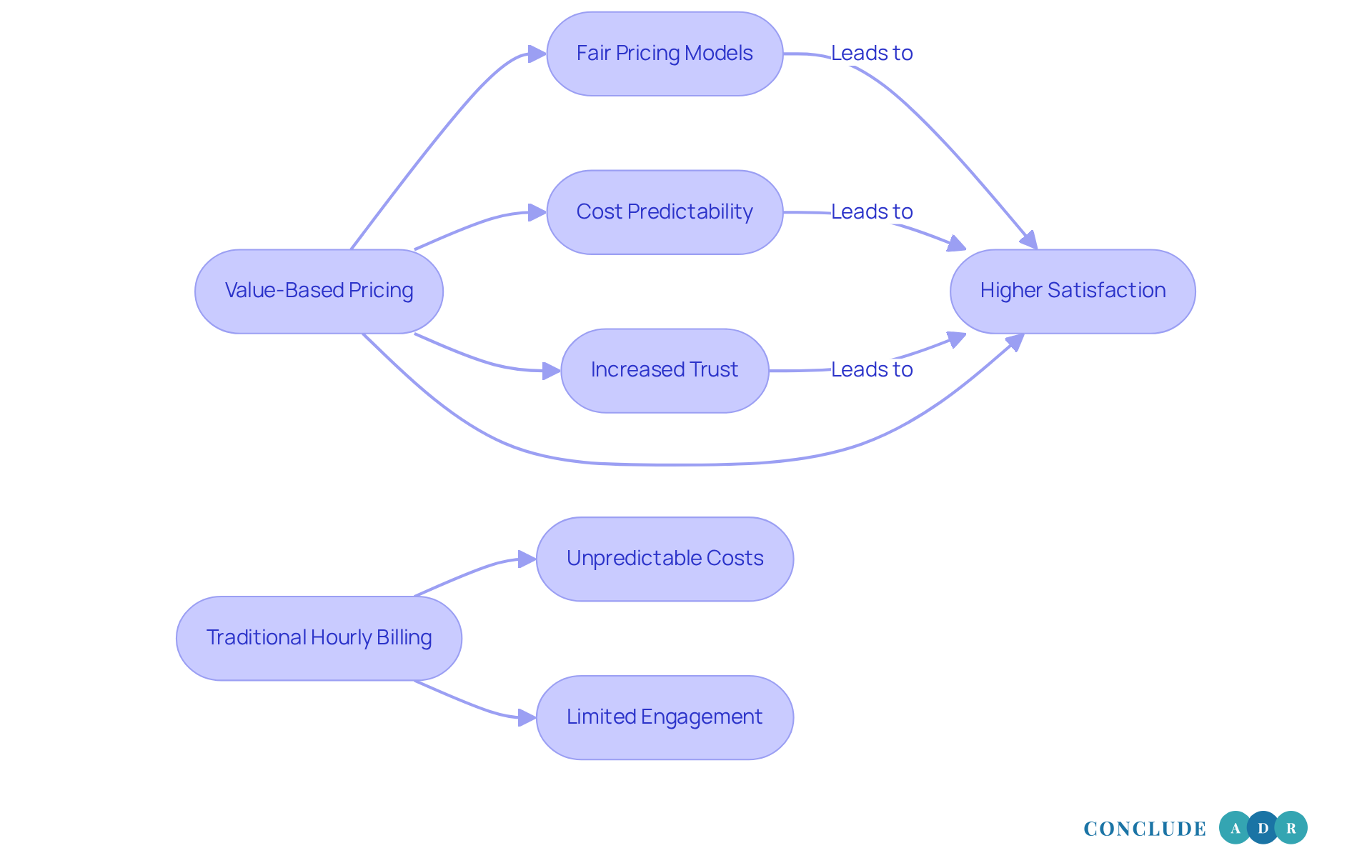

Value-Based Pricing: Ensuring Fair and Efficient Solutions

ADR's commitment to value-based pricing truly sets it apart in the debt resolution consultants landscape. This approach ensures that you only , fostering a deep sense of trust and satisfaction. By offering fair pricing models, like flat fees or capped fees, we make our services more accessible, allowing a wider range of individuals to seek help without the worry of unexpected costs.

Imagine feeling secure in your financial commitments—this alignment of interests between you and the neutrals creates a collaborative atmosphere, which is essential for effective conflict resolution. Financial advisors note that transparent pricing simplifies your decision-making process and significantly boosts your satisfaction with the negotiation experience. After all, who doesn't desire greater cost predictability?

In contrast to traditional hourly billing, value-based pricing provides you with the comfort of knowing what to expect. As you feel more at ease, you’re more inclined to engage in the resolution process, paving the way for better outcomes for everyone involved. Additionally, this pricing model encourages efficiency and focuses on achieving the results you desire, reinforcing the effectiveness of our approach in negotiations with debt resolution consultants. Let's work together towards a brighter resolution.

Accessibility: Luxury Meeting Rooms and Virtual Options

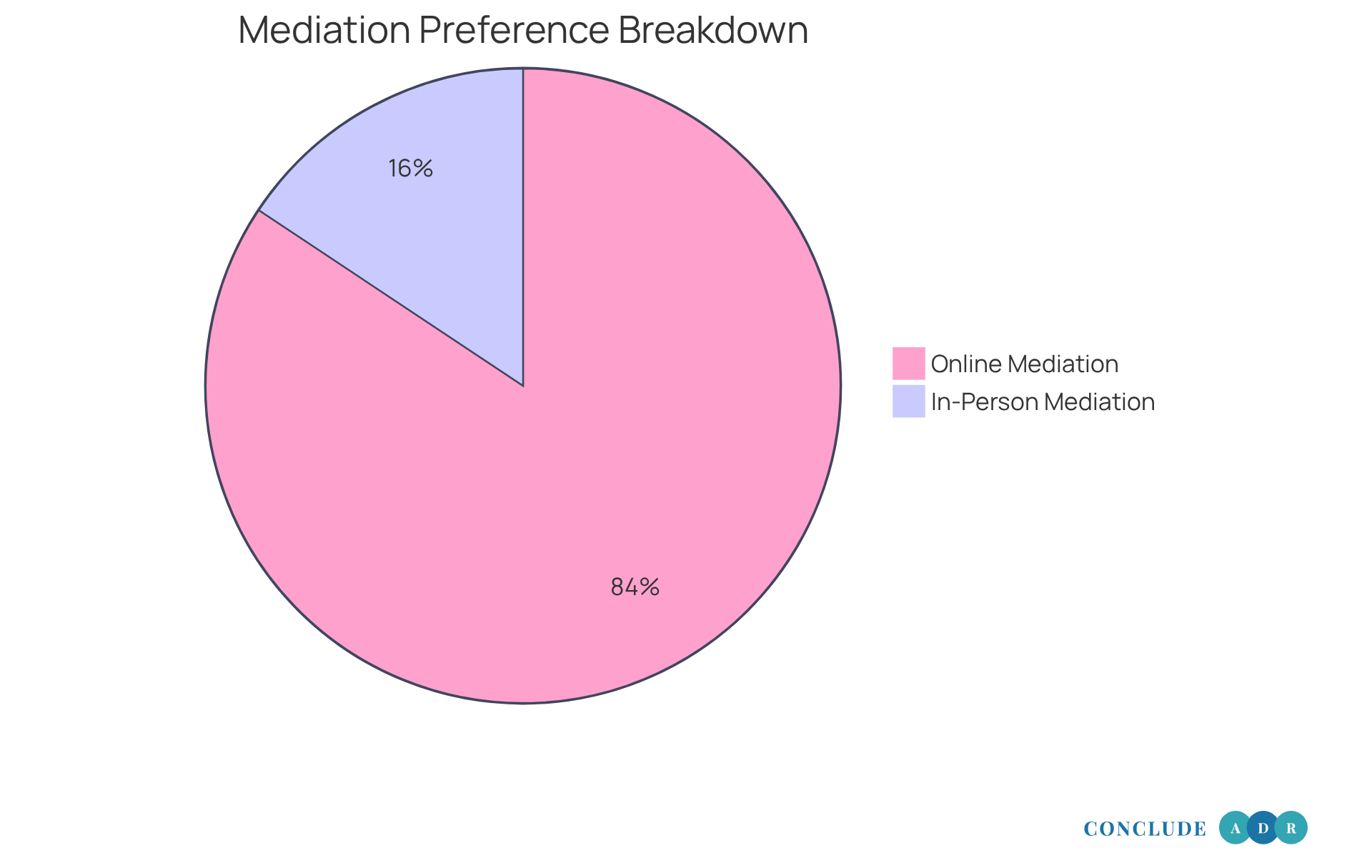

Conclude ADR significantly enhances accessibility by providing luxury meeting rooms across Southern California, complemented by virtual session options. This dual approach allows you to choose the setting that best matches your comfort and preferences, whether you prefer an in-person meeting or a remote session. Have you ever thought about how much flexibility and convenience matter in dispute management? Studies show that almost 70% of participants prefer online options, while only 13% favor face-to-face arbitration for upcoming sessions. By accommodating diverse preferences, Conclude ADR fosters a welcoming environment for everyone, ultimately facilitating a smoother resolution process.

The selection of your meeting environment can greatly affect negotiation results. Settings that emphasize comfort and professionalism often lead to more effective discussions. Luxury meeting rooms not only enhance your experience but also contribute to higher satisfaction rates, providing a conducive space for open dialogue. As industry leaders observe, the right environment can significantly influence the success of conflict resolution. It’s vital for you to feel comfortable during this process.

However, it’s important to recognize potential challenges in virtual facilitation, such as technical issues like connectivity problems and software glitches, which can disrupt the experience. To maximize the advantages of mediation, consider your and the specific needs of your case when selecting between in-person and virtual options. Remember, your choice can make a difference in achieving a successful resolution.

Commitment to Client Satisfaction: Building Trust and Relationships

At Conclude ADR, we believe that customer satisfaction is not just a goal; it is the very foundation of our practice. By prioritizing your needs and concerns, we cultivate trust and build lasting relationships. This commitment not only enhances your overall experience but also ensures that you feel valued and understood throughout the facilitation process. When you feel appreciated, you’re more likely to return for our services, confident in the ability of our to support you effectively through your debt challenges.

Trust is essential in conflict resolution. It encourages open communication and cooperation, leading to more satisfactory outcomes. As David Root wisely noted, 'Although the parties may never genuinely trust one another, a mediator can earn their confidence—both confidence in the method and confidence in the mediator—and facilitate the path to resolution.' This highlights the importance of our role in fostering an environment of trust.

Moreover, studies show that addressing your concerns promptly can lead to increased loyalty and referrals. This reinforces our dedication to building trust at every stage of the mediation process. To enhance this trust further, we encourage open dialogue and active listening, ensuring that you feel heard and respected.

Are you ready to experience a mediation process where your voice truly matters? Let’s work together to navigate your challenges with care and compassion.

Conclusion

Navigating the complexities of debt can feel overwhelming, but the essential qualities of top debt resolution consultants shine as a beacon of hope for those seeking financial stability. By focusing on expert-driven solutions, flexible scheduling, and a genuine commitment to client satisfaction, these consultants empower you to face your financial challenges with renewed confidence. The core message is simple: with the right support, achieving resolution is not just possible, it is within your reach.

Throughout this journey, key insights illustrate how effective debt resolution relies on practical strategies. Have you considered how a responsive team can make a difference? The benefits of open communication cannot be overstated, as each quality enhances your mediation experience. Value-based pricing ensures you feel secure in your financial commitments, while the diverse backgrounds of consultants foster innovative solutions tailored to your unique situation. Together, these elements contribute to a more effective and satisfying resolution process.

Ultimately, the path to financial freedom is a collaborative effort that thrives on trust, transparency, and a proactive approach. By embracing these essential qualities, you can take significant strides toward resolving your debt issues. It is vital to recognize the value of engaging with skilled debt resolution consultants who prioritize your needs and create a supportive environment. Taking that first step toward resolution today can lead to a brighter financial future, where confidence and stability flourish.

Frequently Asked Questions

What services does Conclude ADR provide for debt resolution?

Conclude ADR offers expert-driven solutions through debt resolution consultants who focus on mediation and arbitration to facilitate fair and efficient outcomes tailored to individual needs.

How does Conclude ADR empower clients during the debt resolution process?

Conclude ADR empowers clients by providing support from debt resolution consultants who not only resolve disputes but also help clients face financial challenges with confidence, ensuring solutions are achieved promptly and economically.

What scheduling options does Conclude ADR offer to clients?

Conclude ADR offers flexible scheduling options, including evenings and weekends, to accommodate clients' needs and reduce barriers to participation in negotiation or arbitration sessions.

How does flexible scheduling impact client engagement in debt resolution?

Flexible scheduling allows clients to choose times that suit them, leading to more active participation in discussions and enhancing the likelihood of successful outcomes.

What is the resolution-focused approach of Conclude ADR?

Conclude ADR's resolution-focused approach emphasizes practical solutions that address the root causes of financial disputes, ensuring all parties leave with a clear understanding of their obligations and a defined path forward.

What success rates are associated with mediation at Conclude ADR?

Mediation at Conclude ADR has proven effective, resolving disputes at a rate of 80-92%, with potential success rates soaring to 90% when both parties are committed to finding a solution.

What outcomes can debt resolution consultants help clients achieve?

Debt resolution consultants can help clients reach agreements, declare stalemates, or finalize and sign contracts throughout the mediation process.

How does Conclude ADR support clients throughout the debt resolution journey?

Conclude ADR supports clients by managing expectations and providing assistance every step of the way, enhancing the likelihood of favorable outcomes through practical strategies and value-based pricing.